Canadian Premium Sand Inc. (“

CPS”

or the “

Company”) (TSXV: CPS) is pleased to report

the results from its Front End Engineering and Design (“FEED”)

study and the receipt of a market report confirming the economic

viability of manufacturing patterned solar glass at a site

identified in Selkirk, Manitoba.

“These studies support our decision to build

North America’s only patterned solar glass manufacturing facility,”

stated Company President, Glenn Leroux. “The business strategy of

integrating our high-quality solar spec sand, Manitoba’s

inexpensive renewable hydroelectricity, and proximity to our North

American customer base through the Winnipeg logistics hub, is a

highly attractive business plan that others cannot easily

replicate.”

The FEED study was carried out by cm.project.ing

GmbH, an internationally recognized independent engineering firm,

specializing in glass manufacturing facilities and processes. The

market report specifically analyzed the North American market for

patterned solar glass, and was completed by Clean Energy

Associates, a global consulting firm specializing in the solar

industry.

The market report conducted by Clean Energy

Associates confirmed that patterned solar glass panels are the most

efficient products on the market and can be expected to dominate

industry demand for the next 20 years. Furthermore, the findings

included a positive outlook for the long-term price of patterned

solar glass in North America, further validating the Company’s

business model.

Since the Company’s announcement of its

intention to develop North America’s only patterned solar glass

manufacturing facility, CPS has received strong levels of industry

support for the project. The Company has commenced commercial

discussions with the majority of solar panel manufacturers that

have existing North American capacity, as well as a number of

global manufacturing entities that are planning to establish a

North American presence. To date, the Company has secured

Expressions of Interest for the purchase of solar glass in excess

of the first phase of planned facility output.

The FEED study focused on the design, capital

needs and operating costs of a patterned solar glass manufacturing

facility in Selkirk, Manitoba and a sand extraction facility

located at the Company’s wholly owned and permitted Wanipigow Sand

Quarry, approximately 150 kms to the North. In addition to

preliminary engineering design, the FEED study also included plant

and equipment selection, production output flow with various

product specifications as well as logistics considerations for raw

materials and finished products.

Taking the FEED study and market report into

consideration, the Company is advancing plans to develop its

integrated solar glass manufacturing project in multiple largescale

phases. Highlights of the first phase of the project include:

- 550 to 600 tonnes per day patterned solar glass manufacturing

and coating facility

- Multiple production lines that accommodate tempered glass

specifications ranging in thickness between 4.0mm and 1.8mm and the

application of advanced anti-reflective and anti-soiling

coatings

- Capable of supplying up to 4 GW of annual solar panel

manufacturing

- $400 to $500 million Class 4 capital cost estimate, which

provides an 80% certainty level and includes costs for both solar

glass manufacturing and sand extraction facilities

- Includes capital for land and certain common operating

infrastructure that will enable CPS to efficiently add future

production capacity to accommodate the anticipated growth in solar

glass demand

- Approximately $200 million of annual EBITDA based on full

production capacity and current solar glass prices of approximately

US$12/sq. m.

- CPS expects to be the lowest cost provider of patterned solar

glass to the North American market due to the use of low-cost

renewable hydroelectric energy, proximity to customers and the

integration of CPS’s wholly owned silica sand supply

- Taking the current capital cost estimate into consideration and

other factors this EBITDA estimate supports an unlevered before-tax

NPV10 of approximately $800 million and internal rate of return

(IRR) of approximately 25%

Based on the growth profile of the market and

the size of the Company-owned silica sand resource, CPS sees the

potential to construct up to three additional equally sized

manufacturing facilities at the same site. Through leveraging

investment in common infrastructure, the second phase of the

project that incorporates a doubling of manufacturing capacity,

would increase the unlevered before-tax NPV10 to over $1.5 billion,

the IRR to over 30% and is expected to be financed organically.

Construction of the initial manufacturing facility and the

associated silica sand extraction operation is estimated to take

approximately two years to complete.

As reported on April 19, 2022, the Company has

retained Green City Glass LLC to assist the Company in its

selection of the key service providers needed to construct the

Company’s solar glass manufacturing facility. Green City Glass will

also provide oversight in vendor selection, plant design,

construction management, commissioning, staffing and preparation

for efficient and profitable plant operations. This process will

result in a Class 2 capital cost estimate, which will provide a

90%+ certainty level, by the second half of 2022, and further

validate the project’s strong economic returns for our current and

future shareholders.

Additionally, the Company continues to advance

other development initiatives that will bring the project to a

shovel-ready status, by Q1 2023, including permitting, silica sand

resource upgrading and testing and ongoing negotiations to secure

firm commercial offtake agreements.

About Canadian Premium Sand Inc.The Company is

developing manufacturing capacity for ultra high-clarity patterned

solar glass through a Company-owned facility to be located in

Selkirk, Manitoba that utilizes the high-purity, low-iron silica

sand from its wholly owned Wanipigow quarry leases and renewable

Manitoba hydroelectricity. The Company is a reporting issuer in

Ontario, Alberta and British Columbia. Its shares trade on the TSXV

under the symbol "CPS".

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

CONTACT

INFORMATION:

|

Canadian Premium Sand Inc. |

|

|

Glenn Leroux |

Cam Deller |

|

President and Chief Executive Officer |

Chief Financial Officer |

|

glenn.leroux@cpsmail.com |

cam.deller@cpsmail.com |

|

|

|

|

Investor Relations |

|

|

IR@cpsmail.com |

|

|

587.355.3714 |

|

|

www.cpsglass.com |

|

Forward Looking Information

Certain statements contained in this press

release constitute forward-looking statements relating to, without

limitation, expectations, intentions, plans and beliefs, including

information as to the future events, results of operations and the

Company’s future performance (both operational and financial) and

business prospects. In certain cases, forward-looking statements

can be identified by the use of words such as “expects”,

“estimates”, “forecasts”, “intends”, “anticipates”, “believes”,

“plans”, “seeks”, “projects” or variations of such words and

phrases, or state that certain actions, events or results “may” or

“will” be taken, occur or be achieved. Such forward-looking

statements reflect the Company's beliefs, estimates and opinions

regarding its future growth, results of operations, future

performance (both operational and financial), and business

prospects and opportunities at the time such statements are made,

and the Company undertakes no obligation to update forward-looking

statements if these beliefs, estimates and opinions or

circumstances should change. Forward-looking statements are

necessarily based upon a number of estimates and assumptions made

by the Company that are inherently subject to significant business,

economic, competitive, political and social uncertainties and

contingencies. Forward-looking statements are not guarantees of

future performance. In particular, this press release contains

forward-looking statements pertaining, but not limited, to: the

market outlook and future pricing of solar glass; the plans to

advance the first stage of the project; the capital cost estimate

for the project; the ability to add future production capacity to

accommodate the anticipated growth in solar glass demand; estimates

of annual EBITDA; the expectation that CPS will be the lowest cost

provider of patterned solar glass; NPV and IRR estimates; the

potential to construct up to three additional equally sized

manufacturing facilities at the same site and the benefits of such

additional facilities; the timing for the construction of the

initial manufacturing facility; the expectations that CPS will

receive a Class 2 capital cost estimate and the timing for such

estimate; the expectation that the project will provide for strong

economic returns for our current and future shareholders; the other

development initiatives the Company plans to advance; future

development plans; industry activity levels; industry conditions

pertaining to the solar glass manufacturing industry; the ability

of and manner by which the Company expects to meet its capital

needs; and the Company's objectives, strategies and competitive

strengths. By their nature, forward-looking statements involve

numerous current assumptions, known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to differ materially

from those anticipated by the Company and described in the

forward-looking statements.

A number of factors, risks and uncertainties

could cause results to differ materially from those anticipated and

described herein including, among others: the effects of

competition and pricing pressures; effects of fluctuations in the

price of glass products and raw materials input costs; risks

related to indebtedness and liquidity, including the Company's

capital requirements; risks related to interest rate fluctuations

and foreign exchange rate fluctuations; changes in general

economic, financial, market and business conditions in the markets

in which the Company operates; the Company's ability to obtain,

maintain and renew required permits, licenses and approvals from

regulatory authorities; the stringent requirements of and potential

changes to applicable legislation, regulations and standards; the

ability of the Company to comply with unexpected costs of

government regulations; liabilities resulting from the Company's

operations; the results of litigation or regulatory proceedings

that may be brought against the Company; uninsured and underinsured

losses; risks related to the transportation of the Company's

products, including potential rail line interruptions or a

reduction in rail car availability; the geographic and customer

concentration of the Company; the ability of the Company to retain

and attract qualified management and staff in the markets in which

the Company operates; labor disputes and work stoppages and risks

related to employee health and safety; general risks associated

with the glass manufacturing and sand quarry industries, loss of

markets, consumer and business spending and borrowing trends;

limited, unfavorable, or a lack of access to capital markets;

uncertainties inherent in estimating quantities of products;

processing problems; the use and suitability of the Company's

accounting estimates and judgments; and the other risk factors

outlined in CPS’s most recent Management’s Discussion and Analysis

which is available on SEDAR at www.sedar.com. Although the Company

has attempted to identify important factors that could cause actual

actions, events or results to differ materially from those

described in its forward-looking statements, there may be other

factors that cause actions, events or results not to be as

anticipated, estimated or intended. There can be no assurance that

forward-looking statements will materialize or prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. The

forward-looking statements contained in this press release are

expressly qualified by this cautionary statement. Readers should

not place undue reliance on forward-looking statements. These

statements speak only as of the date of this press release. Except

as may be required by law, the Company expressly disclaims any

intention or obligation to revise or update any forward-looking

statements or information whether as a result of new information,

future events or otherwise. Any financial outlook and

future-oriented financial information contained in this press

release regarding prospective financial performance, financial

position, cash flows or EBITDA projections are based on assumptions

about future events, including economic conditions and proposed

courses of action based on management’s assessment of the relevant

information that is currently available. Projected operational

information contains forward-looking information and is based on a

number of material assumptions and factors, as are set out above.

These projections may also be considered to contain future oriented

financial information or a financial outlook. The actual results of

the Company's operations for any period will likely vary from the

amounts set forth in these projections and such variations may be

material. Actual results will vary from projected results. Readers

are cautioned that any such financial outlook and future-oriented

financial information contained herein should not be used for

purposes other than those for which it is disclosed herein. The

forward-looking information and statements contained in this

document speak only as of the date hereof and the Company does not

assume any obligation to publicly update or revise them to reflect

new events or circumstances, except as may be required pursuant to

applicable laws

Market, Independent Third Party and

Industry Data

Certain market, independent third-party and

industry data contained in this press release is based upon

information from government or other independent industry

publications and reports or based on estimates derived from such

publications and reports. Government and industry publications and

reports generally indicate that they have obtained their

information from sources believed to be reliable, but the Company

has not conducted its own independent verification of such

information. This press release also includes certain data derived

from public filings made by independent third parties. While the

Company believes this data to be reliable, market and industry data

is subject to variations and cannot be verified with complete

certainty due to limits on the availability and reliability of raw

data, the voluntary nature of the data gathering process and other

limitations and uncertainties inherent in any statistical survey.

The Company has not independently verified any of the data from

independent third-party sources referred to in this press release

or ascertained the underlying assumptions relied upon by such

sources.

Non-GAAP Financial Measures

In this press release, CPS has used the

following term (a “Non-GAAP Financial Measure”) which is not

defined by International Financial Reporting Standards (“IFRS”) but

is used by management to evaluate the performance of CPS and its

business: "EBITDA". EBITDA is defined as earnings before interest,

taxes, depreciation and amortization. This measure may also be used

by investors, financial institutions and others to assess CPS’s

performance and ability to service debt. Non-GAAP Financial

Measures do not have standardized meanings prescribed by IFRS and

are therefore unlikely to be comparable to similar measures

presented by other companies. Securities regulations require that

Non-GAAP Financial Measures are clearly defined, qualified and

reconciled to their most comparable IFRS financial measures. Except

as otherwise indicated, Non-GAAP Financial Measures are calculated

and disclosed on a consistent basis from period to period. Specific

items may only be relevant in certain periods. The intent of

Non-GAAP Financial Measures is to provide additional useful

information to investors and analysts, and the measures do not have

any standardized meaning under IFRS. The measures should not,

therefore, be considered in isolation or used in substitute for

measures of performance prepared in accordance with IFRS. Other

issuers may calculate Non-GAAP Financial Measures differently.

Investors should be cautioned that EBITDA should not be construed

as an alternative to net earnings, cash flow from operating

activities or other measures of financial results determined in

accordance with GAAP as an indicator of CPS’s performance.

Currency

All references to “$” in this press release are

to Canadian dollars, unless otherwise noted.

Endnote

Internal financial modeling based on: capital and operating cost

details from the FEED study; current solar glass price data from

Singapore Solar Exchange and PV InfoLink; and logistics quotes for

delivery costs of solar glass to North American locations. Implicit

in forward-looking information in respect of the EBITDA projections

contained in this press release are certain current assumptions,

including, among others, that the Company will continue to execute

on its strategy of developing manufacturing capacity for solar

glass, attracting customers and end-users, realize operational

efficiencies from its integrated sand quarry, and extract

procurement and cost synergies on time and on budget. Additional

assumptions include no changes to the current economic environment,

no material changes in interest rates and foreign exchange rates,

procurement, development or supply costs, access to equity and debt

capital and sufficient cash flow for ongoing operations. These

assumptions are based on the fact that funding for the construction

of the facility will be obtained, the project will receive final

investment decision approval from the CPS board and the ultimate

construction of the facility will proceed as scheduled and on

budget, markets for solar glass and access to end markets. See also

“Forward Looking Information” above.

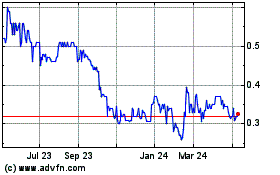

Canadian Premium Sands (TSXV:CPS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Canadian Premium Sands (TSXV:CPS)

Historical Stock Chart

From Feb 2024 to Feb 2025