Clear Blue Technologies International Inc. (TSXV: CBLU) (the

"

Company") is pleased to announce that it has

received significant financial support from its stakeholders to

provide financial support to the Company as it continues to invest

in its AI leadership in Smart Power for Internet of Things, Smart

City and Telecom markets around the world. The financing consists

of the following transactions:

- SOFII (Southern Ontario Fund for

Investment in Innovation), a previous supporter of Clear Blue has

provided a 7-year loan of $500,000 with interest payable at 14%

compounded annually to Clear Blue. Southern Ontario Fund for

Investment in Innovation (SOFII). Launched by the Government of

Canada in July 2012, SOFII supports high-growth, innovative Small

and Medium-sized Enterprises (SMEs) in rural and urban

communities.

- A private placement of convertible

debentures, including participation by management, contributed

additional cash contribution, with the total sum of the convertible

debenture totaling up to $2.2M, of which an initial tranche of

$1.46M has been completed.

- Business Development Bank of Canada

(BDC), Clear Blue’s main financing partner, deferred a total of

$240,000 of payments due in 2024 to a balloon payment at the end of

the loan term, in 2026.

Taken combined, the above financings provide

cash, deferred payments and additional liquidity totaling

$2.9M.

“During these difficult financial and market

times, the support from Clear Blue’s community of stakeholders –

shareholders, investment bankers, Government of Canada (SOFII), and

BDC is greatly appreciated and Clear Blue’s customers, employees,

suppliers and other stakeholders greatly appreciate the ongoing

support,” said Miriam Tuerk, CEO of Clear Blue. “Clear Blue’s

expanded product line of 4 products has grown our addressable

market and our investment in Smart Power management, control and

predictive analytics has established us a global leader in

providing reliable, mission critical Off-Grid and Hybrid power in

the market. Our outlook for revenue growth is strong with an

ever-growing sales funnel. This funding allows us to continue to

execute on our plan, and grow our revenue and profitability.”

Additional details on the financing are outlined

below:

The convertible debenture financing takes the

form of a private placement offering (the

"Offering") in the aggregate principal amount of

up to $2,200,000 of unsecured convertible debentures (each, a

"Debenture") at a price of $1,000 per Debenture.

In this initial tranche of the Offering, gross proceeds of

approximately $1.41M were subscribed for. Additionally, the Company

has indications of interest for an incremental amount of $0.79M ,

expected to be completed in one or more additional tranches to be

announced in due course.

The Debentures bear interest from the applicable

issuance date at 14% per annum until the date that is 36 months

following the closing date (the "Maturity Date").

The principal amount of the Debentures will be convertible into

units of the Company (the "Units") at the option

of the holder at any time prior to the close of business on the

last business day immediately preceding the Maturity Date, at a

conversion price of $0.10 per Unit (the "Conversion

Price"), subject to adjustment in certain events.

Each Unit is comprised of: (i) one common share

of the Company (each, a "Common Share"); and (ii)

one half of one Common Share purchase warrant (each whole warrant,

a "Warrant"). Each Warrant will be exercisable to

acquire one Common Share at an exercise price of $0.15 per Common

Share, subject to adjustment in certain events, until the Maturity

Date; provided however, the Company will have the right to

accelerate the expiry date of the Warrants to a date which is not

less than 21 days after the date on which a written notice is

provided to the holders of Warrants if the daily volume weighted

average trading price of the Common Shares is greater than $0.25

(subject to adjustment in certain events) for any 10 consecutive

trading days on the TSX Venture Exchange (the

"TSXV").

Beginning on the date that is one year following

the closing date, but subject to receipt of any required approvals,

the Company may force the conversion of all of the principal amount

of the then outstanding Debentures at the Conversion Price on not

less than 21 days' notice should the daily volume weighted average

trading price of the Common Shares be greater than $0.25 (subject

to adjustment in certain events) for any 10 consecutive trading

days on the TSXV.

Certain directors and officers of the Company

(collectively, the "Insiders") participated in the

Offering in the aggregate amount of $319,000, and, as such, the

Offering constitutes a related party transaction under Multilateral

Instrument 61-101 – Protection of Minority Security Holders in

Special Transactions ("MI 61-101"), but is

otherwise exempt from the formal valuation and minority approval

requirements of MI 61-101 by virtue Sections 5.5(a) and 5.7(1)(a)

of MI 61-101 in respect of such Insider participation. No special

committee was established in connection with the Offering or the

participation of the Insiders, and no materially contrary view or

abstention was expressed or made by any director of the Company in

relation thereto. Further details will be included in a material

change report that will be filed by the Company in connection with

the completion of the initial closing of the Offering. Closing of

the participation of Insiders in the Offering remains subject to

the approval of the TSXV.

Fees of $5,740 and 22,400 broker warrants at a

price of $0.06 were paid as finders fees for this transaction.

The net proceeds received by the Company will be

used for working capital purposes. The closing of the Offering is

subject to the satisfaction of customary conditions, including the

approval of the TSXV. All securities issued under the Offering

remain subject to a statutory four month hold period.

Lastly, Clear Blue has entered into debt

settlement agreements with a consultant of the Company to settle

indebtedness of $132,200 in exchange for the issuance of 2,203,333

warrants of the company, convertible to equal number of common

shares at a price per share of $0.06, thereby allowing the Company

to preserve cash and improve its balance sheet.

About Clear Blue Technologies

International

Clear Blue Technologies International, the Smart

Off-Grid™ company, was founded on a vision of delivering clean,

managed, “wireless power” to meet the global need for reliable,

low-cost, solar and hybrid power for lighting, telecom, security,

Internet of Things devices, and other mission-critical systems.

Today, Clear Blue has thousands of systems under management across

37 countries, including the U.S. and Canada. (TSXV: CBLU) (FRA:

0YA) (OTCQB: CBUTF).

About SOFII

Community Futures Eastern Ontario (CFEO) and are

non-profit organizations delivering the Southern Ontario Fund for

Investment in Innovation (SOFII) across Southern Ontario. This

program supports scale-up of high-growth, innovative Small and

Medium-sized Enterprises (SMEs) in rural and urban communities by

offering loans of $150,000 to $500,000 (additional funding

available on an exception basis). SOFII provides interest-bearing

business loans to help innovation and growth in small and medium

sized enterprises (SMEs) across the region.

About BDC

BDC is the only bank devoted exclusively to

entrepreneurs. It provides access to financing, both online and

in-person, as well as advisory services to help Canadian businesses

grow and succeed. Its investment arm, BDC Capital, offers a

wide range of risk capital solutions. For 75 years and counting,

BDC’s purpose has been to support entrepreneurs in all

industries and all stages of growth. For more information and to

consult more than 1,000 free tools, articles and entrepreneurs’

stories, visit bdc.ca.

For more information,

contact:

Miriam Tuerk, Co-Founder and CEO

+1 416 433 3952

investors@clearbluetechnologies.com

www.clearbluetechnologies.com/en/investors

Nikhil Thadani, Sophic Capital

+1 437 836 9669

Nik@SophicCapital.com

Legal Disclaimer

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward-Looking Statement

This press release contains certain

"forward-looking information" and/or "forward-looking statements"

within the meaning of applicable securities laws. Such

forward-looking information and forward-looking statements are not

representative of historical facts or information or current

condition, but instead represent only Clear Blue’s beliefs

regarding future events, plans or objectives, many of which, by

their nature, are inherently uncertain and outside of Clear Blue's

control. Generally, such forward-looking information or

forward-looking statements can be identified by the use of

forward-looking terminology such as "plans", "expects" or "does not

expect", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates" or "does not anticipate", or

"believes", or variations of such words and phrases or may contain

statements that certain actions, events or results "may", "could",

"would", "might" or "will be taken", "will continue", "will occur"

or "will be achieved". The forward-looking information contained

herein may include, but is not limited to, information concerning

the completion of future tranches of the Offering and the use of

proceeds of the Offering.

By identifying such information and statements

in this manner, Clear Blue is alerting the reader that such

information and statements are subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of Clear Blue to be

materially different from those expressed or implied by such

information and statements.

An investment in securities of Clear Blue is

speculative and subject to several risks including, without

limitation, the risks discussed under the heading "Risk Factors" in

Clear Blue's listing application dated July 12, 2018. Although

Clear Blue has attempted to identify important factors that could

cause actual results to differ materially from those contained in

the forward-looking information and forward-looking statements,

there may be other factors that cause results not to be as

anticipated, estimated or intended.

In connection with the forward-looking

information and forward-looking statements contained in this press

release, Clear Blue has made certain assumptions. Although Clear

Blue believes that the assumptions and factors used in preparing,

and the expectations contained in, the forward-looking information

and statements are reasonable, undue reliance should not be placed

on such information and statements, and no assurance or guarantee

can be given that such forward-looking information and statements

will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such information

and statements. The forward-looking information and forward-looking

statements contained in this press release are made as of the date

of this press release. All subsequent written and oral forward-

looking information and statements attributable to Clear Blue or

persons acting on its behalf is expressly qualified in its entirety

by this notice.

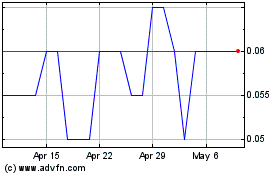

Clear Blue Technologies (TSXV:CBLU)

Historical Stock Chart

From Oct 2024 to Nov 2024

Clear Blue Technologies (TSXV:CBLU)

Historical Stock Chart

From Nov 2023 to Nov 2024