Green Shift Commodities Ltd. (TSXV: GCOM)

(OTCQB: GRCMF), (“Green Shift”, “GCOM” or

the

“Company”) is pleased to announce that it has

closed the previously announced acquisition (the

“

Acquisition”) of a 25% interest in Pampa Litio

S.A. (“

Pampa Litio”) from New Peak Metals Limited

(ASX: NPM). Pampa Litio is a private Argentinean company exploring

for hard rock spodumene bearing pegmatites in the Pampean Ranges of

Central Argentina.

Terms of the Pampa

Litio Acquisition

Pursuant to the Acquisition, GCOM has acquired a

25% interest in Pampa Litio for a consideration comprised of

CAD$150,000 in cash and 535,714 common shares of GCOM (the

“Common Shares”) issued at a deemed price of $0.14

per share, which is the 7-day volume weighted average trading price

of the Common Shares traded on the TSX Venture Exchange on the day

immediately prior to signing the definitive agreement in respect of

the Acquisition.

The Common Shares issued in connection with the

Acquisition are subject to a hold period expiring four months and

one day from the date of issuance. There are no finders’ fees

payable in connection with the Acquisition and New Peak is an

arms-length party with respect to the Company.

About Pampa Litio

Pampa Litio was created by Argentinean

geologists to explore for hard rock lithium bearing pegmatites,

particularly within the Province of San Luis which has historical

occurrences of lithium bearing pegmatites. New Peak acquired an

interest in the Mineral Exploration Tenements of Pampa Litio and

completed a number of early-stage exploration programs. GCOM

completed the Acquisition with a view to continuing this

exploration in a highly prospective region.

To date, Pampa Litio has applied for four

exploration titles totaling 34,300 hectares within the San Luis

Province in Argentina. The Pampean Ranges are host to numerous

granitic pegmatites with historic mineral resources that have been

mined during the past 90 years, accounting for the majority of the

feldspar, quartz, mica, beryllium, tungsten, lithium, tantalum and

rubidium produced in Argentina.

Qualified Person

The scientific and technical information

contained in this news release was reviewed and approved by Peter

Mullens (FAusIMM), Executive Chairman of the Company, who is a

“Qualified Person” in accordance with National Instrument 43-101 -

Standards of Disclosure for Mineral Projects.

About Green Shift Commodities

Ltd.

Green Shift Commodities Ltd. is focused on the

exploration and development of commodities needed to help

decarbonize and meet net-zero goals.

The Company is developing the Berlin Deposit in

Colombia. Apart from uranium, for clean nuclear energy, the Berlin

Deposit contains battery commodities including nickel, phosphate,

and vanadium. Phosphate is a key component of lithium-ion

ferro-phosphate (“LFP”) batteries that are being used by a growing

list of electric vehicle manufacturers. Nickel is a component of

various lithium-ion batteries, while vanadium is the element used

in vanadium redox flow batteries. Neodymium, one of the rare earth

elements contained within the Berlin Deposit, is a key component of

powerful magnets that are used to increase the efficiency of

electric motors and in generators in wind turbines.

The Company recently acquired the district scale

Rio Negro Project in Argentina. This Project represents an exciting

opportunity to unlock the potential of over 500,000 Ha of land,

known to contain hard rock lithium pegmatite occurrences that were

first discovered in the 1960s but have seen little exploration

since.

For further information, please

contact:

Trumbull Fisher, CEO, Green Shift Commodities

Ltd.E: tfisher@greenshiftcommodities.comTel: (416) 917-5847

Forward-Looking Statements

This news release includes certain “forward

looking statements”. Forward-looking statements consist of

statements that are not purely historical, including statements

regarding beliefs, plans, expectations or intensions for the

future, and include, but are not limited to, statements with

respect to activities, events or developments that are expected,

anticipated or may occur in the future, including the Company’s

anticipated exploration activities and future prospects and

outlook. These statements are based on assumptions, including that:

(i) the ability to achieve positive outcomes from test work; (ii)

actual results of exploration, resource goals, metallurgical

testing, economic studies and development activities will continue

to be positive and proceed as planned, (iii) requisite regulatory

and governmental approvals will be received on a timely basis on

terms acceptable to Green Shift (iv) economic, political and

industry market conditions will be favourable, and (v) financial

markets and the market for uranium, battery commodities and rare

earth elements will continue to strengthen. Such statements are

subject to risks and uncertainties that may cause actual results,

performance or developments to differ materially from those

contained in such statements, including, but not limited to: (1)

changes in general economic and financial market conditions, (2)

changes in demand and prices for minerals, (3) the Company’s

ability to source commercially viable reactivation transactions and

/ or establish appropriate joint venture partnerships, (4)

litigation, regulatory, and legislative developments, dependence on

regulatory approvals, and changes in environmental compliance

requirements, community support and the political and economic

climate, (5) the inherent uncertainties and speculative nature

associated with exploration results, resource estimates, potential

resource growth, future metallurgical test results, changes in

project parameters as plans evolve, (6) competitive developments,

(7) availability of future financing, (8) the effects of COVID-19

on the business of the Company, including, without limitation,

effects of COVID-19 on capital markets, commodity prices, labour

regulations, supply chain disruptions and domestic and

international travel restrictions, (9) exploration risks, and other

factors beyond the control of Green Shift including those factors

set out in the “Risk Factors” in our Management Discussion and

Analysis dated May 1, 2023 for the fiscal year ended December 31,

2022 and other public documents available on SEDAR at

www.sedar.com. Readers are cautioned that the assumptions used in

the preparation of such information, although considered reasonable

at the time of preparation, may prove to be imprecise and, as such,

undue reliance should not be placed on forward-looking statements.

Green Shift Commodities Ltd. assumes no obligation to update such

information, except as may be required by law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this press release.

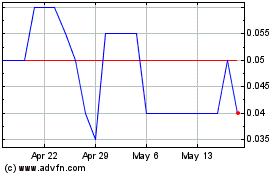

Green Shift Commodities (TSXV:GCOM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Green Shift Commodities (TSXV:GCOM)

Historical Stock Chart

From Jan 2024 to Jan 2025