Glass Earth Gold Files Q3 Financials to 30 September 2013

November 29 2013 - 11:00AM

Marketwired

Glass Earth Gold Files Q3 Financials to 30 September 2013

WELLINGTON, NEW ZEALAND--(Marketwired - Nov 29, 2013) - Glass

Earth Gold Limited (TSX-VENTURE:GEL)(NZAX:GEL) ("Glass Earth" or

the "Company") announced today that it has filed its September 30

2013, third quarter Financial Statements and associated

Management's Discussion and Analysis ("MD&A") report,

pertaining to that period, with regulatory authorities.

The Company is now focused solely on exploration and development

projects in the Hauraki Region of the North Island of New Zealand.

This area is where its key hard-rock projects of WKP and

Neavesville lie, as well as its Waihi West prospect, which is

adjacent to the Newmont owned and operated Martha gold mine at

Waihi.

In spite of the cost-containment measures taken (ref: News

release Nov 6, 2013), there has been some strain in meeting the

Company's financial obligations in this period. As a result, it has

been necessary to reach a deferred payment compromise with its

subsidiary's placer mining creditors ($620,000) and another

accommodation with Newmont Mining on cash calls due in respect of

the Hauraki Joint Venture ($588,000).

Hauraki Joint Venture (includes WKP) - Prospective change in

management

Since Glass Earth Gold decided to focus on the WKP project,

management has explored several avenues to boost exploration and

give more momentum to the project. Consequently, negotiations are

well advanced with Newmont Mining (65%) for Glass Earth (New

Zealand) Limited (35%) to assume management of the Hauraki Joint

Venture and sole fund exploration activities in order to increase

its equity in the JV.

Outstanding cash calls of $588,000, due to Newmont by GENZL as

at 30 September 2013, would form part of the overall funding for

the 2014 & 2015 exploration expenditures. Newmont has reserved

its position in respect of the unpaid cash calls by issuing a

Default Notice under the terms of the Hauraki Joint Venture

Agreement ("JVA") on 17 October 2013.

Neavesville Prospect (GENZL was 50% - now 100%)

As from 6 November 2013, the Company has regained 100% ownership

of the Neavesville prospect opportunity. Negotiations are underway

with Eurasian Minerals to amend the terms of the Option Agreement

with them in order to defer a looming Option payment deadline of 31

December 2013.

Corporate Refinancing

The Company, in common with many junior gold explorers, needs to

refinance. Management and the Board are of the opinion that the

above-mentioned change in management for WKP and 100% ownership

opportunity for Neavesville will add value to the Company's

profile, thus enhancing its potential to attract funding to

continue hard-rock activities and cover General &

Administration expenses.

FINANCIALS

Operational Activities

The Company's corporate and exploration activities for the

quarter are summarized in the attached Quarterly Overview. The

Company's cash position as at September 30, 2013 was $423,000 with

trade payables of $1,368,000, of which $1,208,000 are discussed

above.

The Company sold its placer mining operations effective end of

August and incurred a net mining loss for the three months ending

September 30, 2013 of $482,000.

|

|

Three months |

|

|

Three months |

|

Notes |

|

|

ended |

|

|

ended |

|

|

|

September 30 |

|

|

September 30 |

|

|

|

|

2013 |

|

|

2012 |

|

|

|

Gold Mining Revenue |

530,000 |

|

|

1,079,000 |

|

1 |

|

Mining costs |

(961,000 |

) |

|

(1,355,000 |

) |

|

|

Depreciation and amortisation |

(51,000 |

) |

|

(5,000 |

) |

|

|

Gross (Loss) |

(482,000 |

) |

|

(281,000 |

) |

|

|

|

|

|

|

|

|

|

|

Administrative and Personnel expenses |

(162,000 |

) |

|

(187,000 |

) |

|

|

Finance (loss)/income |

77,000 |

|

|

12,000 |

|

|

|

|

|

|

|

|

|

|

|

Loss before Income Taxes |

(567,000 |

) |

|

(456,000 |

) |

|

|

Income tax recovery |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

Loss after Income Taxes |

(567,000 |

) |

|

(456,000 |

) |

|

Note 1: Sales revenues down due to poor 24/7 July and reduced

hours in Aug (12/5) prior to handover of operations to new owner.

The severe drop in the gold price impacted the operations over the

past few months.

About Glass Earth Gold

Glass Earth Gold is an exploration company focused on unveiling

the high-grade potential of the Wharekirauponga (WKP) and

Neavesville projects in Hauraki, New Zealand. The properties are

situated in areas of low suphidation gold-silver epithermal

systems, similar to the system that hosts the Newmont Mining-owned

Martha Hill mine.

The WKP project is a joint-venture between Glass Earth Gold

(35%) and Newmont Mining (65%). It holds a NI 43-101 inferred

resource of 1.3 million tonnes at an average grade of 6.1 g/t Au

and 9.3 g/t Ag for a total of 260,000 ounces of gold and 390,000

ounces of silver.

For more information on Glass Earth Gold, please visit

www.glassearthgold.com.

To receive Company news via email, contact

info@glassearthgold.com and mention "Glass Earth news" in the

subject line.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) nor New Zealand Exchange Limited has reviewed

this release and neither accepts responsibility for the adequacy or

accuracy of this release.

Glass Earth Gold LimitedSimon HendersonPresident and Chief

Executive Officer+64 4 903 4980info@glassearthgold.comGlass Earth

Gold LimitedAnne RobertManager, Investor Relations+ 1 514 880

0184anne.robert@glassearth.co.nzwww.glassearthgold.com

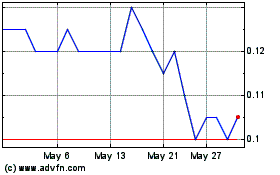

Graphano Energy (TSXV:GEL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Graphano Energy (TSXV:GEL)

Historical Stock Chart

From Jan 2024 to Jan 2025