Changfeng Reports Second Quarter 2012 Financial Results and Provides Business Updates

August 29 2012 - 3:47PM

Marketwired Canada

Changfeng Energy Inc. ("Changfeng" or the "Company") (TSX VENTURE:CFY), a

natural gas utility in China, today reported its unaudited interim consolidated

financial results for the second quarter ended June 30, 2012. All figures are in

Canadian dollars unless otherwise stated. The unaudited interim consolidated

financial statements and Management Discussion and Analysis can be downloaded

from www.SEDAR.com or from the Company's website at www.changfengenergy.com.

Summary of Q2 2012 Consolidated Financial Results

----------------------------------------------------------------------------

(in thousands in

$Cdn) except

percentages and Q2 Q2 Change % YTD YTD Change %

per share data 2012 2011 2012 2011

----------------------------------------------------------------------------

Revenue 7,122 6,776 346 5% 14,487 13,310 1,177 9%

Gross profit 3,421 1,830 1,591 87% 7,323 5,364 1,959 37%

EBITDA 2,130 552 1,578 286% 4,217 2,776 1,441 52%

Net income (loss) 826 (300) 1,126 375% 1,652 810 842 104%

Adjusted net

income (loss)

(Note a) 193 (300) 493 164% 1,019 810 208 26%

Basic and diluted

EPS 0.013 (0.005) 0.018 360% 0.025 0.012 0.013 108%

----------------------------------------------------------------------------

Note: (a) The adjusted net income excludes a one-time government grant of

$722,535 and associated income tax provision of $90,000.

Financial Results

Revenue

Revenue for Q2-2012 was $7.1 million, an increase of $0.3 million, or 5%, from

$6.8 million for Q2-2011. Revenue for the six months ended June 30, 2012 was

$14.5 million, an increase of $1.2 million, or 9%, from $13.3 million for the

same period in 2011. Sales growth during the quarter and YTD were driven

primarily by continued gas volume growth of 109% in Q2'12 and 119% YTD, from the

CNG refueling retail station, and 7% appreciation of the Chinese RMB against the

Canadian dollar, partially offset by a slight decrease of 11% in Q2-2012 and 3%

YTD, in the piped gas sales from the Company's Sanya operation primarily due to

limited gas sources.

Other operating income

During the quarter, the Company received a $0.7 million government subsidy from

the municipal government of Sanya City, Hainan Province, to partially compensate

the Company for high purchase costs of additional volume of Other Gas purchased

at market-based prices in 2011 to satisfy customer demand in Sanya Region. Going

forward, the municipal government has indicated that it plans to implement a

long-term budget process (the "Budget Process") to address the ongoing gas

shortage issue in Sanya Region. The Budget Process, based on the Company's

actual purchase cost of additional Other Gas, is intended to provide (i) an

annual government subsidy to partially compensate the Company for the loss, if

any, on the gas sales to its residential customers, and this subsidy will be

included in the municipal government annual fiscal budget; and (ii) periodical

sales price adjustments for its commercial customers enabling the sales prices

to reflect interaction between supply and demand.

Gross profit

Gross profit for Q2-2012 increased by $1.6 million (or 87%) and for the six

months ended June 30, 2012 increased by $2.0 million (or 37%), compared to the

same periods in 2011. Gross profit as a percentage of sales for the second

quarter and YTD of 2012 increased accordingly by 21% to 48% and by 11% to 51%,

compared to 27% and 40%, respectively, for the same periods of 2011. CNG

refueling retail station gross margins year-over-year improved 8% due primarily

to lower operating costs resulting from gas volume increases. Piped gas gross

margins year-over-year improved 27% reflecting a reduced volume of Other Gas

purchased at market-based prices. Pipeline connection fee margins year-over-year

improved 23% which varied with the timing of obtaining large value pipeline gas

connection contracts.

Operating expenses

General and administrative expenses for Q2-2012 increased by $0.4 million (or

32%) to $1.5 million and for the six months ended June 30, 2012 increased by

$0.5 million (or 25%) to $2.7 million, compared to the same periods in 2011. The

increase was attributable to general expenses including employee salary and

benefits as a result of a high inflation rate in China and sales increases.

General and administrative expenses as a percentage of sales for the second

quarter and YTD of 2012 increased accordingly by 4% to 21% and by 2% to 19%,

compared to 17% and 17%, respectively, for the same periods of 2011.

Travel and business development expenses for Q2-2012 increased by $0.5 million

(or 87%) to $1.0 million and for the six months ended June 30, 2012 increased by

$0.8 million (or 61%) to $2.1 million, compared to the same periods of 2011. The

increase was attributable to the travel and business development activities in

mainland China and a $0.2 million one-time sponsorship fee for a

provincial-level table tennis tournament. The majority of the travel and

business development expenses do not relate to the Company's business in Sanya

City or the CNG retail station but instead relate to projects under

consideration or development in mainland China.

EBITDA

Earnings before interest, tax, depreciation and amortization ("EBITDA") as

defined in the Management Discussion and Analysis for Q2-2012 increased by $1.6

million, or 286%, to $2.1 million and for the six months ended June 30,2012

increased by $1.4 million, or 52%, to $4.2 million, compared to the same periods

in 2011. The increase was attributable primarily to the improved gross margin

and a $0.7 million government grant, partially offset by the higher operating

expenses.

Net income (loss)

The net income for Q2-2012 was $0.8 million or $0.013 per share compared to net

loss of $0.3 million or $0.005 per share for the same period in 2011, primarily

due to the reasons stated above. The net income for the six months ended June

30, 2012 was $1.7 million, or $0.025 per share compared to $0.8 million or

$0.012 per share for the same period of 2011. The adjusted earnings for this

quarter, excluding $0.7 million one-time government grant, was $0.2 million or

$0.003 per share, compared to net loss of $0.3 million in the same period of

2011.

Financial position

Cash and cash equivalents increased by $0.9 million to $6.0 million at June 30,

2012 from $5.1 million at December 31, 2011, primarily from cash provided by

operating activities of $4.2 million, offset by cash used for capital

expenditure of $2.7 million and $0.5 million of principal repayment on the bank

term loan.

Working capital deficit as at June 30, 2012 was $10.8 million, relatively

constant when compared to $10.7 million as at December 31, 2011.

The adjusted working capital as defined in the Management Discussion and

Analysis was $4.2 million as at June 30, 2012, compared to $2.4 million as at

December 31, 2012.

Business Updates

Xiangdong project, Xiangdong District, Pingxiang City, Jiangxi Province

The Company continues to accelerate the first phase of construction at Xiangdong

project. During the first half of the year, the Company completed construction

of 7km main pipelines in the Park. The construction of the citygate is underway.

However, the construction work was delayed due to unseasonal weather in this

region. For the second half of the year, the Company will continue with its

first phase of construction plan, which is expected to be completed by late

2012, and thereupon will commence supplying gas to the ceramic manufacturers in

the Park.

The Company also made various efforts in coordinating the approved quota gas,

and applying for an alternative source of gas for the upcoming commencement of

gas supply before the interprovincial sub-pipeline linking to the Petro-China's

Second West-East Pipeline is accessible for this region.

Sanya Operation, Sanya City, Hainan Province

During the quarter, the Company commenced the first phase of construction of the

Gas & Electricity Exchange Program (the "Program") as previously announced on

February 22, 2012. The total investment related to the first phase of

construction is estimated to be approximately RMB 6.8 million ($1.1 million),

which will be funded by internal cash flow. Upon completion of the first phase

of construction, the Program will enable the Company to acquire approximately 5

million m3 (177 million ft3) of natural gas annually until 2015. The

construction was rescheduled to be completed by late 2012 due to a modification

of the engineering design as requested by the other party of the Program.

In addition, other progress has been made in addressing the ongoing gas shortage

and high purchase prices for Other Gas in the Sanya Region. Based on the Budget

Process as stated above, the Company's proposal to raise the sales prices to its

commercial customers is pending the final approval by the Hainan Provincial

Pricing Bureau.

Subsequent to the quarter end, the Company prepaid $641,600(RMB 4,000,000) for

the purchase of additional volume of natural gas (over quota) in amount of 4

million m3 (141 million ft3) for a total purchase cost of $1,914,107(RMB

11,933,333), which will be fully delivered and consumed before December 31,

2012. This additional volume of gas is reallocated from a gas quota originally

belonging to a local gas-fired power plant. The purchased price for the

additional gas is favorable when compared to what the Company currently pays for

Other Gas in the form of LNG/CNG.

Proposed Joint Venture for a Pipeline Project, Guangdong Province

As previously announced on March 29, 2012, the proposed joint venture is still

under development. An arm's length pipeline project research firm is finalizing

the project feasibility study. The establishment of the proposed joint venture

will be subject to satisfaction of the feasibility study and approval from the

head office of PetroChina.

"Our performance in this quarter continues to demonstrate the long-term

sustainability of our business model with a reliable and stable operating cash

flow, while a growth was recorded. We are pleased to advance our business

development plan by developing our projects as scheduled and optimize our

operating cash flow from our current operations." stated Mr. Huajun Lin,

Chairman and CEO, "We continue working with local government to address the gas

issue in our Sanya operation, and diligently move forward the proposed pipeline

project in Guangdong Province and the natural gas liquid processing project in

Xiangtan City with our partners."

About Changfeng Energy Inc.

Changfeng Energy Inc., is a local natural gas distribution company ("LDC" or

natural gas utility) with operations located throughout the southern part of

People's Republic of China. The Company serves industrial, commercial and

residential customers, providing them with natural gas for heating purposes and

fuel for transportation. The Company has developed a significant natural gas

pipeline network as well as urban gas delivery networks, stations, substations

and gas pressure regulating stations in Sanya City & Haitang Bay. Through its

network of pipelines, the Company provides safe and reliable delivery of natural

gas to both homes and businesses. The Company is headquartered in Toronto,

Ontario and its shares trade on the Toronto Venture Exchange under the trading

symbol "CFY". For more information, please visit the Company website at

www.changfengenergy.com

Forward-Looking Statements

Information set forth in this news release may involve forward-looking

statements under applicable securities laws. The forward-looking statements

contained herein are expressly qualified in their entirety by this cautionary

statement. The forward-looking statements included in this document are made as

of the date of this document and the Company disclaims any intention or

obligation to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as expressly

required by applicable securities legislation. Although Management believes that

the expectations represented in such forward-looking statements are reasonable,

there can be no assurance that such expectations will prove to be correct. This

news release does not constitute an offer to sell or solicitation of an offer to

buy any of the securities described herein and accordingly undue reliance should

not be put on such.

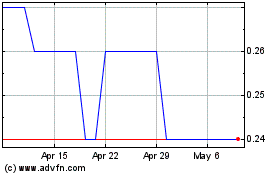

CF Energy (TSXV:CFY)

Historical Stock Chart

From Apr 2024 to May 2024

CF Energy (TSXV:CFY)

Historical Stock Chart

From May 2023 to May 2024