Magellan Announces Plans for Two UK Wells in 2014

June 03 2014 - 5:05AM

Marketwired Canada

Magellan Petroleum Corporation (NASDAQ: MPET) ("Magellan" or the "Company")

today announced plans for two exploration wells to be drilled during 2014 within

the Company's license areas in the UK. The Company's partner Angus Energy

("Angus") has announced plans to spud in July 2014 an exploration well on the

Horse Hill prospect located within the Petroleum Exploration and Development

License ("PEDL") 137 area. Angus will carry 100% of Magellan's costs for this

well, after which the Company will retain a 35% working interest in the well and

the PEDL. Later in 2014, the Company plans to fund its 50% share of a well to be

drilled by its partner Celtique Energie ("Celtique") at Broadford Bridge,

located within the license area of PEDL 234.

Both wells will be drilled vertically and completed without the use of hydraulic

fracturing and ultimately target conventional Triassic gas plays. However,

during drilling, Magellan will have the opportunity to core and log various

shale and tight formations in the Cretaceous and Jurassic sections of the Weald

Basin.

The Weald Basin, which is located southwest of London, underlays substantially

all of Magellan's 347,000 gross (162,000 net) acres of exploration and

development licenses in the UK. Three of these licenses, PEDLs 231, 234, and

243, which the Company co-owns equally with Celtique, cover the depocenter of

the basin. A map delineating the Company's acreage position can be found at

www.magellanpetroleum.com/operations/united-kingdom. On May 23, 2014, the

British Geological Survey ("BGS"), in association with the UK Department of

Energy and Climate Change ("DECC"), publicly released a report (the "BGS

Report") on the hydrocarbon resource potential of the Jurassic shale formations

in the Weald Basin. The BGS Report estimated that a combined total of between

2.2 billion and 8.6 billion barrels of oil are in place in five shale formations

within the basin, with a median estimated quantity of oil in place of 4.4

billion barrels. The BGS Report did not study or assess the hydrocarbon resource

potential of tight formations.

J. Thomas Wilson, President and CEO of Magellan, commented, "The median estimate

of 4.4 billion barrels of liquid resource in the Weald is, in our opinion, a

very encouraging target. Magellan believes that this figure may be supplemented

with additional resources contained in tight formations present between the

thick shale packages of the Jurassic and Cretaceous sections. The two wells

planned in 2014, in addition to providing us exposure to attractive conventional

plays, will provide invaluable data for validating the BGS's findings on the

shale formations and our expectations for the tight formations."

CAUTIONARY INFORMATION ABOUT FORWARD-LOOKING STATEMENTS

Statements in this press release, including forecasts or projections that are

not historical in nature, are intended to be, and are hereby identified as,

forward-looking statements for purposes of the Private Securities Litigation

Reform Act of 1995. The words "anticipate", "assume", "believe", "budget",

"estimate", "evaluate", "expect", "forecast", "intend", "should", "initial",

"plan", "project", and similar expressions are intended to identify

forward-looking statements. These statements about the Company may relate to its

businesses and prospects, planned capital projects and expenditures, increases

or decreases in oil and gas production and reserves, estimates regarding

resource potential, revenues, expenses and operating cash flows, and other

matters that involve a number of uncertainties that may cause actual results to

differ materially from expectations. Among these risks and uncertainties are the

following: whether the BGS Report accurately estimates the hydrocarbon resource

potential of the Weald Basin; the potential of hybrid plays, tight rock

formations, and conventional Triassic plays in the Weald Basin; the value of our

UK acreage position; the success of coring and logging programs; the uncertain

nature of oil and gas prices in the United States; uncertainties inherent in

projecting future rates of production from drilling activities; the uncertainty

of drilling and completion conditions and results; the availability and cost of

drilling, completion, and operating equipment and services; and other matters

discussed in the "Risk Factors" section of The Company's most recent Annual

Report on Form 10K and most recent Quarterly Report on Form 10Q. Any

forward-looking information provided in this release should be considered with

these factors in mind. The Company assumes no obligation to update any

forward-looking statements contained in this report, whether as a result of new

information, future events, or otherwise.

ABOUT MAGELLAN

Magellan Petroleum Corporation is an independent oil and gas exploration and

production company focused on the development of a CO2-enhanced oil recovery

("CO2-EOR") program at Poplar Dome in eastern Montana and the exploration of

unconventional hydrocarbon resources in the Weald Basin, onshore UK. Magellan

also owns an exploration block, NT/P82, in the Bonaparte Basin, offshore

Northern Territory, which the Company currently plans to farm-out; and an 11%

ownership stake in Central Petroleum Limited (ASX: CTP), a Brisbane based junior

exploration and production company that operates one of the largest holdings of

prospective onshore acreage in Australia. Magellan is headquartered in Denver,

Colorado. The Company's mission is to enhance shareholder value by maximizing

the full potential of existing assets. Magellan routinely posts important

information about the Company on its website at www.magellanpetroleum.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

For further information, please contact:

Matthew Ciardiello

Manager, Investor Relations

720.484.2404

IR@magellanpetroleum.com

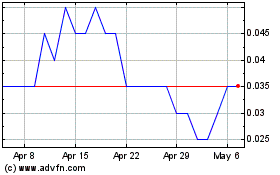

Baroyeca Gold and Silver (TSXV:BGS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Baroyeca Gold and Silver (TSXV:BGS)

Historical Stock Chart

From Jan 2024 to Jan 2025