Compass Gold Closes $1,094,800 Private Placement

June 03 2022 - 6:30AM

Compass Gold Corporation (TSX-V: CVB) ("Compass" or the "Company")

announced today that it has issued, on a non-brokered private

placement basis, a total of 7,298,668 units of the Company

("

Units"), at a price of $0.15 per Unit, for

aggregate gross proceeds of approximately $1.1 million pursuant to

the closing of its previously announced private placement (the

"Offering") (see Compass news release dated April 21, 2022).

Larry Phillips, Compass Gold's President

and CEO, said, "The completion of this private placement,

despite the challenging market conditions, will allow our

exploration team to commence the initial 1000 metres of RC

drilling on our highest priority target zones within the Moribala

Permit area. The results from this first stage of drilling

should be received in July. Based on those results, we will

conduct follow up drilling over the remainder of the year, which

will be fully funded from the proceeds of this private

placement.

We believe that the target zones we have

identified along the fault zones at Moribala hold tremendous

potential for a significant discovery and that the drilling planned

between now and the end of the year will be an important step

towards that objective."

An extensive new exploration and drill

program launched

The proceeds of this financing will initially be

used on the Moribala permit to follow up on the highly encouraging

drill results reported in March 2022, where a 21 m interval

containing 0.5 grams per tonne (g/t) gold (Au) was identified on a

blind target. Four 1-km segments associated with the 6-km

long Moribala and Tarabala faults will be tested in June through a

1,000-m reverse circulation (RC) drilling program (Figure 1).

This drilling is aimed to further identify and determine the depth

extent of near-surface gold mineralization along the broad target

zones. While the drilling takes place, two additional

Gradient IP geophysical surveys will be carried out on the Moribala

fault to precisely locate the site of additional AC drilling

planned for the fourth quarter.

Figure 1: Planned RC drill hole

locations on high-priority target zones at

Moribala.https://www.globenewswire.com/NewsRoom/AttachmentNg/0a13d651-efc3-4b14-9575-4389b6d27d39

Placement Details

Each Unit issued pursuant to the Offering

consists of one common share of the Company (a "Common

Share") and one Common Share purchase warrant (a

"Warrant"), with each Warrant entitling the holder

thereof to purchase one additional Common Share at a price of $0.30

for a period of three years from the date of issuance (subject to

the acceleration of the expiry date of the Warrants as described

below).

If the closing price of the Common Shares on the

TSX Venture Exchange is greater than $0.40 for a period of 20

consecutive trading days, the expiry date of the Warrants may be

accelerated by the Company providing notice to the holders of

Warrants and, in such case, the expiry date of the Warrants shall

be the date which is 30 days following the date on which such

notice is provided. The Company will also issue a press release

announcing the accelerated expiry date concurrently with the giving

of such notice.

Insiders of the Company purchased an aggregate

of 1,733,334 shares under the Offering, for aggregate consideration

of $260,000. Such participation is considered a "related party

transaction" within the meaning of Multilateral Instrument 61-101 –

Protection of Minority Security Holders in Special Transactions

("MI 61-101"). Participation by insiders in the Offering was exempt

from: (i) the valuation requirements of MI 61-101 by virtue of the

exemption contained in Section 5.5(b) of MI 61-101, as the Company

is listed only on the TSX Venture Exchange; and (ii) the minority

shareholder approval requirements of MI 61-101 by virtue of the

exemption contained in Section 5.7(1)(a) of MI 61-101, as at the

time the Offering was agreed to, neither the fair market value of

the subject matter of, nor the fair market value of the

consideration for, the Offering, insofar as it involved interested

parties, exceeded 25% of the market capitalization of the

Company.

All securities issued pursuant to the Offering

are subject to a hold period expiring four months and one day after

the date of issuance. Subsequent to the completion of the Offering,

the Company has a total of 93,810,336 common shares issued and

outstanding. The Offering is subject to final acceptance by the TSX

Venture Exchange.

The securities offered pursuant to the Offering

have not been registered under the United States Securities Act of

1933, as amended, and may not be offered or sold in the United

States or to, or for the account or benefit of, U.S. persons absent

registration or an applicable exemption from registration

requirements. This release does not constitute an offer for sale of

securities in the United States.

About Compass Gold

Corporation

Compass is a Tier 2 issuer listed on the

TSX- V. Through the 2017 acquisition of MGE and Malian

subsidiaries, Compass holds gold exploration permits located in

Mali that comprise the Sikasso Property. The exploration permits

are located in three sites in southern Mali with a combined land

holding of 867 km2. The Sikasso Property is located in the same

region as several multi-million-ounce gold projects, including

Morila, Syama, Kalana and Komana. Mineralization hosted on adjacent

and or nearby properties is not necessarily indicative of

mineralization hosted on the Company's property. The Company's

Mali-based technical team, led in the field by Dr. Madani Diallo

and under the supervision of Dr. Sandy M. Archibald, P.Geo, is

conducting the current exploration program on several anomalous

areas of the Sikasso Property, southern Mali.

Forward‐Looking Information

This news release contains "forward‐looking

information" within the meaning of applicable securities laws,

including statements regarding the Company's planned exploration

work and use of proceeds for the Offering. Readers are cautioned

not to place undue reliance on forward‐looking information. Actual

results and developments may differ materially from those

contemplated by such information. The statements in this news

release are made as of the date hereof. The Company undertakes no

obligation to update forward‐looking information except as required

by applicable law.

Dr. Sandy M. Archibald, P.Geo, is Technical

Director of Compass Gold Corporation and a Qualified Person as

defined by National Instrument 43-101. He is responsible for the

supervision of the exploration on the Sikasso project and for the

preparation of the technical information in this disclosure.

For further information please contact:

|

Compass Gold Corporation |

Compass Gold Corporation |

|

Larry Phillips – Pres. & CEO |

Greg Taylor – Dir. Investor Relations & Corporate

Communications |

|

lphillips@compassgoldcorp.com |

gtaylor@compassgoldcorp.com |

|

T: +1 416-596-0996 X 302 |

T: +1 416-596-0996 X 301 |

Website: www.compassgoldcorp.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE.

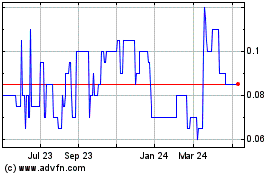

Compass Gold (TSXV:CVB)

Historical Stock Chart

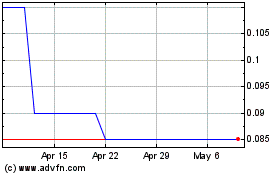

From Jan 2025 to Feb 2025

Compass Gold (TSXV:CVB)

Historical Stock Chart

From Feb 2024 to Feb 2025