Torex Gold Resources Inc. (the “Company” or “Torex”) (TSX: TXG)

provides Q3 2023 update on the development of its Media Luna

Project (“Media Luna”). Unless otherwise stated, progress and

milestones referenced in this press release are as of September 30,

2023.

Jody Kuzenko, President & CEO of Torex,

stated:

“Development of Media Luna continues to track

well to plan, with first concentrate production remaining on track

for late 2024 and commercial production in early 2025. At

quarter-end, the Media Luna Project was 49% complete across

engineering, procurement, underground development/construction, and

surface construction. With 68% of upfront expenditures committed

(including 42% incurred), expenditures to date have tracked

reasonably well to the initial budget of $875 million, noting the

stronger Mexican peso remains a headwind to manage. With $242

million incurred on the project year-to-date, project spending in

2023 is tracking toward the lower end of the annual guided range of

$390 million to $440 million.

“Solid progress was made with respect to

underground development and construction, which included another

notable quarter of advance in the schedule-critical Guajes Tunnel

and mobilization of the underground construction contractor.

Breakthrough of the Guajes Tunnel is expected by year-end, three

months ahead of schedule.

“Significant progress was also made on the

engineering front, which is expected to drive increased procurement

activity through year-end. Surface construction continued with pad

and foundation preparation for several key areas advanced during

the quarter. The pace of construction is set to pick up in Q4 as

concrete works ramp up, larger equipment deliveries to the south

side commence with the completion of the Mazapa bypass road, and

steel erection at the flotation plant begins before year-end.

“The Media Luna Project is now soundly at the

halfway mark and tracking to schedule and budget. With solid

ongoing cash flow from El Limón Guajes and a healthy balance sheet

with strong liquidity, we remain well positioned to execute on the

remainder of the development plan over the next 15 months.”

CAPITAL EXPENDITURES

To date, upfront expenditures have tracked

reasonably well to the initial budget of $874.5 million, noting the

strength of the Mexican peso and general inflationary pressures

have been headwinds to manage. As at quarter-end, $591.2 million of

expenditures had been committed (68%), including $367.0 million

incurred (42%).

Table 1: Media Luna Project – Project

Expenditures (April 1, 2022 through September 30, 2023)

|

Millions of U.S. dollars |

Project To DateQ3 2023 |

|

Project expenditures per 2022 Technical Report |

$848.4 |

|

Adjustment for Q1 2022 underspend |

$26.1 |

|

Total budgeted spend post March 31, 2022 |

$874.5 |

|

Expenditures incurred post March 31, 2022 |

($367.0) |

|

Remaining spend |

$507.5 |

|

Committed expenditures (inclusive of total project expenditures

incurred to date) |

$591.2 |

|

Uncommitted expenditures |

$283.3 |

1) Project period commenced on

April 1, 2022; excludes capital expenditures incurred prior to

Board approval on March 31, 2022.2) Project period

is defined as April 1, 2022 through December 31,

2024.3) Excludes borrowing costs capitalized.

During Q3, $98.7 million was invested in the

project, the highest quarterly spend to date. With $242.3 million

invested year-to-date and the level of spending expected to

increase further in Q4 2023, the Company is tracking towards the

low end of the full year guided range of $390 million to $440

million. Quarterly expenditures are expected to remain elevated

through Q3 2024 before declining with the commissioning of the

upgraded processing plant.

To manage the capital expenditure risk related

to a further strengthening of the Mexican peso, the Company has

placed several zero cost collars for a total notional amount of

$103.5 million of peso-related project expenditures. The average

floor price of the collars is 17.38 Mexican pesos per U.S. dollar

and the average ceiling price is 20.0, with the collars covering

the remaining project period (October 2023 and December 2024).

Approximately 40% to 50% of the remaining expenditures are expected

to be denominated in pesos. The initial upfront capital cost of

developing Media Luna assumed a Mexican peso of 20.0, which,

weighted by quarterly expenditures, has averaged 18.4 since the

project commenced on April 1, 2022.

PROJECT COMPLETION

As at quarter-end, development of Media Luna was

tracking to plan, with the project 49% complete, up from 35% at the

end of Q2 2023. Detailed engineering is at the 70% completion mark,

while procurement is 52% complete, with several purchase orders and

contract awards pending at quarter-end. Based on the current

schedule, the tie-in of upgrades to the processing plant are still

on track to occur over a four-week period during the fourth quarter

of 2024, which will allow for commissioning and first concentrate

production in late 2024 and commercial production in early

2025.

Table 2: Media Luna Project – Project Completion

(April 1, 2022 through September 30, 2023)

|

|

Project To DateQ3 2023 |

|

Procurement |

52% |

|

Engineering |

70% |

|

Underground development/construction |

50% |

|

Surface construction |

30% |

|

Total Project |

49% |

Notes to Table1) Physical

progress measured starting as of April 1, 2022; excludes progress

made prior to Board approval on March 31,

2022.2) Project period is defined as April 1, 2022

through December 31, 2024.3) Total Project is

weighted average based on activity levels.

The Company has also added a Media Luna Project

construction update section to its website that includes a gallery

timeline of the project

(https://torexgold.com/assets/projects-media-luna/construction-progress/).

ProcurementDuring the quarter, the Company

executed numerous key purchase orders including the ore/waste pass

grizzlies, press frames and chutes, fabrication of the copper

concentrate building structure, ore bins and associated steel

infrastructure, underground 15 kV electrical cable, as well as

numerous pumps required throughout the processing plant and in the

underground. For the surface plant, several key orders and

contracts were awarded including civil works for the copper

concentrate building, civil works for the 230 kV switchyard, and

site-wide concrete supply and installation contracts. Steel

fabrication packages have been released for both the water

treatment and flotation plant areas in anticipation of beginning to

erect steel for the flotation plant by year-end.

First equipment deliveries of a diesel scoop

truck and a diesel haul truck were made at the end of September.

Delivery of the first electric jumbo is scheduled for December,

with the remainder of the battery electric/diesel fleet expected to

be delivered steadily over the next two years.

EngineeringThe pace of detailed engineering

continued to increase during the third quarter with a focus on

design that supports the advancement of priority construction

activities and purchase orders. Key underground engineering

activities included advancing critical electrical systems design

for procurement, completing critical underground ore and waste

handling infrastructure design for construction, and completion of

the Hazard and Operability Analysis (“HAZOP”) workshops for the

underground facilities. For the surface facilities, the first phase

of flotation area steel, including the pipe rack from grinding and

the water treatment plant, were released for fabrication along with

other process areas being detailed for release to shops. The

balance of the electrical single line diagrams were issued to

finalize equipment requirements. Requests for quotes were sent to

vendors for the remaining surface facilities. HAZOP workshops for

surface facilities were also completed.

Underground Development and ConstructionSteady

progress was made in advancing the Guajes Tunnel and South Portal

Lower. Breakthrough of the Guajes Tunnel on the south side of the

Balsas River is expected in late December, well ahead of the March

2024 breakthrough date assumed in the Technical Report. A majority

of the conveyor table segments are now at site, as are

approximately half of the conveyor belt segments, with the

remainder in transit.

As of the end of September, the Guajes Tunnel

had advanced 5,160 metres and South Portal Lower had advanced 2,325

metres, leaving approximately 970 metres of tunnel advance

remaining until breakthrough.

Figure 1: Breakthrough of Guajes Tunnel expected

in late December (advance rates as at end of September)

Steady progress was also made on ventilation and

in-mine development during the quarter. The second 175 metre

raise has progressed 67% and will be completed in Q4 2023, allowing

for ventilation between the upper and lower parts of the mine. As

of the end of September, there were twenty active headings,

including eleven in Media Luna Lower and nine in Media Luna Upper.

Development in areas of key infrastructure advanced, including

access to the top and bottom of the main ore bins and completion of

the rock breaker #1 and conveyor #3 areas. Vertical development of

the first ore pass also commenced. Some challenges were experienced

with increased water infiltration at the lower section of the

internal ramp which was controlled through established grouting

protocols. Development across all headings continued to advance,

with monthly development rates increasing in the latter half of the

quarter. Overall, ground conditions remain excellent.

Surface ConstructionOn the north side of the

Balsas River, the relocated security structure was completed and

foundation work began in the water treatment plant area. Additional

camp modules to house project staff were also installed. Extension

of the main water management culvert below the area of the new

flotation plant was completed, allowing the final placement of the

remaining civil backfill that extends the flotation area pad.

Relocation of the power distribution and installation of new buried

power conduits around the flotation plant were completed to allow

for the removal of the overhead power lines in Q4 2023. This work

enabled the start of the concrete foundations for the flotation

plant and tower crane to begin.

On the south side of the Balsas River, expansion

of the construction camp pad was completed and additional

two-storey camp modules were placed for occupation in Q4 2023 as

the underground contractor continues to mobilize. Concrete

foundation installation for the backup generator area began and

will be completed in Q4 2023, allowing work to start on the paste

plant foundations. The mine pipeline access drift, specifically for

the paste and return water lines into the mine, was completed. Work

continued on both the Mazapa – San Miguel bypass road and the

Mazapa bridge, with the first concrete headwall completed. This

will be completed in Q4 2023 to accept deliveries of larger

equipment related to both the paste plant and the underground

construction. Both the sedimentation pond and decant

pond dams are nearing completion, with construction of the concrete

spillway started on the sedimentation dam.

Operational ReadinessIn parallel with

development and construction activities, the surface and

underground operational readiness strategy is progressing to plan.

Operational readiness teams are accountable for ensuring that

processes and systems for all new work areas are established and

ready in advance of the handover from the project team to

operations. This includes workforce transition planning and

training, developing the operating strategy (including all standard

operating procedures), maintenance plans for all fixed and mobile

equipment, blend and feed strategies, detailed commissioning plans,

first fills, concentrate shipment logistics, and all other

requirements to ensure a smooth ramp-up to commercial production in

Q1 2025.

PROJECT EXECUTION PLAN

Based on progress made during Q3 2023 and a

detailed review of both the surface and underground schedules

completed late in the quarter, the overall project end dates are

unchanged compared to the prior plan outlined within the inaugural

Media Luna update press release published on February 9, 2023, with

some movement within the plan as set out below.

Figure 2: Project execution plan for the Media

Luna Project

Initiatives to expedite the delivery of the

paste plant filter presses are progressing and the delivery

schedule has been maintained with further initiatives under review.

The Company is also working to expedite the underground electrical

equipment to reduce schedule risk given delivery times for this

equipment are some of the longest for the project. As noted in the

previous Media Luna update, plans for the early installation of the

FeS flotation circuit and water treatment plant have been adjusted.

Given the Company’s success with reducing cyanide consumption

levels over the past several quarters, the business benefits of a

single schedule for construction and commissioning the FeS circuit

and water treatment plant at the same time as the Cu flotation

circuit outweighed the benefits to landing the FeS circuit

early.

In terms of underground development, schedule

gains have been made since the last update as we are now

forecasting the Guajes Tunnel breakthrough in late December.

Consequently, first development ore and first stope have been

rescheduled to facilitate haulage directly through the Guajes

Tunnel to avoid stockpiling and rehandling from the south side.

Given tunnelling is ahead of schedule, installing anchors for the

conveyor tables was rescheduled to post-breakthrough to avoid any

coordination issues with the tunneling and anchoring crews. The

revised execution plan will not impact the installation and

commissioning of the Guajes Tunnel conveyor, which remains on track

for completion in August 2024.

The current project plan relative to the

Technical Report reflects the Company’s estimates for the

completion of key project deliverables. These updated deliverables

have not impacted the overall project schedule given the original

plan had assumed the potential for schedule adjustments and the

possibility for supply chain disruptions.

More detail on the Media Luna Project, including

the feasibility study results, can be found in the Company’s most

recent Technical Report dated effective March 16, 2022, filed on

March 31, 2022 (“Technical Report”).

ABOUT TOREX GOLD RESOURCES

INC.

Torex is an intermediate gold producer based in

Canada, engaged in the exploration, development, and operation of

its 100% owned Morelos Property, an area of 29,000 hectares in the

highly prospective Guerrero Gold Belt located 180 kilometres

southwest of Mexico City. The Company’s principal asset is the

Morelos Complex, which includes the El Limón Guajes (“ELG”) Mine

Complex, the Media Luna Project, a processing plant and related

infrastructure. Commercial production from the Morelos Complex

commenced on April 1, 2016, and an updated Technical Report for the

Morelos Complex was released in March 2022. Torex’s key strategic

objectives are to optimize and extend production from the ELG Mine

Complex, de-risk and advance Media Luna to commercial production,

build on ESG excellence, and to grow through ongoing exploration

across the entire Morelos Property.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

| TOREX GOLD RESOURCES INC. |

| Jody

Kuzenko |

Dan

Rollins |

| President and CEO |

Senior Vice President, Corporate Development & Investor

Relations |

| Direct: (647) 725-9982 |

Direct: (647) 260-1503 |

| jody.kuzenko@torexgold.com |

dan.rollins@torexgold.com |

QUALIFIED PERSONThe technical

and scientific information in this press release has been reviewed

and approved by Dave Stefanuto, P. Eng, Executive Vice President,

Technical Services and Capital Projects of the Company, and a

qualified person under National Instrument 43-101.

CAUTIONARY NOTES ON FORWARD LOOKING

STATEMENTSThis press release contains “forward-looking

statements” and “forward-looking information” within the meaning of

applicable Canadian securities legislation. Forward-looking

information includes, but is not limited to, statements that: the

Guajes Tunnel breakthrough is expected by year-end; with $242

million incurred on the project year-to-date, project spending is

tracking toward the lower end of the annual guided range of $390

million to $440 million; progress was also made on the engineering

front, which is expected to drive increased procurement activity

through year-end; the pace of construction is set to pick up in Q4

as concrete works ramp up, larger equipment deliveries to the south

side commence with the completion of the Mazapa bypass road, and

steel erection at the flotation plant begins before year-end; the

Media Luna Project is now soundly at the halfway mark and tracking

to schedule and budget; with solid ongoing cash flow from El Limón

Guajes and a healthy balance sheet with strong liquidity, the

Company remains well positioned to execute on the remainder of the

development plan over the next 15 months; quarterly expenditures

are expected to remain elevated through Q3 2024 before declining

with the commissioning of the upgraded processing plant;

approximately 40% to 50% of the remaining expenditures are expected

to be denominated in pesos; based on the current schedule, the

tie-in of upgrades to the processing plant are still on track to

occur over a four-week period during the fourth quarter of 2024,

which will allow for commissioning and first concentrate production

in late 2024 and commercial production in early 2025; the remainder

of the battery electric/diesel fleet expected to be delivered

steadily over the next two years; the surface and underground

operational readiness strategy is progressing to plan including the

workforce transition planning and training, developing the

operating strategy (including all standard operating procedures),

maintenance plans for all fixed and mobile equipment, blend and

feed strategies, detailed commissioning plans, first fills,

concentrate shipment logistics, and all other requirements to

ensure a smooth ramp-up to commercial production in Q1 2025; the

project execution plan for the Media Luna Project; the revised

execution plan will not impact the installation and commissioning

of the Guajes Tunnel conveyor, which remains on track for August

2024; the current project plan relative to the Technical Report

reflects the Company’s estimates for the completion of key project

deliverables; these updated deliverables have not impacted the

overall project schedule given the original plan had assumed the

potential for schedule adjustments and the possibility for supply

chain disruptions; and the Company’s key strategic objectives are

to optimize and extend production from the ELG Mine Complex,

de-risk and advance Media Luna to commercial production, build on

ESG excellence, and to grow through ongoing exploration across the

entire Morelos Property. Generally, forward-looking information can

be identified by the use of forward-looking terminology such as

“expect”, “plan”, “strategy”, “schedule”, “anticipate”, “guide”,

“continue”, “forecast”, or variations of such words and phrases or

statements that certain actions, events or results “will” occur or

are “on track” to occur. Forward-looking information is subject to

known and unknown risks, uncertainties and other factors that may

cause the actual results, level of activity, performance or

achievements of the Company to be materially different from those

expressed or implied by such forward-looking information,

including, without limitation, risks and uncertainties identified

in the technical report (“Technical Report”) titled ELG Mine

Complex Life of Mine Plan and Media Luna Feasibility Study, with an

effective date of March 16, 2022, and a filing date of March 31,

2022 and in the Company’s annual information form (“AIF”) and

management’s discussion and analysis (“MD&A”) or other unknown

but potentially significant impacts. Forward-looking information is

based on the reasonable assumptions, estimates, analyses and

opinions of management made in light of its experience and

perception of trends, current conditions and expected developments

as set out in the Technical Report, AIF and MD&A, and other

factors that management believes are relevant and reasonable in the

circumstances at the date such statements are made. Although the

Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

the forward-looking information, there may be other factors that

cause results not to be as anticipated. There can be no assurance

that such information will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such information. Accordingly, readers should not place undue

reliance on forward-looking information. The Company does not

undertake to update any forward-looking information, whether as a

result of new information or future events or otherwise, except as

may be required by applicable securities laws.

Photos accompanying this announcement are available

athttps://www.globenewswire.com/NewsRoom/AttachmentNg/70614923-6580-45b5-9a25-df1f74386b36https://www.globenewswire.com/NewsRoom/AttachmentNg/9f41e842-b587-48d2-b011-6711c688caee

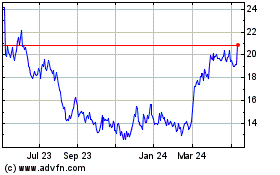

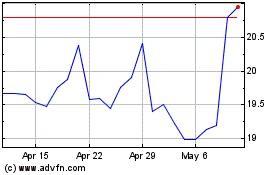

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Feb 2025 to Mar 2025

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Mar 2024 to Mar 2025