Americas Gold and Silver Corporation (TSX: USA) (NYSE American:

USAS) (“Americas” or the “Company”), a growing North American

precious metals producer, reports consolidated financial and

operational results for the year ended December 31, 2021.

This earnings release should be read in conjunction with the

Company’s Management’s Discussion and Analysis, Financial

Statements and Notes to Financial Statements for the corresponding

period, which have been posted on the Americas Gold and Silver

Corporation SEDAR profile at www.sedar.com, and on its EDGAR

profile at www.sec.gov, and which are also available on the

Company’s website at www.americas-gold.com. All figures are in U.S.

dollars unless otherwise noted.

Highlights

- The Company had a strong finish to the year highlighted by

improvement at the 60%-owned Galena Complex and the resumption of

mining and milling at the Cosalá Operations in Q4-2021. These

improvements have continued into Q1-2022 as the Cosalá operations

ramped up to full production.

- Silver equivalent1 production is expected to increase by

approximately 240% in 2022 and by 375% in 2024 as production

ramps-up into the higher-silver grade Upper Zone of the San Rafael

deposit at the Cosalá Operations and the Galena hoist project at

the Galena Complex is completed in the second half of 2022. These

operations are expected to generate solid margins at current silver

and zinc prices. Please see the Company’s February 22, 2022 press

release for full details regarding the multi-year outlook.

- Overall, 2021 was a challenging year for the Company with

Relief Canyon contributing to the majority of the losses which are

now largely behind the Company.

- Revenue of $44.8 million and net loss of $160.6 million for

2021 or a loss of $1.11 per share. Net loss for the year included

the Relief Canyon Q1-2021 impairment charge to property, plant and

equipment, write-downs to inventory for changes to Relief Canyon’s

expected gold recovery and production, Relief Canyon inventory

write-downs to net realizable value, care and maintenance costs at

the Cosalá Operations, and a loss on a metals contract liability.

Excluding these mostly non-cash adjustments, the adjusted net loss2

for the year was $37.0 million or an adjusted loss of $0.26 per

share2.

- The balance sheet is steadily improving with the resumption of

mining at the Cosalá Operations in Q4-2021 and return to full

production in Q1-2022, combined with current silver and zinc

prices. The Company had a cash and cash equivalents balance of $2.9

million as of December 31, 2021 and an estimated cash and cash

equivalents balance of $7.2 million as at February 28, 2022.

“The financial results for 2021 do not reflect the current state

of the Company,” stated Americas Gold and Silver President &

CEO Darren Blasutti. “The reopening of the Cosalá Operations and

return to full production combined with the increasing silver and

zinc prices have greatly improved the Company’s financial position

and will provide steady cash flow for the Company. Continued

exploration success at the Galena Complex and the Galena hoist

project are expected to increase throughput and production for the

asset over the next several years beginning in Q4-2022. While 2021

was a disappointment at Relief Canyon, the Company continues to

advance certain technical studies, including metallurgical testing,

and is hopeful for a positive solution to re-start mining

operations given the constructive gold price outlook over the next

few years.”

Cosalá Operations

The Cosalá Operations recalled all workers in September 2021 and

successfully re-started mining and milling operations after

reaching an agreement with union representatives and certain

Mexican government ministries in July 2021. Production from the San

Rafael mine increased during Q4-2021 as the normal mining cycle was

re-established. The Los Braceros processing plant was fed with a

combination of over 20,000 tonnes of existing stockpiled ore and

new production from the mine. The milling rate ramped up in tandem

with mine production, averaging approximately 1,700 tonnes per day

during December 2021 and continuing into 2022. During Q4-2021, the

Cosalá Operations produced approximately 61,000 ounces of silver,

4.2 million pounds of zinc and 1.7 million pounds of lead.

Initial production will focus on maximizing near-term cash flow

by mining high-grade zinc areas of the Main Zone which were fully

developed prior to the illegal blockade. Over the course of the

next six months, the mine will continue development and start

production from the Upper Zone, which carries silver grades

approximately 5-6 times higher than the Main Zone.

Based on the Cosalá Operations being in full production and

planned development/production from the Upper Zone, silver

production from the Cosalá Operations in 2022 is forecast to be

between 0.7 to 0.9 million ounces. The Cosalá Operations are

expected to increase silver production through 2022 benefitting

from higher-grade silver areas in the Upper Zone of the San Rafael

mine in the second half of 2022. Zinc production from the Cosalá

Operations is expected to be approximately 36 to 40 million pounds

and lead production is expected to be 13 to 15 million pounds.

Galena Complex

The Phase II drill program at the Galena Complex began in late

August 2021. The initial focus is to test the recently discovered

Silver Vein extension below the 5500 Level, the deepest level of

the mine. To date, the Silver Vein extension has been delineated to

over 350 ft below the 5500 Level. As part of the 5500 Level

drilling of the Silver Vein, the Company has successfully

intersected the high grade 185 Vein approximately 800 ft below the

5500 Level. In addition, continued definition drilling from the

4900 Level to define mineral reserves and increase mineral

resources adjacent to current production areas is part of the Phase

II plan. With the most recent update to its Mineral Reserve and

Resource statement as at June 30, 2021, the Company successfully

increased proven and probable silver reserves at the Galena Complex

by 38%, increased the measured and indicated silver resources by

72% and the inferred mineral silver resources by 36% and expects

continuing increases with the Phase II drill program which runs

through the end of 2022. The Company anticipates releasing a

fulsome exploration update for the Galena Complex in Q2-2022.

Attributable silver production to the Company from the Galena

Complex (60% owned by Americas) in 2022 is expected to be between

0.7 to 0.9 million silver ounces. Attributable lead production is

expected to be between 9 to 11 million pounds. The Company expects

to complete the Galena hoist project in Q4-2022.

Relief Canyon

The Company is committed to continuing efforts to resolve the

metallurgical challenges at Relief Canyon. An independent

metallurgical lab has been contracted to complete a metallurgical

test program to evaluate process modifications, including the use

of blinding agents, to minimize the impact of naturally occurring

carbonaceous material on gold recovery. Initial work is expected to

be completed by end of Q2-2022. Based on the success of these

initial tests, the Company is expected to initiate larger scale

testing in the second half of 2022.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious

metals mining company with multiple assets in North America. The

Company owns and operates the Relief Canyon mine in Nevada, USA,

the Cosalá Operations in Sinaloa, Mexico and manages the 60%-owned

Galena Complex in Idaho, USA. The Company also owns the San Felipe

development project in Sonora, Mexico. For further information,

please see SEDAR or www.americas-gold.com.

Technical Information and Qualified Persons

The scientific and technical information relating to the

operation of the Company’s material operating mining properties,

its mineral resources and exploration contained herein has been

reviewed and approved by Daren Dell, P.Eng., Chief Operating

Officer of the Company. The Company’s current Annual Information

Form and the NI 43-101 Technical Reports for its other material

mineral properties, all of which are available on SEDAR at

www.sedar.com, and EDGAR at www.sec.gov contain further details

regarding mineral reserve and mineral resource estimates,

classification and reporting parameters, key assumptions and

associated risks for each of the Company’s material mineral

properties, including a breakdown by category.

All mining terms used herein have the meanings set forth in

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”), as required by Canadian securities

regulatory authorities. These standards differ significantly from

the requirements of the SEC that are applicable to domestic United

States reporting companies. Any mineral reserves and mineral

resources reported by the Company in accordance with NI 43-101 may

not qualify as such under SEC standards. Accordingly, information

contained in this news release may not be comparable to similar

information made public by companies subject to the SEC’s reporting

and disclosure requirements.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within

the meaning of applicable securities laws. Forward-looking

information includes, but is not limited to, Americas Gold and

Silver’s expectations, intentions, plans, assumptions and beliefs

with respect to, among other things, estimated and targeted

production rates and results for gold, silver and other metals, the

expected prices of gold, silver and other metals, as well as the

related costs, expenses and capital expenditures; the Phase II

drill program at and production from the Galena Complex, including

the expected production levels and potential additional mineral

resources thereat; mining and processing operations at the Cosalá

Operations continuing, including expected production levels and the

continuity of legal access for employees and contractors; and the

goal and results of test work intended to address metallurgical

challenges at Relief Canyon. Guidance and outlook contained in this

press release was prepared based on current mine plan assumptions

with respect to production, costs and capital expenditures, the

metal price assumptions disclosed herein, and assumes no adverse

impacts to operations from the COVID-19 pandemic and no further

adverse impacts to the Cosalá Operations from blockades and is

subject to the risks and uncertainties outlined below. Often, but

not always, forward-looking information can be identified by

forward-looking words such as “anticipate”, “believe”, “expect”,

“goal”, “plan”, “intend”, “potential’, “estimate”, “may”, “assume”

and “will” or similar words suggesting future outcomes, or other

expectations, beliefs, plans, objectives, assumptions, intentions,

or statements about future events or performance. Forward-looking

information is based on the opinions and estimates of Americas Gold

and Silver as of the date such information is provided and is

subject to known and unknown risks, uncertainties, and other

factors that may cause the actual results, level of activity,

performance, or achievements of Americas Gold and Silver to be

materially different from those expressed or implied by such

forward-looking information. With respect to the business of

Americas Gold and Silver, these risks and uncertainties include

risks relating to widespread epidemics or pandemic outbreak

including the COVID-19 pandemic; the impact of COVID-19 on our

workforce, suppliers and other essential resources and what effect

those impacts, if they occur, would have on our business, including

our ability to access goods and supplies, the ability to transport

our products and impacts on employee productivity, the risks in

connection with the operations, cash flow and results of the

Company relating to the unknown duration and impact of the COVID-19

pandemic; interpretations or reinterpretations of geologic

information; unfavorable exploration results; inability to obtain

permits required for future exploration, development or production;

general economic conditions and conditions affecting the industries

in which the Company operates; the uncertainty of regulatory

requirements and approvals; fluctuating mineral and commodity

prices; the ability to obtain necessary future financing on

acceptable terms or at all; the ability to operate the Company’s

projects; and risks associated with the mining industry such as

economic factors (including future commodity prices, currency

fluctuations and energy prices), ground conditions, illegal

blockades and other factors limiting mine access or regular

operations without interruption, failure of plant, equipment,

processes and transportation services to operate as anticipated,

environmental risks, government regulation, actual results of

current exploration and production activities, possible variations

in ore grade or recovery rates, permitting timelines, capital and

construction expenditures, reclamation activities, labor relations

or disruptions, social and political developments and other risks

of the mining industry. The potential effects of the COVID-19

pandemic on our business and operations are unknown at this time,

including the Company’s ability to manage challenges and

restrictions arising from COVID-19 in the communities in which the

Company operates and our ability to continue to safely operate and

to safely return our business to normal operations. The impact of

COVID-19 on the Company is dependent on a number of factors outside

of its control and knowledge, including the effectiveness of the

measures taken by public health and governmental authorities to

combat the spread of the disease, global economic uncertainties and

outlook due to the disease, and the evolving restrictions relating

to mining activities and to travel in certain jurisdictions in

which it operates. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated, or intended. Readers are cautioned not to

place undue reliance on such information. Additional information

regarding the factors that may cause actual results to differ

materially from this forward-looking information is available in

Americas Gold and Silver’s filings with the Canadian Securities

Administrators on SEDAR and with the SEC. Americas Gold and Silver

does not undertake any obligation to update publicly or otherwise

revise any forward-looking information whether as a result of new

information, future events or other such factors which affect this

information, except as required by law. Americas Gold and Silver

does not give any assurance (1) that Americas Gold and Silver will

achieve its expectations, or (2) concerning the result or timing

thereof. All subsequent written and oral forward-looking

information concerning Americas Gold and Silver are expressly

qualified in their entirety by the cautionary statements above.

____________________ 1 Silver equivalent ounces for the 2022

guidance, and 2023 and 2024 outlook references were calculated

based on $22.00/oz silver, $1.30/lb zinc and $0.95/lb lead

throughout this press release. 2 This is a non-GAAP financial

measure or ratio. The Company uses the financial measure “adjusted

net loss” and “adjusted loss per share” because it understands

that, in addition to conventional measures prepared in accordance

with IFRS, certain investors and analysts use this information to

evaluate the Company’s profitability. The presentation of adjusted

net loss is not meant to be a substitute for the net loss presented

in accordance with IFRS, but rather should be evaluated in

conjunction with such IFRS measure.

Adjusted net loss is net loss with certain non-cash items

backed-out (i.e. impairment to property, plant and equipment,

write-downs to inventory, and loss related to the fair value of

financial instruments). Adjusted loss per share is adjusted net

loss divided by the weighted average number of common shares

outstanding.

Reconciliation of Adjusted Net Loss and

Adjusted Loss per Share

2021

2020

Net Loss (‘000)

$

160,576

$

30,066

Less impairment to property, plant and

equipment from Relief Canyon (‘000)

(55,623)

-

Less Relief inventory write-downs from

lowering expected gold recoveries (‘000)

(24,780)

-

Less Relief inventory write-downs to net

realizable value (‘000)

(15,127)

-

Less loss on metal contract liability

(‘000)

(20,780)

-

Less care and maintenance costs from

Cosalá Operations (‘000)

(7,309)

(5,501)

Adjusted net loss (‘000)

$

36,957

$

24,565

Weighted average number of common shares

outstanding (‘000)

141,888

103,941

Adjusted loss per share

$

0.26

$

0.24

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220317006024/en/

Stefan Axell VP, Corporate Development & Communications

Americas Gold and Silver Corporation 416-874-1708

Darren Blasutti President and CEO Americas Gold and Silver

Corporation 416‐848‐9503

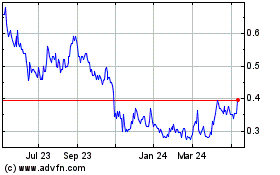

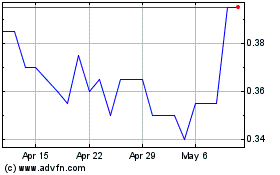

Americas Gold and Silver (TSX:USA)

Historical Stock Chart

From Feb 2025 to Mar 2025

Americas Gold and Silver (TSX:USA)

Historical Stock Chart

From Mar 2024 to Mar 2025