Canadian Premium Sand Inc. (“CPS” or the

“Company”) (TSXV:CPS) is pleased to

announce the results of an independent Preliminary Feasibility

Study (“PFS” or the “Study”) and Mineral Resource update of

Wanipigow Sand Project, on the Company’s 100% owned Ordovician

silica sand deposit in southeastern Manitoba. The PFS was completed

jointly by APEX Geoscience Ltd. and John T. Boyd Company with other

technical inputs completed by sub-consultants including Turnkey

Processing Solutions (“TPS”).

Key Updates of the Preliminary

Feasibility Study

- New definition of geological units based on CPS’s 2018 drill

program, which included 93 sonic core holes (see Jan. 23, 2019 News

Release) and includes: Lower Black Island (“LBI”); Upper Black

Island (“UBI”); Black Shale (“BS”); and Pleistocene Glaciofluvial

(“Pgf”). The PFS resource and reserve estimations and mine plan

were developed in consideration of these geological sub-units.

- Definition of Measured & Indicated Mineral Resources of

49.6 million tonnes reported for LBI and UBI.

- Definition of an Inferred Mineral Resource of 97.3 million

tonnes reported for Pgf and UBI.

- Definition of Proven & Probable Mineral Reserves of 30.6

million tonnes.

- Initial 25-year mine life

- After-Tax Net Present Value of CDN$220 million discounted at an

8% discount rate

- After-Tax Internal Rate of Return of 20.2%.

- Initial CAPEX of CDN$220 million and sustaining capital of

CDN$110-$115 million

Mineral Resources

The mineral resource update benefited from the

results of the 93-drillhole program (1,574 metres; vertical -90º

holes with true width intersections), which was managed, logged and

sampled by APEX Geoscience Ltd. A total of 761 samples were

collected including 237 LBI, 57 UBI, 17 BS and 450 Pgf samples. All

761 samples were analyzed for particle grainsize distribution

analysis using a Camsizer P4 Particle analyzer. A subset of 675

grain size fractions were analyzed for proppant characterization

test work including Krumbein shape factor and crush resistance. An

additional 14 samples underwent complete proppant test work that

included acid solubility and turbidity (in addition to Krumbein

shape factors and crush resistance test work). A split of 58

samples were collected and analyzed for loose-sand bulk density

analysis.

Quality Assurance – Quality Control samples were

collected and analyzed to test the precision and accuracy of

duplicate sample pairs for both gradation measurements and crush

resistance tests (and at multiple labs).

The analytical work was completed at Turnkey

Processing Solutions in Ottawa, IL and Stim-Lab in Duncan, OK. The

analytical work was carried out by independent, accredited

laboratories. The analytical methods are standard and routine in

the field of silica sand, or proppant, test work pursuant to

International Organization for Standardization 13503-2.

The mineral resources within the Wanipigow

Property has been classified as Measured, Indicated and Inferred

Resources in accordance with NI 43-101, and has been estimated

using the CIM Estimation of Mineral Resources and Mineral Reserves

Best Practice Guidelines (2003) and the CIM “Definition Standards

for Mineral Resources and Mineral Reserves (2014). Several factors

were considered for the Mineral Resource classification including:

drillhole spacing; nature of the geological contacts; the degree of

testing; proppant quality, and lateral and vertical continuity.

These factors serve as a proxy for geological confidence and the

level of uncertainty of the individual units.

The 3-D geological model is defined by 93

vertical drillholes completed by CPS in 2018. The gradation data

form an assay file that was used to calculate the Wanipigow

Property Silica Sand Resource Estimate. The resource is calculated

using a block model with a size of 20 by 20 m in the horizontal

directions and 2 m in the vertical direction. The Wanipigow

estimation of the individual sieve size fractions was completed and

reported using a lower cutoff of mesh-sizes that are greater to or

equal to 20-mesh and less than or equal to 140-mesh fraction. The

loose bulk densities were converted to in-situ compacted bulk

densities using a bulking factor of 30% and include: Pgf: 1.90

g/cm3; UBI: 1.91 g/cm3; LBI: 1.88 g/cm3. Bulk densities were

utilized to convert volume (cubic metres) to tonnages.

Mineral resources are not mineral reserves and

do not have demonstrated economic viability. This Wanipigow

Property Silica Sand Resource Estimate predicts total (i.e.,

global) resources of:

- Lower Black Island Measured &

Indicated Resources of 45.1 million tonnes;

- Upper Black Island Indicated

Resource of 4.4 million tonnes and Inferred Resource of 1.7 million

tonnes; and

- Pleistocene glaciofluvial Inferred

Resource of 95.6 million tonnes (Tables 1 and 2).

Mineral Reserves

The Mineral Resources were converted to Mineral

Reserves through the application of the appropriate Modifying

Factors to potential mining volumes created during the mine design

and planning process. In this PFS, a Mineral Reserve is defined as

the Measured and Indicated Mineral Resource that would be extracted

by the mine design and which can then be processed and sold at a

profit. Inferred Resources were not converted to Mineral Reserves.

The Measured resources meeting that standard were classified as

Proven mineral reserves, while the Indicated resources meeting that

standard were classified as Probable mineral reserves.

To derive the estimate of the saleable product

tons, or Mineral Reserves: no external dilution was applied;

internal dilution consisted of the +20 and -140 size fractions as

interpolated in the Mineral Resource block model; mining losses of

5% represent Mineral Resources not extracted due to operational

constraints encountered during routine mining operations; and

processing losses of 5% due to general inefficiencies in the

processing of silica sand.

The Mineral Reserve complies with CIM

definitions and is supported by a detailed mine plan and cash flow

model. The Mineral Reserves estimated for the Wanipigow Silica Sand

Project are subject to the types of risks common to most silica

sand quarry operations that exist in Canada. These risks include

but are not limited to: site-specific mining and geological

conditions, management and personnel capabilities, availability of

funding to properly operate and capitalise the operation,

variations in cost elements and market conditions, developing and

operating the mine in an efficient manner, unforeseen changes in

legislation and new industry developments. There is no guarantee

that all or any part of the estimated Mineral Resource or Mineral

Reserve will be recoverable.

The mineral reserves, expressed as saleable

product tonnages, estimates Proven & Probable reserves of: 26.8

million tonnes of LBI; and 3.8 million tonnes of UBI (Table 3).

Mining Method

The Wanipigow Silica Sand Project is projected

to include a conventional, open pit quarry employing typical

truck-and-excavator mining operations. The quarry and fully

enclosed plant are planned to operate 24 hours per day, 7 days

per week year-round (weather permitting) and are expected to

extract approximately 1.8 million tonnes of raw sand per year at

full production. At this mining rate, the operation will produce an

average of 1.2 million product tonnes per year after processing

losses. The mine life is projected to be at least 26 years after

which an estimated 43.2 million tonnes of raw sand and 11.6 million

bank cubic metres of waste materials will have been mined.

Table

1. https://www.globenewswire.com/NewsRoom/AttachmentNg/601ebd44-7606-422a-a662-83006dd53d5f

Table

2. https://www.globenewswire.com/NewsRoom/AttachmentNg/fa5b7fbd-7fd4-4fc8-adb3-926bd20cc60b

Notes for Table 1 and Table 2Note 1:

Mineral resources are not mineral reserves and do not have

demonstrated economic viability. The estimate of mineral resources

may be materially affected by geology, environment, permitting,

legal, title, taxation, socio-political, marketing or other

relevant issues.Note 2: The Qualified Person (QP) responsible

for the Mineral Resource estimates is Mr. Roy Eccles, P. Geo., of

APEX Geoscience Ltd. The Effective Date of the Mineral Resource

estimates is 28 March 2019.Note 3: The weights are reported in

metric tonnes (1,000 kg or 2,204.6 lbs) and United States short

tons (2,000 lbs or 907.2 kg).Note 3: Numbers may not add up

due to rounding of the resource values percentages (rounded to the

nearest 100,000 unit).Note 4: The product size fractions

overlap and are not cumulative. Note 5: The total volume and

weights are estimated on a global basis and represent the main

Measured & Indicated LBI and UBI Silica Sand Resource (Table 1)

and main Inferred Pgf and UBI Silica Sand Resource (Table 2).

Table

3. https://www.globenewswire.com/NewsRoom/AttachmentNg/227c42d6-5a05-4922-b8d2-6ab02205147b

Note 1: The Mineral Reserve is expressed as saleable

product tonnages.Note 2: The Qualified Person (QP)

responsible for the Mineral Reserve estimate is Mr. Robert J.

Farmer, P.Eng., Vice President of John T. Boyd CompanyNote 3:

The Effective Date of the Mineral Reserve estimates is 28 March

2019.Note 4: The Mineral Reserve has been estimated in

accordance with Canadian Institute of Mining and Metallurgy and

Petroleum (CIM) definitions, as required under NI 43-101.Note 5:

The Mineral Reserve is a subset of, not additive to, the Mineral

Resource and is quoted on a 100% project basis.Note 6: The

Mineral Reserve may be materially affected by geology, environment,

permitting, legal, title, taxation, socio-political, marketing or

other relevant issues.Note 7: Tonnages are reported in metric

tonnes (1,000 kg or 2,204.6 lbs) and United States short tons

(2,000 lbs or 907.2 kg).

Capital Costs

Capital expenditure estimates were provided by

TPS and developed by using first principles and applying direct

project experience. The estimates were reviewed by the qualified

persons and found to be reasonable and appropriate for a

Preliminary Feasibility Study. The accuracy of the capital

expenditure estimate is +/-10% and includes initial, sustaining and

total Capital Cost estimations. Salvage value was not considered in

the PFS.

The capital expenditure estimate for the CPS wet

and dry plant, loadout and related infrastructure is approximately

CDN$220 million, including a contingency of approximately CDN$16

million. Additionally, the company expects to lease mobile

equipment to minimize upfront expenditures. Mobile equipment lease

payments are estimated to total approximately CDN$90 million over

the life of the mine (“LOM”). A further CDN$20 to CDN$25 million

are contemplated for miscellaneous development and rebuilds for

sustaining capital expenditures over the LOM. As a result, the

total capital expenditure and lease‑related costs are estimated at

CDN$330 to CDN$335 million for LOM plan.

Sustaining capital expenditures are incurred to

maintain production and expected to be in the range of CDN$0.75 per

tonne, or CDN$20 to CDN$25 million over LOM. Exclusions from the

capital expenditures estimate include, but are not limited to,

project financing and interest charges and working capital.

Operating Costs

Operating cost estimates were provided by TPS.

These were reviewed by the qualified persons and found to be

reasonable and appropriate for a Preliminary Feasibility Study. A

summary of the first five years of operating costs is presented in

Table 4.

Table

4. https://www.globenewswire.com/NewsRoom/AttachmentNg/687fafa3-005e-4192-b800-2d7d61835337

QP Recommended Programs

As part of CPS’s plan for the future, funding

should be considered to include work necessary to:

- Enhance the economics of the deposit by upgrading inferred

resource areas or geo-units to higher levels of resource/reserve

classification by way of additional exploratory work;

- Prepare the silica sand resources/reserves to a feasibility

level of mine design and costing accuracy and/or open pit mining

and mine production phases at the discretion of CPS;

- Conduct exploratory work to define the extent of the deposit

beyond the current resource/reserve area; and

- Ongoing environmental management planning, permitting, and

social and local community engagement.

About Canadian Premium Sand Inc.

The Preliminary Feasibility Report is the culmination of a

9-month program initiated by the Company in 2018 which focused on

the completion of a 93 sonic drill hole exploration program

completed by Boart Longyear of Calgary with independent oversight

by APEX including 1,574 meters of core within its 42 Quarry Leases

encompassing 2,289 hectares. Laboratory testing was conducted on

761 samples by Stim-Lab and TPS to estimate the potential product

quality of the silica sand reserves and to allow development of a

mine plan and conduct the engineering to develop a detailed plant

flowsheet. In addition, a market study was completed and the

necessary infrastructure improvements were identified to support

the entire facility.

Simultaneously with this program, the Company began the

permitting and licensing process to obtain all necessary approvals

from Hollow Water First Nation, the local community of Seymourville

and the province of Manitoba. All of these approvals have been

granted including a confirmation from the Canadian Minister of

Environment and Climate Change that the project would not be

designated for environmental assessment under CEAA 2012.

Technical Disclosure

The technical information in this News Release

with respect to the PFS has been reviewed and approved by Roy

Eccles, P. Geol. of APEX Geoscience Ltd. and Robert Farmer P. Eng.

of John T. Boyd Company, each of whom is independent of CPS and a

“qualified person” under National Instrument 43-101 Standards of

Disclosure for Mineral Projects (“NI-43-101”).

A Technical Report in respect of the PFS will be

filed on SEDAR (www.sedar.com) within 45 days of this News Release

providing details of the Wanipigow Sand Project including the

quality assurance program and quality control measures applied and

key assumptions, parameters and methods used to estimate the

Mineral Resources and Reserves.

Forward Looking Information

Certain statements contained in this press

release constitute forward-looking statements relating to, without

limitation, expectations, intentions, plans and beliefs, including

information as to the future events, results of operations and the

Company’s future performance (both operational and financial) and

business prospects. In certain cases, forward-looking statements

can be identified by the use of words such as “expects”,

“estimates”, “forecasts”, “intends”, “anticipates”, “believes”,

“plans”, “seeks”, “projects” or variations of such words and

phrases, or state that certain actions, events or results “may” or

“will” be taken, occur or be achieved. Such forward-looking

statements reflect the Company's beliefs, estimates and opinions

regarding its future growth, results of operations, future

performance (both operational and financial), and business

prospects and opportunities at the time such statements are made,

and the Company undertakes no obligation to update forward-looking

statements if these beliefs, estimates and opinions or

circumstances should change. Forward-looking statements are

necessarily based upon a number of estimates and assumptions made

by the Company that are inherently subject to significant business,

economic, competitive, political and social uncertainties and

contingencies. Forward-looking statements are not guarantees of

future performance. In particular, this press release contains

forward-looking statements pertaining, but not limited, to: the

amount of raw sand to be extracted and produced from the Wanipigow

Sand Project; the mine life of the Wanipigow Sand Project; the

design and operation of the Wanipigow Sand Project and related

operating, capital and sustaining costs; the ability to transport

silica sand to market from the Wanipigow Sand Project and the

ultimate uses of such sand; the number of jobs to be created from

the development of the Wanipigow Sand Project; the anticipated

effects on local sand beaches or the local water table or community

wells from the Wanipigow Sand Project; the anticipated economic and

social benefits and opportunities, including employment,

contracting and training initiatives; the plans with respect to

financing ongoing operating activities; the timing and approval or

permitting process with respect to the Wanipigow Sand Project; the

intention to use cash on hand and proceeds from future equity

issuances to fund the Company's operations and future development

plans; industry activity levels; industry conditions pertaining to

the silica sand industry; the ability of and manner by which the

Company expects to meet its capital needs; and the Company's

objectives, strategies and competitive strengths.

By their nature, forward-looking statements

involve numerous current assumptions, known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to differ materially

from those anticipated by the Company and described in the

forward-looking statements.

With respect to the forward-looking statements

contained in this press release, assumptions have been made

regarding, among other things: the ability to obtain the necessary

stakeholder, regulatory and environmental approval to advance the

development of the Wanipigow Sand Project; the ability to continue

to consult with, and address feedback received from interested

stake holders including the Hollow Water First Nation and

surrounding communities; environmental risks and regulations;

future global economic and financial conditions; future commodity

prices; operating, capital and sustaining costs; that the

regulatory environment in which the Company operates will be

maintained in the manner currently anticipated by the Company;

future exchange and interest rates; geological and engineering

estimates in respect of the Company's silica sand quantities; the

recoverability of the Company’s silica sand and its quality; the

accuracy and veracity of information and projections sourced from

third parties respecting, among other things, future industry

conditions and product demand; demand for horizontal drilling and

hydraulic fracturing and the maintenance of current techniques and

procedures, particularly with respect to the use of silica sand;

the Company's ability to obtain qualified staff and equipment in a

timely and cost-efficient manner; the regulatory framework

governing royalties, taxes and environmental matters in the

jurisdictions in which the Company conducts its business and any

other jurisdictions in which the Company may conduct its business

in the future; future capital expenditures to be made by the

Company; future sources of funding for the Company's capital

program; the Company's future debt levels; the impact of

competition on the Company; and the Company's ability to obtain

financing on acceptable terms.

A number of factors, risks and uncertainties

could cause results to differ materially from those anticipated and

described herein including, among others: the effects of

competition and pricing pressures; effects of fluctuations in the

price of proppants; risks related to indebtedness and liquidity,

including the Company's capital requirements; risks related to

interest rate fluctuations and foreign exchange rate fluctuations;

changes in general economic, financial, market and business

conditions in the markets in which the Company operates; changes in

the technologies used to drill for and produce oil and natural gas;

the Company's ability to obtain, maintain and renew required

permits, licenses and approvals from regulatory authorities; the

stringent requirements of and potential changes to applicable

legislation, regulations and standards; the ability of the Company

to comply with unexpected costs of government regulations;

liabilities resulting from the Company's operations; the results of

litigation or regulatory proceedings that may be brought against

the Company; uninsured and underinsured losses; risks related to

the transportation of the Company's products, including potential

rail line interruptions or a reduction in rail car availability;

the geographic and customer concentration of the Company; the

ability of the Company to retain and attract qualified management

and staff in the markets in which the Company operates; labour

disputes and work stoppages and risks related to employee health

and safety; general risks associated with the oil and natural gas

industry, loss of markets, consumer and business spending and

borrowing trends; limited, unfavourable, or a lack of access to

capital markets; uncertainties inherent in estimating quantities of

mineral resources; sand processing problems; and the use and

suitability of the Company's accounting estimates and

judgments.

Although the Company has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in its

forward-looking statements, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking statements

will materialize or prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. The forward-looking statements contained in this

press release are expressly qualified by this cautionary statement.

Readers should not place undue reliance on forward-looking

statements. These statements speak only as of the date of this

press release. Except as may be required by law, the Company

expressly disclaims any intention or obligation to revise or update

any forward-looking statements or information whether as a result

of new information, future events or otherwise.

Any financial outlook and future-oriented

financial information contained in this press release regarding

prospective financial performance, financial position or cash flows

is based on assumptions about future events, including economic

conditions and proposed courses of action based on management’s

assessment of the relevant information that is currently available.

Projected operational information contains forward-looking

information and is based on a number of material assumptions and

factors, as are set out above. These projections may also be

considered to contain future oriented financial information or a

financial outlook. The actual results of the Company's operations

for any period will likely vary from the amounts set forth in these

projections and such variations may be material. Actual results

will vary from projected results. Readers are cautioned that any

such financial outlook and future-oriented financial information

contained herein should not be used for purposes other than those

for which it is disclosed herein. The forward-looking information

and statements contained in this document speak only as of the date

hereof and the Company does not assume any obligation to publicly

update or revise them to reflect new events or circumstances,

except as may be required pursuant to applicable laws.

CONTACT INFORMATION:

Canadian Premium Sand

Inc. Glenn Leroux President and Chief Executive

Officer 403.815.9907glenn.leroux@cpsmail.com

Media ContactBronwyn

WeaverCommunications and Community Liaison

Officer204.363.7202Bronwyn.Weaver@cpsmail.com

www.canadianpremiumsand.com

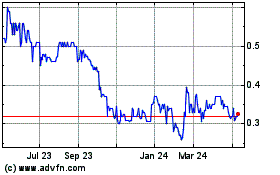

Canadian Premium Sands (TSXV:CPS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Canadian Premium Sands (TSXV:CPS)

Historical Stock Chart

From Feb 2024 to Feb 2025