Canadian Premium Sand Inc. Announces Exercise of Warrants and Extension of Convertible Debenture Maturity Date

December 11 2023 - 4:00PM

Canadian Premium Sand Inc. (“

CPS”

or the “

Company”) (TSXV: CPS) announces the

completion of two financing initiatives in support of the ongoing

process to raise project financing for the construction of the

Company’s patterned solar glass manufacturing facility in Selkirk,

Manitoba (the “

Project”).

The Company’s insiders, including board members

and management, as well as certain key strategic investors have

exercised 4,747,692 common share purchase warrants, at an exercise

price of $0.40 per warrant, resulting in cash proceeds to CPS of

$1,899,077. Following this initiative, the Company has 83,420,752

common shares outstanding.

Additionally, the Company has reached an

agreement with the holders of its outstanding convertible

debentures to extend the maturity date by one year from February

26, 2024 to February 26, 2025. All holders of the convertible

debentures are insiders or key strategic investors in the

Company.

“Despite a challenging macro-economic and

fundraising landscape, we continue to make progress toward a

successful Project financing. We believe a patient approach to this

financing will deliver the best outcome for our shareholders. This

approach is supported by our insiders and key strategic investors

who have ensured the Company is in a strong position to execute the

financing strategy. Management is confident that the market for our

patterned solar glass remains strong. We continue to engage with

our customers, all of which maintain their commitment to the

Project and establishing North American solar glass supply to

support their own capital investment and growth initiatives. We

look forward to completing the Project financing process so we can

support our customer’s growth objectives and create value for our

shareholders,” stated Company President & CEO, Glenn

Leroux.

Certain directors of the Company, being Lowell

Jackson, John Assman and Glenn Leroux, and each of its two

significant shareholders being Paramount Resources Ltd. and David

Wilson, directly or indirectly participated in the convertible

debenture maturity extension, which may result in this transaction

being a "related party transaction" as defined under Multilateral

Instrument 61-101 ("MI 61-101"). The transaction

is exempt from the need to obtain minority shareholder and a formal

valuation as required by MI 61-101 as the Company is listed on the

TSX Venture Exchange and at the time the transaction was agreed to,

neither the fair market value of the subject matter of nor, the

fair market value of the consideration for, the transaction,

insofar as it involved "interested parties" (as defined in MI

61-101), exceeded 25 percent of the Company's market

capitalization. The convertible debenture maturity extension is

subject to the approval of the TSX Venture Exchange.

About Canadian Premium Sand

Inc.

The Company is developing manufacturing capacity

for ultra high-clarity patterned solar glass through a

Company-owned facility to be located in Selkirk, Manitoba that

utilizes the high-purity, low-iron silica sand from its wholly

owned Wanipigow quarry leases and renewable Manitoba

hydroelectricity. The Company is a reporting issuer in Ontario,

Alberta and British Columbia. Its shares trade on the TSXV under

the symbol "CPS".

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

CONTACT INFORMATION:

|

Canadian Premium Sand Inc. |

|

|

Glenn Leroux |

Cam Deller |

|

President and Chief Executive Officer |

Chief Financial Officer |

|

glenn.leroux@cpsmail.com |

cam.deller@cpsmail.com |

|

|

|

|

Investor Relations |

|

|

IR@cpsmail.com |

|

|

587.355.3714 |

|

|

www.cpsglass.com |

|

|

|

|

Forward-Looking Information

Certain statements contained in this press

release constitute forward-looking statements relating to, without

limitation, expectations, intentions, plans and beliefs, including

information as to the future events, results of operations and the

Company’s future performance (both operational and financial) and

business prospects. In certain cases, forward-looking statements

can be identified by the use of words such as “expects”,

“estimates”, “forecasts”, “intends”, “anticipates”, “believes”,

“plans”, “seeks”, “projects” or variations of such words and

phrases, or state that certain actions, events or results “may” or

“will” be taken, occur or be achieved. Such forward-looking

statements reflect the Company's beliefs, estimates and opinions

regarding its future growth, results of operations, future

performance (both operational and financial), and business

prospects and opportunities at the time such statements are made,

and the Company undertakes no obligation to update forward-looking

statements if these beliefs, estimates and opinions or

circumstances should change. Forward-looking statements are

necessarily based upon a number of estimates and assumptions made

by the Company that are inherently subject to significant business,

economic, competitive, political and social uncertainties and

contingencies. Forward-looking statements are not guarantees of

future performance. In particular, this press release contains

forward-looking statements pertaining, but not limited, to: the

financing of the Project and the approach to be taken with respect

to the financing of the Project and the anticipated benefits of

such approach for the Company's shareholders; the anticipated

market for the Company's patterned solar glass; the continued

engagement with customers and the benefits of completing the

Project financing for the Company's customers and shareholders;

future development plans; industry activity levels; industry

conditions pertaining to the solar glass manufacturing industry;

the ability of and manner by which the Company expects to meet its

capital needs; and the Company's objectives, strategies and

competitive strengths. By their nature, forward-looking statements

involve numerous current assumptions, known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to differ materially

from those anticipated by the Company and described in the

forward-looking statements. The forward-looking information and

statements contained in this document speak only as of the date

hereof and the Company does not assume any obligation to publicly

update or revise them to reflect new events or circumstances,

except as may be required pursuant to applicable laws.

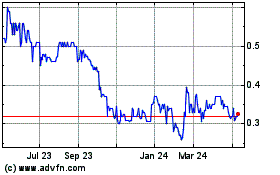

Canadian Premium Sands (TSXV:CPS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Canadian Premium Sands (TSXV:CPS)

Historical Stock Chart

From Feb 2024 to Feb 2025