Itafos Inc. (TSX-V: IFOS) (the “Company”) reported today its Q1

2024 financial and operational highlights. The Company’s financial

statements and management’s discussion and analysis for the quarter

ended March 31, 2024 are available under the Company’s profile at

www.sedarplus.ca and on the Company’s website at www.itafos.com.

All figures are in thousands of US Dollars except as otherwise

noted.

CEO Commentary

“We are pleased to report another quarter of

strong operational and financial performance. For the three months

ended March 31, 2024, we reported revenues of $128.0 million, 7%

higher than Q1 2023 driven by increased sales volumes, and adjusted

EBITDA of $43.2 million.

During Q1 2024, we have continued to make

progress on a number of key initiatives related to the company’s

asset portfolio. On April 29, 2024 we released our updated NI

43-101 Technical Report for Conda, confirming our 2037 mine life

for the Husky 1 / North Dry Ridge (“H1/NDR) mine. We also acquired

the Dry Ridge lease that is adjacent to Husky 1 and continued work

on the build-out of infrastructure associated with the H1/NDR

project which remains on schedule and on budget.

In Brazil, we continue to make progress on our

Fertilizer Restart Program and commissioning has commenced

associated with our Partially Acidulated Phosphate Rock (“PAPR”)

product. Additionally, we successfully negotiated a 25-year

extension to the mining contract and mining lease associated with

the Farim asset, which is now valid until 2048.

Finally, the process to explore and evaluate

various strategic alternatives to enhance value for all Itafos

shareholders has concluded without an announced transaction. The

Board of Directors and the management team have and will continue

to operate the business with the objective of creating shareholder

value and will review strategic opportunities as they arise.” said

G. David Delaney, CEO of Itafos.

Q1 2024 Key Highlights

- revenues of $128.0 million

- Adjusted EBITDA of $43.2 million1

- net income of $23.7 million

- basic earnings of C$ 0.17/share

- free cash flow of $17.7 million1

March 31, 2024 Key

Highlights

- trailing 12 months Adjusted EBITDA of $132.0 million1

- net debt of $47.1 million1

- net leverage ratio of 0.4x1

Maintained FY 2024 Guidance

- sales volumes guidance of 320-340 thousands of tonnes

P2O52

- corporate selling, general and administrative expenses guidance

of $17-20 million1

- maintenance capex guidance of $25-35 million1

- growth capex guidance of $35-46 million1

Q1 2024 Market Highlights

Monoammonium phosphate (“MAP”) New Orleans

(“NOLA”) prices averaged $624/st in Q1 2024 compared to $580/st in

Q1 2023, up 8% year-over-year. Specific factors driving the

year-over-year increase in MAP NOLA were as follows:

- the tightening of MAP supply into the North American market;

and

- minor increase in on farm MAP application in the spring of

2024.

Q1 2024 Financial

Highlights

For Q1 2024, the Company’s financial highlights

were as follows:

- revenues of $128.0 million in Q1 2024 compared to $119.6

million in Q1 2023;

- Adjusted EBITDA of $43.2 million in Q1 2024 compared to $43.0

million in Q1 2023;

- net income of $23.7 million in Q1 2024 compared to $28.2

million in Q1 2023;

- basic earnings of C$0.17/share in Q1 2024 compared to

C$0.20/share in Q1 2023; and

- free cash flow of $17.7 million in Q1 2024 compared to $18.8

million in Q1 2023.

The company’s Adjusted EBITDA performance was

flat compared to the corresponding period in the prior year. The

reduction in the Company’s Q1 2024 net income compared to Q1 2023

was primarily due to higher income taxes, partially offset by lower

selling, general, and administrative expenses and finance

expenses.

The Company’s total capex3 spend in Q1 2024 was

$6.4 million compared to $2.8 million in Q1 2023 with the increase

primarily due to development activities at H1/NDR at Conda and

activities related to the Fertilizer Restart Program at

Arraias.

March 31, 2024 Highlights

As at March 31, 2024, the Company had trailing

12 months Adjusted EBITDA of $132.0 million compared to $131.8

million at the end of 2023.

As at March 31, 2024, the Company had net debt

of $47.1 million compared to $61.3 million at the end of 2023, with

the reduction due to the repayment of principal debt outstanding

from free cash flows generated and higher cash and cash

equivalents. The Company’s net debt as at March 31, 2024 was

comprised of $37.7 million in cash and $84.8 million in debt (gross

of deferred financing costs). As at March 31, 2024 and December 31,

2023, the Company’s net leverage ratio was 0.4x and 0.5x,

respectively.

As at March 31, 2024, the Company had liquidity4

of $74.2 million comprised of $37.7 million in cash and $36.5

million in undrawn borrowing capacity under its $80 million

asset-based revolving credit facility (the “ABL Facility”).

Q1 2024 Operational

Highlights

Environmental, Health, and Safety (“EHS”)

§ Sustained EHS performance, including no

reportable environmental releases and three recordable incidents,

which resulted in a consolidated TRIFR of 0.88.

Conda

- Produced 90,246 tonnes P2O5 at Conda in Q1 2024 compared to

82,145 tonnes P2O5 in Q1 2023 with the increase primarily due to

higher throughput in 2024;

- Generated revenues of $122.8 million at Conda in Q1 2024

compared to $116.0 million in Q1 2023 with the increase primarily

due to higher sales volumes, partially offset by lower realized

prices; and

- Generated Adjusted EBITDA at Conda of $46.6 million in Q1 2024

compared to $47.5 million in Q1 2023 with the decrease primarily

due to lower realized prices, which were partially offset by higher

sales volumes.

Q1 2024 Other Highlights

- Produced 33,216 tonnes of sulfuric acid at Arraias in Q1 2024

compared to 20,614 tonnes in Q1 2023 with the increase due to

higher customer demand; and

- Generated Adjusted EBITDA at Arraias of $0.4 million in Q1 2024

compared to $0.2 million in Q1 2023 with the increase due to higher

sulfuric acid and DAPR sales volumes.

Market Outlook

Prices in Q1 2024 were comparable to prices in

2023. Phosphate application through the fall of 2023 and now into

the spring of 2024 has remained strong, supporting higher prices

despite softer crop prices. Moving forward, the Company expects a

softening in Q2 in pricing due to seasonal factors including a

summer reset and lower crop prices. Expectations of supply

adjustments in the overall phosphate import market into North

America continue to create some uncertainty in the market going

forward.

Specific factors the Company expects to support

pricing in the global phosphate fertilizer markets through the end

of 2024 are as follows:

- low inventory levels in the North American market and continued

strength in global demand;

- ongoing export restrictions from China; partially offset

by

- constructive crop prices that have softened from historical

highs.

Financial Outlook

The Company maintained its guidance for 2024 as

follows:

|

(in millions of US Dollars |

|

|

|

Projected |

| except

as otherwise noted) |

|

|

|

FY 2024 |

|

Sales Volumes (thousands of tonnes P2O5) |

|

|

|

320-340 |

|

Corporate selling, general and administrative expenses |

|

|

|

$17-20 |

|

Maintenance capex |

|

|

|

$25-35 |

|

Growth capex |

|

|

|

$35-46 |

Business Outlook

The Company continues to focus on the following

key objectives to drive long-term value and shareholder

returns:

- improving financial and operational performance; and

- executing on the infrastructure and civil works required for

the mine development for H1/NDR.

About Itafos

The Company is a phosphate and specialty

fertilizer company. The Company’s businesses and projects are:

- Conda – a vertically integrated phosphate fertilizer business

located in Idaho, US with production capacity as follows:

- approximately 550kt per year of monoammonium phosphate (“MAP”),

MAP with micronutrients (“MAP+”), superphosphoric acid (“SPA”),

merchant grade phosphoric acid (“MGA”) and ammonium polyphosphate

(“APP”); and

- approximately 27kt per year of hydrofluorosilicic acid

(“HFSA”);

- Arraias – a vertically integrated phosphate fertilizer business

located in Tocantins, Brazil with production capacity as follows:

- approximately 500kt per year of single superphosphate (“SSP”)

and SSP with micronutrients (“SSP+”); and

- approximately 40kt per year of excess sulfuric acid (220kt per

year gross sulfuric acid production capacity);

- Farim – a high-grade phosphate mine project located in Farim,

Guinea-Bissau;

- Santana – a vertically integrated high-grade phosphate mine and

fertilizer plant project located in Pará, Brazil; and

- Araxá – a vertically integrated rare earth elements and niobium

mine and extraction plant project located in Minas Gerais,

Brazil.

The Company is a Delaware corporation that is

headquartered in Houston, TX. The Company’s shares trade on the TSX

Venture Exchange (“TSX-V”) under the ticker symbol “IFOS”. The

Company’s principal shareholder is CL Fertilizers Holding LLC

(“CLF”). CLF is an affiliate of Castlelake, L.P., a global private

investment firm.

For more information, or to join the Company’s

mailing list to receive notification of future news releases,

please visit the Company’s website at www.itafos.com.

Forward-Looking Information

Certain information contained in this news

release constitutes forward-looking information, including

statements with respect to: the Company’s planned operations and

strategies; the timing for the commencement of operations,

infrastructure and civil works at H1 / NDR; the expected resource

life of H1 / NDR; the Fertilizer Restart Program at Arraias; and

economic and market trends with respect to the global agriculture

and phosphate fertilizer markets. All information other than

information of historical fact is forward-looking information.

Statements that address activities, events or developments that the

Company believes, expects or anticipates will or may occur in the

future include, but are not limited to, statements regarding

estimates and/or assumptions in respect of the Company’s financial

and business outlook are forward-looking information. The use of

any of the words “intend”, “anticipate”, “plan”, “continue”,

“estimate”, “expect”, “may”, “will”, “project”, “should”, “would”,

“believe”, “predict” and “potential” and similar expressions are

intended to identify forward-looking information.

The forward-looking information contained in

this news release is based on the opinions, assumptions and

estimates of management set out herein, which management believes

are reasonable as at the date the statements are made. Those

opinions, assumptions and estimates are inherently subject to a

variety of risks and uncertainties and other known and unknown

factors that could cause actual events or results to differ

materially from those projected in the forward-looking information.

These include the Company’s expectations and assumptions with

respect to the following: commodity prices; operating results;

safety risks; changes to the Company’s mineral reserves and

resources; risk that timing of expected permitting will not be met;

changes to mine development and completion; foreign operations

risks; changes to regulation; environmental risks; the impact of

weather and climate change; risks related to asset retirement

obligations, general economic changes, including inflation and

foreign exchange rates; the actions of the Company’s competitors

and counterparties; financing, liquidity, credit and capital risks;

the loss of key personnel; impairment risks; cybersecurity risks;

risks relating to transportation and infrastructure; changes to

equipment and suppliers; concentration risks, adverse litigation;

changes to permitting and licensing; geo-political risks; loss of

land title and access rights; changes to insurance and uninsured

risks; the potential for malicious acts; market and stock price

volatility; changes to technology, innovation or artificial

intelligence; changes to tax laws; the risk of operating in foreign

jurisdictions; the risks posed by a controlling shareholder and

other conflicts of interest; risks related to reputational damage,

the risk associated with epidemics, pandemics and public health;

the risks associated with environmental justice; and any risks

related to internal controls over financial reporting risks.

Readers are cautioned that the foregoing list of risks,

uncertainties and assumptions is not exhaustive.

Although the Company has attempted to identify

crucial factors that could cause actual actions, events or results

to differ materially from those described in forward-looking

information, there may be other factors that cause actions, events

or results not to be as anticipated, estimated or intended.

Additional risks and uncertainties affecting the forward-looking

information contained in this news release are described in greater

detail in the Company’s Annual Information Form and current

Management’s Discussion and Analysis available under the Company’s

profile on SEDAR+ at www.sedarplus.ca and on the Company’s website

at www.itafos.com. There can be no assurance that forward-looking

information will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

information. The reader is cautioned not to place undue reliance on

forward-looking information. The Company undertakes no obligation

to update forward-looking statements if circumstances or

management’s estimates, assumptions or opinions should change,

except as required by applicable securities law. The

forward-looking information included in this news release is

expressly qualified by this cautionary statement and is made as of

the date of this news release.

This news release contains future-oriented

financial information and financial outlook information (together,

“FOFI”) about the Company’s prospective results of operations,

including statements regarding expected adjusted EBITDA, net

income, basic earnings per share, maintenance capex, growth capex

and free cash flow. FOFI is subject to the same assumptions, risk

factors, limitations and qualifications as set forth in the above

paragraph. The Company has included the FOFI to provide an outlook

of management’s expectations regarding anticipated activities and

results, and such information may not be appropriate for other

purposes. The Company and management believe that the FOFI has been

prepared on a reasonable basis, reflecting management’s reasonable

estimates and judgements; however, actual results of operations and

the resulting financial results may vary from the amounts set forth

herein. Any financial outlook information speaks only as of the

date on which it is made and the Company undertakes no obligation

to publicly update or revise any financial outlook information

except as required by applicable securities laws.

NEITHER THE TSX-V NOR ITS REGULATION SERVICES

PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX-V)

ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS

RELEASE.

For further information, please

contact:

Matthew O’NeillItafos Investor

Relationsinvestor@itafos.com713-242-8446

Scientific and Technical

Information

The scientific and technical information

contained in this news release related to Mineral Resources for

Conda and Farim has been reviewed and approved by Jerry DeWolfe,

Professional Geologist (P.Geo.) with the Association of

Professional Engineers and Geoscientists of Alberta. Mr. DeWolfe is

a full-time employee of WSP Canada Inc. and is independent of the

Company. The scientific and technical information contained in this

news release related to Mineral Reserves for Conda and Farim has

been reviewed and approved by Terry Kremmel, Professional Engineer

(P.E.) licensed by the States of Missouri and North Carolina. Mr.

Kremmel is a full-time employee of WSP USA, Inc. and is independent

of the Company. The Company’s latest technical report in respect of

Conda is entitled, “NI 43-101 Technical Report Itafos Conda

Project, Idaho, USA,” with an effective date of July 1, 2023 (the

“Conda Technical Report”) and is available under the Company’s

website at www.itafos.com and under the Company’s profile on SEDAR+

at www.sedarplus.ca

Non-IFRS Financial Measures

This press release contains both International

Financial Reporting Standards (“IFRS”) and certain non-IFRS

measures that management considers to evaluate the Company’s

operational and financial performance. Non-IFRS measures are a

numerical measure of a company’s performance, that either include

or exclude amounts that are not normally included or excluded from

the most directly comparable IFRS measures. Management believes

that the non-IFRS measures provide useful supplemental information

to investors, analysts, lenders and others. In evaluating non-IFRS

measures, investors, analysts, lenders and others should consider

that non-IFRS measures do not have any standardized meaning under

IFRS and that the methodology applied by the Company in calculating

such non-IFRS measures may differ among companies and analysts.

Non-IFRS measures should not be considered as a substitute for, nor

superior to, measures of financial performance prepared in

accordance with IFRS. Definitions and reconciliations of non-IFRS

measures to the most directly comparable IFRS measures are included

below.

DEFINITIONS

The Company defines its non-IFRS measures as

follows:

|

Non-IFRS measure |

Definition |

Most directly comparable IFRS measure |

Why the Company uses the measure |

|

EBITDA |

Earnings before interest, taxes, depreciation, depletion and

amortization |

Net income (loss) and operating income (loss) |

EBITDA is a valuable indicator of the Company’s ability to generate

operating income |

|

Adjusted EBITDA |

EBITDA adjusted for non-cash, extraordinary, non-recurring and

other items unrelated to the Company’s core operating

activities |

Net income (loss) and operating income (loss) |

Adjusted EBITDA is a valuable indicator of the Company’s ability to

generate operating income from its core operating activities

normalized to remove the impact of non-cash, extraordinary and

non-recurring items. The Company provides guidance on Adjusted

EBITDA as useful supplemental information to investors, analysts,

lenders, and others |

|

Trailing 12 months Adjusted EBITDA |

Adjusted EBITDA for the current and preceding three quarters |

Net income (loss) and operating income (loss) for the current and

preceding three quarters |

The Company uses the trailing 12 months Adjusted EBITDA in the

calculation of the net leverage ratio (non-IFRS measure) |

|

Total capex |

Additions to property, plant, and equipment and mineral properties

adjusted for additions to asset retirement obligations, additions

to right-of-use assets and capitalized interest |

Additions to property, plant and equipment and mineral

properties |

The Company uses total capex in the calculation of total cash capex

(non-IFRS measure) |

|

Maintenance capex |

Portion of total capex relating to the maintenance of ongoing

operations |

Additions to property, plant and equipment and mineral

properties |

Maintenance capex is a valuable indicator of the Company’s required

capital expenditures to sustain operations at existing levels |

|

Growth capex |

Portion of total capex relating to the development of growth

opportunities |

Additions to property, plant and equipment and mineral

properties |

Growth capex is a valuable indicator of the Company’s capital

expenditures related to growth opportunities. |

|

Net debt |

Debt less cash and cash equivalents plus deferred financing costs

(does not consider lease liabilities) |

Current debt, long-term debt and cash and cash equivalents |

Net debt is a valuable indicator of the Company’s net debt position

as it removes the impact of deferring financing costs. |

|

Net leverage ratio |

Net debt divided by trailing 12 months Adjusted EBITDA |

Current debt, long-term debt and cash and cash equivalents; net

income (loss) and operating income (loss) for the current and

preceding three quarters |

The Company’s net leverage ratio is a valuable indicator of its

ability to service its debt from its core operating

activities. |

|

Liquidity |

Cash and cash equivalents plus undrawn committed borrowing

capacity |

Cash and cash equivalents |

Liquidity is a valuable indicator of the Company’s liquidity |

|

Free cash flow |

Cash flows from operating activities, which excludes payment of

interest expense, plus cash flows from investing activities |

Cash flows from operating activities and cash flows from investing

activities |

Free cash flow is a valuable indicator of the Company’s ability to

generate cash flows from operations after giving effect to required

capital expenditures to sustain operations at existing levels. Free

cash flow is a valuable indicator of the Company’s cash flow

available for debt service or to fund growth opportunities. The

Company provides guidance on free cash flow as useful supplemental

information to investors, analysts, lenders, and others. |

|

Corporate selling, general and administrative expenses |

Corporate selling, general and administrative less share-based

payment expense. |

Selling, general and administrative expenses |

The Company uses corporate selling, general and administrative

expenses to assess corporate performance. |

EBITDA, ADJUSTED EBITDA AND TRAILING 12

MONTHS ADJUSTED EBITDA

For the three months ended

March 31, 2024 and 2023

For the three months ended March 31, 2024,

the Company had EBITDA and Adjusted EBITDA by segment as

follows:

|

(unaudited in thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Development and exploration |

|

|

Corporate |

|

|

Total |

|

|

Net income (loss) |

|

$ |

29,512 |

|

|

$ |

277 |

|

|

$ |

(193 |

) |

|

$ |

(5,879 |

) |

|

$ |

23,717 |

|

| Finance

(income) expense, net |

|

|

1,433 |

|

|

|

(252 |

) |

|

|

1 |

|

|

|

2,387 |

|

|

|

3,569 |

|

| Current

and deferred income tax expense (recovery) |

|

|

6,484 |

|

|

|

— |

|

|

|

— |

|

|

|

(2,330 |

) |

|

|

4,154 |

|

|

Depreciation and depletion |

|

|

8,926 |

|

|

|

701 |

|

|

|

5 |

|

|

|

85 |

|

|

|

9,717 |

|

|

EBITDA |

|

$ |

46,355 |

|

|

$ |

726 |

|

|

$ |

(187 |

) |

|

$ |

(5,737 |

) |

|

$ |

41,157 |

|

|

Unrealized foreign exchange (gain) loss |

|

|

— |

|

|

|

611 |

|

|

|

(67 |

) |

|

|

— |

|

|

|

544 |

|

|

Share-based payment expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

422 |

|

|

|

422 |

|

|

Transaction costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

227 |

|

|

|

227 |

|

|

Non-recurring compensation expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,560 |

|

|

|

1,560 |

|

| Other

(income) expense, net |

|

|

211 |

|

|

|

(955 |

) |

|

|

1 |

|

|

|

— |

|

|

|

(743 |

) |

|

Adjusted EBITDA |

|

$ |

46,566 |

|

|

$ |

382 |

|

|

$ |

(253 |

) |

|

$ |

(3,528 |

) |

|

$ |

43,167 |

|

|

(unaudited in thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Development and exploration |

|

|

Corporate |

|

|

Total |

|

|

Operating income (loss) |

|

$ |

37,637 |

|

|

$ |

(319 |

) |

|

$ |

(258 |

) |

|

$ |

(5,822 |

) |

|

$ |

31,238 |

|

| Depreciation and

depletion |

|

|

8,926 |

|

|

|

701 |

|

|

|

5 |

|

|

|

85 |

|

|

|

9,717 |

|

| Realized foreign exchange

loss |

|

|

3 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3 |

|

| Share-based payment

expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

422 |

|

|

|

422 |

|

| Transaction costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

227 |

|

|

|

227 |

|

| Non-recurring compensation

expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,560 |

|

|

|

1,560 |

|

|

Adjusted EBITDA |

|

$ |

46,566 |

|

|

$ |

382 |

|

|

$ |

(253 |

) |

|

$ |

(3,528 |

) |

|

$ |

43,167 |

|

For the three months ended March 31, 2023,

the Company had EBITDA and Adjusted EBITDA by segment as

follows:

|

(unaudited in thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Development and exploration |

|

|

Corporate |

|

|

Total |

|

|

Net income (loss) |

|

$ |

27,985 |

|

|

$ |

(248 |

) |

|

$ |

70 |

|

|

$ |

400 |

|

|

$ |

28,207 |

|

| Finance

(income) expense, net |

|

|

1,702 |

|

|

|

(136 |

) |

|

|

84 |

|

|

|

3,836 |

|

|

|

5,486 |

|

| Current

and deferred income tax expense (recovery) |

|

|

8,416 |

|

|

|

— |

|

|

|

— |

|

|

|

(12,598 |

) |

|

|

(4,182 |

) |

|

Depreciation and depletion |

|

|

9,384 |

|

|

|

681 |

|

|

|

3 |

|

|

|

47 |

|

|

|

10,115 |

|

|

EBITDA |

|

$ |

47,487 |

|

|

$ |

297 |

|

|

$ |

157 |

|

|

$ |

(8,315 |

) |

|

|

39,626 |

|

|

Unrealized foreign exchange (gain) loss |

|

|

— |

|

|

|

(76 |

) |

|

|

(401 |

) |

|

|

488 |

|

|

|

11 |

|

|

Share-based payment expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,700 |

|

|

|

2,700 |

|

|

Transaction costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

711 |

|

|

|

711 |

|

| Other

income |

|

|

(17 |

) |

|

|

(32 |

) |

|

|

(38 |

) |

|

|

— |

|

|

|

(87 |

) |

|

Adjusted EBITDA |

|

$ |

47,470 |

|

|

$ |

189 |

|

|

$ |

(282 |

) |

|

$ |

(4,416 |

) |

|

$ |

42,961 |

|

|

(unaudited in thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Development and exploration |

|

|

Corporate |

|

|

Total |

|

|

Operating income (loss) |

|

$ |

38,088 |

|

|

$ |

(492 |

) |

|

$ |

(285 |

) |

|

$ |

(7,875 |

) |

|

$ |

29,436 |

|

|

Depreciation and depletion |

|

|

9,384 |

|

|

|

681 |

|

|

|

3 |

|

|

|

47 |

|

|

|

10,115 |

|

| Realized

foreign exchange gain |

|

|

(2 |

) |

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

(1 |

) |

|

Share-based payment expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,700 |

|

|

|

2,700 |

|

|

Transaction costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

711 |

|

|

|

711 |

|

|

Adjusted EBITDA |

|

$ |

47,470 |

|

|

$ |

189 |

|

|

$ |

(282 |

) |

|

$ |

(4,416 |

) |

|

$ |

42,961 |

|

As at March 31, 2024 and

2022

As at March 31, 2024 and December 31, 2023 the

Company had trailing 12 months Adjusted EBITDA as follows:

|

(unaudited in thousands of US Dollars) |

March 31, 2024 |

|

|

December 31, 2023 |

|

|

For the three months ended March 31, 2024 |

$ |

43,167 |

|

|

$ |

— |

|

| For the

three months ended December 31, 2023 |

|

29,509 |

|

|

|

29,509 |

|

| For the

three months ended September 30, 2023 |

|

19,655 |

|

|

|

19,655 |

|

| For the

three months ended June 30, 2023 |

|

39,677 |

|

|

|

39,677 |

|

| For the

three months ended March 31, 2023 |

|

— |

|

|

|

42,961 |

|

|

Trailing 12 months Adjusted EBITDA |

$ |

132,008 |

|

|

$ |

131,802 |

|

TOTAL CAPEX

For the three months ended March 31,

2024 and 2023

For the three months ended March 31, 2024, the

Company had capex by segment as follows:

|

(unaudited in thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Development and exploration |

|

|

Corporate |

|

|

Total |

|

|

Additions to property, plant and equipment |

|

$ |

(1,443 |

) |

|

$ |

1,109 |

|

|

$ |

(1 |

) |

|

$ |

— |

|

|

$ |

(335 |

) |

| Additions to mineral

properties |

|

|

3,762 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,762 |

|

| Additions to asset retirement

obligations |

|

|

2,987 |

|

|

|

177 |

|

|

|

— |

|

|

|

— |

|

|

|

3,164 |

|

| Additions to right-of-use

assets |

|

|

— |

|

|

|

(162 |

) |

|

|

1 |

|

|

|

— |

|

|

|

(161 |

) |

| Total

capex |

|

$ |

5,306 |

|

|

$ |

1,124 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

6,430 |

|

| Accrued capex |

|

|

(2,054 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,054 |

) |

| Total cash

capex |

|

$ |

3,252 |

|

|

$ |

1,124 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

4,376 |

|

| Maintenance capex |

|

$ |

419 |

|

|

$ |

408 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

827 |

|

| Accrued maintenance capex |

|

|

(179 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(179 |

) |

| Cash maintenance

capex |

|

$ |

240 |

|

|

$ |

408 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

648 |

|

| Growth capex |

|

$ |

4,887 |

|

|

$ |

716 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

5,603 |

|

| Accrued growth capex |

|

|

(1,875 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,875 |

) |

|

Cash growth capex |

|

$ |

3,012 |

|

|

$ |

716 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

3,728 |

|

For the three months ended March 31, 2023,

the Company had capex by segment as follows:

|

(unaudited in thousands of US Dollars) |

|

Conda |

|

|

Arraias |

|

|

Development and exploration |

|

|

Corporate |

|

|

Total |

|

|

Additions to property, plant and equipment |

|

$ |

8,251 |

|

|

$ |

(799 |

) |

|

$ |

— |

|

|

$ |

9 |

|

|

$ |

7,461 |

|

| Additions to mineral

properties |

|

|

694 |

|

|

|

881 |

|

|

|

72 |

|

|

|

— |

|

|

|

1,647 |

|

| Additions to asset retirement

obligations |

|

|

(6,181 |

) |

|

|

(56 |

) |

|

|

— |

|

|

|

— |

|

|

|

(6,237 |

) |

| Additions to right-of-use

assets |

|

|

— |

|

|

|

(22 |

) |

|

|

— |

|

|

|

— |

|

|

|

(22 |

) |

| Total

capex |

|

$ |

2,764 |

|

|

$ |

4 |

|

|

$ |

72 |

|

|

$ |

9 |

|

|

$ |

2,849 |

|

| Accrued capex |

|

|

(611 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(611 |

) |

| Total cash

capex |

|

$ |

2,153 |

|

|

$ |

4 |

|

|

$ |

72 |

|

|

$ |

9 |

|

|

$ |

2,238 |

|

| Maintenance capex |

|

$ |

1,450 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

9 |

|

|

$ |

1,459 |

|

| Accrued maintenance capex |

|

|

(273 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(273 |

) |

| Cash maintenance

capex |

|

$ |

1,177 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

9 |

|

|

$ |

1,186 |

|

| Growth capex |

|

$ |

1,314 |

|

|

$ |

4 |

|

|

$ |

72 |

|

|

$ |

— |

|

|

$ |

1,390 |

|

| Accrued growth capex |

|

|

(338 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(338 |

) |

|

Cash growth capex |

|

$ |

976 |

|

|

$ |

4 |

|

|

$ |

72 |

|

|

$ |

— |

|

|

$ |

1,052 |

|

NET DEBT AND NET LEVERAGE

RATIO

As at March 31, 2024 and December 31, 2023 the

Company had net debt and net leverage ratio as follows:

| (unaudited in thousands of US

Dollars |

|

March 31, |

|

|

December 31, |

|

| except

as otherwise noted) |

|

2024 |

|

|

2023 |

|

|

Current debt |

|

$ |

29,133 |

|

|

$ |

29,127 |

|

|

Long-term debt |

|

|

54,345 |

|

|

|

61,441 |

|

| Cash and

cash equivalents |

|

|

(37,704 |

) |

|

|

(30,753 |

) |

| Deferred

financing costs related to the Credit Facilities |

|

|

1,353 |

|

|

|

1,489 |

|

|

Net debt |

|

$ |

47,127 |

|

|

$ |

61,304 |

|

| Trailing

12 months Adjusted EBITDA |

|

$ |

132,008 |

|

|

$ |

131,802 |

|

|

Net leverage ratio |

|

0.4x |

|

|

0.5x |

|

LIQUIDITY

As at March 31, 2024 and 2023 the Company had

liquidity as follows:

| |

|

March 31, |

|

|

December 31, |

|

|

(unaudited in thousands of US Dollars) |

|

2024 |

|

|

2023 |

|

|

Cash and cash equivalents |

|

$ |

37,704 |

|

|

$ |

30,753 |

|

| ABL

Facility undrawn borrowing capacity |

|

|

36,542 |

|

|

|

40,000 |

|

|

Liquidity |

|

$ |

74,246 |

|

|

$ |

70,753 |

|

FREE CASH FLOW

For the three months ended March 31, 2024 and

2023, the Company had free cash flow as follows:

| |

For the three months ended March 31, |

|

|

(unaudited in thousands of US Dollars) |

2024 |

|

|

2023 |

|

|

Cash flows from operating activities |

$ |

21,555 |

|

|

$ |

21,072 |

|

| Cash

flows used by investing activities |

|

(3,868 |

) |

|

|

(2,238 |

) |

|

Free cash flow |

$ |

17,687 |

|

|

$ |

18,834 |

|

CORPORATE SELLING, GENERAL AND

ADMINISTRATIVE EXPENSES

For the three months ended March 31, 2024 and

2023, the Company had corporate selling, general and administrative

expenses as follows:

| |

|

For the three months ended March 31, |

|

|

(unaudited in thousands of US Dollars) |

|

2024 |

|

|

2023 |

|

|

Selling, general and administrative expenses |

|

$ |

5,822 |

|

|

$ |

7,875 |

|

|

Share-based payment expense |

|

|

(422 |

) |

|

|

(2,700 |

) |

|

Corporate selling, general and administrative

expenses |

|

$ |

5,400 |

|

|

$ |

5,175 |

|

1Adjusted EBITDA, trailing 12 months Adjusted EBITDA,

maintenance capex, growth capex, net debt, net leverage ratio, free

cash flow and corporate selling, general and administrative

expenses are each a non-IFRS financial measure. For additional

information on non-IFRS financial measures, see “Non-IFRS financial

measures” below.

2Sales volumes reflect quantity in P2O5 of Conda

sales projections.

3Total capex is a non-IFRS financial measure.

For additional information on non-IFRS and other financial

measures, see “Non-IFRS financial measures” below.

4Liquidity is a non-IFRS financial measure. For additional

information on non-IFRS and other financial measures, see “Non-IFRS

financial measures” below.

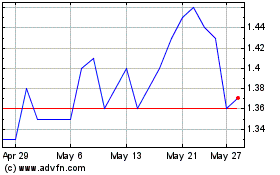

Itafos (TSXV:IFOS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Itafos (TSXV:IFOS)

Historical Stock Chart

From Feb 2024 to Feb 2025