Carmen Energy Inc. Announces Reserve Additions

December 02 2011 - 4:10PM

PR Newswire (Canada)

CALGARY, Dec. 2, 2011 /CNW/ - Carmen Energy Inc. ("Carmen" or the

"Corporation") is pleased to report an independent reserves

evaluation by InSite Petroleum Consultants Ltd. ("InSite") entitled

"Evaluation of the Oil and Gas Reserves in the Sylvan Lake and

Viking-Kinsella Areas" (the "InSite Sylvan Lake/Viking-Kinsella

Report"). The InSite Sylvan Lake/Viking-Kinsella Report is an

estimate of the oil, natural gas and natural gas liquids reserves

associated with the 102/14-7-38-3w5 well on the Sylvan Lake

properties and the Hz16-17-49-12w4 well on the Viking-Kinsella

properties in which Carmen has a right to earn a working interest

pursuant to previously disclosed farmin agreements. The InSite

Sylvan Lake/Viking-Kinsella Report has an effective date of

December 1, 2011 and was prepared in accordance with National

Instrument 51-101 - Standards of Disclosure for Oil and Gas

Activities and the Canadian Oil and Gas Evaluation Handbook ("COGE

Handbook"). The following is a summary of data contained in the

InSite Sylvan Lake/Viking-Kinsella Report of estimated reserves as

evaluated in the InSite Sylvan Lake/Viking-Kinsella Report with

regards to now on first month production. All evaluations of future

net revenue are after the deduction of future, royalties,

development costs, production costs and well abandonment costs but

before consideration of indirect costs such as administrative,

overhead and other miscellaneous expenses. The estimated future net

revenue contained in the following tables do not represent the fair

market value of the reserves in which Carmen has a right to earn an

interest. There is no assurance that the forecast price and cost

assumptions contained in the InSite Sylvan Lake/Viking-Kinsella

Report will be attained and variations could be material. Reserves

Data (Forecast Prices and Costs) SUMMARY OF OIL AND NATURAL GAS

RESERVES AND NETPRESENTVALUESOF FUTURENETREVENUEASOF DECEMBER 1,

2011 FORECAST PRICES AND COSTS (SEPTEMBER 30, 2011) RESERVES LIGHT

AND NATURALGAS MEDIUMOIL HEAVYOIL NATURAL GAS LIQUIDS SULPHUR Gross

Net Gross Net Gross Net Gross Net Gross Net RESERVES CATEGORY

(Mbbls) (Mbbls) (Mbbls) (Mbbls) (MMcf) (MMcf) (Mbbls) (Mbbls) (LT)

(LT) PROVED: Developed 4.9 4.5 - - 126.7 115.9 4.9 3.8 114.1 97.9

Producing Developed - - - - - - - - - - Non-Producing Undeveloped -

- - - - - - - - - TOTAL PROVED 4.9 4.5 - - 126.7 115.9 4.9 3.8

114.1 97.9 PROBABLE 63.8 54.4 - - 168.6 155.0 3.4 2.5 45.6 38.1

TOTAL PROVED PLUS PROBABLE 68.7 58.9 - - 295.3 270.9 8.4 6.4 159.7

136.0 Notes: (1) "Gross" means: (i) in relation to Carmen's

interest in production and reserves, its "company gross reserves",

which are Carmen's interest (operating and non operating) share

before deduction of royalties and without including any royalty

interest of Carmen; (ii) in relation to wells, the total number of

wells in which Carmen has an interest; and (iii) in relation to

properties, the total area of properties in which Carmen has an

interest. (2) "Net" means: (a) in relation to Carmen's interest in

production and reserves, Carmen's working interest (operating and

non operating) share after deduction of royalty obligations, plus

Carmen's royalty interests in production or reserves; (b) in

relation to wells, the number of wells obtained by aggregating

Carmen's working interest in each of its gross wells; and (c) in

relation to Carmen's interest in a property, the total area in

which Carmen has an interest multiplied by the working interest

owned by Carmen. The estimated net present value of future net

revenue before income taxes associated with the Sylvan Lake and

Viking-Kinsella reserves effective December 1, 2011 and based on

published InSite future price forecast as of September 30, 2011 are

summarized in the following table: UNIT VALUE BEFORE INCOME TAXES

NETPRESENTVALUESOF FUTURE NETREVENUE DISCOUNTEDAT BEFORE

INCOMETAXESDISCOUNTEDAT (%/year) 10%(1) 0% 5% 10% 15% 20% RESERVES

CATEGORY ($000s) ($000s) ($000s) ($000s) ($000s) ($/BOE) PROVED:

Developed 416.7 351.6 301.2 261.6 230.2 10.91 Producing Developed -

- - - - - Non-Producing Undeveloped - - - - - - TOTAL PROVED 416.7

351.6 301.2 261.6 230.2 10.91 PROBABLE 4,361.5 3,254.8 2,586.3

2,147.2 1,838.5 31.23 TOTAL PROVED PLUS 4,778.2 3,606.5 2,887.4

2,408.8 2,068.7 26.15 PROBABLE Note:

(1) Unit values are based on net

reserve volumes. Pricing Assumptions The forecast cost and price

assumptions in this section assume increases in wellhead selling

prices and take into account inflation with respect to future

operating and capital costs. Crude oil and natural gas benchmark

reference pricing, inflation and exchange rates utilized in the

InSite Sylvan Lake/Viking-Kinsella Report were as follows: SUMMARY

OF PRICING ASSUMPTIONS AS OFSEPTEMBER30, 2011FORECAST

PRICESANDCOSTS(1)(2) OIL NATURALGAS NATURAL GASLIQUIDS SULPHUR WTI

Edmonton Cushing Par Price AECO Edmonton Edmonton Edmonton EXCHANGE

Oklahoma 40° API Gas Price Condensate Butane Propane Ethane RATE(3)

Year ($US/Bbl) ($Cdn/Bbl) ($Cdn/MMBtu) ($Cdn/Bbl) ($Cdn/Bbl)

($Cdn/Bbl) ($Cdn/Bbl) ($/LT) ($US/$Cdn) 2011 85.00 84.73 3.83 88.97

67.79 50.84 11.50 65.00 0.980 2012 95.00 92.50 4.30 95.28 74.00

55.50 13.01 66.30 1.000 2013 100.00 97.50 5.00 100.43 78.00 58.50

15.27 67.63 1.000 2014 101.00 98.45 5.60 101.40 78.76 59.07 17.20

68.98 1.000 2015 102.00 99.40 6.00 102.38 79.52 59.64 18.49 70.36

1.000 2016 104.00 101.35 6.35 104.39 81.08 60.81 19.61 71.77 1.000

2017 106.00 103.29 6.59 106.39 82.64 61.98 20.37 73.20 1.000 2018

108.12 105.36 7.07 108.52 84.29 63.22 21.94 74.66 1.000 2019 110.28

107.47 7.22 110.69 85.97 64.48 22.38 76.16 1.000 2020 112.49 109.62

7.36 112.90 87.69 65.77 22.83 77.68 1.000 2021 114.74 111.81 7.51

115.16 89.45 67.09 23.30 79.23 1.000 2022 117.03 114.04 7.66 117.47

91.24 68.43 23.77 80.82 1.000 2023 119.37 116.33 7.81 119.82 93.06

69.80 24.25 82.44 1.000 2024 121.76 118.65 7.97 122.21 94.92 71.19

24.74 84.08 1.000 2025 124.20 121.03 8.13 124.66 96.82 72.62 25.24

85.77 1.000 2026 126.68 123.45 8.29 127.15 98.76 74.07 25.75 87.48

1.000 There- after +2.0%/yr +2.0%/yr +2.0%/yr +2.0%/yr +2.0%/yr

+2.0%/yr +2.0%/yr +2.0%/yr 1.000 Notes:

(1) As at September 30, 2011.

(2) Inflation rate for costs escalated

2% per year from 2011. (3) Exchange

rate used to generate the benchmark reference prices in this table.

About Carmen Energy Inc. Carmen is based in Calgary, Alberta and a

publicly traded oil and gas exploration and production company. The

focus is on exploration and development of Western Canadian

Sedimentary Basin based oil and gas properties. The current

projects are the Jumpbush properties in south eastern Alberta, the

Ferrybank properties in central Alberta, the Sylvan Lake area

properties in Southern Alberta, the Viking-Kinsella properties in

Alberta and the Hamburg properties in northern western Alberta. ON

BEHALF OF THE BOARD OF DIRECTORS Mr. Brian Doherty, President, CEO

and Director Contact: brian.doherty@carmenenergy.ca; (403) 537-5590

Advisory Regarding Forward-Looking Information and Statements This

press release contains forward-looking statements and

forward-looking information within the meaning of applicable

securities laws. The use of any of the words "will", "expects",

"believe", "plans", "potential" and similar expressions are

intended to identify forward-looking statements or information.

More particularly and without limitation, this press release

contains statements relating to "reserves" which are deemed to be

forward-looking statements as they involve the implied assessment,

based on certain estimates and assumptions, which the reserves

described, can be profitably produced in the future. Readers should

be cautioned that the forgoing list of forward-looking statements

and information contained herein should not be considered

exhaustive. The forward-looking statements and information in this

press release are based on certain key expectations and assumptions

made by Carmen. Although Carmen believes that the expectations and

assumptions on which such forward looking statements and

information are based are reasonable, undue reliance should not be

placed on the forward-looking statements and information because

Carmen can give no assurance that they will prove to be correct.

Since forward-looking statements and information address future

events and conditions, by their very nature they involve inherent

risks and uncertainties. Actual results could differ materially

from those currently anticipated due to a number of factors and

risks. These include, but are not limited to, the risks associated

with the oil and gas industry in general such as operational risks

in development, exploration and production; delays or changes in

plans with respect to exploration or development projects or

capital expenditures; the uncertainty of reserve and resource

estimates; the uncertainty of estimates and projections relating to

reserves, resources, production, costs and expenses; health, safety

and environmental risks; commodity price and exchange rate

fluctuations; marketing and transportation; loss of markets;

environmental risks; competition; incorrect assessment of the value

of acquisitions; failure to realize the anticipated benefits of

acquisitions including the Acquisitions; ability to access

sufficient capital from internal and external sources; changes in

legislation, including but not limited to tax laws, royalties and

environmental regulations. Management has included the above

summary of assumptions and risks related to forward-looking

information provided in this press release in order to provide

securityholders with a more complete perspective on Carmen's future

operations and such information may not be appropriate for other

purposes. The forward-looking statements and information contained

in this press release are made as of the date hereof and Carmen

undertakes no obligation to update publicly or revise any

forward-looking statements or information, whether as a result of

new information, future events or otherwise, unless so required by

applicable securities laws. BARRELS OF OIL EQUIVALENT Barrels of

oil equivalent (BOE) is calculated using the conversion factor of 6

Mcf (thousand cubic feet) of natural gas being equivalent to one

barrel of oil. BOEs may be misleading, particularly if used in

isolation. A BOE conversion ratio of 6 Mcf:1 bbl (barrel) is based

on an energy equivalency conversion method primarily applicable at

the burner tip and does not represent a value equivalency at the

wellhead. Neither the TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this press release. Carmen Energy Inc CONTACT:

Mr. Brian Doherty, President, CEO and DirectorContact:

brian.doherty@carmenenergy.ca; (403) 537-5590

Copyright

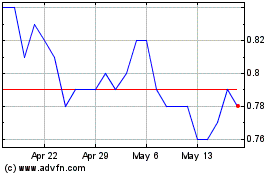

Coelacanth Energy (TSXV:CEI)

Historical Stock Chart

From Apr 2024 to May 2024

Coelacanth Energy (TSXV:CEI)

Historical Stock Chart

From May 2023 to May 2024