TSX-V: CWV: Crown Point Energy Inc. (“Crown

Point”, the

“Company”,

"

we" or "

our"

)

today announced certain reserve information for the year ended

December 31, 2023. All dollar figures are expressed in

United States dollars ("

USD" or

"

US$") unless otherwise stated, and

"

MMUS$" means millions of USD.

Sproule Associates Limited

(“Sproule”), an independent qualified reserves

engineer, evaluated the oil and natural gas reserves attributable

to all of Crown Point’s properties as at December 31, 2023 based on

forecast prices and costs and in accordance with National

Instrument 51-101 ("NI 51-101") and the Canadian

Oil and Gas Evaluation Handbook (the "COGE

Handbook"). Sproule’s evaluation report (the

"Sproule Report") also presents the estimated net

present value of future net revenue associated with Crown Point's

reserves. A summary of Crown Point’s crude oil, natural gas and

natural gas liquids reserves, as evaluated by Sproule, and the

associated net present value of future net revenue associated

therewith as at December 31, 2023 is presented below.

The following table presents, in the aggregate,

the Company's gross and net proved and probable reserves, estimated

using forecast prices and costs, by product type and by barrel of

oil equivalent, as of December 31, 2023.

|

SUMMARY OF RESERVES AS OF DECEMBER 31,

2023(Forecast Prices & Costs) |

| |

|

|

|

|

| |

Light and Medium Crude Oil |

Conventional Natural Gas |

Natural Gas Liquids |

Total Reserves |

|

(Mbbl) |

(MMcf) |

(Mbbl) |

MBOE |

|

Reserves Category

(2) |

Gross |

Net |

Gross |

Net |

Gross |

Net |

Gross |

Net |

| Proved: |

|

|

|

|

|

|

|

|

|

Developed Producing |

1,219 |

1,068 |

2,762 |

2,389 |

15 |

13 |

1,694 |

1,479 |

|

Developed Non-Producing |

1,034 |

903 |

- |

- |

- |

- |

1,034 |

903 |

|

Undeveloped |

1,058 |

924 |

- |

- |

- |

- |

1,058 |

924 |

| Total

Proved |

3,310 |

2,895 |

2,762 |

2,389 |

15 |

13 |

3,785 |

3,306 |

| Total Probable |

3,134 |

2,722 |

5,200 |

4,498 |

28 |

24 |

4,028 |

3,496 |

| Total Proved plus

Probable |

6,444 |

5,617 |

7,962 |

6,887 |

42 |

37 |

7,813 |

6,801 |

| |

|

|

|

|

|

|

|

|

The following table discloses, in the aggregate,

the net present value of the Company's future net revenue

attributable to the reserves categories in the table above,

estimated using forecast prices and costs, before deducting future

income tax expenses, and calculated without discount and using

discount rates of 5%, 10%, 15% and 20%.

|

SUMMARY OF NET PRESENT VALUE OF FUTURE NET

REVENUEAS OF DECEMBER 31, 2023(Forecast Prices

& Costs) |

| |

|

| |

Net Present Values of Future Net Revenue Before Income

Taxes (1) |

|

Discounted at (%/year) |

|

Reserves Category

(2) |

0% |

5% |

10% |

15% |

20% |

|

MMUS$ |

MMUS$ |

MMUS$ |

MMUS$ |

MMUS$ |

| Proved: |

|

|

|

|

|

| Developed Producing |

13.37 |

13.55 |

13.00 |

12.23 |

11.45 |

| Developed Non-Producing |

20.07 |

14.84 |

11.09 |

8.33 |

6.27 |

| Undeveloped |

22.56 |

15.13 |

9.80 |

5.87 |

3.91 |

| Total Proved |

56.00 |

43.51 |

33.88 |

26.44 |

20.63 |

| Total Probable |

88.88 |

59.24 |

40.70 |

28.67 |

20.59 |

| Total Proved plus

Probable |

144.88 |

102.75 |

74.58 |

55.10 |

41.22 |

(1) The estimated net

present values of future net revenues disclosed do not represent

fair market value.

(2) The definitions of

the various categories of reserves are those set out in NI 51-101

and the COGE Handbook.

The Company's proved plus probable ("2P") gross

reserves as at December 31, 2023, as evaluated by Sproule, were

7,813 MBOE compared to 7,942 MBOE as evaluated by McDaniel &

Associates Consultants Ltd. in their report at December 31, 2022.

The decrease in 2P reserves is attributable to 2023 production of

322 MBOE which was partially offset by a positive adjustment in the

production forecast due to updated performance of oil and gas wells

and the assignment of an additional probable well location in

Chanares Herrados.

The estimated before tax net present value of

the Company's 2P reserves as at December 31, 2023 (discounted at

10%) was $74.6 million, compared with $66.2 million as at December

31, 2022. The increase in the before tax net present value is

attributable to an increase in oil and gas prices as a consequence

of the normalization of the market in Argentina.

Approximately 17% of the Company's before tax

net present value of 2P reserves (discounted at 10%) is categorized

as "developed producing" and the before tax net present value of

future net revenues associated with the Company's total proved

reserves (discounted at 10%) represents approximately 45% of the

Company's before tax net present value of future net revenues

associated with all of the Company's 2P reserves. Crude oil

accounts for approximately 83% of the Company's 2P reserves (gross)

as at December 31, 2023 compared with approximately 85% as at

December 31, 2022, whereas natural gas accounts for the remaining

17% of the Company's 2P gross reserves as at December 31, 2023

compared with 15% as at December 31, 2022.

The following table sets forth, for each product

type, the pricing assumptions used by Sproule in estimating the

reserves data disclosed herein as at December 31, 2023.

|

SUMMARY OF PRICING AND INFLATION RATE

ASSUMPTIONSAS OF DECEMBER 31, 2023 (Forecast

Prices & Costs) |

|

|

|

|

|

|

|

|

|

Year |

Brent Crude Oil Price

(1)US$/bbl |

TDF Crude Oil Price

(1)US$/bbl |

TDF NGL Price

(2)US$/bbl |

TDF Natural Gas

Price

(3)US$/Mcf |

CH/PPCOOil Price

(4)US$/bbl |

Inflation Rate

(5)% /

Year |

|

2024 |

80.00 |

65.00 |

31.21 |

5.05 |

65.35 |

0.0 |

|

2025 |

80.00 |

65.00 |

31.83 |

5.40 |

70.84 |

4.5 |

|

2026(6) |

80.00 |

65.00 |

32.47 |

5.41 |

70.84 |

4.1 |

|

2027 |

81.60 |

66.60 |

33.12 |

5.35 |

72.31 |

3.7 |

|

2028 |

83.23 |

68.23 |

33.78 |

5.45 |

73.81 |

3.9 |

|

2029 |

84.90 |

69.90 |

34.46 |

5.55 |

75.35 |

3.5 |

|

2030 |

86.59 |

71.59 |

35.15 |

5.67 |

76.90 |

3.0 |

|

2031 |

88.33 |

73.33 |

35.85 |

5.78 |

78.50 |

2.9 |

|

2032 |

90.09 |

75.09 |

36.57 |

5.89 |

80.12 |

2.7 |

|

2033 |

91.89 |

76.89 |

37.30 |

6.01 |

81.78 |

2.6 |

|

2034 |

93.73 |

78.73 |

38.04 |

6.13 |

83.47 |

2.4 |

|

2035 |

95.61 |

80.61 |

38.81 |

6.26 |

85.20 |

2.3 |

|

2036 |

97.52 |

82.52 |

39.58 |

6.38 |

86.96 |

2.2 |

|

2037 |

99.47 |

84.47 |

40.37 |

6.51 |

88.75 |

2.1 |

|

2038 |

101.46 |

86.46 |

41.18 |

6.64 |

90.58 |

2.0 |

|

(1) |

Forecast pricing for Tierra del Fuego ("TDF")

crude oil is based on the forecast Brent crude oil benchmark

reference pricing published by Sproule, less a discount of US$15.00

per bbl. |

|

(2) |

The 2024 TDF NGL price is based on the 12 month average price

received in 2023 which was then escalated at 2% per annum

thereafter. |

|

(3) |

Natural gas production from the TDF concessions is sold to

consumers in TDF as well as to mainland Argentina, all of which

receive different prices as set by sales agreements from time to

time. The forecast prices represent a blend of such prices adjusted

for a 1,000 Btu/Scf heating factor. |

|

(4) |

Forecast 2024 pricing for Chañares Herrados (“CH”)

and Puesto Pozo Cercado Oriental (“PPCO”) crude

oil is based on the Company's current sales agreements and the

operator's 2024 budgets. From 2025 onwards the price forecast is

based on 92% of Sproule´s Brent crude oil price deck less a

discount of US$3.00 per bbl. |

|

(5) |

Inflation rates used for forecasting costs adjusted for

inflationary pressures affecting the Argentine economy. |

|

(6) |

The TDF concessions expire in August 2026 unless extended by

agreement with the Province of TDF. The Company intends to

participate with the TDF joint venture in obtaining an extension to

the primary term of the TDF concessions. |

|

|

|

Further details of the evaluation of the

Company’s reserves as at December 31, 2023 will be contained in the

Company’s NI 51-101 filings for the year ended December 31, 2023,

which will be filed with Canadian securities regulatory authorities

in due course and will be made available under the Company’s

profile at www.sedarplus.ca and on the Company’s website at

www.crownpointenergy.com.

|

For inquiries please contact: |

|

|

|

Gabriel ObradorPresident & CEOPh: (403) 232-1150Crown Point

Energy Inc.gobrador@crownpointenergy.com |

Marisa TormakhVice-President, Finance & CFOPh: (403)

232-1150Crown Point Energy Inc.mtormakh@crownpointenergy.com |

About Crown Point

Crown Point Energy Inc. is an international oil

and gas exploration and development company headquartered in

Calgary, Canada, incorporated in Canada, trading on the TSX Venture

Exchange and operating in Argentina. Crown Point's exploration and

development activities are focused in three producing basins in

Argentina, the Austral basin in the province of Tierra del Fuego,

and the Neuquén and Cuyo basins in the province of Mendoza. Crown

Point has a strategy that focuses on establishing a portfolio of

producing properties, plus production enhancement and exploration

opportunities to provide a basis for future growth.

Oil and Gas Advisories

Barrels of oil equivalent

("BOE") may be misleading, particularly if used in

isolation. A BOE conversion ratio of six thousand cubic feet (6

Mcf) to one barrel (1 bbl) is based on an energy equivalency

conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. In addition,

given that the value ratio based on the current price of crude oil

in Argentina as compared to the current price of natural gas in

Argentina is significantly different from the energy equivalency of

6:1, utilizing a conversion on a 6:1 basis may be misleading as an

indication of value.

"MBOE" means thousands of barrels of oil

equivalent. “Mcf” means thousand cubic feet. “MMcf” means million

cubic feet. "bbl" means barrel. "Mbbl" means thousands of barrels.

"NGL" means natural gas liquids. "Btu/Scf" means

British thermal unit per standard cubic foot.

The reserves estimates contained in this news

release represent our gross and net reserves as at December 31,

2023. Gross reserves are defined under NI 51-101 as our working

interest (operating or non-operating) share before deduction of

royalties and without including any of our royalty interests. Net

reserves are defined under NI 51-101 as our working interest

(operating or non-operating) share after deduction of royalty

obligations, plus our royalty interests in reserves. It should not

be assumed that the present worth of estimated future net revenues

presented in the tables above represents the fair market value of

the reserves. There is no assurance that the forecast price and

cost assumptions will be attained and variances could be material.

The recovery and reserves estimates of our crude oil, natural gas

liquids and natural gas reserves provided herein are estimates only

and there is no guarantee that the estimated reserves will be

recovered. Actual crude oil, natural gas and natural gas liquids

reserves may be greater than or less than the estimates provided

herein.

All future net revenues are estimated using

forecast prices arising from the anticipated development and

production of our reserves, net of the associated royalties,

operating costs, development costs, and abandonment and reclamation

costs and are stated prior to provision for interest and general

and administrative expenses. Future net revenues have been

presented on a before tax basis.

The estimates of reserves and future net revenue

for individual properties may not reflect the same confidence level

as estimates of reserves and future net revenue for all properties,

due to the effects of aggregation.

Forward Looking Statements

Certain information set forth in this document

is considered forward-looking information, and necessarily involves

risks and uncertainties, certain of which are beyond Crown Point’s

control. Forward-looking information herein includes: the Company's

intention to participate with the TDF joint venture in obtaining an

extension to the primary term (expiring August 2026) of the TDF

concessions; and the forecast pricing and inflation rate

assumptions set forth herein. In addition, information relating to

our reserves is deemed to be forward-looking information, as it

involves the implied assessment, based on certain estimates and

assumptions, that the reserves described can be economically

produced in the future. Such risks include but are not limited to:

the risk that the TDF joint venture is not able to obtain an

extension to the primary term of the TDF concessions at all or on

acceptable terms and/or that the receipt of the extension is

delayed; the risks that pandemics and outbreaks of communicable

disease such as COVID-19 pose to the oil and gas industry generally

and our business in particular; risks associated with oil and gas

exploration, development, exploitation, production, marketing and

transportation, including the risk that the infrastructure on which

we rely to produce, transport and sell our products breaks down and

requires parts that are not readily available or repairs that

cannot be made on a timely basis, and which impair our ability to

operate and/or sell our products; risks associated with operating

in Argentina, including risks of changing government regulations

(including the adoption of, amendments to, or the cancellation of

government incentive programs or other laws and regulations

relating to commodity prices, taxation, currency controls and

export restrictions, in each case that may adversely impact Crown

Point), risks that new government initiatives will not have the

consequences the Company believes (including the benefits to be

derived therefrom), expropriation/nationalization of assets, price

controls on commodity prices, inability to enforce contracts in

certain circumstances, the potential for a hyperinflationary

economic environment, the imposition of currency controls, risks

associated with a default on Argentine government debt, and other

economic and political risks; volatility of commodity prices;

currency fluctuations; imprecision of reserve estimates;

environmental risks; competition from other producers; inability to

retain drilling services; incorrect assessment of value of

acquisitions and failure to realize the benefits therefrom; delays

resulting from or inability to obtain required regulatory

approvals; the lack of availability of qualified personnel or

management; stock market volatility; inability to access sufficient

capital from internal and external sources; the need to shut-in,

flare and/or curtail production as a result of a lack of

infrastructure and/or damage to existing infrastructure; and

economic or industry condition changes. Actual results, performance

or achievements could differ materially from those expressed in, or

implied by, the forward-looking information and, accordingly, no

assurance can be given that any events anticipated by the

forward-looking information will transpire or occur, or if any of

them do so, what benefits that Crown Point will derive therefrom.

With respect to forward-looking information contained herein, the

Company has made assumptions regarding: the ability of the TDF

joint venture to obtain an extension to the primary term of the TDF

concessions on acceptable terms and the timing thereof; the impact

of increasing competition; the general stability of the economic

and political environment in Argentina; the timely receipt of any

required regulatory approvals; the ability of the Company to obtain

qualified staff, equipment and services in a timely and cost

efficient manner; drilling results; the costs of obtaining

equipment and personnel to complete the Company’s capital

expenditure program; the ability of the operator of the projects

which the Company has an interest in to operate the field in a

safe, efficient and effective manner; the ability of the Company to

obtain financing on acceptable terms when and if needed; the

ability of the Company to service its debt repayments when

required; field production rates and decline rates; the ability to

replace and expand oil and natural gas reserves through

acquisition, development and exploration activities; the timing and

costs of pipeline, storage, transportation and facility repair,

construction and expansion and the ability of the Company to secure

adequate product transportation; future oil and natural gas prices;

costs of operational activities in Argentina; currency, exchange,

inflation and interest rates; the regulatory framework regarding

royalties, commodity price controls, currency controls,

import/export matters, taxes and environmental matters in

Argentina; and the ability of the Company to successfully market

its oil and natural gas products. Additional information on these

and other factors that could affect Crown Point are included in

reports on file with Canadian securities regulatory authorities,

including under the heading “Risk Factors” in the Company’s most

recent annual information form, and may be accessed through the

SEDAR+ website (www.sedarplus.ca). Furthermore, the forward-looking

information contained in this document are made as of the date of

this document, and Crown Point does not undertake any obligation to

update publicly or to revise any of the included forward looking

information, whether as a result of new information, future events

or otherwise, except as may be expressly required by applicable

securities law.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

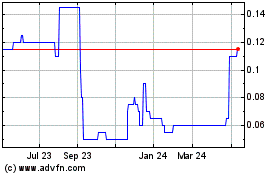

Crown Point Energy (TSXV:CWV)

Historical Stock Chart

From Oct 2024 to Nov 2024

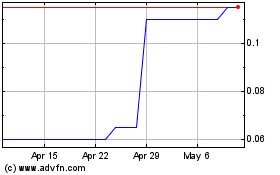

Crown Point Energy (TSXV:CWV)

Historical Stock Chart

From Nov 2023 to Nov 2024