Golconda Gold Ltd. (“Golconda Gold” or the “Company”) (TSX-V: GG;

OTCQB: GGGOF) continued its progression in 2022 to meet its goal of

becoming a long-life and low-cost operation that can produce

positive returns for investors across commodity cycles.

1. Produced 9,979

ounces of gold at Galaxy in

2022(1),

a 20% increase on 2021 production demonstrating the progress made

on unlocking the significant value contained in the Galaxy

resource. Despite the operational challenges encountered during the

year associated with unprecedented rainfall and resultant flooding

and lower than budgeted equipment availabilities, Galaxy still

delivered significant production growth year on year.

2. Completed the sale of Mupane Gold

Mining Proprietary Limited (“Mupane”) to Hawks Mining Company

Proprietary Limited. The completion of the sale removed

US$17.3 million of liabilities from the Company’s balance sheet.

Mupane had been the cornerstone of the Company for the previous 11

years but was at a point where it needed to transition to be a

smaller producer and required significant capital investment. The

sale of Mupane has transformed the Company’s balance sheet and

freed up capital and management time to invest in both Galaxy and

Summit which are expected to provide a greater return on

capital(2).3. Signed and commenced

deliveries under a new offtake agreement for the Galaxy operation

with Ocean Partners UK Limited and an associated unsecured US$3

million revolving finance facility. The new offtake

agreement incorporates a higher payable percentage for the gold

content in the Company’s concentrate. For example, at a production

level of 25,000 ounces per annum at US$1,800 per ounce gold price

generates US$1.4 million more revenue when compared with the

Company’s previous offtake

agreement.4. Repayment of the Barak

US$5 million secured facility. Coupled with the sale of

Mupane this has created a much-improved balance sheet that the

Company can leverage to finance expansion at Galaxy and the restart

of Summit(2).5. Produced an updated

Preliminary Economic Assessment of the Summit Mine and Banner Mill

in New

Mexico(3).

Based on a gold price of US$1,850 and silver price of US$22 per

ounce the assessment showed the following results:

-

A 7-year mine life;

-

Average annual production of:

-

9,500 ounces of gold

-

444,000 ounces of silver

-

14,700 ounces of gold equivalent production;

-

Life-of-mine capital cost of US$13.4 million;

-

Peak funding requirement of US$8.2 million;

-

Project payback in 26 months;

-

Pre-tax NPV (5%) of US$66.4 million; and

-

All-in sustaining cash cost of US$864 per ounce of gold.

6. Mining of the

total footprint of the Galaxy Ore Body at 22 level generated 29%

more ounces than

forecasted(4). It

was expected, from the mine plan included in the Galaxy Technical

Report (as defined below), that the Company would mine 12,342

tonnes to complete the footprint at a grade of 2.66 grams per tonne

(“g/t”), with a cut-off grade of 1.4 g/t, for 1,056

ounces. The Company actually mined 11,874 tonnes at a grade of

3.56 g/t for 1,359 ounces, an increase of 33.8% on grade and 28.7%

in ounces. The total Galaxy measured and indicated

resource according to the Galaxy Technical Report, was

approximately 3.0 million tonnes at 2.64 g/t containing 254,241

ounces as of December 31, 2021.

7. Renamed the

Company to Golconda Gold. The new name more accurately

represents the Company going forward following the disposal of

Mupane and the transformation of the Company’s balance sheet. The

Company believes the new name will make it clear to current and

future stakeholders that the Company is concentrating on

progressing both Galaxy and the Summit Mine and Banner Mill and

unlocking their inherent value.

Nicholas Brodie, CEO of Golconda Gold, commented

“As a Company we have been clear in our overriding goal of becoming

a long-life and low-cost operator and we continue to ensure that

this is core to our decision-making process. We reached the end of

2022 having made some giant strides towards reaching our goals. To

transform our balance sheet, increase our revenue, repay all our

secured debt removing the security over our assets, provide a very

positive economic outlook for Summit and outperform the modelled

resource at Galaxy has given us a tremendous platform to start 2023

on. We intend to keep travelling in the same direction and hope

that 2023 will be as full of important, transformational steps to

achieving our goals(2).”

About Golconda Gold

Golconda Gold is an un-hedged gold producer and

explorer with mining operations and exploration tenements in South

Africa and New Mexico. Golconda Gold is a public company and its

shares are quoted on the TSX Venture Exchange under the symbol “GG”

and the OTCQB under the symbol “GGGOF”. Golconda Gold’s management

team is comprised of senior mining professionals with extensive

experience in managing mining and processing operations and

large-scale exploration programmes. Golconda Gold is committed to

operating at world-class standards and is focused on the safety of

its employees, respecting the environment, and contributing to the

communities in which it operates.

Notes:

(1) All information herein is subject to

change based on the reported audited annual financial results,

expected to be reported no later than May 1, 2023.(2) This is

forward-looking information and is based on a number of

assumptions. See “Cautionary Notes”.(3) The PEA is an update

of the economic model provided by Waterton Precious Metals Fund II

Cayman, the previous owner of Summit, to the Company with an

effective date of September 17, 2014, which was included in

the "Technical Report, Preliminary Economic Assessment, Summit

Gold-Silver Project, Grant and Hidalgo Counties, New Mexico",

prepared by Douglas F. Irving, P.E., Susan C. Bird, P.Eng., and

Tracey D. Meintjes, P. Eng. of Chapman, Wood and Griswold, Inc. in

Albuquerque, New Mexico. The PEA has been updated by the creation

of a new mine plan, updated costings, revised off-take terms and

updated metal prices. The updated PEA is preliminary in nature, and

includes inferred mineral resources that are considered too

speculative geologically to have the economic considerations

applied to them that would enable them to be categorized as mineral

reserves. There is no certainty that the updated PEA will be

realized. Please see the Company’s press release dated June 27,

2022 for further details.(4) The deposits at the Galaxy mine

are supported by a technical report entitled “NI 43-101 Technical

Report on the Galaxy Gold Mine, South Africa” which was issued on

July 3, 2020 (the “Galaxy Technical Report”), with an effective

date of June 29, 2020, a copy of which is available under the

Company’s profile on www.sedar.com. The Galaxy Technical Report was

prepared by Minxcon (Pty) Ltd and approved by Mr. Uwe Engelmann,

BSc (Zoo. & Bot.), BSc Hons (Geol.) Pr.Sci.Nat., MGSSA, and Mr.

Daniel (Daan) van Heerden, B Eng (Min.), MCom (Bus. Admin.), MMC,

Pr.Eng., FSAIMM, AMMSA, both “qualified persons” as defined by

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”), and independent of the Company for the

purposes of NI 43-101. The preliminary economic assessment (“PEA”)

supported by the Galaxy Technical Report is preliminary in nature

as the resources included in the PEA are comprised 54% of inferred

mineral resources. Inferred mineral resources are considered too

speculative geologically to have the economic considerations

applied to them that would enable them to be categorized as mineral

reserves. There is no certainty that the PEA will be realized.

Cautionary Notes

Certain statements contained in this press

release constitute “forward-looking statements”. All statements

other than statements of historical fact contained in this press

release, including, without limitation, those regarding the

Company’s ability to provide a greater return on capital at Galaxy

and Summit, the Company’s ability to finance an expansion at Galaxy

and the restart of Summit, and the Company’s future financial

position and results of operations, strategy, proposed

acquisitions, plans, objectives, goals and targets, and any

statements preceded by, followed by or that include the words

“believe”, “expect”, “aim”, “intend”, “plan”, “continue”, “will”,

“may”, “would”, “anticipate”, “estimate”, “forecast”, “predict”,

“project”, “seek”, “should” or similar expressions or the negative

thereof, are forward-looking statements. These statements are not

historical facts but instead represent only the Company’s

expectations, estimates and projections regarding future events.

These statements are not guarantees of future performance and

involve assumptions, risks and uncertainties that are difficult to

predict. Therefore, actual results may differ materially from what

is expressed, implied or forecasted in such forward-looking

statements.

Additional factors that could cause actual

results, performance or achievements to differ materially include,

but are not limited to: the Company’s dependence on two mineral

projects; gold price volatility; risks associated with the conduct

of the Company’s mining activities in South Africa and New Mexico;

regulatory, consent or permitting delays; risks relating to the

Company’s exploration, development and mining activities being

situated in South Africa and New Mexico; risks relating to reliance

on the Company’s management team and outside contractors; risks

regarding mineral resources and reserves; the Company’s inability

to obtain insurance to cover all risks, on a commercially

reasonable basis or at all; currency fluctuations; risks regarding

the failure to generate sufficient cash flow from operations; risks

relating to project financing and equity issuances; risks arising

from the Company’s fair value estimates with respect to the

carrying amount of mineral interests; mining tax regimes; risks

arising from holding derivative instruments; the Company’s need to

replace reserves depleted by production; risks and unknowns

inherent in all mining projects, including the inaccuracy of

reserves and resources, metallurgical recoveries and capital and

operating costs of such projects; contests over title to

properties, particularly title to undeveloped properties; laws and

regulations governing the environment, health and safety; the

ability of the communities in which the Company operates to manage

and cope with the implications of COVID-19; the economic and

financial implications of COVID-19 to the Company; operating or

technical difficulties in connection with mining or development

activities; lack of infrastructure; employee relations, labour

unrest or unavailability; health risks in Africa; the Company’s

interactions with surrounding communities and artisanal miners; the

Company’s ability to successfully integrate acquired assets; risks

related to restarting production; the speculative nature of

exploration and development, including the risks of diminishing

quantities or grades of reserves; development of the Company’s

exploration properties into commercially viable mines; stock market

volatility; conflicts of interest among certain directors and

officers; lack of liquidity for shareholders of the Company; risks

related to the market perception of junior gold companies; and

litigation risk. Management provides forward-looking statements

because it believes they provide useful information to investors

when considering their investment objectives and cautions investors

not to place undue reliance on forward-looking information.

Consequently, all of the forward-looking statements made in this

press release are qualified by these cautionary statements and

other cautionary statements or factors contained herein, and there

can be no assurance that the actual results or developments will be

realized or, even if substantially realized, that they will have

the expected consequences to, or effects on, the Company. These

forward-looking statements are made as of the date of this press

release and the Company assumes no obligation to update or revise

them to reflect subsequent information, events or circumstances or

otherwise, except as required by law.

Information of a technical and scientific nature

that forms the basis of the disclosure in the press release has

been prepared and approved by Kevin Crossling Pr. Sci. Nat.,

MAusIMM. and former Business Development Manager for Golconda Gold,

and a “qualified person” as defined by NI 43-101. Mr. Crossling has

verified the technical and scientific data disclosed herein and has

conducted appropriate verification on the underlying data.

Neither the TSX Venture Exchange nor its

regulation services provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information please

contact:Nick BrodieCEO, Golconda Gold Ltd.+ 44 7905

089878Nick.Brodie@GolcondaGold.comwww.GolcondaGold.com

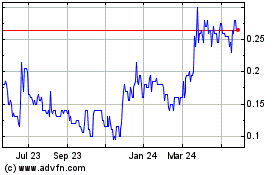

Golconda Gold (TSXV:GG)

Historical Stock Chart

From Jan 2025 to Feb 2025

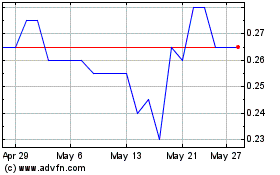

Golconda Gold (TSXV:GG)

Historical Stock Chart

From Feb 2024 to Feb 2025