Itafos Inc. (TSX-V: IFOS) (“Itafos” or the “Company”) is pleased to

announce the results of the updated Feasibility Study (“FS” or

“feasibility study”) for the Farim Phosphate Project (the “Farim

Project”), a high-grade phosphate mine project located in

Guinea-Bissau, West Africa.

Farim Project 2023 FS

Highlights:

- After-tax net present value

(“NPV”) (10%) of $572 million at a base case life-of-mine (“LOM”)

average rock price of US$197.5 per tonne concentrate.

- After-tax internal rate of

return (“IRR”) of 34.9% and after-tax payback on pre-production

capital expenditures of 4.2 years.

- High-grade, free-dig

open-pit mine with an average run-of-mine (“ROM”)

P2O5

grade (dry basis) of 30.0% and an overall ROM strip ratio

of 10.09 bank cubic meters (bcm) per tonne of ROM phosphate

matrix.

- LOM production of

approximately 2.19 million tonnes per annum (“Mt/a”) of ROM

phosphate matrix on an as-received basis (at approximately 20%

moisture) or 1.75 Mt/a ROM phosphate matrix on a dry

basis.

- The process plant is

designed to achieve an annual throughput of 1.75 Mt/a. The material

from the south and north pits are expected to produce 1.36 Mt/a and

1.30 Mt/a of dried concentrate product annually,

respectively.

- Estimated pre-production

capital expenditures (“CAPEX”) of $308 million, yielding after-tax

NPV:CAPEX ratio of 1.9:1

- LOM all-in Operating Cost

of $70.9/tonne rock concentrate loaded Free on Board (“FOB”)

basis.

- Proven and Probable Mineral

Reserves of 43.8 million tonnes at 30.0%

P2O5.

David Delaney, the Company’s CEO, commented,

“The updated feasibility study confirms that the Farim Project has

robust economics and demonstrates that the Farim Project has the

potential to be an important phosphate producing asset. Additional

new phosphate capacity and capital investment are required to meet

projected phosphate global demand growth over the medium- to

long-term, which bodes well for the Farim Project, as we believe it

is one of the highest-grade undeveloped deposits in the world.”

Farim Project Feasibility

StudyA technical report, entitled “Farim Phosphate Project

– NI 43-101 Technical Report and Feasibility Study,” (the ”Farim

Technical Report”), was prepared for the Company by Ausenco

Engineering Canada Inc. (“Ausenco”) in accordance with National

Instrument 43-101 – Standards of Disclosure for Mineral Projects

(“NI 43-101”). The Report was prepared to summarize the results of

the Feasibility Study and consolidate all project de-risk work

conducted between 2015 and 2022. Ausenco was supported by KEMWorks

Technology, Inc., WSP/Golder, Knight Piésold Consulting, WF Baird

and Kristal Font Inc.

Data VerificationThe Mineral

Resource Qualified Person (“QP”), Jerry DeWolfe, P.Geo. considers

sample preparation, analytical, and security protocols employed by

the Farim Project to be acceptable. The QP has reviewed the QA/QC

procedures used by the Company including the use of certified

reference materials, blank, duplicate, and umpire data, and

considers the assay database to be adequate for Mineral Resource

estimation. The QP also carried out data verification both on site

and on the database. This included a review of the assay database

and collar locations. The QP considers the assay database to be

acceptable for Mineral Resource estimation. In addition, there are

no identified significant factors or concerns regarding the

accuracy and reliability of the results from the exploration

programs in the Project area.

Farim Project Mineral Resource

EstimateThe Farim Project’s current Mineral Resource

estimate, as shown in Table 1, was completed by WSP/Golder and has

an effective date of September 30, 2022. The QP is not aware of any

material changes between the September 30, 2022, effective date of

the Mineral Resource estimate and the May 17, 2023 publication date

of this News Release that would affect the resource model or

Mineral Resource estimate. The Mineral Resource estimate forms the

basis for the FS and are reported inclusive of Mineral Reserves.

Mineral Resources that are not Mineral Reserves do not have

demonstrated economic viability at this time.

Farim Project Mineral Reserve

EstimationThe assessment of mineable phosphate matrix

reserves within the project area was based on the 25-year mine plan

and corresponding open pit design. The pit design was developed

based on a pit optimization exercise that delineated the most

economical 43.75 Mt of ROM material to feed a 25-year plan at a

rate of 1.75 Mt/a on a dry basis. The Mineral Reserve Estimate is

shown in Table 2 and concerns the decarbonized phosphate unit

(“FPA”) only, as the calcareous phosphate member (“FPB”) was

previously deemed to be uneconomic. No additional mineralization

outside the modelled deposit was considered in the Mineral Resource

and Reserve estimates. The Mineral Reserve estimate has an

effective date of September 30, 2022. The QP is not aware of any

material changes between the September 30, 2022, effective date of

the Mineral Reserve estimate and the May 17, 2023 publication date

of this News Release that would affect the Mineral Reserve

estimate.

As per the Mineral Resource estimation

methodology, a 20% P2O5 technical cut-off grade was applied to

target the in-situ Mineral Resource grade requirements that would

subsequently meet the plant feed and product grade requirements.

This technical cut-off grade did not change in the Mineral Reserve

estimation.

Table 1: Global Mineral Resource Statement, Farim

Phosphate Deposit, September 30, 2022.

|

Class |

Block |

Tonnage, Dry Basis(Mt) |

FPA(m) |

P2O5,Dry

Basis (%) |

Al2O3,Dry

Basis(%) |

CaO,Dry

Basis(%) |

Fe2O3,Dry

Basis(%) |

SiO2,Dry

Basis(%) |

Overburden(Mbcm) |

Stripping Ratio(bcm/t) |

|

Measured |

North of River |

102.5 |

|

2.91 |

|

28.53 |

|

2.69 |

|

39.71 |

|

5.65 |

|

11.28 |

|

1,162.30 |

|

11.34 |

|

|

South of River |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

|

Subtotal |

102.5 |

|

2.91 |

|

28.53 |

|

2.69 |

|

39.71 |

|

5.65 |

|

11.28 |

|

1,162.30 |

|

11.34 |

|

|

Indicated |

North of River |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

|

South of River |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

|

Subtotal |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

|

Measured + Indicated |

North of River |

102.5 |

|

2.91 |

|

28.53 |

|

2.69 |

|

39.71 |

|

5.65 |

|

11.28 |

|

1,162.30 |

|

11.34 |

|

|

South of River |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

|

Subtotal |

102.5 |

|

2.91 |

|

28.53 |

|

2.69 |

|

39.71 |

|

5.65 |

|

11.28 |

|

1,162.30 |

|

11.34 |

|

|

Inferred |

North of River |

6.8 |

|

2.30 |

|

25.17 |

|

2.99 |

|

39.08 |

|

4.86 |

|

10.46 |

|

119.62 |

|

17.63 |

|

|

South of River |

24.4 |

|

2.21 |

|

29.06 |

|

5.32 |

|

36.21 |

|

4.97 |

|

11.62 |

|

236.18 |

|

9.70 |

|

|

Subtotal |

31.1 |

|

2.23 |

|

28.08 |

|

4.73 |

|

36.94 |

|

4.94 |

|

11.32 |

|

355.80 |

|

11.42 |

|

Notes: 1. Mineral resources are

reported on a dry in-situ basis and are inclusive of Mineral

Reserves. 2. The statement of estimates of Mineral

Resources has been compiled by Mr. Jerry DeWolfe, who is a

full-time employee of WSP Canada Inc. (formerly WSP Golder) and a

professional geologist (P.Geo.) with the Association of

Professional Engineers and Geoscientists of Alberta (APEGA). Mr.

DeWolfe has sufficient experience that is relevant to the style of

mineralization and type of deposit under consideration and to the

activity that he has undertaken to qualify as a Qualified Person

(“QP”) as defined in NI 43-101. 3. All Mineral

Resources figures reported in the table above represent estimates

at September 30, 2022. Mineral Resource estimates are not precise

calculations, being dependent on the interpretation of limited

information on the location, shape and continuity of the occurrence

and on the available sampling results. The totals contained in the

above table have been rounded to reflect the relative uncertainty

of the estimate. Rounding may cause some computational

discrepancies. 4. Mineral Resources are reported

in accordance with NI 43-101 and CIM Definition Standards for

Mineral Resource and Mineral Reserves (2014) and CIM Estimation of

Mineral Resource and Mineral Reserve Best Practices (2019).

5. The reported Mineral Resource estimate was

constrained by a conceptual Mineral Resource optimized pit shell

for the purpose of establishing reasonable prospects of economic

extraction based on potential mining, metallurgical and processing

grade parameters identified by mining, metallurgical and processing

studies performed to date on the project. Key inputs in developing

the Mineral Resource pit shell included a mining cost of

US$1.69/tonne for mineralization and US1.41/tonne for waste, plus

processing costs of US$31.72/ ROM tonne, phosphate recovery of 76%,

pit slope angle of 20°, and a concentrate selling price of

US$147/tonne. In addition, a minimum FPA P2O5 grade of 20%, a

minimum FPA thickness of 1 m as well as a restriction on any FPA

within 50 m of River Cacheu was applied.

Table 2: Proven and Probable Reserves

|

Category |

ROM (Plant Feed) FPA

Tonnes,Dry Basis (Mt) |

Mean ROM

P2O5,

Dry Basis (%) |

Mean

ROMAl2O3,

Dry Basis (%) |

Mean ROMCaO, Dry Basis (%) |

Mean

ROMFe2O3,

Dry Basis (%) |

Mean ROM SiO2, Dry Basis

(%) |

|

Proven |

43.8 |

30.0 |

2.6 |

41.1 |

4.8 |

10.6 |

|

Probable |

- |

- |

- |

- |

- |

- |

|

Total |

43.8 |

30.0 |

2.6 |

41.1 |

4.8 |

10.6 |

Notes: 1. Mineral Reserves are

reported on a dry in-situ basis. 2. The statement

of estimates of Mineral Reserves has been compiled by Mr. Terry

Kremmel, who is a full-time employee of WSP USA Inc. (formerly WSP

Golder) and a professional engineer (P.E.) and registered member

with the Society for Mining, Metallurgy, and Exploration. Mr.

Kremmel has sufficient experience that is relevant to the style of

mineralization and type of deposit under consideration and to the

activity that he has undertaken to qualify as a QP as defined in NI

43-101. 3. All Mineral Reserve figures reported in

the table above represent estimates at September 30, 2022. Mineral

Reserve estimates are not precise calculations, being dependent on

the interpretation of limited information on the location, shape

and continuity of the occurrence and on the available sampling

results. The totals contained in the above table have been rounded

to reflect the relative uncertainty of the estimate. Rounding may

cause some computational discrepancies. 4. Mineral

Reserves are reported in accordance with NI 43-101.

5. The reported Mineral Reserve estimate was

constrained by the River Cacheu, the Rio de Bunja, and surface

encumbrances including the two ex-pit waste dumps, tailings storage

facility, and processing plant.

Mining MethodsThe FPA matrix is

mined by a free-dig, multiple-bench, open-pit, haul-back mine using

excavators and trucks. Mining will be accomplished using

conventional loader, excavator and truck materials handling with an

average strip ratio of 10 bcm/t of ROM phosphate matrix. Overburden

excavation will advance ahead of the matrix extraction in maximum

10 m height production benches. The overburden thickness ranges

from 26 to 68 m within the 25-year pit, multiple overburden

stripping benches will be developed and maintained in advance of

the matrix extraction. The matrix thickness ranges between 1.5 m

and 6.25 m within the 25-year pit.

The most critical design element of the proposed

mining plan is water management. All mining areas must be dewatered

in advance of mining activities to allow sufficient

depressurization and dissipation of pore water pressure and to

accommodate dry mining of the deposit. Dewatering pump test data

indicates that dry open-pit mining will be feasible. The proximity

of the mine site to the River Cacheu will require the construction

of a protective water control berm (bund) to prevent in-pit

flooding. In addition to advanced dewatering, in-pit water

management is critical and has been accounted for in the

feasibility study.

Metallurgy and ProcessingAt the

process plant, the objective is to remove impurities to achieve the

required minor element ratio and phosphate grade in the

concentrate. Impurity removal is achieved by concentrating the -20

µm to +1,180 µm particle size fraction of the ROM ore and rejecting

the remainder. ROM ore is processed through drum and attrition

scrubbing stages, and classified by cyclones, vibrating screens,

and hydro separators. The -20 µm size fraction is thickened and

pumped to the TSF. The +1,180 µm material is rejected and trucked

to a waste stockpile. The resulting fine concentrate stream is

thickened and filtered in a vertical plate and frame filter press.

The coarse concentrate stream does not require thickening and is

sent directly to two vertical plate-and-frame filter presses

operating in parallel. The concentrate filter cakes are combined

and conveyed to a covered filtered concentrate stockpile at the

truck load-out area. The filtered concentrate is then reclaimed and

trucked to the Mineral Terminal.

The process objective at the Mineral Terminal

site is to dry the concentrate to a moisture content suitable for

transport after which it is loaded on to ships. Filtered

concentrate is received at the Mineral Terminal site in a covered

stockpile building. The material is then reclaimed and dried in a

diesel fired rotary dryer. Dry concentrate is then stockpiled in a

covered building, prior to reclamation and ship loading.

The process plant is designed to achieve an

annual throughput of 1.75 Mt/a. The material from the south and

north pits are expected to produce 1.36 Mt/a and 1.30 Mt/a of

concentrate annually, respectively. The process developed for the

beneficiation of Farim phosphate ore is robust, continuous, and

reliable, rendering reproducible metallurgical results. The

flowsheet is based upon unit operations that are proven in

industry. Continuous pilot plant tests indicate most likely results

of yield (mass recovery) of 77.5%, P2O5 recovery of 81.8%, and

likely P2O5 grade of 33.6% for the South pit. The phosphate rock

produced is a high-grade, high-quality product that will attract a

premium price.

Project InfrastructureLocal

mining infrastructure is limited and must be upgraded, or in some

cases, designed and built as part of the initial construction plan.

Although the government of Guinea-Bissau is advancing

infrastructure improvements across the country, this study assumes

the following key infrastructure works:

- Hybrid power plants (solar and

diesel generator) are located at Ponta Chugue and north-east of the

Farim process plant.

- Truck loading facility on the south

side of River Cacheu. Concentrate will be transported from the

plant (north side of the River), via a conveyor over the River

Cacheu. These facilities are all within the mining lease.

- Upgraded access road from Ponta

Chugue to Mansoa (remainder of road to the truck loading site is

approved and acceptable for truck haulage and access).

- Mineral Terminal at Ponta Chugue to load and ship the dried

concentrate. Ponta Chugue will also be used to accept diesel fuel

into holding tanks for delivery to Farim. The channel design has

been assessed against PIANC channel design guidelines and with

desktop and real-time navigation simulations. The channel

alignment, including through the Bernafel section, is suitable for

the water depths, design depths and prevailing currents. The

navigation fairway surrounding the Ponte Chugue Marine Terminal is

suitable and provides a generous maneuvering area for inbound and

departing vessels.

- Tailings storage facility (“TSF”)

adjacent to the beneficiation plant to store fines generated from

the process facility. This TSF will be developed in stages as

individual cells over the life of mine.

- Waste overburden storage piles for

permanent storage of overburden. A cell within one of the waste

storage piles will be designed to store potentially acid generating

(“PAG”) material based on the mining sequence and expected PAG

volumes.

- Temporary topsoil storage piles

sufficient to manage development of waste piles, roads, TSF cell

construction, and for use in closure plans.

- Water management system including

supply wells, dewatering wells, water diversion channels, flood

prevention berms, and settlement ponds. The site will continuously

discharge water throughout the operation.

- Camp facilities already built will

be supported by local contractors and be secure.

All associated infrastructure costs are captured

in the construction and operating plans. All future infrastructure

development by the Government of Guinea-Bissau is considered as

opportunities to enhance the Farim Project.

Capital Cost EstimateTable 3

provides a summary of the project capital cost estimate, with costs

grouped into major scope areas, expressed in Q4 2022 US dollars.

The estimate conforms to Class 3 guidelines for a feasibility study

level estimate with a ±15% accuracy according to the Association of

the Advancement of Cost Engineering International (AACE

International). Major cost categories (permanent equipment,

material purchase, installation, subcontracts, indirect costs, and

Owner’s costs) were identified and analyzed. A percentage of

contingency was allocated to each of these categories on a

line-item basis based on the accuracy of the data. An overall

weighted contingency amount was derived in this fashion.

Table 3: Project Capital Cost Estimate

|

Description |

Initial Capital(US$M) |

Sustaining Capital (US$M) |

Total Capital(US$M) |

|

Mining |

32.243 |

|

265.348 |

|

297.591 |

|

|

Process Plant and Infrastructure |

68.934 |

|

- |

|

68.934 |

|

|

Ponte Chugue Infrastructure (Mineral Terminal & Drying) |

99.728 |

|

12.050 |

|

111.778 |

|

|

Tailings Storage Facility & Water Management |

14.049 |

|

57.722 |

|

71.771 |

|

|

South Pit Dewatering |

4.420 |

|

12.737 |

|

17.157 |

|

|

North Pit Dewatering |

- |

|

20.995 |

|

20.995 |

|

|

Resettlement and Livelihood Restitution |

11.985 |

|

5.635 |

|

17.620 |

|

|

EPCM |

27.452 |

|

- |

|

27.452 |

|

|

Indirects |

6.057 |

|

- |

|

6.057 |

|

|

Owners’ Cost |

11.637 |

|

- |

|

11.637 |

|

|

Contingency |

31.765 |

|

- |

|

31.765 |

|

|

Progressive Closure and Rehabilitation (TSF) |

- |

|

58.817 |

|

58.817 |

|

|

Progressive Closure and Rehabilitation (Pits & WDs) |

|

|

21.169 |

|

21.169 |

|

|

Total Site Closure |

|

|

33.997 |

|

33.997 |

|

|

Salvage Value – Mine |

|

|

-12.893 |

|

-12.893 |

|

|

Salvage Value – Port |

- |

|

-8.433 |

|

-8.433 |

|

|

Total |

308.270 |

|

467.142 |

|

775.413 |

|

Operating Cost EstimateThe

operating cost estimate includes mining, processing, ship loading,

environmental, fuel, and general and administration (G&A)

costs. A summary of the average annual operating costs is presented

in Table 4. The estimate conforms to Class 3 guidelines for a

feasibility study level estimate with a ±15% accuracy according to

the Association of the Advancement of Cost Engineering

International (AACE International). The capital and operating cost

estimates were reviewed by the respective QP’s. See section titled

“Technical Report and Qualified Persons” below for further

details.

Table 4: Operating Cost Estimate Summary - Average Costs

per pit

|

Description |

Life-of-Mine Operating Cost |

South Pit |

North Pit |

|

US$M |

US$/tFeed |

US$/t Conc. |

US$M/a |

US$/t Feed |

US$/t Conc. |

US$M/a |

US$/t Feed |

US$/t Conc. |

|

Mining |

661.4 |

|

15.1 |

|

20.1 |

|

31.3 |

|

17.9 |

|

23.1 |

|

24.6 |

|

14.0 |

|

18.9 |

|

|

Process |

343.0 |

|

7.8 |

|

10.4 |

|

13.9 |

|

7.9 |

|

10.3 |

|

13.6 |

|

7.8 |

|

10.5 |

|

|

Ship loading |

111.3 |

|

2.5 |

|

3.4 |

|

4.5 |

|

2.5 |

|

3.3 |

|

4.5 |

|

2.5 |

|

3.4 |

|

|

Tailings, Environment, Water |

15.7 |

|

0.4 |

|

0.5 |

|

0.6 |

|

0.4 |

|

0.5 |

|

0.6 |

|

0.4 |

|

0.5 |

|

|

G&A |

186.8 |

|

4.3 |

|

5.7 |

|

7.5 |

|

4.3 |

|

5.5 |

|

7.5 |

|

4.3 |

|

5.7 |

|

|

Fuel |

952.3 |

|

21.8 |

|

28.9 |

|

35.4 |

|

20.2 |

|

26.1 |

|

39.1 |

|

22.4 |

|

30.1 |

|

|

Total |

2,270.5 |

|

51.9 |

|

69.0 |

|

93.2 |

|

53.2 |

|

68.7 |

|

89.9 |

|

51.4 |

|

69.1 |

|

Note: Fuel is itemized separately and is not

included in mining, processing, ship loading or G&A costs.

Economic AnalysisThe results of

the economic analyses in this report represent forward-looking

information as defined under Canadian securities law. The results

are subject to several known and unknown risks, uncertainties and

other factors that may cause actual results to differ materially

from those presented here. See the section titled “Forward-Looking

Information” below for further details. Salient financial data of

the Farim Project is shown in Table 5.

Table 5: Financial Data (US$, Millions)

|

Description |

Life-of-Mine (US$M) |

|

Revenue |

6,497.2 |

|

|

Total Preproduction Capital |

308.3 |

|

|

Total All-in LOM Operating Costs (see below) |

2,332.1 |

|

|

Total Sustaining Capital (including Progressive Closure and Final

Closure Costs – See Below) |

467.1 |

|

|

Operating Margin Ratio (Operating Revenue / Operating Cost) |

2.8 |

|

|

Royalties |

129.9 |

|

|

Income Taxes |

714.8 |

|

|

Pre-Tax Cumulative Cash Flow |

3,259.8 |

|

|

After-Tax Cumulative Cash Flow |

2,545.0 |

|

|

Detail of Expenditures |

|

|

|

Total Operating Costs |

2,270.5 |

|

|

Total Other Costs (Corporate Overhead) |

61.7 |

|

|

Total All-in LOM Operating Costs |

2,332.1 |

|

|

|

|

|

|

Sustaining Capital Cost |

374.5 |

|

|

Sustaining Capital Cost – Progressive Closure |

80.0 |

|

|

Closure Capital Cost |

12.7 |

|

|

Total Sustaining Capital (including Progressive Closure and Final

Closure Costs) |

467.1 |

|

A sensitivity analysis was conducted on the

post-tax NPV, IRR and payback period of the project using the

following variables: revenue (P2O5 rock price), operating cost,

total capital cost, and fuel. The analysis revealed that the

project is most sensitive to changes in P2O5 rock price. The

after-tax NPV, IRR and Payback sensitivities to rock price is shown

in Table 6.

Table 6: After-Tax NPV, IRR and Payback Sensitivities to

Rock Price assumptions

|

|

|

Change in Rock Price |

|

|

Units |

-20% |

-10% |

Base case |

+10% |

+20% |

|

Average Rock Price |

US$/t |

$158.0 |

|

$177.7 |

|

$197.5 |

|

$217.2 |

|

$237.0 |

|

|

Net Present Value |

|

|

|

|

|

|

|

|

|

|

|

|

Discounted at 5% |

US$M |

$643 |

|

$896 |

|

$1,149 |

|

$1,402 |

|

$1,655 |

|

|

Discounted at 8% |

US$M |

$391 |

|

$570 |

|

$749 |

|

$929 |

|

$1,108 |

|

|

Discounted at 10% |

US$M |

$280 |

|

$426 |

|

$572 |

|

$718 |

|

$864 |

|

|

Discounted at 15% |

US$M |

$114 |

|

$207 |

|

$301 |

|

$394 |

|

$488 |

|

|

Internal Rate of Return |

% |

22.6% |

|

28.9% |

|

34.9% |

|

40.5% |

|

46.0% |

|

|

Payback Period |

years |

5.4 |

|

4.7 |

|

4.2 |

|

3.9 |

|

3.6 |

|

|

After tax NPV10/Initial Capex |

ratio |

0.9 |

|

1.4 |

|

1.9 |

|

2.3 |

|

2.8 |

|

|

Undiscounted cumulative net cashflow |

US$M |

$1,535 |

|

$2,040 |

|

$2,545 |

|

$3,050 |

|

$3,555 |

|

Environmental and Permitting

ConsiderationsThe Farim Phosphate Project lies within

Mining Lease License No. 004/2009 (“Mining Lease 004/2009”),

covering 30,625 hectares (“ha”), granted by the Government of

Guinea-Bissau on May 28, 2009 to GB Minerals AG (“GBMAG”). GBMAG is

registered in Switzerland and is a wholly owned subsidiary of

Itafos Farim Holdings, which is registered in the Cayman Islands.

Itafos Farim Holdings is 100% owned by Itafos Guinea-Bissau

Holdings, also registered in the Cayman Islands. Itafos

Guinea-Bissau Holdings is 100% owned by Itafos Inc., a corporation

headquartered in Delaware.

A Mining Agreement was negotiated and signed

between the Ministry of Energy and Natural Resources and GBMAG on

May 1, 2009. The Mining Agreement allowed for the subsequent

issuance of the following:

- Mining Lease 004/2009 was granted

by the Government of Guinea-Bissau to GBMAG for the exploration and

extraction of mining substances within the License Area with the

objective of commercializing them. The exclusive right of GBMAG to

perform mining operations within the license area is subject to the

payment of an annual license fee to the Government of Guinea-Bissau

and to reporting requirements.

- In addition to Mining Lease

004/2009, GB Minerals AG was granted on May 28, 2009, a mining

license, Mining License No. 001/2009 (“Mining License 001/2009”),

for a period of 25 years, giving it the exclusive right to; (i)

execute its mining operations within the License Area; (ii) erect

the equipment, installations and buildings necessary for the

extraction, transportation and treatment of minerals; (iii)

commercialize the minerals, inside or outside the national

territory; (iv) undertake prospecting activities; and (v) store or

discharge any mining product or waste.

- Since the initial mining license

term of 25 years is from 2009, Itafos is in the process of filing a

request with the Minister of Natural Resources of Guinea-Bissau for

a 25-year mining license term extension which effectively provides

a 25-year term from the issue of the request. A mining license and

a mining lease may be renewed repeatedly by the holder according to

the 2000 Mining Law.

GBMAG is in good standing on both the mining

lease and mining license.

Comprehensive environmental and social baseline

studies were conducted for the project from 2011 through 2015,

supporting an ESIA published by Knight Piésold in September 2015.

The 2015 ESIA for the project, as well as a subsequent ESIA for the

Buredanfa Resettlement Village, were approved by the Government of

Guinea-Bissau, according to a Declaração de Conformidade Ambiental

(Declaration of Environmental Compliance) issued to Itafos on

September 14, 2018.

Additional baseline studies were conducted from

2016 to 2019 in the areas of meteorology, air quality, noise,

groundwater resources, and groundwater and surface water quality to

establish an additional and contemporary pre-development baseline

record that can be used for comparison in future monitoring

programs.

Closure and Reclamation

ConsiderationsA preliminary Mine Reclamation and Closure

Plan (MRCP) and closure cost estimate has been prepared that meets

the requirements under Guinea-Bissau’s Mining and Minerals Law

1/2000. The MRCP adopts the International Finance Corporation’s

closure objectives in terms of protecting future public health and

safety; ensuring the after-use of the site is beneficial,

sustainable, and appropriate for the affected communities in the

long-term; minimizing adverse socioeconomic impacts; and maximizing

benefits.

The MRCP contemplates the progressive

rehabilitation of several facilities at the mine, including the

TSF, overburden waste dumps and the north and south open pits. The

south pit and most of the north pit will be backfilled with waste

overburden as part of operations.

At the Ponte Chugue Mineral Terminal, buildings,

machinery and equipment will be decommissioned and removed from the

site. Remediation will be undertaken, as required, so that the

Mineral Terminal site will be compatible with future commercial or

industrial land use.

Post-closure monitoring and maintenance will

take place for a period of at least 15 years to verify that the

site has been returned to a physically and chemically stable state

that is compatible with and capable of sustaining the agreed-upon

final land uses. Furthermore, the MRCP commits to developing

post-closure social management plans to address potential adverse

socioeconomic impacts of closure as part of the Company’s Community

Development Plan.

Social and Community

ConsiderationsKey social impacts that require management

include:

- Community health, safety, and

security – The project will interrupt the current flow of mostly

pedestrian and bicycle traffic between the regional service center

of Farim to villages and the west and north of the mine. In

addition, the presence of the mine and project traffic to and from

the mine will present safety hazards. Traffic safety and other

community health and safety risks will extend along the transport

route to the Mineral Terminal site.

- Risk of influx and associated

impacts – The presence of the mine may result in an influx of

people into the region, which will require management in

conjunction with the regional and national governments. The effects

can be far-reaching in terms of social unrest, overloading of

available public services and infrastructure, and causing increased

pressures on ecological resources. A Community Health, Safety and

Security Management Plan identifies these issues and proposes

preliminary mitigation measures that can be discussed with the

appropriate authorities.

- Involuntary resettlement – The

project will require the acquisition of approximately 3,000 ha of

land resulting in the physical and/or economic displacement of an

estimated 175 households in villages in the mine area. Candidate

host sites were identified, and a preferred site was selected at

Buredanfa, immediately northwest of the mine. A livelihoods

baseline and restoration strategy and resettlement action plan

(“RAP”) was also prepared in 2017. Because time has passed since

this work was completed, the communities that require resettlement

may have grown, and it will be necessary to conduct another land

and asset survey to update the RAP.

- Livelihood restoration – Other mine

project components, such as the truck loadout facility, highway

bypass around the town of Mansoa, and Mineral Terminal facility and

associated access road, will be positioned on lands held by others.

Compensation is planned as part of securing land tenure for these

areas, although no household resettlement is required.

- Cultural Heritage – Development of

the project will result in direct and unavoidable physical impacts

on the following cultural heritage resources:

- three cemeteries (one of high and

two of low sensitivity);

- two mosques (both of high

sensitivity);

- three sacred sites (one of high and

two of low sensitivity); and

- six archaeological sites (two of

medium and four of low sensitivity).

Risks and OpportunitiesProject

risks have been outlined in the feasibility study along with

mitigation plans to de-risk the project. Costs have been estimated

to a level of accuracy suitable for a feasibility study. Overall

economic risks include financing, price escalation, inflation,

commodity sales price variability, and general global economic

conditions. General technical risks include project construction

timeline, dewatering and water management, mining productivity,

achieving optimum P2O5 grade and recovery, and waste

management.

Geopolitical risk of operating in a relatively

underdeveloped region must be managed through ongoing local

engagement and responsible social practices.

Opportunities exist to de-risk the project or

improve economics which will be investigated further during the

detailed design stage. This includes connecting to the planned

Guinea-Bissau electrical grid and the option to trans-ship dried

concentrate using barges to offshore ships.

RecommendationsThe financial

analysis of the feasibility study demonstrates that the Farim

Project has robust economics, and it is recommended to continue

developing the project through detailed engineering and de-risking,

to support a construction decision. Analysis of the results of the

feasibility study suggests numerous recommendations for further

investigations to mitigate risks and/or improve the base case

designs. Costs associated with future recommendations are included

within the detailed design initial capital costs or operating

costs.

Recommended work for the next phase, based on

the feasibility study, include:

- Confirm that the dry density values

used are representative for future resource and reserve

estimations. Additional density measurements should be taken to

verify these values.

- A lack of geotechnical samples in

the vicinity of the East highwall of the South pit (“Area 4”) has

prevented a thorough evaluation of the liquefaction susceptibility

in this Area. Samples in Area 4 should be collected and screened

prior to excavation to evaluate the soil’s liquefaction

susceptibility.

- An important component of the slope

development will be to monitor the degree of pore pressure

reduction that has been achieved in the bench face that is being

excavated. This can be achieved by installation of piezometers or

pushed probes with pressure transducers into critical areas along

the pit slopes. Supplemental pumping wells or horizontal drains

will be needed where isolated pressurized zones are encountered.

Further studies should be done to advise the precise locations of

these piezometers for optimized performance.

- Conduct continuous phosphoric acid

plant tests to assess likely performance in an industrial plant.

Results from this test work will be used in product off-take

negotiations and is independent of the investment decision.

- Further evaluate tailings

thickening and dewatering to maximize achievable underflow density

and optimize thickener sizing.

- Complete additional tailings

characterization and settling test work to improve Tailings Storage

Facility design, including tailings settled dry density and

tailings entrainment among other design parameters.

- Additional closer spaced drilling

and testing of boreholes to determine the depth to bedrock,

continuity of clay and sandstone lenses with installation of more

vibrating wire piezometers (VWP) to monitor pressure heads in

different units, particularly in the vicinity of the pit walls

closest to planned infrastructure (Tailings Storage Facility,

overburden dumps).

- Update the transshipping trade-off

study to evaluate barge loading to offshore ships. This includes

updating the costs from the previously performed work,

re-evaluating barge, vessel requirements and throughput, updating

the social impacts, and overall project benefits.

- The Resettlement Action Plan should

be updated following completion of an updated land and asset

survey.

- The Biodiversity Management Plan

should be updated based on updated biodiversity surveys.

- The project should seek the renewal

of the Declaration of Environmental Compliance from the Competent

Environmental Assessment Authority.

Each recommendation is independent and is not

contingent on the other recommendations.

Farim Technical Report and Qualified

PersonsThe Farim Technical Report, prepared in accordance

with NI 43-101, will be filed on SEDAR (www.sedar.com) within 45

days. Readers are encouraged to read the Farim Technical Report in

its entirety once it is available, including all qualifications,

assumptions and exclusions that relate to the feasibility study.

The Farim Technical Report is intended to be read as a whole, and

sections should not be read, or relied upon, out of context.

Scientific and technical information contained

in this news release was reviewed and verified by:

- Tommaso Roberto Raponi, P. Eng,

Ausenco Engineering Canada Inc., Processing, infrastructure, hybrid

power plans and truck loadout facility

- Dr. Francisco J. Sotillo, P.E.,

KEMWorks Technology Inc., Metallurgy

- Jerry DeWolfe, P.Geo, WSP Canada

Inc. (formerly WSP Golder), Geology and Mineral Resource

- Terry L. Kremmel, P.E. WSP USA Inc.

(formerly WSP Golder), Mineral Reserve and mining methods

- Alex Duggan, P.Eng, Kristal Font,

Economic Analysis and review of capital and operating cost

estimates

- Ed Liegel, P.E., Baird, Mineral

Terminal

- Richard Michael Elmer, C.Eng. MIMMM

MCSM, Knight Piésold Ltd., Geotechnical and all other

infrastructure but excluding the hybrid power plants, truck loadout

facility and the Mineral Terminal

- Richard Cook, P.Geo, Knight Piésold

Ltd, Environmental and permitting, closure and reclamation plans,

and social and community considerations.

Each of these persons is a “Qualified Person” as

defined by NI 43-101 for this Project and have the ability and

authority to verify the authenticity and validity of the data and

is independent from the Company. Each of these QP’s has reviewed

and verified the respective scientific and technical disclosure

contained in this news release.

Further information about the Farim Project,

including a description of the key assumptions, parameters,

description of sampling methods, data verification and QA/QC

programs, methods relating to resources and reserves and factors

that may affect those estimates will be contained in the Farim

Technical Report.

About Itafos

The Company is a phosphate and specialty fertilizer company. The

Company’s businesses and projects are as follows:

- Conda – a vertically integrated phosphate fertilizer business

located in Idaho, US with production capacity as follows:

- approximately 550 kt per year of monoammonium phosphate

(“MAP”), MAP with micronutrients (“MAP+”), superphosphoric acid

(“SPA”), merchant grade phosphoric acid (“MGA”) and ammonium

polyphosphate (“APP”); and

- approximately 27 kt per year of hydrofluorosilicic acid

(“HFSA”);

- Arraias – a vertically integrated phosphate fertilizer business

located in Tocantins, Brazil with production capacity as follows:

- approximately 500 kt per year of single superphosphate (“SSP”)

and SSP with micronutrients (“SSP+”); and

- approximately 40 kt per year of excess sulfuric acid (220 kt

per year gross sulfuric acid production capacity);

- Farim – a high-grade phosphate mine project located in Farim,

Guinea-Bissau;

- Santana – a vertically integrated high-grade phosphate mine and

fertilizer plant project located in Pará, Brazil; and

- Araxá – a vertically integrated rare earth elements and niobium

mine and extraction plant project located in Minas Gerais,

Brazil.

In addition to the businesses and projects described above, the

Company also owns Mantaro (Junin, Peru), a phosphate mine project

that is in the process of being wound down.

The Company is a Delaware corporation that is headquartered in

Houston, TX. The Company’s shares trade on the TSX Venture Exchange

(“TSX-V”) under the ticker symbol “IFOS”. The Company’s principal

shareholder is CL Fertilizers Holding LLC (“CLF”). CLF is an

affiliate of Castlelake, L.P., a global private investment

firm.

For more information, or to join the Company’s mailing list to

receive notification of future news releases, please visit the

Company’s website at www.itafos.com.

Forward-Looking Information

Certain information contained in this news

release constitutes forward-looking information (“FLI”). Except for

statements of historical fact relating to the Company, information

contained herein may constitute FLI, including any information

related to: the successful development of the Farim Project;

capital expenditures; operating costs; sustaining capital

requirements; after-tax NPV and sensitivity analyses; cash flows

and IRR; estimates of mineral resources and mineral reserves;

development of mineral resources and mineral reserves; government

regulation of mining operations and treatment under governmental

and taxation regimes; future price of commodities, including

phosphate; realization of mineral resources and mineral reserves

estimates, including whether mineral resources will ever be

developed into mineral reserves and information and underlying

assumptions related thereto; timing and amount of future

production; currency exchange and interest rates; expected outcome

and timing of environmental surveys and permit applications and

other environmental and social matters; expected expenditures to be

made by the Company; timing, cost, quantity, capacity and product

quality of production at the Project; and the ability to achieve

capital cost efficiencies. The use of any of the words “intend”,

“anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”,

“will”, “project”, “should”, “would”, “believe”, “predict” and

“potential” and similar expressions are intended to identify

forward-looking information.

The FLI contained in this news release is based

on the opinions, assumptions and estimates of management set out

herein, which management believes are reasonable as at the date the

statements are made. Those opinions, assumptions and estimates are

inherently subject to a variety of risks and uncertainties and

other known and unknown factors that could cause actual events or

results to differ materially from those projected in the FLI. These

include the Company’s expectations and assumptions with respect to

the following: commodity prices; operating results; safety risks;

changes to the Company’s mineral reserves and resources; risk that

timing of expected permitting will not be met; changes to mine

development and completion; foreign operations risks; changes to

regulation; environmental risks; the impact of adverse weather and

climate change; general economic changes, including inflation and

foreign exchange rates; the actions of the Company’s competitors

and counterparties; financing, liquidity, credit and capital risks;

the loss of key personnel; impairment risks; cybersecurity risks;

risks relating to transportation and infrastructure; changes to

equipment and suppliers; adverse litigation; changes to permitting

and licensing; loss of land title and access rights; changes to

insurance and uninsured risks; the potential for malicious acts;

market volatility; changes to technology; changes to tax laws; the

risk of operating in foreign jurisdictions; and the risks posed by

a controlling shareholder and other conflicts of interest. Readers

are cautioned that the foregoing list of risks, uncertainties and

assumptions is not exhaustive.

Although the Company has attempted to identify

crucial factors that could cause actual actions, events or results

to differ materially from those described in FLI, there may be

other factors that cause actions, events or results not to be as

anticipated, estimated or intended. There can be no assurance that

FLI will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such information.

The reader is cautioned not to place undue reliance on FLI. The

Company undertakes no obligation to update forward-looking

statements if circumstances or management’s estimates, assumptions

or opinions should change, except as required by applicable

securities law. Risks and uncertainties affecting the FLI contained

in this news release are described in greater detail in the

Company’s current Annual Information Form and current Management’s

Discussion and Analysis available under the Company’s profile on

SEDAR at www.sedar.com and on the Company’s website at

www.itafos.com. The FLI included in this news release is expressly

qualified by this cautionary statement and is made as of the date

of this news release.

NEITHER THE TSX-V NOR ITS REGULATION SERVICES PROVIDER (AS THAT

TERM IS DEFINED IN THE POLICIES OF THE TSX-V) ACCEPTS

RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS

RELEASE.

For further information, please contact:

Matthew O’NeillItafos Investor

Relationsinvestor@itafos.com713-242-8446

Cautionary Note Regarding Mineral Resource and Mineral

Reserve Estimates

This press release uses Mineral Reserve and

Mineral Resource classification terms that comply with reporting

standards set forth in NI 43-101 for all public disclosure of

scientific and technical information concerning mineral projects by

Canadian registered issuers. NI 43- 101 standards differ

significantly from standards set forth by the United States

Securities and Exchange Commission (“SEC”). Therefore, information

regarding mineralization presented herein may not be directly

comparable to similar information disclosed by companies in

accordance with SEC standards. For instance, Mineral Reserve

estimates contained in this presentation may not qualify as

“reserves” under SEC standards. The reader is cautioned not to

assume that any part or all of the Mineral Resources identified as

“Mineral Resources,” “Measured Mineral Resources,” “Indicated

Mineral Resources” and “Inferred Mineral Resources” in this

presentation will ever be converted into Mineral Reserves as

defined in NI 43-101, be upgraded to a higher category, or be

economically or legally mineable.

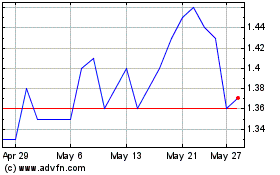

Itafos (TSXV:IFOS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Itafos (TSXV:IFOS)

Historical Stock Chart

From Jan 2024 to Jan 2025