EnWave Reports 2024 Third Quarter Consolidated Interim Financial Results

August 23 2024 - 8:00AM

EnWave Corporation (TSX-V:ENW | FSE:E4U) (“EnWave”, or the

"Company") today reported the Company’s consolidated

interim financial results for the third quarter ended June 30th,

2024, demonstrating strong improvement over the first and second

quarters this fiscal year.

All values in thousands and denoted in CAD

unless otherwise stated.

- Reported revenue for Q3 2024 of $2,622 compared to $2,486 for

Q3 2023, representing an increase of $136. The increase was related

to a large-scale machine resale with a higher margin and increased

small scale machines sales for the period.

- Reported royalty revenues of $425, representing an increase of

$31 relative to the comparable period in the prior year due to

increased sales and production from current royalty partners.

- Reported an Adjusted EBITDA(1)

(refer to NON-IFRS Financial Measures section below) profit of $85

for Q3 2024, compared to an Adjusted EBITDA(1) loss of $192 in the

same period in the prior year due to the resale of a high margin

large-scale machine and increased royalty revenues.

- Gross margin for the three months ended Q3 2024 was 44%

compared to 29% for the three months ended Q3 2023. The increase in

margin was a result of the resale of the large-scale machine with a

higher margin and increased royalties.

- Reported Selling, General & Administrative (“SG&A”)

costs (including Research & Development (“R&D”)) of $1,364

which increased by $178 from the comparable period in the prior

year due to increased personnel costs, legal fees and increased

sales efforts, including higher attendance at trade shows.

Consolidated Financial

Performance:

|

($ ‘000s) |

Three months ended June

30, |

|

|

Nine months ended June

30, |

|

| |

|

|

|

|

|

|

Change |

|

|

|

|

|

|

|

|

Change |

|

|

|

|

2024 |

|

|

2023 |

|

|

% |

|

|

|

2024 |

|

|

2023 |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

2,622 |

|

|

2,486 |

|

5 |

% |

|

|

|

4,547 |

|

|

9,906 |

|

(54 |

%) |

|

| Direct

costs |

|

(1,471 |

) |

|

(1,767 |

) |

(17 |

%) |

|

|

|

(3,330 |

) |

|

(5,894 |

) |

(44 |

%) |

|

|

Gross margin |

|

1,151 |

|

|

719 |

|

60 |

% |

|

|

|

1,217 |

|

|

4,012 |

|

(70 |

%) |

|

| |

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

General and administration |

|

664 |

|

|

501 |

|

33 |

% |

|

|

|

1,740 |

|

|

1,753 |

|

(1 |

%) |

|

|

Sales and marketing |

|

358 |

|

|

277 |

|

29 |

% |

|

|

|

1,149 |

|

|

1,167 |

|

(2 |

%) |

|

|

Research and development |

|

342 |

|

|

408 |

|

(16 |

%) |

|

|

|

1,127 |

|

|

1,220 |

|

(8 |

%) |

|

|

|

|

1,364 |

|

|

1,186 |

|

15 |

% |

|

|

|

4,016 |

|

|

4,140 |

|

(3 |

%) |

|

| Net loss - continuous

operations |

|

(235 |

) |

|

(918 |

) |

74 |

% |

|

|

|

(2,938 |

) |

|

(974 |

) |

206 |

% |

|

| Net loss - discontinued

operations |

|

(32 |

) |

|

(1,031 |

) |

97 |

% |

|

|

|

(35 |

) |

|

(5,703 |

) |

99 |

% |

|

| Adjusted EBITDA(1) income

(loss) |

|

85 |

|

|

(192 |

) |

144 |

% |

|

|

|

(1,939 |

) |

|

703 |

|

(376 |

%) |

|

| Loss per share: |

|

|

|

|

|

|

|

|

Continuous operations – basic and diluted |

$ |

0.00 |

|

$ |

(0.01 |

) |

|

|

$ |

(0.02 |

) |

$ |

(0.01 |

) |

|

|

Discontinued operations – basic and diluted |

$ |

0.00 |

|

$ |

(0.01 |

) |

|

|

$ |

0.00 |

|

$ |

(0.05 |

) |

|

|

Basic and diluted |

$ |

0.00 |

|

$ |

(0.02 |

) |

|

|

$ |

(0.02 |

) |

$ |

(0.06 |

) |

|

Note: (1) Adjusted EBITDA is a

non-IFRS financial measure. Refer to the Non-IFRS Financial

Measures disclosure below for a reconciliation to the nearest IFRS

equivalent. EnWave’s consolidated interim financial statements and

MD&A are available on SEDAR+ at www.sedarplus.ca and on

the Company’s website www.enwave.net

Key Financial Highlights for the Nine

Months Ended Q3 2024 (expressed in 000’s)

- Royalties for the nine months ending June 30, 2024 were $1,319

compared to $1,085 for the same period ending June 30, 2023, an

increase of $234 or 22%. Royalties grew due to increased partner

product sales and production offset by a decrease in exclusivity

fees.

- Reported revenue for Q3 2024 of $4,547, representing a decrease

of $5,349 relative to the comparable period in the prior year. The

decrease was related to overall fewer machine sales and machines in

fabrication compared to the prior period due to the inherent

volatility in large-scale Radiant Energy Vacuum (“REV™”) machine

orders.

- SG&A costs for the nine months ending June 30, 2024 were

$4,016 compared to $4,140 for the same period ending June 30, 2023,

a decrease of $124, as a result of concerted efforts to maintain

discretionary spending.

- Adjusted EBITDA(1) loss for the

nine months ended Q3 2024 of $1,939, compared to an Adjusted

EBITDA(1) profit of $703 in the same period in the prior year due

to fewer machine sales to absorb fixed overhead costs.

Significant Corporate Accomplishments in

Q3 2024 and Subsequently:

- Signed a

Technology Evaluation and License Option Agreement with a North

American food company led by a renowned chef with multiple Michelin

Stars.

- Signed an

Equipment Purchase Agreement for a 120kW REV® dehydration machine

with an existing royalty partner.

- Signed an

Equipment Purchase Agreement with BranchOut Foods LLC, a current

royalty partner, for a 100kW REV™ dehydration machine to provide

additional drying capacity.

- Signed a

Commercial License Agreement with Bounty Specialty Foods to produce

several product types in the Philippines and sold a 10kW REV™

dehydration machine for product development.

- Signed a

Commercial Licence Agreement with an existing royalty partner to

produce several tropical fruit products in an unspecified Central

American country. An annual six-figure royalty fee will be paid in

exchange for the exclusive rights.

- Subsequent to

the quarter, repurchased a large-scale machine from a cannabis

multi-state operator to expedite the completion of the 120kW REV™

Branchout Foods LLC Equipment Purchase Agreement.

Non-IFRS Financial

Measures:

This news release refers to Adjusted EBITDA which is a non-IFRS

financial measure. We define Adjusted EBITDA as earnings before

deducting amortization and depreciation, stock-based compensation,

foreign exchange gain or loss, finance expense or income, income

tax expense or recovery and non-recurring impairment, restructuring

and severance charges, and discontinued operations. This measure is

not necessarily comparable to similarly titled measures used by

other companies and should not be construed as an alternative to

net income or cash flow from operating activities as determined in

accordance with IFRS. Please refer to the reconciliation between

Adjusted EBITDA and the most comparable IFRS financial measure

reported in the Company’s consolidated interim financial

statements.

|

|

Three months endedJune 30, |

|

|

Nine months endedJune 30 |

|

|

($ ‘000s) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

| Net loss after income tax |

(267 |

) |

|

(1,949 |

) |

|

(2,973 |

) |

|

(6,677 |

) |

|

Amortization and depreciation |

299 |

|

|

276 |

|

|

862 |

|

|

841 |

|

|

Stock-based compensation |

32 |

|

|

103 |

|

|

218 |

|

|

468 |

|

|

Foreign exchange (gain) loss |

(9 |

) |

|

54 |

|

|

(36 |

) |

|

86 |

|

|

Finance income |

(42 |

) |

|

(53 |

) |

|

(148 |

) |

|

(132 |

) |

|

Finance expense |

40 |

|

|

31 |

|

|

103 |

|

|

99 |

|

|

Non-recurring impairment expense |

- |

|

|

315 |

|

|

- |

|

|

315 |

|

|

Discontinued operations |

32 |

|

|

1,031 |

|

|

35 |

|

|

5,703 |

|

|

Adjusted EBITDA |

85 |

|

|

(192 |

) |

|

(1,939 |

) |

|

703 |

|

Non-IFRS financial measures should be considered

together with other data prepared in accordance with IFRS to enable

investors to evaluate the Company’s operating results, underlying

performance and prospects in a manner similar to EnWave’s

management. Accordingly, these non-IFRS financial measures are

intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. For more information,

please refer to the Non-IFRS Financial Measures section in the

Company’s MD&A available on SEDAR+ www.sedarplus.ca.

About EnWave EnWave is a global

leader in the innovation and application of vacuum microwave

dehydration. From its headquarters in Delta, BC, EnWave has

developed a robust intellectual property portfolio, perfected its

Radiant Energy Vacuum (REV™) technology, and transformed an

innovative idea into a proven, consistent, and scalable drying

solution for the food, pharmaceutical and cannabis industries that

vastly outperforms traditional drying methods in efficiency,

capacity, product quality, and cost.

With more than fifty royalty-generating partners

spanning twenty-three countries and five continents, EnWave’s

licensed partners are creating profitable, never-before-seen snacks

and ingredients, improving the quality and consistency of their

existing offerings, running leaner and getting to market faster

with the company’s patented technology, licensed machinery, and

expert guidance.

EnWave’s strategy is to sign royalty-bearing

commercial licenses with food producers who want to dry better,

faster and more economical than freeze drying, rack drying and air

drying, and enjoy the following benefits of producing exciting new

products, reaching optimal moisture levels up to seven times

faster, and improve product taste, texture, color and nutritional

value.

Learn more at EnWave.net.

EnWave CorporationMr. Brent

Charleton, CFAPresident and CEO

For further information:

Brent Charleton, CFA, President and CEO at +1 (778)

378-9616E-mail: bcharleton@enwave.net

Dylan Murray, CPA, CA, CFO at +1 (778) 870-0729E-mail:

dmurray@enwave.net

Safe Harbour for Forward-Looking Information

Statements: This press release may contain forward-looking

information based on management's expectations, estimates and

projections. All statements that address expectations or

projections about the future, including statements about the

Company's strategy for growth, product development, market

position, expected expenditures, and the expected synergies

following the closing are forward-looking statements. All

third-party claims referred to in this release are not guaranteed

to be accurate. All third-party references to market information in

this release are not guaranteed to be accurate as the Company did

not conduct the original primary research. These statements are not

a guarantee of future performance and involve a number of risks,

uncertainties and assumptions. Although the Company has attempted

to identify important factors that could cause actual results to

differ materially, there may be other factors that cause results

not to be as anticipated, estimated or intended. There can be no

assurance that such statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

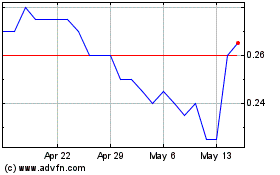

EnWave (TSXV:ENW)

Historical Stock Chart

From Jan 2025 to Feb 2025

EnWave (TSXV:ENW)

Historical Stock Chart

From Feb 2024 to Feb 2025