Vitalhub Corp. (the “Company” or “VitalHub”) (TSX:VHI)

(OTCQX:VHIBF) announced today it has filed its Interim

Condensed Consolidated Financial Statements and Management's

Discussion and Analysis report for the three and nine months ended

September 30, 2024, with the Canadian securities authorities. These

documents may be viewed under the Company’s profile at

www.sedarplus.com.

“We are pleased to report strong third quarter

2024 results, continuing our path of driving stable revenue and

cash flow growth,” said Dan Matlow, CEO of VitalHub. “Financial

highlights include $16.5 million of revenue, 28% adjusted EBITDA

⁽²⁾ margin, and $1.1 million of sequential net new organic ARR

⁽¹⁻²⁾ in the seasonally quieter summer quarter. We are continuing

to build on the success of our diversified portfolio, from a

product and geographic perspective.”

“Subsequent to the quarter, we closed the

acquisitions of MedCurrent and Strata Health, bringing our third

quarter 2024 pro forma ARR ⁽¹⁻²⁾ to $68.0 million. Both of these

acquisitions expand the functionality of our patient flow platform.

The technologies are innovative and will increase our growth

potential as healthcare systems increasingly embrace

digitization.”

“Inclusive of these transactions, we closed the

quarter with a September 30, 2024 pro forma cash balance of over

$50 million and no debt. In combination with our stable quarterly

cash generation, we are in a strong position to continue on our

M&A path. We have record activity in our deal pipeline. We will

continue to exercise discipline to transact only on the

opportunities that enhance the value of the VitalHub suite for our

healthcare partners and our shareholders.”

VitalHub’s quarterly investor conference call

will take place on Thursday, November 14, 2024, at 9:00AM EST.

To register for the call, please visit:

https://us06web.zoom.us/webinar/register/WN_b6XzLByVR0yOqO4IN-9UiQ

Third Quarter 2024

Highlights

- Revenue of $16,509,135 as compared

to $13,224,264 in the equivalent prior year period, an increase of

$3,284,871 or 25%.

- Gross profit as a percentage of

revenue was 81% compared to 82% in the equivalent prior year

period.

- ARR ⁽¹⁻²⁾ at September 30, 2024 was

$53,452,108 as compared to $51,283,570 at June 30, 2024, an

increase of $2,168,538 or 4%.

- ARR ⁽¹⁻²⁾ growth was due to organic

growth of $1,081,181 or 2%, and an increase of $1,087,357 or 2% due

to the fluctuations in foreign exchange rates during the

quarter.

- Net income before income taxes of

$2,360,258 as compared to net income before income taxes of

$1,820,543 in the equivalent prior year period, an increase of

$539,715 or 30%.

- EBITDA ⁽²⁾ of $3,004,034 compared

to $2,928,358 in the equivalent prior year period, an increase of

$75,676 or 3%.

- Adjusted EBITDA⁽²⁾ of $4,554,597 or

28% of revenue, compared to $3,411,871 or 26% of revenue in the

equivalent prior year period, an increase of $1,142,726 or

33%.

- On October 4, 2024, the Company

acquired all of the issued and outstanding shares of MedCurrent

Corporation and its subsidiaries (“MedCurrent”). MedCurrent

integrates evidence-based guidelines at the point of care, serving

over 80 customers in Canada, the UK, the US, and Australia. Total

closing consideration for the acquisition was $8.3 million in cash

after working capital adjustments.

- On October 29, 2024, the Company

acquired all of the issued and outstanding shares of Strata Health

Solutions Inc. (“Strata Health”). Strata Health designs, builds,

and deploys software that improves access and navigation to care

for customers internationally. Total closing consideration for the

acquisition was $32.3 million, composed of a cash payment of $18.6

million and the issuance of 1,480,726 common shares of

VitalHub.

- With the addition of the ARR⁽¹⁻²⁾

of MedCurrent and Strata Health subsequent to the quarter, the

Company’s pro forma ARR ⁽¹⁻²⁾ would be approximately $68.0

million.

Nine Month 2024 Highlights

- Revenue of $48,003,531 as compared

to $38,904,879 in the equivalent prior year period, an increase of

$9,098,652 or 23%.

- Gross profit as a percentage of

revenue was 81% compared to 81% in the equivalent prior year

period.

- ARR ⁽¹⁻²⁾ at September 30, 2024 was

$53,452,108 as compared to $42,612,166 at September 30, 2023, an

increase of $10,839,942 or 25%.

- ARR ⁽¹⁻²⁾ growth was primarily due

to organic growth of $5,826,248 or 14%, acquisition growth of

$3,311,500 or 8%, and a gain of $1,702,194 or 4% due to

fluctuations in foreign exchange rates.

- Net income before income taxes of

$5,722,758 as compared to net income before income taxes of

$3,343,487 in the equivalent prior year period, an increase of

$2,379,271 or 71%.

- EBITDA ⁽²⁾ of $8,075,502 compared

to $6,895,569 in the equivalent prior year period, an increase of

$1,179,933 or 17%.

- Adjusted EBITDA

⁽²⁾ of $12,793,514 or 27% of revenue, compared to $9,305,973 or 24%

of revenue in the equivalent prior year period, an increase of

$3,487,541 or 37%.

- Cash on hand at September 30, 2024

was $81,438,615 compared to $33,480,018 as at December 31, 2023.

- The increase is primarily due to a

bought deal offering of approximately $37 million in net proceeds,

plus cash generated from operations.

- Cash from operations before changes

in working capital was $8,135,174 as compared to $8,536,603 for the

same period last year.

(1) The Company defines annual recurring revenue

(“ARR”) as the recurring revenue expected based on yearly

subscriptions of the renewable software license fees and

maintenance services.(2) Non-IFRS measure. Disclaimers and

reconciliations can be found in SEDAR filings.

| |

|

|

|

|

|

|

|

|

|

|

| SELECTED

FINANCIAL

INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

Nine months ended |

|

|

September 30, 2024 |

% Revenue |

September 30, 2023 |

% Revenue |

Change |

September 30, 2024 |

% Revenue |

September 30, 2023 |

% Revenue |

Change |

|

|

$ |

|

$ |

|

% |

$ |

|

$ |

|

% |

|

Revenue |

16,509,135 |

|

100% |

13,224,264 |

|

100% |

25% |

48,003,531 |

|

100% |

38,904,879 |

|

100% |

23% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

3,215,845 |

|

19% |

2,392,707 |

|

18% |

(34%) |

9,258,338 |

|

19% |

7,333,455 |

|

19% |

(26%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

13,293,290 |

|

81% |

10,831,557 |

|

82% |

23% |

38,745,193 |

|

81% |

31,571,424 |

|

81% |

23% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

3,555,539 |

|

22% |

2,683,879 |

|

20% |

(32%) |

10,008,360 |

|

21% |

8,853,440 |

|

23% |

(13%) |

|

Sales and marketing |

1,562,915 |

|

9% |

1,466,675 |

|

11% |

(7%) |

5,081,213 |

|

11% |

4,488,319 |

|

12% |

(13%) |

|

Research and development |

3,943,697 |

|

24% |

3,167,468 |

|

24% |

(25%) |

11,037,178 |

|

23% |

8,981,113 |

|

23% |

(23%) |

|

Depreciation of property and equipment |

93,687 |

|

1% |

84,202 |

|

1% |

(11%) |

252,691 |

|

1% |

242,370 |

|

1% |

(4%) |

|

Depreciation of right-of-use assets |

108,905 |

|

1% |

100,951 |

|

1% |

(8%) |

326,912 |

|

1% |

298,600 |

|

1% |

(9%) |

|

Share-based compensation |

636,177 |

|

4% |

266,784 |

|

2% |

(138%) |

1,660,430 |

|

3% |

838,425 |

|

2% |

(98%) |

|

Deferred share-based compensation |

0 |

|

0% |

0 |

|

0% |

0% |

0 |

|

0% |

97,560 |

|

0% |

100% |

|

Foreign currency loss (gain) |

(323,458 |

) |

(2%) |

103,766 |

|

1% |

412% |

(175,072 |

) |

(0%) |

(55,319 |

) |

(0%) |

216% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income and expenses |

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangible assets |

1,197,953 |

|

7% |

1,066,767 |

|

8% |

(12%) |

3,418,794 |

|

7% |

3,191,228 |

|

8% |

(7%) |

|

Business acquisition, restructuring and integration

costs |

841,454 |

|

5% |

216,729 |

|

2% |

(288%) |

2,652,758 |

|

6% |

1,228,094 |

|

3% |

(116%) |

|

Loss on change in fair value of contingent

consideration |

72,932 |

|

0% |

0 |

|

0% |

(100%) |

404,824 |

|

1% |

246,325 |

|

1% |

(64%) |

|

Interest expense and accretion (net of interest

income) |

(766,046 |

) |

(5%) |

(160,917 |

) |

(1%) |

376% |

(1,680,448 |

) |

(4%) |

(237,272 |

) |

(1%) |

608% |

|

Interest expense from lease liabilities |

9,277 |

|

0% |

16,812 |

|

0% |

45% |

34,795 |

|

0% |

57,156 |

|

0% |

39% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current and deferred income taxes |

1,131,871 |

|

7% |

(1,006,534 |

) |

(8%) |

(212%) |

3,510,958 |

|

7% |

(267,209 |

) |

(1%) |

(1414%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

1,228,387 |

|

7% |

2,827,077 |

|

21% |

(57%) |

2,211,800 |

|

5% |

3,610,696 |

|

9% |

(39%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA (Non-IFRS measure) |

3,004,034 |

|

18% |

2,928,358 |

|

22% |

3% |

8,075,502 |

|

17% |

6,895,569 |

|

18% |

17% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA (Non-IFRS

measure) |

4,554,597 |

|

28% |

3,411,871 |

|

26% |

33% |

12,793,514 |

|

27% |

9,305,973 |

|

24% |

37% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual recurring revenue (Non-IFRS

measure) |

53,452,108 |

|

|

42,612,166 |

|

|

25% |

53,452,108 |

|

|

42,612,166 |

|

|

25% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Term licences, maintenance and support

revenue |

13,892,323 |

|

84% |

10,821,758 |

|

82% |

28% |

39,396,754 |

|

82% |

31,029,887 |

|

80% |

27% |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

As at |

|

|

|

|

|

| |

|

|

|

September 30, 2024 |

December 31, 2023 |

|

|

|

|

|

| |

|

|

|

$ |

$ |

|

|

|

|

|

| |

Cash balance |

|

|

81,438,615 |

|

33,480,018 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Deferred revenue |

|

29,506,802 |

|

21,049,975 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

About VitalHub

Software for Health and Human Services providers

designed to simplify the user experience and optimize outcomes.

VitalHub is a leading software company dedicated

to empowering Health and Human Services providers. Our clients

include hospitals, regional health authorities, mental health and

addictions services providers for children and adults, long-term

care facilities, home health agencies, correctional services, and

community and social services providers.

VitalHub’s comprehensive suite of SaaS solutions

include:

- Electronic Health Record (EHR),

Case Management, Care Coordination, and Optimization

- Patient Flow, Operational

Visibility, and Patient Journey Optimization

- Workforce Automation

The Company has a robust two-pronged growth

strategy, targeting organic growth opportunities within its product

suite, and pursuing an aggressive M&A plan. Currently VitalHub

serves more than 1,000 clients across Canada, USA, UK, Australia,

the Middle East, and Europe.

VitalHub is based in Toronto, Canada, with an

offshore development hub in Sri Lanka. The VitalHub team comprises

more than 500 team members globally. The Company is publicly traded

on the Toronto Stock Exchange (TSX) under the symbol "VHI" and on

the OTC Markets OTCQX Exchange under the symbol "VHIBF".

https://www.vitalhub.com/

Contact Information

Christian Sgro, CPA, CA, CFAHead of IR and

M&A Specialist(416) 277-3776christian.sgro@vitalhub.com

Dan MatlowChief Executive Officer, Director(416)

727-9061dan.matlow@vitalhub.com

Cautionary Statement

Certain statements contained in this news

release may constitute "forward-looking information" or "financial

outlook" within the meaning of applicable securities laws that

involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements to

be materially different from any future results, performance or

achievements expressed or implied by such forward-looking

information or financial outlook. Often, but not always,

forward-looking statements can be identified by the use of words

such as "plans", "is expected", "expects", "scheduled", "intends",

"contemplates", "anticipates", "believes", "proposes" or variations

(including negative variations) of such words and phrases, or state

that certain actions, events or results "may", "could", "would",

"might" or "will" be taken, occur or be achieved. Such statements

are based on the current expectations of the management of each

entity and are based on assumptions and subject to risks and

uncertainties. Although the management of each entity believes that

the assumptions underlying these statements are reasonable, they

may prove to be incorrect. Although the Company has attempted to

identify important factors that could cause actual actions, events

or results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results to differ from those anticipated,

estimated or intended. No forward-looking statement can be

guaranteed. Except as required by applicable securities laws,

forward-looking statements speak only as of the date on which they

are made and the Company undertakes no obligation to publicly

update or revise any forward-looking statement, whether as a result

of new information, future events, or otherwise.

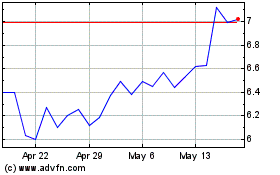

Vitalhub (TSX:VHI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Vitalhub (TSX:VHI)

Historical Stock Chart

From Dec 2023 to Dec 2024