VitalHub Corp. (the “Company” or “VitalHub”) (TSX:VHI)

(OTCQX:VHIBF) announced today it has filed its Consolidated

Financial Statements and Management's Discussion and Analysis

report for the year ended December 31, 2023, with the Canadian

securities authorities. These documents may be viewed under the

Company’s profile at www.sedar.com.

"As VitalHub closes another quarter, it's with a

great sense of achievement that we reflect on the strides we've

made. Our Q4 2023 revenue reached $13,603,419, marking a 20%

increase over the same period last year. This growth underscores

the successful execution of our strategy and the unwavering

dedication of our team. Q4 gross profit as a percentage of revenue

improved to 83%, up from 82% in the prior year quarter,

demonstrating our ability to enhance margins while expanding our

service offerings. This is a reflection of our growing recurring

revenue base to 83% of revenue compared to 77% in the prior year

quarter. We achieved Annual Recurring Revenue (ARR) of $44,573,739,

a testament to our robust business model and the trust our clients

place in our solutions. ARR increased 23% over the same period last

year. The bulk of this ARR growth, $6,387,730 or 18%, was organic,

$1,100,000 or 3% was from acquisitions, and $938,859 or 3% was from

currency fluctuations. Significantly, our EBITDA for Q4 surged by

536% to $2,992,273, and our adjusted EBITDA (Non-IFRS measure) saw

a 62% increase to $3,985,553. These figures are a clear indication

of our operational efficiency and the scalability of our platform.

Notably, our net income before taxes stood at $1,984,246,

illustrating a substantial improvement from the previous year and

underscoring our fiscal health and the effectiveness of our growth

strategies," said Dan Matlow, Chief Executive Officer of

VitalHub.

"Looking at the annual highlights, our revenue

for 2023 was $52,508,298, a 31% increase from the previous year,

with gross profit remaining robust at 82%. Our EBITDA for the year

almost doubled to $9,887,842, and we closed with an adjusted EBITDA

of $13,291,526, reinforcing our operational strength and market

position. Our cash position improved, with $33,480,018 on hand,

thanks to our disciplined approach to cash management and

operational excellence. This solid financial foundation empowers us

to continue our investment in innovation, pursue strategic

acquisitions, and further our mission to transform healthcare

technology. As we look to the future, our focus remains on driving

sustainable growth, expanding our market reach, and delivering

exceptional value to our clients and shareholders. With a clear

strategy and a dedicated team, I am confident in our ability to

navigate the opportunities and challenges ahead. I want to extend

my heartfelt thanks to our employees for their dedication and hard

work, our customers for their trust and partnership, and our

shareholders for their continued support. Together, we are setting

new standards in healthcare technology, and I am excited for what

the future holds for VitalHub."

VitalHub Corp’s quarterly investor conference

call will take place on Friday, March 22nd, 2024, at 9:00AM

EST.

To register for the call, please

visit:

https://us02web.zoom.us/webinar/register/WN_BERtvZQxTRuBDjh3Q_PO2A#/registration

Fourth Quarter 2023

Highlights

- Revenue of $13,603,419 as compared

to $11,289,606 in the equivalent prior year period, an increase of

$2,313,813 or 20%.

- Gross profit as a percentage of

revenue was 83% compared to 82% in the equivalent prior year period

(Q3 2023 - 82%).

- The increase in Q4 2023 was primarily due to higher term

licences, maintenance and support revenue, with recurring revenue

representing 83% of revenues in the quarter compared to 77% in Q4

2022

- ARR ⁽¹⁻²⁾ at December 31, 2023, was

$44,573,739 as compared to $42,612,166 at September 30, 2023.

- ARR ⁽¹⁻²⁾ growth was due to organic growth in Q4’23 of

$1,959,986 or 5% (21.7% annualized).

- EBITDA ⁽²⁾ of $2,992,273 compared

to $470,220 in the equivalent prior year period, an increase of

$2,522,053 or 536%.

- Adjusted EBITDA ⁽²⁾ of $3,985,553

or 29% of revenue, compared to $2,455,377 or 22% of revenue in the

equivalent prior year period, an increase of $1,530,176 or 62%.

- The increase in EBITDA ⁽²⁾ and adjusted EBITDA ⁽²⁾ from Q4 2022

to Q4 2023 was primarily attributable to the higher recurring

revenues of $11,302,366 in Q4 2023, as compared to $8,736,265 in Q4

2022, coupled with an ongoing effort to reduce costs and gain

operating cost synergies.

- Net income before income taxes of $1,984,246 as compared to a

net loss of $656,336 in the equivalent prior year period, an

increase of $2,640,582 or 402%.

- The increase was primarily

attributable to the significant increase in revenues from organic

growth and acquisitions, coupled with an ongoing effort to reduce

costs and gain operating cost synergies.

Annual 2023 Highlights

- Revenue of $52,508,298 as compared

to $39,970,814 in the equivalent prior year period, an increase of

$12,537,484 or 31%.

- Gross profit as a percentage of

revenue was 82% compared to 82% in the equivalent prior year

period.

- Gross profit as a percentage of revenue is largely dependent

upon the sales mix, with perpetual and term licenses, maintenance

and support generating a higher margin than consulting services and

hardware revenue.

- ARR ⁽¹⁻²⁾ at December 31, 2023 was

$44,573,739 as compared to $36,145,150 at December 31, 2022, an

increase of $8,428,589 or 23%.

- ARR ⁽¹⁻²⁾ benefited from organic growth of $6,387,730 or 18%;

growth from acquisitions of $1,100,000 or 3%, and a gain of

$938,859 or 3% primarily due to the fluctuation in the GB pound and

US dollar rates relative to the Canadian dollar.

- EBITDA⁽²⁾ of $9,887,842 compared to

$5,250,015 in the equivalent prior year period, an increase of

$4,637,827 or 88%.

- Adjusted EBITDA⁽²⁾ of $13,291,526

or 25% of revenue, compared to $9,524,708 or 24% of revenue in the

equivalent prior year period, an increase of $3,766,818 or 40%.

- The increase in EBITDA and adjusted EBITDA from Q4 2022 to Q4

2023 was primarily attributable to the higher recurring revenues of

$42,333,253 for the year ended December 31, 2023, as compared to

$29,359,361 in the equivalent prior year, coupled with an ongoing

effort to manage costs and gain operating cost synergies.

- Cash on hand at December 31, 2023

was $33,480,018 compared to $17,452,210 as at December 31, 2022.

- The increase was primarily due to an increase in cash generated

from operations, as management continues to gain synergies from

acquisitions and continues to reduce costs of operations.

- Cash from operations before changes

in working capital was $11,180,747 as compared to $7,119,817 last

year.

- Net income before income taxes of $5,327,733 as compared to

$1,306,717 in the equivalent prior year period, an increase of

$4,021,016 or 308%.

- The change in net income was

primarily attributable to higher revenues from term licenses,

maintenance and support, services and hardware.

|

(1) |

|

The Company defines annual recurring revenue (“ARR”) as the

recurring revenue expected based on yearly subscriptions of the

renewable software license fees and maintenance services. |

| (2) |

|

Non-IFRS measure. |

| |

|

|

|

SELECTED FINANCIAL INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

Year ended |

|

|

December 31, 2023 |

% Revenue |

December 31, 2022 |

% Revenue |

Change |

December 31, 2023 |

% Revenue |

December 31, 2022 |

% Revenue |

Change |

|

|

$ |

|

$ |

|

% |

$ |

|

$ |

|

% |

|

Revenue |

13,603,419 |

100% |

11,289,606 |

100% |

20% |

52,508,298 |

100% |

39,970,814 |

100% |

31% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

2,364,543 |

17% |

1,999,560 |

18% |

(18%) |

9,697,998 |

18% |

7,031,819 |

18% |

(38%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

11,238,876 |

83% |

9,290,046 |

82% |

21% |

42,810,300 |

82% |

32,938,995 |

82% |

30% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

2,911,708 |

21% |

2,390,847 |

21% |

(22%) |

11,765,148 |

22% |

8,556,468 |

21% |

(38%) |

|

Sales and marketing |

1,394,948 |

10% |

1,126,839 |

10% |

(24%) |

5,883,267 |

11% |

4,275,151 |

11% |

(38%) |

|

Research and development |

3,188,172 |

23% |

3,223,157 |

29% |

1% |

12,169,285 |

23% |

10,431,212 |

26% |

(17%) |

|

Depreciation of property and equipment |

76,496 |

1% |

76,422 |

1% |

(0%) |

318,866 |

1% |

250,287 |

1% |

(27%) |

|

Depreciation of right-of-use assets |

101,115 |

1% |

163,222 |

1% |

38% |

399,715 |

1% |

342,863 |

1% |

(17%) |

|

Stock based compensation |

220,494 |

2% |

267,584 |

2% |

18% |

1,058,919 |

2% |

1,140,387 |

3% |

7% |

|

Deferred share-based compensation |

- |

0% |

- |

0% |

0% |

97,560 |

0% |

- |

0% |

(100%) |

|

Foreign currency (gain) loss |

(241,505) |

(2%) |

93,826 |

1% |

357% |

(296,824) |

(1%) |

150,399 |

0% |

297% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income and expenses |

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangible assets |

1,067,885 |

8% |

952,787 |

8% |

(12%) |

4,259,113 |

8% |

3,279,803 |

8% |

(30%) |

|

Business acquisition, restructuring and integration costs |

306,741 |

2% |

1,022,171 |

9% |

70% |

1,534,835 |

3% |

2,438,904 |

6% |

37% |

|

Loss on change in fair value of contingent consideration |

466,045 |

3% |

695,402 |

6% |

33% |

712,370 |

1% |

695,402 |

2% |

(2%) |

|

Interest expense and accretion (net of interest income) |

(252,294) |

(2%) |

10,288 |

0% |

(2552%) |

(489,566) |

(1%) |

40,914 |

0% |

1297% |

|

Interest expense from lease liabilities |

14,825 |

0% |

(76,163) |

(1%) |

119% |

71,981 |

0% |

29,431 |

0% |

(145%) |

|

(Gain) loss on disposal of property and equipment |

0 |

0% |

0 |

0% |

0% |

(2,102) |

(0%) |

1,057 |

0% |

299% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current and deferred income taxes |

1,045,457 |

8% |

(318,005) |

(3%) |

429% |

778,248 |

1% |

92,081 |

0% |

(745%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

938,789 |

7% |

(338,331) |

(3%) |

377% |

4,549,485 |

9% |

1,214,636 |

3% |

275% |

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA (Non-IFRS measure) |

2,992,273 |

22% |

470,220 |

4% |

536% |

9,887,842 |

19% |

5,250,015 |

13% |

88% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA (Non-IFRS

measure) |

3,985,553 |

29% |

2,455,377 |

22% |

62% |

13,291,526 |

25% |

9,524,708 |

24% |

40% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual recurring revenue (Non-IFRS

measure) |

44,573,739 |

|

36,145,150 |

|

23% |

44,573,739 |

|

36,145,150 |

|

23% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Term licences, maintenance and support

revenue |

11,302,366 |

83% |

8,736,265 |

77% |

29% |

42,332,253 |

81% |

29,359,361 |

73% |

44% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As at |

|

|

|

|

|

|

|

|

|

|

December 31, 2023 |

December 31, 2022 |

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

Deferred revenue |

|

|

|

21,049,975 |

15,495,461 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash balance |

|

|

|

33,480,018 |

17,452,210 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABOUT VITALHUB

Software for Health and Human Services providers

designed to simplify the user experience and optimize outcomes.

VitalHub Corp. (the “Company” or “VitalHub”)

provides technology to Health and Human Services providers

including Hospitals, Regional Health Authorities, Mental Health,

Long Term Care, Home Health, Community and Social Services.

VitalHub solutions span the categories of Electronic Health Record

(EHR), Case Management, Care Coordination & Optimization, and

Patient Flow & Operational Visibility solutions.

The Company has a robust two-pronged growth

strategy, targeting organic growth opportunities within its product

suite, and pursuing an aggressive merger and acquisition

(“M&A”) plan. Currently VitalHub serves more than 1,000 clients

across Canada, USA, UK, Australia, the Middle East, and Europe.

VitalHub is based in Toronto, Canada, with an

offshore development hub in Sri Lanka. The VitalHub team comprises

more than 400 team members globally. The Company is publicly traded

on the Toronto Stock Exchange (TSX) under the symbol "VHI" and on

the OTC Markets OTCQX Exchange under the symbol “VHIBF”.

CAUTIONARY STATEMENT

Certain statements contained in this news

release may constitute "forward-looking information" or "financial

outlook" within the meaning of applicable securities laws that

involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements to

be materially different from any future results, performance or

achievements expressed or implied by such forward-looking

information or financial outlook. Often, but not always,

forward-looking statements can be identified by the use of words

such as "plans", "is expected", "expects", "scheduled", "intends",

"contemplates", "anticipates", "believes", "proposes" or variations

(including negative variations) of such words and phrases, or state

that certain actions, events or results "may", "could", "would",

"might" or "will" be taken, occur or be achieved. Such statements

are based on the current expectations of the management of each

entity and are based on assumptions and subject to risks and

uncertainties. Although the management of each entity believes that

the assumptions underlying these statements are reasonable, they

may prove to be incorrect. Although the Company has attempted to

identify important factors that could cause actual actions, events

or results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results to differ from those anticipated,

estimated or intended. No forward-looking statement can be

guaranteed. Except as required by applicable securities laws,

forward-looking statements speak only as of the date on which they

are made and the Company undertakes no obligation to publicly

update or revise any forward-looking statement, whether as a result

of new information, future events, or otherwise.

CONTACT INFORMATION

Dan MatlowChief Executive Officer, Director(416)

727-9061dan.matlow@VitalHub.com

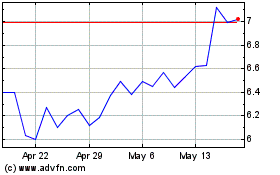

Vitalhub (TSX:VHI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Vitalhub (TSX:VHI)

Historical Stock Chart

From Dec 2023 to Dec 2024