Atico Mining Corporation (the “Company” or “Atico”) (TSX.V: ATY |

OTC: ATCMF) today announced its financial results for the year

ended December 31, 2021, posting income from mining operations of

$28.0 million and a net income of $7.0 million. Production for the

year at Atico’s El Roble mine totaled 18.1 million pounds (“lbs”)

of copper and 11,018 ounces (“oz”) of gold in concentrate at a cash

cost(1) of $1.45 per payable pound of copper(2).

Fernando E. Ganoza, CEO and Director, commented,

"At the beginning of the year, the operation had a very rough start

due to extreme weather conditions and equipment failure. However,

the team was able to turn things around at mid-year, making up for

most of lost production to reach our 2021 budget. As a result,

along with a very strong metal price environment, the Company

achieved its highest single year revenue and income from operations

since inception. These results continue to strengthen our balance

sheet and cash position.” Mr. Ganoza continued, “Over at the La

Plata project the Company successfully consolidated 100% ownership

while fast tracking development and permitting of the asset with

the support of the Ecuadorian government. In 2022, the main focus

will be on extending the life of mine at El Roble while in parallel

putting tremendous emphasis on advancing La Plata towards a

construction decision.”

2021 Consolidated Financial

Highlights

- Net income for the year ended

December 31, 2021, amounted to $7.0 million, compared with $8.4

million for last year. The increase in income from operations was

offset by higher income taxes, higher interest and G&A

expenses, and losses from metal hedging and foreign exchange, as

compared to 2020.

- Sales for the year increased 22% to

$72.7 million when compared with 2020. Copper (“Cu”) and gold

(“Au”) accounted for 89% and 11% of the 38,783 (2020 – 43,150) dry

metric tones of concentrate sold during the year. The Company ended

the year with 8,202 dry metric tones of concentrate in inventory

(December 31, 2020 – 4,824).

- The average realized price per

metal on provisional invoicing was $4.24 (2020 - $2.87) per pound

of copper and $1,790 (2020 - $1,802) per ounce of gold.

- Working capital was $13.7 million

(2020 - $22.5 million), while the Company had $6.0 million (2020 -

$6.8 million) in long-term loans payable and convertible

debenture.

- Cash costs(1) were $119.31 per

tonne of processed ore and $1.45 per pound of payable copper

produced(2), increases of 14% and 37% over the previous year,

respectively.

- Income from operations was $21.4

million (2020 - $12.8 million) while cash flow from operations,

before changes in working capital, was $22.7 million (2020 - $20.3

million). Cash used for capital expenditures amounted to $19.1

million (2020 - $10.9 million).

- All-in sustaining cash cost per

payable pound of copper produced(1)(2) for the year was $2.36 (2020

- $1.53).

2021 Consolidated Operating Highlights

and Review

- Ore processed decreased 1%

year-on-year;

- Copper head-grade decreased 12%

year-on-year;

- Concentrate production decreased 5%

year-on-year;

- Copper metal production decreased

12% year-on-year; and

- Gold metal production increased 2%

year-on-year.

The Company has come in just below its copper

production target while meeting almost all other operational goals

set for El Roble mine in 2021. During the first half of 2021, the

Company faced a number of weather-related challenges due to a very

strong and persistent rainy season in the region. At the mid-year

point, the Company made an important turnaround and was able to

make up for almost all of the shortfall during the second half of

2021.

In 2021, the Company produced 18.1 million lbs

of copper, 11,018 oz of gold, and 40,238 oz of silver. When

compared to same period in 2020, production decreased by 12% for

copper and increased 2% for gold. The decrease for copper is mostly

explained by 12% decrease in processed head-grade along operational

setbacks in the first half of the year caused by challenging

weather conditions.

Cash costs(1) were $119.31 per tonne of

processed ore and $1.45 per pound of payable copper produced(2),

which were increases of 14% and 37% over 2020, respectively (refer

to non-GAAP Financial Measures). The increase in cash costs per

tonne processed compared to the prior year is mainly explained by a

higher price of energy, more back-filling required at the mine, the

operation of the new tailings-filtering plant and some

tailing-rehandling required prior to completion of the new

dry-stack tailings facility. The increase in cash cost per pound of

payable copper produced is also explained by lower processed

head-grade for copper than in prior year, resulting in lower

payable copper production, and an increase in transportation costs.

The all-in sustaining cash cost net of by-product credits(1)(2) was

$2.36 per pound of payable copper produced, which represents a 54%

increase over 2020.2021 Consolidated Operational

Details

|

|

Q1 |

Q2 |

Q3 |

Q4 |

Total |

|

Production(Contained in Concentrates)(3) |

|

|

|

|

|

|

Copper (000s pounds) |

4,385 |

4,312 |

4,442 |

4,928 |

18,067 |

|

Gold (ounces) |

2,189 |

2,699 |

2,978 |

3,152 |

11,018 |

|

Silver (ounces) |

7,383 |

10,440 |

11,692 |

10,723 |

40,238 |

|

Mine |

|

|

|

|

|

|

Tonnes of ore mined |

64,101 |

71,437 |

76,276 |

74,864 |

286,678 |

|

Mill |

|

|

|

|

|

|

Tonnes processed |

68,282 |

68,238 |

77,816 |

74,414 |

288,750 |

|

Tonnes processed per day |

954 |

892 |

919 |

908 |

918 |

|

Copper grade (%) |

3.15 |

3.10 |

2.80 |

3.23 |

3.06 |

|

Gold grade (g/t) |

1.76 |

2.00 |

2.02 |

2.16 |

1.98 |

|

Silver grade (g/t) |

6.77 |

9.04 |

8.27 |

8.44 |

8.14 |

|

Recoveries |

|

|

|

|

|

|

Copper (%) |

92.3 |

92.6 |

92.6 |

93.0 |

92.6 |

|

Gold (%) |

57.3 |

61.5 |

58.8 |

61.1 |

59.8 |

|

Silver (%) |

49.8 |

53.2 |

56.6 |

53.3 |

53.4 |

|

Concentrates |

|

|

|

|

|

|

Copper Concentrates (dmt) |

10,366 |

10,020 |

10,704 |

11,159 |

42,249 |

|

Copper (%) |

19.2 |

19.5 |

18.8 |

20.0 |

19.4 |

|

Gold (g/t) |

6.6 |

8.6 |

8.7 |

8.8 |

8.1 |

|

Silver (g/t) |

22.3 |

31.6 |

34.0 |

29.9 |

29.6 |

|

|

|

|

|

|

|

|

Payable copper produced (000s lb) |

4,166 |

4,070 |

4,182 |

4,682 |

17,100 |

|

Cash cost per pound of payable copper(1)(2)($/lb) |

1.71 |

1.33 |

1.40 |

1.36 |

1.45 |

The financial statements and MD&A are

available on SEDAR and have also been posted on the company's

website at http://www.aticomining.com/s/FinancialStatements.asp

Fourth Quarter Financial

Highlights

During the quarter, the Company generated sales

of $8.1 million, where copper accounted for 91% and gold for 9%.

The average realized price per metal on provisional invoicing was

$4.37 per pound of copper and $1,803 per ounce of gold. Cash flow

used in operations, before changes in working capital, for the

quarter was $5.1 million. Cash costs(1) for the quarter were

$123.03 per tonne of processed ore and $1.36 per pound of payable

copper produced(2), increases of 13% and 32% over Q4-2020,

respectively.

Annual General Meeting

Atico Mining cordially invites all shareholders

to its Annual General and Special Meeting of Shareholders, at 10:00

am, Tuesday, June 14, 2022, at Suite 501 - 543 Granville Street,

Vancouver, British Columbia. This year, to proactively deal with

the unprecedented health impact of the novel coronavirus, also

known as COVID-19, to mitigate risks to the health and safety of

our communities, shareholders, employees, and other stakeholders,

and in compliance with current government direction and advice, the

meeting will be held by teleconference.

Corporate Update

The Company announced in its press release dated

July 22, 2021 and then again on December 29 2021, that it is in the

process of renewing the title on its claim hosting the El Roble

mine in Colombia, which under the current agreement was set to

expire in January 2022. This process is still ongoing and the

company can continue operating while the renewal process is defined

by the authorities. The Company is working diligently with the

authorities who have confirmed all the renewal requirements have

been fulfilled. However, at this time, the title has not been

renewed and there is no assurance that it will be renewed, in which

case the outcome would be materially adverse for the Company since

it will have no cash flow from operations and will be required to

change its priorities.

At the La Plata Project in Ecuador, the

Company’s current focus is on concluding the Feasibility Study

which is near completion. In parallel, the Company has completed

and presented the Environmental Impact Study to the Ecuadorian

authorities for review and approval. This effort is being

complemented by advancing towards securing the necessary permits

and licenses to begin construction.

El Roble Mine

The El Roble mine is a high grade, underground

copper and gold mine with nominal processing plant capacity of

1,000 tonnes per day, located in the Department of Choco in

Colombia. Its commercial product is a copper-gold concentrate.

Since obtaining control of the mine on November

22, 2013, Atico has upgraded the operation from a historical

nominal capacity of 400 tonnes per day.

El Roble has Proven and Probable reserves of

1.00 million tonnes grading 3.02% copper and 1.76 g/t gold, at a

cut-off grade of 1.3% copper equivalent with an effective date of

September 30, 2020. Mineralization is open at depth and along

strike and the Company plans to further test the limits of the

deposit. On the larger land package, the Company has identified a

prospective stratigraphic contact between volcanic rocks and black

and grey pelagic sediments and cherts that has been traced by Atico

geologists for ten kilometers. This contact has been determined to

be an important control on VMS mineralization on which Atico has

identified numerous target areas prospective for VMS type

mineralization occurrence, which is the focus of the current

surface drill program at El Roble.

La Plata Overview

Atico’s wholly-owned La Plata project is a gold

rich volcanogenic massive sulphide deposit that was the subject of

small-scale mining from 1975-1981 by Outokumpu Finland. The project

benefits from a modern drill and exploration database which was

completed by Cambior Inc. from 1996-1999, Cornerstone Capital from

2006-2009 and Toachi from 2016-2019.

Toachi Mining completed a PEA estimating an

inferred resource of 1.85 million tonnes grading 4.10 grams gold

per tonne, 50.0 grams silver per tonne, 3.30% copper, 4.60% zinc

and 0.60% lead per tonne.

The La Plata project consists of two concessions

covering a total area of 2,235 hectares along its 4-kilometer

length, which contains known mineralization in two VMS lenses and

nine priority exploration targets.

Qualified Person

Mr. Thomas Kelly (SME Registered Member

1696580), advisor to the Company and a qualified person under

National Instrument 43-101 standards, is responsible for ensuring

that the technical information contained in this news release is an

accurate summary of the original reports and data provided to or

developed by Atico.

About Atico Mining Corporation Atico is a

growth-oriented Company, focused on exploring, developing and

mining copper and gold projects in Latin America. The Company

generates significant cash flow through the operation of the El

Roble mine and is developing it’s high-grade La Plata VMS project

in Ecuador. The Company is also pursuing additional acquisition of

advanced stage opportunities. For more information, please

visit www.aticomining.com.

ON BEHALF OF THE BOARD

Fernando E. GanozaCEOAtico Mining

Corporation

Trading symbols: TSX.V: ATY | OTC: ATCMF

Investor RelationsIgor DutinaTel:

+1.604.633.9022

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

No securities regulatory authority has either

approved or disapproved of the contents of this news release. The

securities being offered have not been, and will not be, registered

under the United States Securities Act of 1933, as amended (the

‘‘U.S. Securities Act’’), or any state securities laws, and may not

be offered or sold in the United States, or to, or for the account

or benefit of, a "U.S. person" (as defined in Regulation S of the

U.S. Securities Act) unless pursuant to an exemption therefrom.

This press release is for information purposes only and does not

constitute an offer to sell or a solicitation of an offer to buy

any securities of the Company in any jurisdiction.

Cautionary Note Regarding Forward

Looking StatementsThis announcement includes certain

“forward-looking statements” within the meaning of Canadian

securities legislation. All statements, other than statements of

historical fact, included herein, without limitation the use of net

proceeds, are forward-looking statements. Forward- looking

statements involve various risks and uncertainties and are based on

certain factors and assumptions. There can be no assurance that

such statements will prove to be accurate, and actual results and

future events could differ materially from those anticipated in

such statements. Important factors that could cause actual results

to differ materially from the Company’s expectations include

uncertainties as to the timing and process for renewal of title to

the El Roble claims; uncertainties relating to interpretation of

drill results and the geology, continuity and grade of mineral

deposits; uncertainty of estimates of capital and operating costs;

the need to obtain additional financing to maintain its interest in

and/or explore and develop the Company’s mineral projects;

uncertainty of meeting anticipated program milestones for the

Company’s mineral projects; the world-wide economic and social

impact of COVID-19 is managed and the duration and extent of the

coronavirus pandemic is minimized or not long-term; disruptions

related to the COVID-19 pandemic or other health and safety issues,

or the responses of governments, communities, the Company and

others to such pandemic or other issues; and other risks and

uncertainties disclosed under the heading “Risk Factors” in the

Company's Management's Discussion and Analysis for the year ended

December 31, 2021 as filed on SEDAR and as available on the

Company's website for further details, and in the prospectus of the

Company dated March 2, 2012 filed with the Canadian securities

regulatory authorities on the SEDAR website at www.sedar.com

Non-GAAP Financial Measures

The items marked with a "(1)" are alternative

performance measures and readers should refer to Non-GAAP Financial

Measures in the Company's Management's Discussion and Analysis for

the year ended December 31, 2021, as filed on SEDAR and as

available on the Company's website for further details.

(1) Alternative performance measures; please refer to “Non-GAAP

Financial Measures” at the end of this release.(2) Net of

by-product credits(3) Subject to adjustments on final

settlement

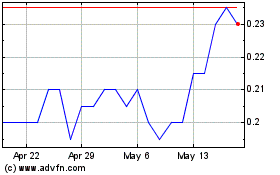

Atico Mining (TSXV:ATY)

Historical Stock Chart

From Feb 2025 to Mar 2025

Atico Mining (TSXV:ATY)

Historical Stock Chart

From Mar 2024 to Mar 2025