Electra Battery Materials Corporation (NASDAQ: ELBM; TSX-V:

ELBM) (“

Electra” or the

“

Company”) is pleased to announce that it has

secured a 10-year exploration permit for its Idaho copper and

cobalt properties, including its Iron Creek project, in the Idaho

Cobalt Belt, U.S.A. Covering 91 designated drill pad locations and

hundreds of potential drill targets, this long-term permit enhances

project certainty, offers greater planning flexibility, and

significantly reduces administrative requirements compared to

annual permits.

Approved by the U.S. Forestry Service, this

permit enables Electra to advance its exploration of critical

mineral resources essential to the U.S. economy across the Iron

Creek Deposit, the Ruby Project, as well as the neighboring CAS and

Redcastle option agreement properties.

Trent Mell, Electra CEO, said, “Securing this

10-year exploration permit is an important milestone for copper and

cobalt mining in the U.S. and supports America's commitment to

strengthening domestic critical mineral production. This permit

provides us the necessary regulatory certainty and flexibility to

advance exploration at 91 designated drilling sites, and positions

Electra as a potential key contributor to North America's evolving

battery supply chain. Our primary near-term focus is completing

construction of North America’s first battery-grade cobalt

refinery, but we see substantial potential in the Idaho Cobalt Belt

and are eager to resume drilling and field exploration as

conditions and strategy dictate.”

The first Trump administration underscored the

strategic importance of securing critical minerals with its 2017

Executive Order 13817, which prioritized identifying and developing

domestic mineral resources. Today, as the demand for electric

vehicles and renewable energy infrastructure surges, the urgency

for secure, reliable access to key elements such as lithium,

nickel, cobalt and copper continue to grow.

Figure 1. Location of the Iron Creek

Property in east-central

Idaho:https://www.globenewswire.com/NewsRoom/AttachmentNg/c07642aa-89a4-4b0a-a0f1-65d1028cad48

The 10-year exploration permit allows the

Company to undertake exploration activities including setting up 91

drilling locations, along with constructing temporary access roads

and staging areas, over 11.3 acres of the Idaho properties. The

Idaho properties consist of mining patents and exploration claims

over an area of 73.15 km2, including the Iron Creek Project, and

cover the strike extent of strata hosting the cobalt-copper sulfide

mineralization. Iron Creek is one of several cobalt-copper mineral

resources and prospects within the Idaho Cobalt Belt, a prospective

mineralized system that contains copper and the largest primary

cobalt resources in the United States, according to the U.S.

Geological Survey.

Historical underground development at Iron Creek

includes 600 metres of drifting in three adits. A road connects

Iron Creek to a state highway and the nearby towns of Challis and

Salmon. Electra’s Iron Creek Property position cover a highly

perspective and underexplored land package including the Redcastle

Property and the CAS Property (Figure 2).

Figure 2. Detail of the Idaho

Properties:https://www.globenewswire.com/NewsRoom/AttachmentNg/c36e5d18-a948-4770-b5a3-16f51768c559

Within Electra’s property boundary, there are

seven reported occurrences of metallic mineralization exposed on

surface or encountered in drilling. Iron Creek is the main

mineralized body and Ruby is the second most important target

identified to date. The resource area of the Iron Creek project

covers an area of 1,652 metres of strike length and 780 metres of

width and extends to a height of 852 metres. In March 2023, Electra

released an updated Mineral Resources Estimate (“MRE”) for the Iron

Creek project area. As a result of infill and step-out drilling,

Electra upgraded 54% of the Inferred classification of the 2019 MRE

to the Indicated classification. Highlights include:

-

Indicated Mineral Resource of 4.5 million tonnes grading 0.19%

cobalt for 18.4 million pounds cobalt and grading 0.73% copper for

71.5 million pounds of copper;

-

Inferred Mineral Resource of 1.2 million tonnes grading at 0.08%

cobalt for 2.1 million pounds of cobalt and grading 1.34% copper

for 36.5 million pounds of copper;

-

The 2023 MRE was prepared for a potential underground scenario with

a US$87.00 net smelter return (NSR) cut-off grade; and

-

Additional drilling was recommended to connect isolated intercepts

by drilling within or along strike and at depth of the Mineral

Resources, and advance Ruby by drilling to increase the Inferred

Mineral Resources.

The 2023 updated MRE is disclosed in a technical

report published by Electra on March 10, 2023 under the title “NI

43-101 Technical Report and Mineral Resource Estimate for the Iron

Creek Cobalt-Copper Property, Lemhi County, Idaho, USA”. The report

was prepared by Martin Perron, P.Eng., Marc R. Beauvais, P.Eng. and

Eric Kinnan, P.Geo, and is dated effective January 27, 2023. A copy

of the report is available under the Company’s profile on

www.sedarplus.ca.

Table 1. Mineral Resource Estimate of

the Iron Creek Cobalt-Copper Project

|

Classification |

Tonnes |

Cobalt (%) |

Copper (%) |

Cobalt(lbs) |

Copper (lbs) |

NSR Value/Tonne (US$) |

|

Indicated |

4,451,000 |

0.19 |

0.73 |

18,364,000 |

71,535,000 |

123.65 |

|

Inferred |

1,231,000 |

0.08 |

1.34 |

2,068,000 |

36,485,000 |

118.48 |

Notes on the 2023 MRE:

- The effective date of the 2023 MRE

is January 27, 2023.

- The independent and qualified

persons for the 2023 MRE are Martin Perron, P. Eng. and Marc R.

Beauvais, P.Eng. all of InnovExplo Inc.

- The 2023 MRE follows the CIM

Standards.

- These Mineral Resources are not

Mineral Reserves, because they do not have demonstrated economic

viability. The results are presented undiluted and are considered

to have reasonable prospects of economic viability.

- The estimate encompasses one large,

mineralized envelope using the grade of the adjacent material when

assayed or a value of zero when not assayed. Dilution zones

encompassing all mineralized zones were created as part of the

mineralized domain to reflect the dilution within the constraining

shapes.

- High-grade capping supported by

statistical analysis was done on raw assay data before compositing

and established on a per-metal basis, having a limiting value at 1%

for cobalt and 10% for copper. Composites (1.5 m) were calculated

within the zones using the grade of the adjacent material when

assayed or a value of zero when not assayed.

- The MRE was completed using a

sub-block model in Surpac 2022. A 4m x 4m x 4m parent block size

was used.

- Grade interpolation was obtained by

Inverse Distance Squared (ID2) using hard boundaries. Dynamic

anisotropy was used for the interpolation of the mineralized

domain.

- A density value of 2.78 g/cm3 was

assigned to the mineralized domain.

- The MRE is classified as Indicated

and Inferred. The Inferred classification is defined with a minimum

of three drill holes within the areas where the drill spacing shows

reasonable geological and grade continuity at the maximum range of

the modelized semi-variogram. The Indicated classification is

defined with a minimum of three drill holes within the areas where

the drill spacing shows reasonable geological and grade continuity

at half the range of the modelled semi-variogram.

- The 2023 MRE is locally constrained

within Deswik Stope Optimizer shapes using a minimal mining width

of 2.0m for a potential underground LH. An NSR-based cut-off grade

was calculated using the following parameters: mining cost =

US$55.00/t; processing cost = US$22.00/t; G&A = US$10.00/t. The

cut-off grade should be re-evaluated in light of future prevailing

market conditions (metal prices, mining costs, etc.).

- The number of metric tonnes was

rounded to the nearest thousand, following the recommendations in

NI 43-101 and any discrepancies in the totals are due to rounding

effects. The metal contents are presented in pounds of in-situ

metal rounded to the nearest hundred.

- The independent and qualified

persons for the 2023 MRE are not aware of any known environmental,

permitting, legal, political, title-related, taxation,

socio-political, or marketing issues that could materially affect

the MRE.

Figure 3. Longitudinal section showing

locations of the Iron Creek Mineral Resources and the Ruby Zone

Target:https://www.globenewswire.com/NewsRoom/AttachmentNg/a6c37b23-56f5-4f39-b388-ea45204c880f

Notes: Longitudinal section

view looking north

Qualified Person Statement

The scientific technical content of this press

release that relates to mineral exploration and the 2023 Mineral

Resource Estimate has been reviewed and approved by Mr. George

King, P.Geo. and Dr. William Stone, P.Geo., who are Qualified

Persons as defined by National Instrument 43-101. Mr. King is

employed as Senior Site Supervising Geologist by Idaho Cobalt. Dr.

Stone is employed as Lead Geoscience Consultant by Electra.

About Electra Battery

Materials

Electra is a processor of low-carbon,

ethically-sourced battery materials. Currently focused on

developing North America’s only cobalt sulfate refinery, Electra is

executing a phased strategy to onshore the electric vehicle supply

chain and provide a North American solution for EV battery

materials refining. In addition to building North America’s only

cobalt sulfate refinery, its strategy includes integrating black

mass recycling, potential cobalt sulfate processing in Bécancour,

Quebec, and exploring nickel sulfate production potential within

North America. For more information, please visit

www.ElectraBMC.com.

Contact

Heather SmilesVice President, Investor Relations & Corporate

Development Electra Battery

Materialsinfo@ElectraBMC.com1.416.900.3891

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Cautionary Note Regarding Estimates of

Resources

Readers are cautioned that mineral resources are

not economic mineral reserves and that the economic viability of

resources that are not mineral reserves has not been demonstrated.

The estimate of mineral resources may be materially affected by

geology, environmental, permitting, legal, title, socio-political,

marketing or other relevant issues. The mineral resource estimate

is classified in accordance with the Canadian Institute of Mining,

Metallurgy and Petroleum's (CIM) "2014 CIM Definition Standards on

Mineral Resources and Mineral Reserves" incorporated by reference

into NI 43-101. Under Canadian rules, estimates of inferred mineral

resources may not form the basis of feasibility or pre-feasibility

studies or economic studies except for a Preliminary Economic

Assessment as defined under NI 43-101. Readers are cautioned not to

assume that further work on the stated resources will lead to

mineral reserves that can be mined economically. An Inferred

Mineral Resource as defined by the CIM Standing Committee is “that

part of a Mineral Resource for which quantity and grade or quality

are estimated on the basis of limited geological evidence and

sampling”. Geological evidence is sufficient to imply but not

verify geological and grade or quality continuity. An Inferred

Mineral Resource has a lower level of confidence than that applying

to an Indicated Mineral Resource and must not be converted to a

Mineral Reserve. It is reasonably expected that the majority of

Inferred Mineral Resources could be upgraded to Indicated Mineral

Resources with continued exploration. United States investors are

cautioned that CIM and NI 43-101 standards for resource

classification and public disclosure differ from the requirements

of the U.S. Securities and Exchange Commission (SEC) and resource

information contained in this news release may not be comparable to

similar information disclosed by domestic United States companies

subject to the SEC’s reporting and disclosure requirements.

Cautionary Note Regarding Forward-Looking

Statements

This news release may contain forward-looking

statements and forward-looking information (together,

“forward-looking statements”) within the meaning of applicable

securities laws and the United States Private Securities Litigation

Reform Act of 1995. All statements, other than statements of

historical facts, are forward-looking statements, including

statements in this release about the expected use of the proceeds

from the Financing. Generally, forward-looking statements can be

identified by the use of terminology such as “plans”, “expects”,

“estimates”, “intends”, “anticipates”, “believes” or variations of

such words, or statements that certain actions, events or results

“may”, “could”, “would”, “might”, “occur” or “be achieved”.

Forward-looking statements are based on certain assumptions, and

involve risks, uncertainties and other factors that could cause

actual results, performance, and opportunities to differ materially

from those implied by such forward-looking statements. Among the

bases for assumptions with respect to the potential for additional

government funding are discussions and indications of support from

government actors based on certain milestones being achieved.

Factors that could cause actual results to differ materially from

these forward-looking statements are set forth in the management

discussion and analysis and other disclosures of risk factors for

Electra Battery Materials Corporation, filed on SEDAR+ at

www.sedarplus.com and with on EDGAR at www.sec.gov. Other factors

that could lead actual results to differ materially include changes

with respect to government or investor expectations or actions as

compared to communicated intentions, and general macroeconomic and

other trends that can affect levels of government or private

investment. Although the Company believes that the information and

assumptions used in preparing the forward-looking statements are

reasonable, undue reliance should not be placed on these

statements, which only apply as of the date of this news release,

and no assurance can be given that such events will occur in the

disclosed times frames or at all. Except where required by

applicable law, the Company disclaims any intention or obligation

to update or revise any forward-looking statement, whether as a

result of new information, future events or otherwise.

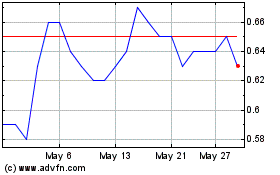

Electra Battery Materials (TSXV:ELBM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Electra Battery Materials (TSXV:ELBM)

Historical Stock Chart

From Dec 2023 to Dec 2024