TLG IMMOBILIEN AG announces publication of offer document for public delisting tender offer to shareholders of WCM Beteiligungs- und Grundbesitz-Aktiengesellschaft

November 05 2024 - 9:30AM

TLG IMMOBILIEN AG (“

TLG”) announces today the

publication of the offer document for the public delisting tender

offer (cash offer) to the shareholders of WCM Beteiligungs- und

Grundbesitz-Aktiengesellschaft (“

WCM”), for the

acquisition of their no-par-value bearer shares in the company

(ISIN DE000A1X3X33) as well as its non-binding English convenience

translation. These documents are available for distribution free of

charge at DZ BANK AG, Deutsche Zentral-Genossenschaftsbank, Platz

der Republik, 60325 Frankfurt am Main, Germany (requests to be made

by providing a complete address via e-mail to

ECM-syndicate@dzbank.de) as well as on TLG’s website at

https://www.tlg.de/investor-relations/delisting-offer-wcm-ag.

The acceptance period for the public delisting

tender offer begins today and will end on December 6, 2024

(end of day – 24:00h, local time in Frankfurt am Main,

Germany).

Contact:

TLG IMMOBILIEN AG

Attn.: Mr. Armin HeidenreichAlexanderstraße 110178

BerlinGermanyFax: +49 (0) 30 -

2470-7151E-mail: armin.heidenreich@tlg.de

https://www.tlg.de/

Important note:

This announcement is for information purposes

only and neither constitutes an invitation to sell, nor an offer to

purchase, securities of WCM but constitutes a legally required

announcement according to the German Securities Acquisition and

Takeover Act (Wertpapiererwerbs- und Übernahmegesetz – “WpÜG”) in

conjunction with Section 39 para. 2 sentence 3 no. 1 German Stock

Exchange Act (Börsengesetz – “BörsG”) in the context of a public

delisting tender offer (the “Offer”). The final terms and further

provisions regarding the Offer are disclosed in the offer document

that has been approved for publication by the German Federal

Financial Supervisory Authority (Bundesanstalt für

Finanzdienstleistungsgsaufsicht). Investors and holders of

securities of WCM are strongly recommended to read the offer

document and all announcements in connection with the Offer as they

contain or will contain important information. The Offer will be

made exclusively under the laws of the Federal Republic of Germany,

especially under the WpÜG, the BörsG and certain provisions of the

securities laws of the United States of America applicable to

cross-border tender offers. The Offer will not be executed

according to the provisions of jurisdictions other than those of

the Federal Republic of Germany or the United States of America (to

the extent applicable). Thus, no other announcements,

registrations, admissions or approvals of the Offer outside of the

Federal Republic of Germany have been filed, arranged for or

granted. Investors in, and holders of, securities in WCM cannot

rely on having recourse to provisions for the protection of

investors in any jurisdiction other than the provisions of the

Federal Republic of Germany. Subject to the exceptions described in

the offer document as well as any exemptions that may be granted by

the relevant regulators, a public tender offer will not be made,

neither directly nor indirectly, in jurisdictions where to do so

would constitute a violation of the laws of such jurisdiction.

TLG reserves the right, to the extent legally

permitted, to directly or indirectly acquire further shares outside

the Offer on or off the stock exchange. If such further

acquisitions take place, information about such acquisitions,

stating the number of shares acquired or to be acquired and the

consideration paid or agreed on, will be published without undue

delay, if and to the extent required by the laws of the Federal

Republic of Germany or any other relevant jurisdiction.

To the extent any announcements in this document

contain forward-looking statements, such statements do not

represent facts and are characterized by the words “expect”,

“believe”, “estimate”, “intend”, “aim”, “assume” or similar

expressions. Such statements express the intentions, opinions or

current expectations and assumptions of TLG and the persons acting

together with TLG. Such forward-looking statements are based on

current plans, estimates and forecasts, which TLG and the persons

acting together with TLG have made to the best of their knowledge,

but which they do not claim to be correct in the future.

Forward-looking statements are subject to risks and uncertainties

that are difficult to predict and usually cannot be influenced by

TLG or the persons acting together with the TLG. These expectations

and forward-looking statements can turn out to be incorrect and the

actual events or consequences may differ materially from those

contained in or expressed by such forward-looking statements. TLG

and the persons acting together with TLG do not assume an

obligation to update the forward-looking statements with respect to

the actual development or incidents, basic conditions, assumptions

or other factors.

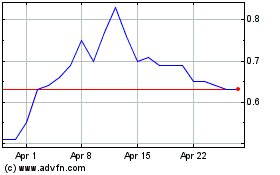

Troilus Gold (TSX:TLG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Troilus Gold (TSX:TLG)

Historical Stock Chart

From Jan 2024 to Jan 2025