DMG Blockchain Solutions Inc. (TSX-V: DMGI) (OTCQB US: DMGGF)

(FRANKFURT: 6AX) ("DMG"), a leading vertically integrated

blockchain and data center technology company, announces its

preliminary Bitcoin mining operational results for October 2024:

- Bitcoin Mined: 34 BTC

(up from 23 BTC in September)

- Hashrate: 1.53 EH/s (up from 1.1 EH/s in

September; includes 0.12 EH/s moved and energized to a hosting

location during October)

- Bitcoin Holdings: 399 BTC (DMG liquidated $2.0

million of its bitcoin to meet the regulatory capital required for

Systemic Trust to become a fully qualified custodian and $1.0

million of its bitcoin to pay down its $1.0 million loan secured by

property.)

DMG is Adding Mining

Capacity

DMG has purchased six one-megawatt hydro mining

containers, scheduled for delivery and installation in the current

quarter, which is ahead of the anticipated hydro miner delivery.

Hydro is a technology that uses water to more efficiently cool the

mining equipment than the fans used in air-cooled miners.

Subsequent to the purchase, delivery and installation of Bitmain

Direct Liquid Cooling (DLC) hydro miners that would completely fill

the six hydro mining containers, this expansion would be expected

to increase DMG’s hashrate by 0.4 EH/s with an efficiency of 15-16

J/TH, thereby bringing DMG’s total mining fleet to approximately

2.1 EH/s at an efficiency of 21 J/TH.

DMG’s CEO, Sheldon Bennett, stated, “In October,

we boosted our bitcoin production by nearly 50% from the previous

month, reaching approximately 1.65 EH/s by month’s end. Now, we are

turning our focus to the next phase of hashrate growth using DLC

hydro technology, planned for deployment in early 2025.

Additionally, we have successfully deployed our miners with a

trusted hosting partner we have known for many years, as we believe

hosting is a valuable tool to enhance site diversification and

reduce operational costs.”

DMG Pays Off $1 Million

Loan

On October 30, 2024, DMG fully repaid its $1

million interest-only loan secured by property. This loan,

initially taken on July 22, 2022, aimed to defer bitcoin

liquidation for capital purchases. At the time of origination, BTC

was priced at USD 22,715, and just before the payoff date, it had

risen to USD 69,908. By deferring the sale of $1 million in

bitcoin, DMG effectively gained over $2 million from the

appreciation in bitcoin value, significantly outpacing the interest

payments made over the loan term.

Future changes in the Bitcoin network-wide

mining difficulty rate or Bitcoin hashrate may materially affect

the future performance of DMG’s production of bitcoin, and future

operating results could also be materially affected by the price of

bitcoin and an increase in hashrate and mining difficulty.

About DMG Blockchain Solutions

Inc.

DMG is a sustainable, vertically integrated

blockchain and data center technology company that develops,

manages, and operates comprehensive platform solutions to monetize

the blockchain ecosystem. The company’s operations are driven by

two strategic pillars: Core and Core+, both unified by DMG’s

commitment to vertical integration and environmentally responsible

practices. DMG is the parent company of Systemic Trust Corporation,

which is focused on the custody of digital assets.

For more information on DMG Blockchain Solutions

visit: www.dmgblockchain.comFollow @dmgblockchain on X, LinkedIn,

Facebook and subscribe to DMG's YouTube channel.

For further information, please

contact:On behalf of the Board of

Directors,

Sheldon Bennett, CEO &

DirectorTel: 516-222-2560Email:

investors@dmgblockchain.comWeb: www.dmgblockchain.com

For Investor

Relations:investors@dmgblockchain.com

For Media Inquiries:Chantelle

BorrelliHead of Communications chantelle@dmgblockchain.com

Neither the TSX Venture Exchange nor its

Regulation Service Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

Cautionary Note Regarding

Forward-Looking Information

This news release contains forward-looking

information or statements based on current expectations.

Forward-looking statements contained in this news release include

statements regarding the expected increase in DMG’s hashrate,

transitioning a part of DMG’s miner fleet to a third-party hosting

provider and the expected benefits and outcomes, DMG’s strategies

and plans, the expected delivery of the hydro mining containers in

the December 2024 quarter, delivering products that enable the

monetization of bitcoin transactions, developing and executing on

the Company’s products and services, increasing self-mining, the

launch of products and services, events, courses of action, and the

potential of the Company’s technology and operations, among others,

are all forward-looking information.

Future changes in the Bitcoin network-wide

mining difficulty rate or Bitcoin hashrate may materially affect

the future performance of DMG’s production of bitcoin, and future

operating results could also be materially affected by the price of

bitcoin and an increase in hashrate and mining difficulty.

Forward-looking statements consist of statements

that are not purely historical, including any statements regarding

beliefs, plans, expectations, or intentions regarding the future.

Such information can generally be identified by the use of

forwarding-looking wording such as "may", "expect", "estimate",

"anticipate", "intend", "believe" and "continue" or the negative

thereof or similar variations. The reader is cautioned that

assumptions used in the preparation of any forward-looking

information may prove to be incorrect. Events or circumstances may

cause actual results to differ materially from those predicted, as

a result of numerous known and unknown risks, uncertainties, and

other factors, many of which are beyond the control of the Company,

including but not limited to, market and other conditions,

volatility in the trading price of the common shares of the

Company, business, economic and capital market conditions; the

ability to manage operating expenses, which may adversely affect

the Company's financial condition; the ability to remain

competitive as other better financed competitors develop and

release competitive products; regulatory uncertainties; access to

equipment; market conditions and the demand and pricing for

products; the demand and pricing of bitcoins; security threats,

including a loss/theft of DMG's bitcoins; DMG's relationships with

its customers, distributors and business partners; the inability to

add more power to DMG's facilities; DMG's ability to successfully

define, design and release new products in a timely manner that

meet customers' needs; the ability to attract, retain and motivate

qualified personnel; competition in the industry; the impact of

technology changes on the products and industry; failure to develop

new and innovative products; the ability to successfully maintain

and enforce our intellectual property rights and defend third-party

claims of infringement of their intellectual property rights; the

impact of intellectual property litigation that could materially

and adversely affect the business; the ability to manage working

capital; and the dependence on key personnel. DMG may not actually

achieve its plans, projections, or expectations. Such statements

and information are based on numerous assumptions regarding present

and future business strategies and the environment in which the

Company will operate in the future, including the demand for its

products, the ability to successfully develop software, that there

will be no regulation or law that will prevent the Company from

operating its business, anticipated costs, the ability to secure

sufficient capital to complete its business plans, the ability to

achieve goals and the price of bitcoin. Given these risks,

uncertainties, and assumptions, you should not place undue reliance

on these forward-looking statements. The securities of DMG are

considered highly speculative due to the nature of DMG's business.

For further information concerning these and other risks and

uncertainties, refer to the Company’s filings on www.sedarplus.ca.

In addition, DMG’s past financial performance may not be a reliable

indicator of future performance.

Factors that could cause actual results to

differ materially from those in forward-looking statements include,

failure to obtain regulatory approval, the continued availability

of capital and financing, equipment failures, lack of supply of

equipment, power and infrastructure, failure to obtain any permits

required to operate the business, the impact of technology changes

on the industry, the impact of viruses and diseases on the

Company's ability to operate, secure equipment, and hire personnel,

competition, security threats including stolen bitcoins from DMG or

its customers, consumer sentiment towards DMG's products, services

and blockchain technology generally, failure to develop new and

innovative products, litigation, adverse weather or climate events,

increase in operating costs, increase in equipment and labor costs,

equipment failures, decrease in the price of Bitcoin, failure of

counterparties to perform their contractual obligations, government

regulations, loss of key employees, directors, officers and

consultants, and general economic, market or business conditions.

Forward-looking statements contained in this news release are

expressly qualified by this cautionary statement. The reader is

cautioned not to place undue reliance on any forward-looking

information. The forward-looking statements contained in this news

release are made as of the date of this news release. Except as

required by law, the Company disclaims any intention and assumes no

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events, or

otherwise. Additionally, the Company undertakes no obligation to

comment on the expectations of or statements made by third parties

in respect of the matters discussed above.

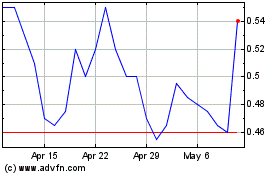

DMG Blockchain Solutions (TSXV:DMGI)

Historical Stock Chart

From Jan 2025 to Feb 2025

DMG Blockchain Solutions (TSXV:DMGI)

Historical Stock Chart

From Feb 2024 to Feb 2025