BWR Exploration Inc. (TSX.V: BWR) (“

BWR” or the

“

Company”) is pleased to announce the closing of

its first tranche of the non-brokered, unit offering previously

announced on November 24, 2022 (the “

Unit

Offering”) comprising of a total of 1,868,000 units (the

“

Units”) set out below at a price of $0.03 per

Unit for aggregate gross proceeds of $56,040. No finders’ fees were

issued as part of this first tranche. The Company is extending the

date of closing of additional tranches on the same terms no later

than February 8, 2023, to raise aggregate proceeds of up to

$240,000.

Each Unit will consist of one common share (a

“Common Share”) of the Company and one-half Common

Share purchase warrant (a “Half Warrant”). Two Half Warrants

comprise one Common Share purchase warrant (a

“Full Warrant”) of the Company.

Each Full Warrant will expire 36 months from the date of issue (the

“Full Warrant Expiry Date”) and

will entitle the holder thereof to purchase one Common Share (a

“Full Warrant Share”) at a price

of $0.06 per Full Warrant Share within 24 months from the closing

of the Unit Offering and for the period that is for 24 months plus

one day from closing of the Unit Offering until the Full Warrant

Expiry Date at a price of $0.10 per Full Warrant Share.

The proceeds from the Unit Offering will be used

for general corporate purposes including advancing the exploration

programs on the Company’s projects in Canada with a focus on the

Little Stull Lake Gold project located in Northeastern Manitoba.

The securities issued in the first tranche contain a statutory four

month plus one day hold period expiring April 23, 2023. The Unit

Offering is subject to TSX Venture Exchange and regulatory

approval.

Certain insiders of the Company have

participated in the first tranche of the Unit Offering for 300,000

Units in the aggregate. Such participation represents a

related-party transaction under Multilateral Instrument 61-101 -

Protection of Minority Security Holders in Special Transactions

(“MI 61-101”), but the transaction is exempt from the formal

valuation and minority shareholder approval requirements of MI

61-101 as neither the fair market value of the subject matter of

the transaction, nor the consideration paid, exceed 25% of the

Company's market capitalization.

This news release does not constitute an offer

to sell or a solicitation of an offer to sell of any of the

securities in the United States. The securities have not been and

will not be registered under the United States Securities Act of

1933, as amended (the "U.S. Securities Act") or any state

securities laws and may not be offered or sold within the United

States or to U.S. Persons unless registered under the U.S.

Securities Act and applicable state securities laws or an exemption

from such registration is available.

BWR Exploration Inc. is a public company focused

on exploring for base and precious metals, with its flagship Little

Stull Lake Gold Project in NE Manitoba along with other exploration

projects in Northern Ontario, and Northern Quebec, Canada.

Management of BWR includes an accomplished group of

exploration/mining specialists with many decades of operational

experience in the junior resource sector. There are currently

103,310,461 shares issued and outstanding in the Company.

Neither the Toronto Venture Exchange nor

its Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For more information about BWR please visit our website:

http://www.bwrexploration.com

or call/email:

Neil Novak, P.Geo., President, CEO & Director,BWR

Exploration Inc.82 Richmond St. EToronto, ON M5C 1P1Office:

416-848-6866nnovak@bwrexploration.com

For information regarding this financing please contact:

Carl Desjardins, Paradox Investor Services Inc.Office:

514-341-0408carldesjardins@paradox-pr.ca

Cautionary and Forward-Looking

Statements

This news release includes certain

forward-looking statements and forward-looking information

(collectively, "forward-looking statements") within the meaning of

applicable Canadian securities legislation. All statements, other

than statements of historical fact, included herein including,

without limitation, statements regarding the Unit Offering and

proposed uses of the proceeds of the Unit Offering, are

forward-looking statements. Although the Company believes that such

statements are reasonable, it can give no assurance that such

expectations will prove to be correct. Often, but not always,

forward looking information can be identified by words such as "pro

forma", "plans", "expects", "will", "may", "should", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates",

"believes", "potential" or variations of such words including

negative variations thereof, and phrases that refer to certain

actions, events or results that may, could, would, might or will

occur or be taken or achieved. Forward-looking statements involve

known and unknown risks, uncertainties and other factors which may

cause the actual results, performance or achievements of the

Company to differ materially from any future results, performance

or achievements expressed or implied by the forward-looking

statements. This forward-looking information reflects the Company’s

current beliefs and is based on information currently available to

the Company and on assumptions the Company believes are reasonable.

These assumptions include, but are not limited to: TSX Venture

Exchange acceptance of the Unit Offering; market acceptance and

approvals; and the anticipated closing date for the Offering.

Forward-looking information is subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of the Company to be

materially different from those expressed or implied by such

forward-looking information. Such risks and other factors may

include, but are not limited to: general business, economic,

competitive, political and social uncertainties; general capital

market conditions and market prices for securities; delay or

failure to receive board or regulatory approvals; the actual

results of future operations; competition; changes in legislation,

including environmental legislation, affecting the Company; the

timing and availability of external financing on acceptable terms;

and lack of qualified, skilled labour or loss of key individuals. A

description of additional assumptions used to develop such

forward-looking information and a description of additional risk

factors that may cause actual results to differ materially from

forward- looking information can be found in the Company’s

disclosure documents on the System for Electronic Document Analysis

and Retrieval (“SEDAR”) website at www.sedar.com. Although the

Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. Readers

are cautioned that the foregoing list of factors is not exhaustive.

Readers are further cautioned not to place undue reliance on

forward-looking information as there can be no assurance that the

plans, intentions or expectations upon which they are placed will

occur. Forward-looking information contained in this news release

is expressly qualified by this cautionary statement. The

forward-looking information contained in this news release

represents the expectations of the Company as of the date of this

news release and, accordingly, is subject to change after such

date. However, the Company expressly disclaims any intention or

obligation to update or revise any forward-looking information,

whether as a result of new information, future events or otherwise,

except as expressly required by applicable securities law.

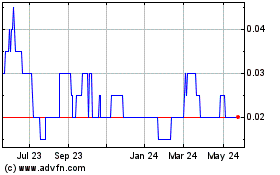

BWR Exploration (TSXV:BWR)

Historical Stock Chart

From Nov 2024 to Dec 2024

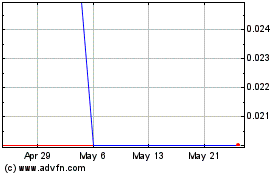

BWR Exploration (TSXV:BWR)

Historical Stock Chart

From Dec 2023 to Dec 2024