Emgold Mining Corporation: Idaho-Maryland Project Update

September 07 2012 - 2:45PM

Marketwired Canada

Emgold Mining Corporation ("Emgold" or the "Company") (TSX

VENTURE:EMR)(OTCQB:EGMCF)(FRANKFURT:EML) is providing the following update on

its Idaho-Maryland Project located in Grass Valley, CA. As previously announced

in its October 26, 2011 press release, the preparation of the Environmental

Impact Report ("EIR") for the Idaho-Maryland Project was placed on hold

temporarily while the Company waited for improved equity market conditions to

raise the funds necessary to complete the EIR. Since that time, equity market

conditions have deteriorated further and the permitting process for the Project

remains on hold. The Company remains optimistic, however, that equity markets

are showing signs of recovery.

The Company's current Permit Applications with the City of Grass Valley ("City")

will be deemed withdrawn on September 10, 2012. Emgold plans to re-file these

Permit Applications once funding is in place to complete the EIR according to

the California Environmental Quality Act ("CEQA"). Management does not expect

the change in status of the current Permit Applications to have any impact on

completion of the EIR or on the CEQA process for the Idaho-Maryland Project (the

"Project") other than timing. Most importantly, assuming the Company is able to

obtain the required funding, the permitting process is expected to restart with

the same scope, budget, and timeframe as is currently proposed by the City.

In the interim, Emgold will focus on advancing its exploration properties in

Nevada and British Columbia. Emgold recently announced the start of its 2012

drill program at its Rozan Property in British Columbia and plans to conduct

drilling at its Stewart Property in British Columbia later this year. Emgold

staff will also continue it technical work on the Idaho-Maryland Project.

History of the Idaho-Maryland Environmental Impact Report Preparation

The preparation of an EIR for the Project in Grass Valley commenced in November

2007. A Draft EIR was completed by the City in October, 2008. Initial review of

the Draft EIR showed that the Company was successful in mitigating most

potential negative impacts of the Project so they had no negative impact, less

than a significant negative impact, or less than a significant negative impact

with mitigation measures in place. These areas include aesthetics; biological

resources; cultural resources; geology, soil, seismicity, and mineral resources;

hazards and hazardous materials; hydrology and water quality; land use planning;

noise; population and housing; public services; recreation; transportation and

traffic; utilities and services systems; and energy. In the area of air quality,

significant and unavoidable impacts were determined for oxides of nitrogen only.

Potentially significant impacts were determined for reactive organic gases and

respirable particulate matter (see November 3, 2008 press release). Emgold

management believes that the mitigation of all potentially significant negative

impacts of the Project except air quality is a major accomplishment for any

mining company or industrial project.

Note that the City did not allow Emgold to review the Draft EIR prior to its

being released to the public. As part of Emgold's subsequent detailed review of

the Draft EIR during the public comment period, Emgold's legal team advised

management that re-circulation of the Draft EIR was recommended because the

Draft EIR had failed to analyze the potential impact of the cleanup of the

historic mine tailings on the Idaho-Maryland site, which Emgold believes to be a

positive impact, as part of the Project. Under CEQA, all potential impacts of a

project, whether positive or negative, must be analyzed and public comment on

that analysis must occur. Emgold also determined in its review of the Draft EIR

that additional improvements could be put in place to further lessen or reduce

potential negative impacts of the Project, including air quality. Hence, in

mid-2009, Emgold management made the decision to revise its Project Applications

and notified the City of this its intention. Emgold did this knowing that the

revision in the Project Applications would result in re-circulation of the Draft

EIR and the need for additional public comment on the Project.

While the City was prepared to complete the Final EIR in mid-2009, Emgold was

not. Emgold believed that the Final EIR would ultimately be challenged in the

courts if a Revised Draft EIR was not completed and re-circulated in order to

allow for public comment prior to moving to a Final EIR. As Emgold has to

indemnify the City against any legal challenges to the EIR, it is in Emgold's

interest to ensure the EIR is completed adequately, with full analysis, and with

full public comment on all potential impacts of the Project. Emgold's goal has

been, and continues to be, to permit and construct a project that is socially

and environmentally responsible and that benefits the community of Grass Valley

as well as the shareholders of Emgold.

Between mid-2009 and early 2011, Emgold completed additional technical work and

revised its Project Applications. These were submitted to the City in April of

2011. At that time, Emgold requested that the City complete a Revised Draft EIR,

re-circulate it for public comment, and then complete the Final EIR. The City

subsequently made the decision that a Revised Draft EIR would be required and

that re-circulation of the Revised Draft EIR would be necessary, based on the

modifications to the Project Applications made by Emgold and because of the time

that had passed since the publishing of the 2008 Draft EIR.

Subsequently, Emgold requested that the City go through a competitive bid

process to finalize the scope, cost, and schedule for a contractor to complete a

Revised Draft EIR and Final EIR. This bid process was completed by the City in

November 2011 and the City selected a new EIR contractor. Estimated cost of the

City and its consultants to complete the EIR process is approximately US$500,000

with an estimated time frame of 12 months, subsequent to financing.

Current Status of the EIR

In an October 2011 letter to the City, with a final scope, budget, and schedule

known, Emgold requested that the City put its EIR related activities on hold

while the Company raised funds to move forward with the permitting process.

Emgold informed the City that this could take 60-90 days, but also could take

considerably longer depending on equity market conditions. In an October 26,

2011 press release, Emgold stated, "Emgold plans to use the next 60-90 day

period to evaluate strategic alternatives respecting continuance of the

Idaho-Maryland Project, and the funding of the Project EIR to completion.

Despite the current high price of gold bullion, financing for projects in the

junior mining sector is extremely difficult. In the event that insufficient

funds can be raised to move the Idaho-Maryland Project forward at the end of

that period, Emgold may have to delay the project until market conditions

improve or, as a worst case, drop the Project entirely to focus on the other

quality assets the Company currently has in its portfolio, including the

Buckskin Rawhide Project in Nevada and the Stewart Property in British

Columbia." This City granted Emgold this extension in November 2011.

To provide a background on market conditions, the TSX-Venture Exchange Composite

Index fell from a peak of 2,389 on April 8, 2011 to a low of 1,166 on July 24,

2012, and currently remains in the low 1,200's. The price of gold peaked at

$1,895 per ounce on September 6th, 2011 and subsequently fell to $1,531 per

ounce by year end 2011. During 2012, the gold price has fluctuated between

$1,500 and $1,800 per ounce, with an average price of $1,641 per ounce for 2012

year to date (London PM Fix, USD, from Kitco.com as at September 4, 2012). The

TSX-V Composite Index is currently at the same value as in August 2003 when the

price of gold was $350 per ounce.

The decline in the TSX-V Composite Index by about 50 percent over the last 18

months has made equity financings for mining companies extremely difficult.

Capital markets have dried up and many mining companies, like Emgold, are in a

holding pattern until markets recover.

In February, 2012 the City requested an update on the Company's financing

activities. Emgold indicated to the City that the Company had successfully

raised CDN $1.4 million in non-flow through funds designated for its Nevada and

B.C. properties and for general working capital. It also indicated that it had

raised CDN $0.8 million in flow through funds which were designated for use on

its B.C. properties. The Company indicated that an additional 60-90 days would

be required to complete financing for the Idaho-Maryland Project and that due to

continuing poor market conditions, financing could take an additional amount of

time.

In March, 2012, the City elected to give the Company 180 additional days, until

September 10, 2012, to complete financing or the Project Applications would be

deemed withdrawn. Both the City and Emgold expected market conditions would

improve during that time. Unfortunately, market conditions have worsened since

March 2012 and equity financing is difficult, if not impossible, to obtain at

this time with terms that are favorable to shareholders. Emgold plans to allow

its current Permit Applications to be deemed withdrawn and the permitting

process with the City will remain on hold pending better market conditions and

financing activity.

City staff has indicated that once financing is in place, the Permit

Applications will need to be re-filed and the permit application fees paid

(estimated to be about $10,000), unless the City elects to waive the fees at

that time. City staff has indicated that the deemed withdrawal of the existing

Permit Applications is not expected to significantly impact the permitting

process.

David Watkinson, President and CEO of Emgold stated, "We are obviously

disappointed with the City's decision to let the existing Permit Applications

for the Idaho-Maryland Project be deemed withdrawn. We do believe the permitting

process for Idaho-Maryland is achievable with adequate funding and we plan to

continue to work with the City to complete the EIR process for the

Idaho-Maryland Project. We look forward to resuming the process in the near

future."

On behalf of the Board of Directors

David G. Watkinson, P.Eng., President & CEO

For more information on the Company, investors should review the Company's

filings that are available at www.sedar.com or the Company's website at

www.emgold.com. This news release includes certain statements that are

"forward-looking statements" within the meaning of applicable securities laws

including statements regarding the timing of completion of the Final EIR for the

Idaho-Maryland Project, the re-filing of the Permit Applications by Emgold,

equity market conditions, expected results, and other statements.

Forward-looking statements are based on certain assumptions that Emgold will be

able to obtain financing in order to re-file the Permit Applications, the City

of Grass Valley and its consultants which are funded by Emgold will complete the

EIR in a reasonable timeframe, the City of Grass Valley will certify the EIR as

complete, and the City of Grass Valley will approve the Conditional Use Permit

for the mine and approve other entitlements under their authority. They assume

other permitting agencies overseeing the project on a local, state and federal

level will grant the permits needed for mining construction and operation.

Although the Company believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are not

guarantees of future performance and actual results or developments may differ

materially from those in the forward-looking statements. Factors that could

cause actual results to differ materially from those in forward-looking

statements include the failure to obtain the required financing and the failure

to obtain the required permits and approvals. Other risk factors include changes

in metal prices, the price of the Company's shares, the costs of labour, the

cost of equipment, the cost of supplies, approvals by federal, state, and local

agencies, permitting delays, legal challenges to permits, general economic,

market or business conditions, and other factors beyond the control of the

Company. Investors are cautioned that any such statements are not guarantees of

future performance and actual results or developments may differ materially from

those projected in the forward-looking statements. The Company does not intend

to update or revise any forward-looking information whether as to a result of

new information, future events or otherwise, except as required by law.

U.S. 20-F Registration: 000-51411

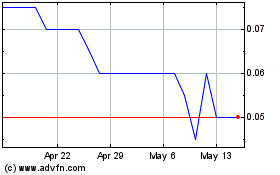

Emergent Metals (TSXV:EMR)

Historical Stock Chart

From Apr 2024 to May 2024

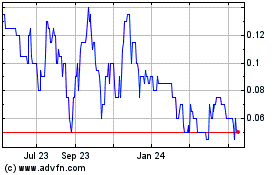

Emergent Metals (TSXV:EMR)

Historical Stock Chart

From May 2023 to May 2024