Eguana Technologies Inc. ("

Eguana" or the

"

Company") (TSX-V: EGT, OTCQB: EGTYF) today

announced results for its third quarter ended September 30, 2023.

The financial results for the third quarter

ended September 30, 2023, continue to reflect the impact of soft

consumer spending due to inflation and high-interest rates and the

resulting high channel inventory position. These factors constrain

Eguana’s sales into residential solar markets. The economic

downturn in the solar industry globally, in early 2023, was not

widely anticipated, and the Company has been managing through 2023

cautiously. Slow collection of the accounts receivable from the

Company’s primary customer has constrained liquidity and is

expected to continue to impact the Company’s short-term liquidity.

As a result of the slow industry recovery, many renewables stock

prices, including Eguana, remain under significant pressure. Until

the industry recovers, consumer spending rebounds and/or solar

energy incentives increase, management believes residential solar

sales, particularly in North American markets, will remain under

forecast. Australian and European markets, along with Virtual Power

Plant (“VPP”) channels, however, appear to be recovering at a

faster pace than direct North American consumer sales.

Additionally, we expect that the Company’s initiatives in VPPs

should be significantly less exposed to the above limiting factors

given their rebate and financing structures.

On November 23, 2023, the Company announced a

private placement, targeted at $2.0 million, to be closed in

multiple tranches. This financing is aimed to ease the current cash

flow constraints of the Company. The first tranche of the Offering

is expected to close on or about November 30, 2023. Through the end

of 2023 and into 2024, management anticipates funding the cash flow

needs of the business by continuing to collect historical

receivables from our primary customer, creating liquidity from the

Company’s current assets, increasing sales, and with the proceeds

from the Offering. In addition to examining operational

restructuring, management, along with the board of directors,

continues to pursue a number of additional options to ease

liquidity by increasing cash inflows and reducing cash

requirements.

Strategically, the Company continues its

progress in the VPP space with the acceptance into 7 VPP programs,

installer training enrollment numbers surpassing 1,200, and with

product development and lab certifications.

The Company has made positive progress pursuing

utility and distributed energy resource management (“DERs”)

partnerships, bringing the Company’s participation in VPPs to seven

across North America and Australia. The Eguana solution is

positioned to work with distributed energy resource provider

platforms that are fully integrated with the Eguana Cloud Platform,

and Eguana’s existing product line of energy storage solutions

(“ESS”). The Eguana energy storage platform has been developed to

support all grid-related VPP functions.

The Company believes increased adoption of ESS

in the VPP space will drive sales growth in 2024 as utilities

reduce the upfront cost for consumers through rebate, credit, and

financing programs. The recent announcement of the multi-year VPP

Referral and Promotion partnership with a long-time major utility

partner in Australia, is just one example. The announced exclusive,

multi-year, partnership with Duesseldorf based FinanzDesk, a modern

financial service provider, with a specialty in renewables, is

expected to promote and finance the sale of the Eguana Enduro, to

its existing residential rooftop solar customers. Further, the

Company anticipates that our existing partnerships and additional

VPP or strategic partnerships will provide sales momentum and

product demand.

Alongside VPP partnerships, Eguana’s installer

training, through Eguana University, continues to exceed

expectations, with over 1,200 enrollments year to date,

representing more than 200 installation companies. Trained

installers are key to the consumer interface and experience,

through both distribution and VPP channels.

Offsetting these positive strategic successes is

the overall lagging industry tied to macro-industry factors.

Increased inventory levels from a year ago, coupled with high

interest rates impacting consumer access to capital, slowed

consumer spending and sell-through in the distribution network and

negatively impacted the industry globally.

Business Highlights

During the Quarter

- Continued

integration with additional DERMS providers, in various markets, to

pursue VPP opportunities, spanning the US and Canadian

markets.

- Signed a multi-year

VPP Referral and Promotion partnership with a long-time utility

partner, to deploy Eguana’s ESS to Australian electricity

customers. The initial rollout across South Australia, Victoria,

Queensland, and New South Wales will engage the utility partner’s

retail network of approximately 750,000 customers with direct

marketing campaigns outlining upfront rebates and monthly on-bill

credits. In addition, the partner has also incentivized referrals

for new customers.

- Completed the

necessary work and steps for self-certification development and

compliance testing and was awarded ISO/IEC 17025 accreditation. The

ISO/IEC 17025 accreditation requires a rigorous assessment process

to meet very stringent guidelines and minimum standards. This

achievement underlines Eguana’s ability to conduct grid compliance

and safety tests independently. By having the ability to conduct

self-testing processes, Eguana gains a significant advantage to not

only certify new products for AC grid interconnection compliance

but also introduce alternate components quickly, while saving time

and money through the certification process. Self-certification

accreditation enables the Company to be in control of our

certification schedules and timing, improving speed to market.

- Entered into a new

partnership with AutoGrid, an industry leader in harnessing DERs

for VPPs, to open additional VPP opportunities for power providers

around the globe. Companies are expected to integrate Eguana’s

residential ESS into the AutoGrid Flex™ platform, to support

utility companies in promoting rapid residential storage adoption

and consumer participation in energy transition. AutoGrid Flex™

supports Eguana’s technology by enabling automated demand response

during periods of peak demand, directing the energy storage devices

to offset home energy loads, discharge energy back into the grid,

and charge up when energy cost is low or from renewable sources. As

a result, VPP operators can overcome shortfalls in supply,

eliminate outages, avoid additional transmission infrastructure,

and bypass the need for heavily polluting peaker power plants.

Further, Eguana joins AutoGrid’s growing network of device makers

aggregated and orchestrated into multi-asset VPPs by AutoGrid’s

AI-driven Flex™ platform. In combination, the two companies’

solutions, along with utility rebate programs, are expected to help

consumers reduce the initial cost of energy storage, cut their

ongoing energy costs, and support the integration of clean,

renewable energy into the grid.

- Signed a

multi-year, exclusive partnership with Duesseldorf based

FinanzDesk, to bring the Eguana Enduro and future Eguana products,

to its residential rooftop solar customer base of over 8,000. The

Eguana Enduro, which was developed specifically for European

markets, is a complete all-in-one custom-engineered energy storage

platform. The Enduro provides a simple and fast installation

process, dashboard control of all storage and consumption data, and

customizable battery management alerts to allow consumers to make

better decisions on their energy consumption, optimize power bill

savings, and support energy security.

- Launched the Eguana

Essential Whole Home ESS, specifically designed for North American

mid-sized homes, as an economical option for homes with existing

100-amp service panels. Initial deliveries to Puerto Rico, started

in September 2023, spurred by the US Department of Energy’s Puerto

Rico Energy Resilience Funding, announced in July 2023, that

anticipates 30,000-40,000 residential installations. The Essential

Whole Home ESS has simplified installation and remote commissioning

processes, delivering installer efficiency and improved homeowner

experience, in terms of both cost and installation times.

- Entered into a

partnership, along with Virtual Peaker, a cloud-based distributed

energy company, to join the Massachusetts Municipal Wholesale

Electric Company (MMWEC) NextZero Connected Homes Program. This

partnership is the newest addition to its rapidly growing roster of

US utility operator partners, as VPPs continue to expand across the

United States energy storage market. The Connected Homes program

offers customers of participating Member utilities technology to

better utilize smart appliances and devices, such as Eguana’s home

energy storage battery systems, to better manage their electric

load. This is expected to generate cost savings and reduce the

carbon footprint of both the utility and its customers. Homeowners

are expected to benefit from upfront rebates on Eguana’s systems

and monthly rewards for participating in the program. Eguana’s

Fleet Control can be tailored for participation in a variety of

grid solutions, depending on the utility and grid requirements.

Eguana’s Energy Management System (EMS) works in conjunction with

its Fleet Control, to provide one of the industry’s best

distributed storage solutions, for residential environments.

- Surpassed 1,200

enrollments year to date, representing more than 200 installation

companies in Eguana University, Eguana’s comprehensive partner

training platform, which includes system design, sales,

installation, and commissioning.

- ITOCHU Corporation,

a strategic investor in the Company, converted $1,164,493.14 of

interest owing under the Company’s 7% unsecured convertible

debenture into 13,580,094 common shares of Eguana, in full

satisfaction of the interest payment due on September 1, 2023. In

connection with the interest conversion, Eguana issued 13,580,094

Common Shares at a deemed price of $0.08575 per share on September

28, 2023. All of the Common Shares are subject to a four-month and

one-day hold period, in accordance with applicable Canadian

securities laws.

Private Placement

On November 23, 2023, the Company announced its

intention to complete a non-brokered private placement offering of

up to 50,000,000 units of the Company (the “Units” or “Unit”) at a

price of $0.04 per Unit, for aggregate gross proceeds of up to $2.0

million. The Company has the option, in its sole discretion, to

increase the size of the offering to up to $2.5 million (the

“Offering”). For additional details on the Offering, see the

Company’s news release dated November 23, 2023.

The Company anticipates using the net proceeds

of the Offering to fund operations and working capital. Closing of

the Offering is expected to occur in one or more tranches, with the

first tranche expected to close on or about November 30, 2023. The

Offering remains subject to final approval by the TSXV.

Fiscal Q3 2023 Financial

Summary

- As a general

reference note, the Company changed its fiscal year-end from

September 30 to December 31, with December 31, 2022, being the

first financial year-end with the new date and comprised of five

quarters. As a result, the comparative period for the third quarter

of 2023 is technically the fourth quarter of 2022, both at

September 30th, in the respective years.

- Overall negative

macro-economic factors continue to constrain the renewable energy

industry, and consumer spending is soft, due to inflation and

high-interest rates. These factors have impacted sales and revenue

for the third quarter. Q3 2023 revenue of $2.6 million, was

consistent with the comparative three months ended September 30,

2022, of $2.6 million. This is related to macro-industry factors,

in general, and with respect to consumer spending, which has slowed

sell-through within renewable distribution networks. Generally, the

rapid increases in consumer interest rates quelled consumer

spending, and, in the industry, peer companies have been impacted

by elevated inventory positions within the distribution network.

Management remains cautious as it approaches the December 31, 2023

year end.

- Q3 2023 gross

margin for the three months ended September 30, 2023, after

adjusting for inventory impairment, was 4.1%, as compared to gross

margin of negative $249,800 or negative 9.6% in the comparative

quarter of 2022. In the comparative quarter of 2022, margin was low

due to one-time transactions, which had a negative impact on the

margin. Management anticipates improved margin in the coming

quarters, as a result of lower freight costs, battery price

reductions, and the removal of import tariffs, resulting from a

prior shift of certain components and sub-assemblies out of China.

The increases in margin are expected to take effect when current

inventories procured in 2022 are consumed. Longer-term cost

reduction activities are also planned, with battery module and

advanced power electronics cost reductions, which are expected to

improve margin in 2024.

- As a response to a

lagging market, in October 2023, the Company proceeded with a staff

rationalization, across all geographies, and reduced headcount by

approximately 22 percent. With restructuring of functional areas

and focus on near-term priorities, management believes this

reduction will not affect near or medium-term operations or

objectives. The Company will continue to explore further prudent

staff rationalizations.

- Q3 2023 operating

loss of $3.5 million, an increase from a $3.0 million operating

loss for the comparative September quarter in 2022. This increase

is largely due to an inventory impairment recorded for certain

inventory components for older generation systems, which have

limited future economic value. There were offsetting variances in

regular expenses such as increases in general and administration of

approximately $0.3 million, sales, marketing, and business

development of approximately $0.2 million, and operations of

approximately $0.2 million. These expense increases are due to

overall company growth in geographic regions of the USA and

Australia. This was partially offset by saving in product

development of $0.2 million, as less new development or

enhancements occurred.

- Working capital at

September 30, 2023, was $17.8 million, a decrease from $33.7

million at December 31, 2022. The decrease relates to ongoing cash

used in operations, and the inventory loss from the product theft,

which is detailed below.

- At September 30,

2023, the Company has a large accounts receivable balance from one

customer of which approximately $17.2 million is over 90 days. The

customer continues to be delayed in making payments however,

progress payments have been received steadily. The Company

originally recognized an expected credit loss provision at year-end

December 31, 2022, and adjusts the estimate on a quarterly basis,

in line with generally accepted accounting principles. For the

three months ended September 30, 2023, an additional estimated

credit loss was recognized of $1.2 million. The expected credit

loss is calculated based on customer-specific factors, expected

timing of future cash receipts, and discount rates to account for

time value of money when required, taking into consideration

historical default rates, and forecasted economic conditions,

amongst other factors. As a major customer, the Company continues

to work with the customer to collect payments and review future

sales and ordering. Given the close working relationship between

the two parties, management believes the full amount will be

collected, however, until the industry recovers, consumer spending

rebounds and/or solar energy incentives increase, management

believes the slower than usual collection on account receivable

will continue to constrain Eguana’s financial position, into

2024.

- In June 2023, the

Company experienced a theft of three truckloads of inventory

components, when it was being transferred between warehouse

locations. Through the initial investigation it was discovered that

additional truckloads, impacting several companies, including

Eguana, were redirected to unknown locations. The Eguana inventory

items had a cost of $2.1M and were written off in the Company

records, resulting in a loss reported in Other Expense of $2.1

million. The theft was immediately reported to the police and all

pertinent documentation sent to insurers. In September 2023, the

Company received partial insurance proceeds of $623,913 USD and

further proceeds are expected and being pursued with the insurer

for the balance of the loss.

The Condensed Unaudited Consolidated Financial

Statements and the Management Discussion and Analysis thereof, for

the three and the nine months ended September 30, 2023, are

available on SEDAR at www.sedarplus.ca.

Conference Call

Given the first tranche closing of the Offering,

anticipated on November 30, 2023, management has rescheduled the

Eguana conference call from November 29, 2023, at 3:00 p.m. eastern

time (ET) to December 1, 2023, at 10:30 a.m. eastern time (ET).

Note that the link published in the November 23, 2023 news release

is no longer valid, due to the date change. Please use the link

below. The quarterly call will provide an overview of Q3 results, a

business update, and allow for a question and answer period.

|

Canada/USA TF: 1-800-319-4610 |

|

International Toll: +1-604-638-5340 |

|

Link

Access: https://services.choruscall.ca/links/eguanatechnology2023q3.html |

About Eguana

Technologies Inc.

Eguana Technologies Inc. (EGT: TSX.V) (OTCQB:

EGTYF) designs and manufactures high performance residential and

commercial energy storage systems. The Company also markets and

sells a suite of micro inverter products, which are integrated with

its energy storage platform providing consumers with full solar +

storage system architecture, for residential and commercial

applications. Eguana has over two decades of experience

delivering grid-edge power electronics for fuel cell, photovoltaic

and battery applications, and delivers proven, durable,

high-quality solutions, from its high-capacity manufacturing

facilities in Europe, Australia and North America.

With thousands of its proprietary energy storage inverters

deployed, Eguana is one of the leading suppliers of power controls

for solar self-consumption, grid services and demand charge

applications at the grid edge. Focused on distributed energy

storage applications located at the point of energy consumption,

Eguana provides cost-effective solutions to modernize the power

grid, from the consumer to the electricity retailer, the

distribution utility, and the system operator.

To learn more, visit www.EguanaTech.com or follow us on Twitter

@EguanaTech.

Company Inquiries

Justin HollandCEO, Eguana Technologies

Inc.+1.416.728.7635Justin.Holland@EguanaTech.com

Forward

Looking Information

The reader is advised that all information

herein, other than statements of historical fact, may constitute

forward-looking statements and forward-looking information

(together, "forward-looking statements") within the meaning

assigned by National Instrument 51-102 - Continuous Disclosure

Obligations and other relevant securities legislation.

Forward-looking statements include, among other

things, statements regarding the timing and completion of the

Offering, the use of proceeds of the Offering, receipt of TSXV

approval, successful accounts receivable collection, creating

additional liquidity with the Company’s current assets, increasing

sales, the Company being able to continue business operations due

to cash flow constraints, whether the results of the Company’s

reduction of headcount will help ease cash flow constraints,

exploration of alternative refinancing options and operational

restructuring, the impact of current economic conditions on the

Company’s initiatives in VPPs, further reduction of cash

requirements, the increase of cash inflows, the positioning of the

Eguana solution, the ability of the Eguana energy storage platform

to support all grid-related VPP functions, the increased adoption

of ESS in the VPP space and the effects of the same, the effects of

the partnership with FinanzDesk, the Company’s existing

partnerships and additional VPP or strategic partnerships ability

to increase sale momentum and product demand, the deployment of

Eguana’s ESS to Australian electricity customers, the timing and

effects of the rollout across South Australia, Victoria, Queensland

and New South Wales, the effects of Eguana’s receipt of ISO/IEC

17025 accreditation the ability to conduct self-testing processes,

the effects of the Company’s partnership with AutoGrid, the timing

and effects of companies integrating Eguana’s residential ESS into

the AutoGrid Flex platform, the effects of utilizing Eguana’s home

energy storage battery systems, the improvement of margins in the

coming quarters, the effects of the Company’s staff

rationalization, the Company successfully collecting the full

accounts receivable balance from its largest customer, the

insurance payout in connection with the theft which occurred in

June 2023, and the successful and ongoing strategy with respect to

product solutions and product development. Forward-looking

statements are not a guarantee of future performance and involve a

number of risks and uncertainties. Many factors could cause the

Company's actual results, performance or achievements, or future

events or developments, to differ materially from those expressed

or implied by the forward-looking information. Such factors

include, but are not limited to, risks associated with: failure to

obtain necessary regulatory approvals to close the Offering;

failure by the Company to close the Offering as contemplated;

failure by the Company to properly allocate use of proceeds for

immediate needs, such as debt service, payroll and payments;

failure by the Company to collect accounts receivable in a timely

manner; failure by the Company to create additional liquidity from

the Company’s current assets; failure by the Company to raise

additional funds to fund working capital requirements or to solve

its current cash flow constraints, which would impact the viability

of the business to continue operating as a going concern or the

viability of the business to continue operating altogether; the

continued weak economic market and business conditions in general

and more specifically in the renewable energy industry; competitive

factors; failure of the Company to deliver on or execute VPP

agreements; warranty or product failures, the Company achieving its

strategic objectives; and other factors as set out in the "Risk

Factors" section of the Company's management's discussion and

analysis for the three and nine months ended September 30, 2023 and

annual information form dated November 29, 2023, which may be found

on its website or at www.sedarplus.ca.

Readers are cautioned not to place undue

reliance on forward-looking information, which speaks only as of

the date hereof. The Company does not undertake any obligation to

release publicly any revisions to forward-looking statements

contained herein to reflect events or circumstances that occur

after the date hereof or to reflect the occurrence of unanticipated

events, except as may be required under applicable securities

laws.

Neither the TSXV nor its Regulation

Services Provider (as that term is defined in the policies of the

TSXV) accepts responsibility for the adequacy or accuracy of this

news release.

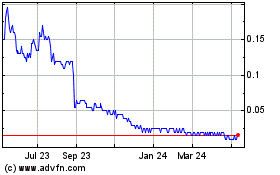

Eguana Technologies (TSXV:EGT)

Historical Stock Chart

From Nov 2024 to Dec 2024

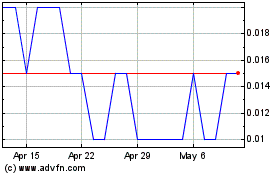

Eguana Technologies (TSXV:EGT)

Historical Stock Chart

From Dec 2023 to Dec 2024