ARCpoint Inc. (TSXV: ARC) (the “

Company” or

“

ARCpoint”) a leading US-based franchise system

providing drug testing, alcohol screening, DNA and direct to

consumer (“DTC”) clinical lab testing services, announces that it

will host a conference call at 11am Eastern time, Friday, May 24,

2024 to review the Company’s Q1 financial results for the period

ending March 31, 2024.

The dial-in number for the conference call is as follows:

Canada / USA Toll Free

1-844-763-8274International Toll +1-647-484-8814

Callers should dial in 5 – 10 min prior to the scheduled start

time and ask to join the ARCpoint call:

ARCpoint President and CEO, John Constantine

commented “In addition to the progress we’ve made in reducing

costs, we are encouraged by the improvement in revenues for our AFG

Services Group, which is largely dominated by our technology

platforms MyARCPointLabs and Total Reporting”.

As reported April 29, 2024, throughout April

2024, the Company enacted reductions in headcount as well as to

operational and administrative costs that are expected to result in

annualized savings of approximately USD$530 thousand in staffing

costs and USD$440 thousand in operational and administrative costs.

These reductions are in addition to the staffing and operational

cuts totalling USD$2.0 million as previously reported by the

Company in its news releases dated March 8 and October 17,

2023.

AFG Services, which primarily provides clinical

testing and software services that support the Company’s franchise

systems as well as other direct business to business customers with

it’s Total Reporting platform, increased revenues by 19% to USD$582

thousand in Q1 2024, versus USD$490 thousand in Q4 2024.

Mr. Constantine concluded, “With most of the

development expense and heavy lifting of the launch of our

technology platforms behind us, we are now positioned to expand the

use of these platforms to new users. In particular, we are working

hard to leverage MyARCPointLabs to create a healthcare ecosystem

that will drive more business to our franchisees and expand our

distribution network through new partnerships”.

On July 10, 2023 the Company reported that it

had launched its new consumer e-commerce platform, MyARCpointLabs.

(“MAPL”) MAPL was developed to make it easier for the Company’s

franchisees to attract and better serve individual healthcare

consumers and for a greater number of consumers to purchase the

Company’s products and services more easily. By year end of 2023,

every ARCpoint franchised location had MAPL integrated into their

location and interfaced with their local website. The combination

of all ARCpoint locations having MAPL deployed and an increase in

monthly reoccurring fees for users to access MAPL, helped MAPL

revenue increase by 23% to USD$223 thousand in Q1 2024, versus

USD$181 thousand in Q4 2023.

MAPL provides interface support with various

other healthcare organizations and acts as the operations tool

within the franchise system. The technology virtualizes the

Company’s consumer business model allowing for the expansion of the

Company’s footprint to other entities beyond traditional ARCpoint

facilities and enabling franchisees to generate revenue prior to

having a brick and mortar facility. MAPL also allows for the

linking of diagnostic testing services with virtual physicians,

telehealth organizations and other healthcare system constituents,

such as independent pharmacies.

On November 21, 2023, the Company further

announced that it had implemented a new application programming

interface (“API”) with MD Care Group LLC, (“MD Care Group”) a

telehealth company, which provides consumers with cost-effective,

virtual access to health care through a national network of

thousands of board-certified physicians and health care providers.

This allows ARCpoint customers to connect with MD Care Group's

doctors, through MAPL, to discuss results from ARCpoint diagnostic

tests or other medical concerns they may have. This opens the door

for future opportunities for the creation of virtual primary care

and urgent care centers anywhere ARCpoint services can be

accessed.

The Company’s other technology platform, Total

Reporting, is the Company’s Business to Business portal. Total

Reporting helps ARCpoint’s franchisees to market more services,

such as background checks and employer physicals through an

efficient, single sign-on integrated platform. In Q1 2024, as a

result of increased volumes and usage uptake, Total Reporting

revenue increased by 12% to $324 thousand, versus $289 Thousand in

Q4, 2023."

For Q1 2024, ARCpoint Franchise Group revenues

declined to USD$1.2 million versus USD$1.5 million in Q4 2023 as

the result of lower recognition and amortization of upfront

franchising. ARCpoint Franchise Group revenue consists primarily of

royalties and Brand Fund contributions based on a percentage of

sales reported by franchise labs. Revenue generated from this

segment also includes franchise fees paid by franchisees and

initial clinical, training and technology setup fees paid by new

franchisees.

As at March 31, 2024, the Company had total cash

on hand of approximately US$0.35 million, comprised of US$0.34

million in unrestricted cash and cash equivalents and US$13,548 in

Brand Fund restricted cash. Use of Brand Fund restricted cash is at

the Company’s discretion and is used to increase sales and the

brand presence of the Company’s entities and franchisees.

All results below are reported under

International Financial Reporting Standards and in US

dollars.

Summary of 2024 Q1 Financial

Results

- Total revenues for the three months

ended March 31, 2024, were $1.6 million compared to $1.7 million

for the three months ended March 31, 2023. The decrease in revenue

for Q1 2024 versus Q1 2023 was primarily due to lower royalty and

franchising revenues due to the pull back of COVID testing across

the country offset by an increase in support service revenues

provided to franchisees and lab services.

- Net loss for the three months ended

March 31, 2024, was $1.5 million compared to a net loss of $2.1

million for the three months ended March 31, 2023. The decrease in

loss for Q1 2024 versus Q1 2023 was primarily due to a decrease in

salary and wages of $0.7 million and decrease in general and

administrative costs of $0.1 million.

- Operating cash flow for the three

months ended March 31, 2024 was negative $1.3 million compared to

negative $1.2 million for the three months ended March 31,

2023.

- EBITDA for the three months ended

March 31, 2024, was negative $1.2 million compared to negative $1.8

million for the three months ended March 31, 2023.

- Adjusted EBITDA for the three

months ended March 31, 2024, was negative $1.0 million compared to

negative $1.1 million for the three months ended March 31,

2023.

DEFINITION AND RECONCILIATION OF

NON-IFRS FINANCIAL MEASURESThe Company reports certain

non-IFRS measures that are used to evaluate the performance of its

businesses and the performance of their respective segments.

Securities regulators require such measures to be clearly defined

and reconciled with their most comparable IFRS measures.

As non-IFRS measures generally do not have a

standardized meaning, they may not be comparable to similar

measures presented by other issuers. Rather, these are provided as

additional information to complement those IFRS measures by

providing further understanding of the results of the operations of

the Company from management’s perspective. Accordingly, these

measures should not be considered in isolation, nor as a substitute

for analysis of the Company’s financial information reported under

IFRS. Non-IFRS measures used to analyze the performance of the

Company’s businesses include “EBITDA” and “Adjusted EBITDA”.

The Company believes that these non-IFRS

financial measures provide meaningful supplemental information

regarding the Company’s performances and may be useful to investors

because they allow for greater transparency with respect to key

metrics used by management in its financial and operational

decision-making. These financial measures are intended to provide

investors with supplemental measures of the Company’s operating

performances and thus highlight trends in the Company’s core

businesses that may not otherwise be apparent when solely relying

on the IFRS measures. These non-IFRS measures are calculated as

follows:

“EBITDA” is comprised as income (loss) less

interest, income tax and depreciation and amortization. Management

believes that EBITDA is a useful indicator for investors, and is

used by management, in evaluating the operating performance of the

Company. See “Consolidated EBITDA and Adjusted EBITDA

Reconciliation” appended to this press release for a quantitative

reconciliation of EBITDA to the most directly comparable financial

measure.

“Adjusted EBITDA” is comprised as income (loss)

less interest, income tax, depreciation, amortization, share-based

compensation, Brand Fund revenue and expense timing difference,

change in fair value of warrant liability, foreign exchange gain

(loss) and other income / expenses not attributable to the

operations of the Company. Management believes that EBITDA is a

useful indicator for investors, and is used by management, in

evaluating the operating performance of the Company. See

“Consolidated EBITDA and Adjusted EBITDA Reconciliation” appended

to this press release for a quantitative reconciliation of Adjusted

EBITDA to the most directly comparable financial measure.

A reconciliation of how the Company calculates

EBITDA and Adjusted EBITDA is provide in the table appended to this

press release.

For more information, please see the

audited annual Financial Statements (the “Financial Statements”)

and the annual Management Discussion & Analysis of the Company

(MD&A”) under the Company’s profile at

www.sedar.com.

About ARCpoint Inc.ARCpoint is

a leading US-based franchise system that leverages technology along

with brick-and-mortar locations to give businesses and individual

consumers access to convenient, cost-effective healthcare

information and solutions with transparent, up-front pricing, so

that they can be proactive and preventative with their health and

well-being. ARCpoint is based in Greenville, South Carolina, USA.

ARCpoint Franchise Group LLC, formed under the laws of the state of

South Carolina in February 2005, is the franchisor of ARCpoint Labs

and supports over 130 independently owned locations. ARCpoint sells

franchises to individuals throughout the United States and provides

support in the form of marketing, technology and training to new

franchisees. ARCpoint Corporate Labs LLC develops corporate-owned

labs committed to providing accurate, cost-effective solutions for

customers, businesses and physicians. AFG Services LLC serves as

the innovation center of the ARCpoint group of companies as it

builds a proprietary technology platform and a physician network to

equip all ARCpoint labs with best-in-class tools and solutions to

better serve their customers. The platform also digitalizes and

streamlines administrative functions such as materials purchasing,

compliance, billing and physician services for ARCpoint franchise

labs and other clients.

For more information, please contact:

ARCpoint Inc.Jason Tong, Chief Financial

OfficerPhone : (604) 889-7827E-mail : invest@arcpointlabs.com

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION :

Forward-Looking Information – this news

release contains “forward-looking information” within the meaning

of applicable Canadian securities laws which are based on

ARCpoint’s current internal expectations, estimates, projections,

assumptions and beliefs and views of future events. Forward-looking

information can be identified by the use of forward-looking

terminology such as “expect”, “likely”, “may”, “will”, “should”,

“intend”, “anticipate”, “potential”, “proposed”, “estimate” and

other similar words, including negative and grammatical variations

thereof, or statements that certain events or conditions “may”,

“would” or “will” happen, or by discussions of

strategy.

The forward-looking information in this

news release is based upon the expectations, estimates,

projections, assumptions and views of future events which

management believes to be reasonable in the circumstances.

Forward-looking information includes estimates, plans,

expectations, opinions, forecasts, projections, targets, guidance

or other statements that are not statements of fact.

Froward-looking information necessarily involve known and unknown

risks, including, without limitation, risks associated with general

economic conditions; adverse industry events; loss of markets;

future legislative and regulatory developments; inability to access

sufficient capital from internal and external sources, and/or

inability to access sufficient capital on favourable terms; the

ability of the Company to implement its business strategies, the

COVID-19 pandemic; competition and other risks.

Any forward-looking information speaks

only as of the date on which it is made, and except as required by

law, the Company does not undertake any obligation to update or

revise any forward-looking information, whether as a result of new

information, future events or otherwise. New factors emerge from

time to time, and it is not possible for the Company to predict all

such factors. When considering the forward-looking information

contained herein, readers should keep in mind the risk factors and

other cautionary statements in the Company’s disclosure documents

filed with the applicable Canadian securities regulatory

authorities on SEDAR at www.sedar.com. The risk factors and other

factors noted in the disclosure documents could cause actual events

or results to differ materially from those described in any

forward-looking information.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the Exchange) accepts responsibility for the adequacy

or accuracy of this Press release.

ARCpoint

Inc.Consolidated EBITDA and Adjusted EBITDA

Reconciliation(Expressed in United States

Dollars)

(a) Finance expense comprised of interest on

bank loans, notes payable and lease liabilities (see Financial

Statements).(b) Share-based compensation expense comprised of

non-cash compensation (see Financial Statements).(c) Other income

comprised of government assistance benefit received pertaining to

the COVID-19 pandemic.(d) The Group operates a Brand Fund

established to collect and administer funds contributed for use in

advertising and promotional programs designed to increase sales and

enhance the reputation of the Group and its franchisees. The Group

reports contributions and expenditures on a gross basis on the

Group’s statement of profit and loss. Brand Fund contributions are

recognized as revenue when invoiced, as the Group has full

discretion on how and when the Brand Fund revenues are spent. Brand

Fund revenue received may not equal advertising expenditures for

the period due to timing of promotions and this difference is

recognized to earnings. This adjustment is made to normalize for

the timing difference of the Brand Fund revenues and Brand Fund

expenditures.

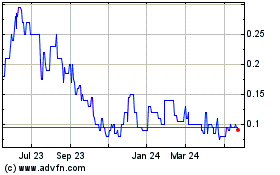

ARCpoint (TSXV:ARC)

Historical Stock Chart

From Dec 2024 to Jan 2025

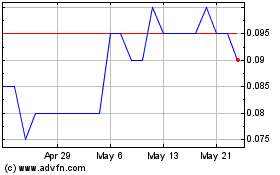

ARCpoint (TSXV:ARC)

Historical Stock Chart

From Jan 2024 to Jan 2025