Vista Gold Corp. (NYSE American: VGZ) (TSX: VGZ) (“Vista” or the

“Company”) today announced its audited financial results for the

year ended December 31, 2021 and filed the feasibility study (“FS”)

reports for its 100% owned Mt Todd Gold Project (“Mt Todd” or the

“Project”) in the Northern Territory, Australia. The Company’s 2021

financial results are highlighted by reported cash totaling $13.1

million at year-end 2021.

Frederick H. Earnest, President and Chief Executive Officer of

Vista, stated, “The size, location, permitting status, and recently

completed FS position Mt Todd as one of the most attractive,

development-ready gold projects in the world. With total cash of

$13.1 million at year-end 2021, our balance sheet is strong and our

prospects for unlocking shareholder value have never been

greater.

“Two of the most significant achievements during 2021 were the

approval of the Mining Management Plan (“MMP”) and the initiation

of the FS. The MMP was approved in June 2021 and marked a

significant de-risking milestone. With the MMP in hand, Vista now

has all major operating and environmental permits required to

proceed with development of Mt Todd.”

Mr. Earnest continued, “As previously announced, the FS was

completed in early February 2022, delivering a 7 million ounce gold

reserve with high operating margins over a 16-year mine life. The

FS affirms the strength of Mt Todd’s gold production capacity and

ability to deliver robust economics with significant cashflows and

resilience to inflation. Our ongoing exploration program continues

to identify targets for efficient future mineral resource

expansion. A few highlights from the FS include:

- After-tax NPV5% of $999.5 million and IRR of 20.6% at a $1,600

gold price and a $0.71 Fx rate;

- After-tax NPV5% of $1.5 billion and IRR of 26.7% at a $1,800

gold price and $0.71 Fx rate;

- After-tax cash flow at a $1,800 gold price of $2.1 billion for

years 1 – 7 of commercial operations; and

- Average annual production of 479,000 ounces of gold during

years 1 – 7 of commercial operations.

Note: All dollar amounts stated herein are in U.S. currency and

are expressed as $ unless specified otherwise. All foreign exchange

(“Fx”) rates are in U.S. dollars per Australian dollar.

“Mt Todd is a unique and compelling near-term development

opportunity. We believe the results of the FS will appeal to many

potential partners, investors and lenders and allow us to evaluate

a broad range of development alternatives as we seek to unlock

maximum shareholder value in 2022.” (See Vista Gold FS News Release

and Mt Todd FS Webcast).

Mt Todd Technical Report Filings

The Company also announced it has filed a Technical Report

Summary (“TRS”) prepared in accordance with subpart 1300 of

Regulation S-K under the United States Securities Exchange Act of

1934, as amended (“S-K 1300”) as an exhibit to today’s filing of

Vista’s Annual Report on Form 10-K. The TRS is entitled “S-K 1300

Technical Report Summary – Mt Todd Gold Project – 50,000 tpd

Feasibility Study – Northern Territory, Australia” with an

effective date of December 31, 2021 and an issue date of February

9, 2022. This TRS is available on EDGAR at www.sec.gov/edgar.shtml.

A companion Technical Report for Canadian purposes, pursuant to

National Instrument 43-101 (“NI 43-101”), was filed on SEDAR on

February 24, 2022 and is entitled “NI 43-101 Technical Report – Mt

Todd Gold Project - 50,000 tpd Feasibility Study – Northern

Territory, Australia” with an effective date of December 31, 2021

and an issue date of February 9, 2022. This Technical Report is

available on SEDAR at www.sedar.com. Both reports may also be found

on Vista’s website at www.vistagold.com.

The technical data and economic conclusions of these reports are

identical, with minor differences between the reports resulting

only from the respective disclosure requirements of S-K 1300 and NI

43-101.

John Rozelle, Vista’s Sr. Vice President, a Qualified Person as

defined by 43-101, has approved this press release.

Summary of Financial Results

Cash and short-term investments (comprised of government

securities) totaled $13.1 million at December 31, 2021 compared to

$8.2 million at December 31, 2020. This net increase of $5.0

million during 2021 reflects net proceeds of $12.3 million from the

Company’s July 2021 public offering, $2.1 million received from

Prime Mining Corp. for cancellation of Vista’s royalty interests

and back-in right in the Guadalupe de los Reyes gold and silver

project (“Los Reyes”), $1.1 million under the Company’s ATM

Program, and $0.7 million received from other dispositions of

non-core assets. These cash inflows were offset by expenditures of

$11.2 million, which included normal recurring costs as well as

expenditures for work towards completing the FS and Vista’s ongoing

exploration drilling program. The Company continued to have no

debt.

For the year ended December 31, 2021, Vista reported a net loss

of $15.2 million, or $0.14 per common share on both a basic and

diluted basis, compared to consolidated net income of $0.4 million,

or $0.00 per common share on both a basic and diluted basis for the

fiscal year ended December 31, 2020. The net loss for the year

ended December 31, 2021 included income of $2.1 million from the

Los Reyes transaction. Offsetting expenses included: $7.9 million

for exploration, property evaluation, and holding costs, which

included expenses associated with the FS and continuation of

exploration drilling throughout 2021; $3.9 million for corporate

administration, which remained relatively consistent with the prior

year; and a $5.5 million non-cash accounting write-down of the

Company’s used mill equipment, which remains for sale.

Net income for the year ended December 31, 2020 was comprised of

$6.1 million in gains on the sale of the Los Reyes project and

partial cancellation of the Awak Mas royalty, $2.4 million of gains

related to the sale of our Midas Gold Corp. shares, and other

income of $0.3 million, offset by $8.4 million of operating

expenses.

The Company’s consolidated audited financial statements and

management’s discussion and analysis together with other important

disclosures can be found in the Company’s Annual Report on Form

10-K for the year ended December 31, 2021, filed with the U.S.

Securities and Exchange Commission and the Canadian securities

regulatory authorities.

Management Conference Call

Management’s quarterly conference call to review financial

results for the fiscal year ended December 31, 2021 and to discuss

corporate and project activities is scheduled for Monday, February

28, 2022 at 2:00 pm MT (4:00 pm ET).

Participant Toll Free: (844) 898-8648 Participant International:

(647) 689-4225 Conference ID: 8829349

This call will also be archived and available at

www.vistagold.com after February 28, 2022. Audio replay will be

available for 21 days by calling toll-free in North America (855)

859-2056 or (404) 537-3406.

If you are unable to access the audio or phone-in on the day of

the conference call, please email your questions to

ir@vistagold.com.

All dollar amounts in this press release are in U.S.

dollars.

For further information, please contact Pamela Solly, Vice

President of Investor Relations, at (720) 981-1185.

About Vista Gold Corp.

Vista is a gold project developer. The Company’s flagship asset

is the Mt Todd gold project located in the Tier 1, mining friendly

jurisdiction of Northern Territory, Australia. Situated

approximately 250 km southeast of Darwin, Mt Todd is the largest

undeveloped gold project in Australia. All major environmental

permits have now been approved.

For further information about Vista or the Mt Todd Gold Project,

please contact Pamela Solly, Vice President of Investor Relations,

at (720) 981-1185 or visit the Company’s website at

www.vistagold.com to access important information, including the

current TRS and Technical Report.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the U.S. Securities Act of 1933, as amended, and

U.S. Securities Exchange Act of 1934, as amended, and

forward-looking information within the meaning of Canadian

securities laws. All statements, other than statements of

historical facts, included in this press release that address

activities, events or developments that we expect or anticipate

will or may occur in the future, including such things as the

expected date for our management’s call regarding our financial

results; our belief that our achievements during 2021, together

with the Project’s size, location and permitting status position Mt

Todd as one of the most attractive, development-ready projects in

the world; our believe that our balance sheet is strong; our

believe that our prospects for unlocking shareholder value have

never been greater; our belief that the approval of the MMP marked

a significant de-risking milestone for the Project; our belief that

Vista has all major operating and environmental permits required to

proceed with development of Mt Todd; our belief that the FS affirms

the strength of Mt Todd’s gold production capacity and ability to

deliver robust economics with significant cashflows and resilience

to inflation; our belief that the FS will appeal to many potential

partners, investors and lenders and allow us to evaluate a broad

range of development alternatives as we continue to focus on

maximizing shareholder value are forward-looking statements and

forward-looking information. The material factors and assumptions

used to develop the forward-looking statements and forward-looking

information contained in this press release include the following:

our forecasts and expected cash flows; our projected capital and

operating costs; our expectations regarding mining and

metallurgical recoveries; mine life and production rates; that laws

or regulations impacting mine development or mining activities will

remain consistent; our approved business plans, our mineral

resource and reserve estimates and results of preliminary economic

assessments; preliminary feasibility studies and feasibility

studies on our projects, if any; our experience with regulators;

our experience and knowledge of the Australian mining industry and

our expectations of economic conditions and the price of gold. When

used in this press release, the words “optimistic,” “potential,”

“indicate,” “expect,” “intend,” “hopes,” “believe,” “may,” “will,”

“if,” “anticipate” and similar expressions are intended to identify

forward-looking statements and forward-looking information. These

statements involve known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or

achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such statements. Such factors include, among others, uncertainty of

resource and reserve estimates, uncertainty as to the Company’s

future operating costs and ability to raise capital; risks relating

to cost increases for capital and operating costs; risks of

shortages and fluctuating costs of equipment or supplies; risks

relating to fluctuations in the price of gold; the inherently

hazardous nature of mining-related activities; potential effects on

our operations of environmental regulations in the countries in

which it operates; risks due to legal proceedings; risks relating

to political and economic instability in certain countries in which

it operates; uncertainty as to the results of bulk metallurgical

test work; uncertainty as to completion of critical milestones for

Mt Todd; and uncertainty as to the impact of the ongoing global

health crisis caused by the COVID-19 pandemic; as well as those

factors discussed under the headings “Note Regarding

Forward-Looking Statements” and “Risk Factors” in the Company’s

latest Annual Report on Form 10-K as filed in February 2022 and

other documents filed with the U.S. Securities and Exchange

Commission and Canadian securities regulatory authorities. Although

we have attempted to identify important factors that could cause

actual results to differ materially from those described in

forward-looking statements and forward-looking information, there

may be other factors that cause results not to be as anticipated,

estimated or intended. Except as required by law, we assume no

obligation to publicly update any forward-looking statements or

forward-looking information; whether as a result of new

information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220224005993/en/

Pamela Solly Vice President of Investor Relations (720)

981-1185

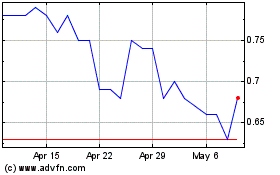

Vista Gold (TSX:VGZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

Vista Gold (TSX:VGZ)

Historical Stock Chart

From Nov 2023 to Nov 2024