Vista Gold Corp. (NYSE American and TSX: VGZ) (“Vista” or the

“Company”) today announced that it has completed the second phase

and commenced a third phase of the exploration drilling program at

its 100% owned Mt Todd gold project (“Mt Todd” or the “Project”)

located in Northern Territory, Australia.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/2292cf02-3914-49ca-8298-5679443b4026

Frederick H. Earnest, President and Chief

Executive Officer of Vista, commented, “We have completed a total

of 18 holes through phase two of our drilling program, or

approximately 6,000 meters of drilling. We are extremely pleased

with our drilling results to date and believe there is opportunity

for significant resource growth and an extended life at Mt Todd.

All holes drilled to date have intersected mineralization. We

expect to report assay results for the last two holes from this

phase of drilling, VB21-012 and VB21-013, in the coming weeks.”

“Our drilling program seeks to identify those

areas where additional resources can be added most efficiently in

the future. We are drilling targets extending from the Batman

deposit northeast toward the Quigleys deposit. We have confirmed

that known mineralized occurrences once thought to be distinct and

unrelated targets are connected by a series of parallel structures

that may form part of the feeder system that helped create the

Batman deposit. Recent results show that our understanding of these

structures is a good predictor of where mineralization is most

likely to be encountered.”

Mr. Earnest concluded, “We recently started a

third phase of drilling with approximately 3,000 meters to provide

a better understanding of mineralization in the vicinity of the

Golf-Tollis target and further to the north.”

Figure 1 below is an aerial view of the drill

locations for the holes in the current program. The image is

looking south, with the Batman pit located in the upper-right

corner of the image. The third phase of drilling is planned to be

in the vicinity of the Golf-Tollis target, located approximately

1.9 km north-northeast of the Batman pit.

Figure 1 - Aerial view of the drill

locations for the holes in the current program

https://www.globenewswire.com/NewsRoom/AttachmentNg/da5a9832-d318-45f8-98d9-cf08d43752b1

About Vista Gold Corp.

Vista is a gold project developer. The Company’s

flagship asset is the Mt Todd gold project located in the Tier 1,

mining friendly jurisdiction of Northern Territory, Australia.

Situated approximately 250 km southeast of Darwin, Mt Todd is the

largest undeveloped gold project in Australia and, if developed as

presently designed, would potentially be Australia’s fourth largest

gold producer on an annual basis, with lowest tertile in-country

and global all-in sustaining costs. All major operating and

environmental permits have now been approved.

For further information, please contact Pamela

Solly, Vice President of Investor Relations, at (720) 981-1185.

Forward Looking Statements

This press release contains forward-looking

statements within the meaning of the U.S. Securities Act of 1933,

as amended, and U.S. Securities Exchange Act of 1934, as amended,

and forward-looking information within the meaning of Canadian

securities laws. All statements, other than statements of

historical facts, included in this press release that address

activities, events or developments that we expect or anticipate

will or may occur in the future, including such things as our

belief that there is opportunity for significant resource growth

and an extended mine life at Mt Todd; our expectation that assay

results for holes VB21-012 and VB21-013 will be reported in the

coming weeks; our belief that our drilling program will identify

areas where additional resources can be added efficiently in the

future; and our belief that the third phase of drilling may provide

a better understanding of the characteristics of mineralization in

the vicinity of the Golf-Tollis target and further to the north;

our expectation that a third phase of drilling with approximately

3,000 meters to provide a better understanding of the

characteristics of mineralization in the vicinity of the

Golf-Tollis target; and our belief that if developed as presently

designed, Mt Todd would potentially be Australia’s fourth largest

gold producer on an annual basis, with lowest tertile in-country

and global all-in sustaining costs are forward-looking statements

and forward-looking information. The material factors and

assumptions used to develop the forward-looking statements and

forward-looking information contained in this press release include

the following: our approved business plans, exploration and assay

results, results of our test work for process area improvements,

mineral resource and reserve estimates and results of preliminary

economic assessments, prefeasibility studies and feasibility

studies on our projects, if any, our experience with regulators,

and positive changes to current economic conditions and the price

of gold. When used in this press release, the words “optimistic,”

“potential,” “indicate,” “expect,” “intend,” “hopes,” “believe,”

“may,” “will,” “if,” “anticipate,” and similar expressions are

intended to identify forward-looking statements and forward-looking

information. These statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by such statements. Such factors include,

among others, uncertainties inherent in the exploration of mineral

properties, the possibility that future exploration results will

not be consistent with the Company’s expectations; there being no

assurance that the exploration program or programs of the Company

will result in expanded mineral resources; uncertainty of resource

and reserve estimates, uncertainty as to the Company’s future

operating costs and ability to raise capital; risks relating to

cost increases for capital and operating costs; risks of shortages

and fluctuating costs of equipment or supplies; risks relating to

fluctuations in the price of gold; the inherently hazardous nature

of mining-related activities; potential effects on our operations

of environmental regulations in the countries in which it operates;

risks due to legal proceedings; risks relating to political and

economic instability in certain countries in which it operates;

uncertainty as to the results of bulk metallurgical test work; and

uncertainty as to completion of critical milestones for Mt Todd; as

well as those factors discussed under the headings “Note Regarding

Forward-Looking Statements” and “Risk Factors” in the Company’s

latest Annual Report on Form 10-K as filed February 25, 2021 and

other documents filed with the U.S. Securities and Exchange

Commission and Canadian securities regulatory authorities. Although

we have attempted to identify important factors that could cause

actual results to differ materially from those described in

forward-looking statements and forward-looking information, there

may be other factors that cause results not to be as anticipated,

estimated or intended. Except as required by law, we assume no

obligation to publicly update any forward-looking statements or

forward-looking information; whether as a result of new

information, future events or otherwise.

Cautionary Note to United States

Investors

The United States Securities and Exchange

Commission (“SEC”) limits disclosure for U.S. reporting purposes to

mineral deposits that a company can economically and legally

extract or produce. The technical reports referenced in this press

release uses the terms defined in Canadian National Instrument

43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”)

and the Canadian Institute of Mining, Metallurgy and Petroleum (the

“CIM”) – CIM Definition Standards on Mineral Resources and Mineral

Reserves, adopted by the CIM Council, as amended (the “CIM

Definition Standards”). These standards are not the same as

reserves under the SEC’s Industry Guide 7 and may not constitute

reserves or resources under the SEC’s newly adopted disclosure

rules to modernize mineral property disclosure requirements (“SEC

Modernization Rules”), which became effective February 25, 2019 and

will be applicable to the Company in its annual report for the

fiscal year ending December 31, 2021. Under the currently

applicable SEC Industry Guide 7 standards, a “final” or “bankable”

feasibility study is required to report reserves, the three-year

historical average price is used in any reserve or cash flow

analysis to designate reserves and all necessary permits and

government approvals must be filed with the appropriate

governmental authority. Additionally, the technical reports uses

the terms “measured resources”, “indicated resources”, and

“measured & indicated resources”. We advise U.S. investors that

while these terms are Canadian mining terms as defined in

accordance with NI 43-101, such terms are not recognized under SEC

Industry Guide 7 and normally are not permitted to be used in

reports and registration statements filed with the SEC. Mineral

resources described in the technical reports have a great amount of

uncertainty as to their economic and legal feasibility. The SEC

normally only permits issuers to report mineralization that does

not constitute SEC Industry Guide 7 compliant “reserves” as

in-place tonnage and grade, without reference to unit measures.

“Inferred resources” have a great amount of uncertainty as to their

existence, and great uncertainty as to their economic and legal

feasibility. It cannot be assumed that any or all part of an

inferred resource will ever be upgraded to a higher category.

U.S. Investors are cautioned not to assume that any part or

all of mineral deposits in these categories will ever be converted

into SEC Industry Guide 7 reserves.

Under the SEC Modernization Rules, the

definitions of “proven mineral reserves” and “probable mineral

reserves” have been amended to be substantially similar to the

corresponding CIM Definition Standards and the SEC has added

definitions to recognize “measured mineral resources”, “indicated

mineral resources” and “inferred mineral resources” which are also

substantially similar to the corresponding CIM Definition Standard.

However there are differences between the definitions and standards

under the SEC Modernization Rules and those under the CIM

Definition Standards and therefore once the Company begins

reporting under the SEC Modernization Rules there is no assurance

that the Company’s mineral reserve and mineral estimates will be

the same as those reported under CIM Definition Standards as

contained in the technical reports prepared under CIM Definition

Standards or that the economics for the Mt Todd project estimated

in such technical reports will be the same as those estimated in

any technical report prepared by the Company under the SEC

Modernization Rules in the future.

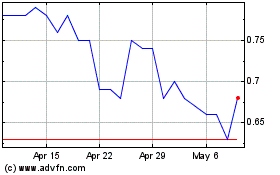

Vista Gold (TSX:VGZ)

Historical Stock Chart

From Jan 2025 to Feb 2025

Vista Gold (TSX:VGZ)

Historical Stock Chart

From Feb 2024 to Feb 2025