Doré Copper Mining Corp. (the "

Corporation" or

"

Doré Copper") (TSXV:DCMC; OTCQX:DRCMF; FRA:DCM)

is pleased to announce that it is commencing a rights offering (the

"

Rights Offering") to the holders of common shares

in the capital of the Corporation ("

Common

Shares") to raise aggregate gross proceeds of

approximately $3,960,000. The net proceeds of the Rights Offering

will be used for exploration and development activities and for

working capital and general corporate purposes.

Under the terms of the Rights Offering, holders

of Common Shares at the close of business (Toronto time) on

November 28, 2023 (the "Record Date") will receive

0.337167854796804 of one transferable right (each whole right, a

"Right") for each Common Share held as of the

Record Date. All fractional Rights will be rounded down to the

nearest whole number of Rights with no additional compensation paid

therefor. Each Right will entitle the holder thereof to subscribe

for one Common Share (the "Basic Subscription

Privilege") at a subscription price of $0.12 per Common

Share (the "Subscription Price"). The Subscription

Price represents a 25% discount to the last closing price of the

Common Shares on the TSX Venture Exchange prior to the announcement

of the Rights Offering. Pursuant to applicable securities laws, and

to the extent that other holders of Rights do not exercise all of

their Rights under the Basic Subscription Privilege, each holder of

Rights who fully exercises its Basic Subscription Privilege will

also be entitled to subscribe for additional Common Shares on a pro

rata basis at the Subscription Price in the manner prescribed by

securities laws and as further detailed in the Rights Offering

Circular (as defined below). The Rights Offering is expected to

expire at 5:00 p.m. (Toronto time) (the "Expiry

Time") on December 22, 2023 (the "Expiry

Date"). Any Rights not exercised at or before the

Expiry Time on the Expiry Date will be void and will have no

value.

The Rights will be listed on the TSX Venture

Exchange under the trading symbol "DCMC.RT" commencing on November

27, 2023 and will be posted for trading until 12:00 p.m. (Toronto

time) on the Expiry Date.

The completion of the Rights Offering is

conditional upon the satisfaction of certain conditions, including,

but not limited to, the receipt of all necessary regulatory

approvals, including the final acceptance of the TSX Venture

Exchange.

In connection with the Rights Offering, the

Corporation has entered into a standby commitment agreement (each,

a "Standby Commitment Agreement") with Ocean

Partners UK Limited ("Ocean Partners") and Equinox

Partners Investment Management, LLC (together with Ocean Partners,

the "Standby Purchasers"), pursuant to which the

Standby Purchasers have each agreed, subject to certain terms and

conditions, to exercise its Basic Subscription Privilege in respect

of any Rights it holds, and, in addition thereto, to acquire any

additional Common Shares available as a result of any unexercised

Rights under the Rights Offering (each, a "Standby

Commitment"), with each Standby Purchaser purchasing 50%

of such Common Shares, such that the Corporation will, subject to

the terms of the Standby Commitment Agreements, be guaranteed to

issue 33,000,000 Common Shares in connection with the Rights

Offering for aggregate gross proceeds to the Corporation of

approximately $3,960,000.

Each of the Standby Purchasers is a "related

party" of the Corporation under Multilateral Instrument 61-101 –

Protection of Minority Security Holders in Special Transactions

("MI 61-101") because each has beneficial

ownership of, or control or direction over, directly or indirectly,

more than 10% of the issued and outstanding Common Shares. The

Rights Offering is not subject to the related party transaction

rules under MI 61-101 based on a prescribed exception related to

rights offerings.

Further details on the Rights Offering,

including eligibility requirements for shareholders to participate

and the procedures to be followed by shareholders in order to

subscribe for Common Shares, will be included in a rights offering

circular (the "Rights Offering Circular"), a

rights offering notice (the "Rights Offering

Notice"), a notice to ineligible holders (the

"Notice to Ineligible Holders") and the Standby

Commitment Agreements which will be available under the

Corporation's issuer profile on SEDAR+ at www.sedarplus.ca. It is

expected that a copy of the Rights Offering Notice, a direct

registration system advice representing the Rights ("Rights

DRS Advice") and a subscription form

("Subscription Form") will be mailed to each

registered shareholder of the Corporation resident in the Eligible

Jurisdictions (as defined below) as at the Record Date. Registered

shareholders who wish to exercise their Rights must forward the

Rights DRS Advice, together with the completed Subscription Form

and the applicable funds, to the rights agent, Computershare

Investor Services Inc., at or before the Expiry Time. Shareholders

who own their Common Shares through an intermediary, such as a

bank, trust company, securities dealer or broker, will receive

materials and instructions from their intermediary.

The Rights Offering will be conducted only in

the provinces and territories of Canada (the "Eligible

Jurisdictions"). Accordingly, and subject to the detailed

provisions of the Rights Offering Circular, Rights will not be

delivered to, nor will they be exercisable by, persons resident

outside of the Eligible Jurisdictions unless such holders can

establish that the transaction is exempt under applicable

legislation. Rather, such Rights may be sold on their behalf. If

you are a holder of Common Shares and reside outside of Canada,

please review the Rights Offering Notice, the Rights Offering

Circular and the Notice to Ineligible Holders to determine your

eligibility and the process and timing requirements to receive and

exercise your Rights. The Corporation requests that any ineligible

holder interested in exercising their Rights contact the

Corporation at their earliest convenience.

Neither the Rights being offered or the Common

Shares have been or will be registered under the United States

Securities Act of 1933, as amended, and may not be exercised,

offered or sold, as applicable, in the United States absent

registration or an applicable exemption from the registration

requirements. This news release shall not constitute an offer to

sell or the solicitation of an offer to buy the securities of the

Corporation. There shall be no offer or sale of these securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification of such

securities under the laws of any such jurisdiction.

In order to ensure that the Corporation can meet

its short‐term obligations prior to the closing of the Rights

Offering, the Corporation has entered into a bridge loan agreement

with Ocean Partners, pursuant to which Ocean Partners has agreed to

provide an unsecured short-term loan to the Corporation in the

amount of C$250,000 and bearing interest at a rate of 15% per annum

(the "Bridge Loan"). The Bridge Loan constitutes a

"related party transaction" for the purposes of MI 61-101 as Ocean

Partners is a "related party" of the Corporation. The Corporation

is exempt from the requirements to obtain a formal valuation or

minority shareholder approval in connection with the Bridge Loan in

reliance on sections 5.5(a) and 5.7(1)(a), respectively, of MI

61-101, as the fair market value of the Bridge Loan does not exceed

25% of the Corporation's market capitalization as calculated in

accordance with MI 61-101.

About Doré Copper Mining

Corp.

Doré Copper Mining Corp. aims to be the next

copper producer in Québec with an initial production target of +50

million pounds of copper equivalent annually by implementing a

hub-and-spoke operation model with multiple high-grade copper-gold

assets feeding its centralized Copper Rand mill1. The Corporation

has delivered its PEA in May 2022 and is proceeding with a

feasibility study.

The Corporation has consolidated a large land

package in the prolific Lac Doré/Chibougamau and Joe Mann mining

camps that has historically produced 1.6 billion pounds of copper

and 4.4 million ounces of gold2. The land package includes 13

former producing mines, deposits and resource target areas within a

60-kilometer radius of the Corporation's Copper Rand Mill.

For further information, please contact:

|

Ernest Mast |

Laurie Gaborit |

| President and Chief Executive

Officer |

Vice President, Investor

Relations |

| Phone: (416) 792-2229 |

Phone: (416) 219-2049 |

| Email:

ernest.mast@dorecopper.com |

Email:

laurie.gaborit@dorecopper.com |

| |

|

| Visit: www.dorecopper.com |

Twitter: @DoreCopper |

| Facebook: Doré Copper

Mining |

Instagram: @DoreCopperMining |

| LinkedIn: Doré Copper Mining

Corp. |

|

| |

|

- Technical report titled

"Preliminary Economic Assessment for the Chibougamau Hub-and-Spoke

Complex, Québec, Canada" dated June 15, 2022, in accordance with

National Instrument 43-101 – Standards of Disclosure for

Mineral Projects ("NI 43-101"). The Technical

Report was prepared by BBA Inc. with several consulting firms

contributing to sections of the study, including SLR Consulting

(Canada) Ltd., SRK Consulting (Canada) Inc. and WSP Inc.

- Sources for historic production

figures: Economic Geology, v. 107, pp. 963–989 - Structural and

Stratigraphic Controls on Magmatic, Volcanogenic, and Shear

Zone-Hosted Mineralization in the Chapais-Chibougamau Mining Camp,

Northeastern Abitibi, Canada by François Leclerc et al. (Lac

Dore/Chibougamau mining camp) and NI 43-101 Technical Report on the

Joe Mann Property dated January 11, 2016 by Geologica

Groupe-Conseil Inc. for Jessie Ressources Inc. (Joe Mann

mine).

Cautionary Note Regarding Forward-Looking

Statements

This news release includes certain

"forward-looking statements" under applicable Canadian securities

legislation. Forward-looking statements include predictions,

projections and forecasts and are often, but not always, identified

by the use of words such as "seek", "anticipate", "believe",

"plan", "estimate", "forecast", "expect", "potential", "project",

"target", "schedule", "budget" and "intend" and statements that an

event or result "may", "will", "should", "could" or "might" occur

or be achieved and other similar expressions and includes the

negatives thereof. All statements other than statements of

historical fact included in this news release, including, without

limitation, statements with respect to the terms of the Rights

Offering, the completion of the Rights Offering, the Standby

Commitments, the anticipated benefits of the Rights Offering, the

net proceeds to be available upon completion of the Rights

Offering, the intended use of proceeds from the Rights Offering,

the timing and ability of the Corporation to close the Rights

Offering, the timing and ability of the Corporation to receive

necessary regulatory approvals, including the final acceptance of

the Rights Offering from the TSX Venture Exchange, the

Corporation's ability to meet its production target, the

commencement, timing and completion of a feasibility study, and the

plans, operations and prospects of the Corporation and its

properties are forward-looking statements. Forward-looking

statements are necessarily based upon a number of estimates and

assumptions that, while considered reasonable, are subject to known

and unknown risks, uncertainties and other factors which may cause

actual results and future events to differ materially from those

expressed or implied by such forward-looking statements. Such

factors include, but are not limited to, the inability of the

Corporation to complete the Rights Offering, the termination of the

Standby Commitment Agreements, the inability of the Corporation to

achieve the anticipated benefits of the Rights Offering, the

inability of the Corporation to obtain the necessary regulatory

approvals for the completion of the Rights Offering on terms

acceptable to the Corporation or at all, the estimated costs of the

Rights Offering and the net proceeds to be available upon

completion of the Rights Offering, the operating expenses of the

Corporation for the 12 month period following the Expiry Date,

actual exploration results, changes in project parameters as plans

continue to be refined, future metal prices, availability of

capital and financing on acceptable terms, general economic, market

or business conditions, uninsured risks, regulatory changes, delays

or inability to receive required regulatory approvals, health

emergencies, pandemics and other exploration or other risks

detailed herein and from time to time in the filings made by the

Corporation with securities regulators. Although the Corporation

has attempted to identify important factors that could cause actual

actions, events or results to differ from those described in

forward-looking statements, there may be other factors that cause

such actions, events or results to differ materially from those

anticipated. There can be no assurance that such statements will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on

forward-looking statements. The Corporation disclaims any intention

or obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

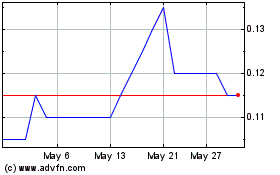

Dore Copper Mining (TSXV:DCMC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Dore Copper Mining (TSXV:DCMC)

Historical Stock Chart

From Dec 2023 to Dec 2024