Klondike Silver Corp. Commences Drilling on Highly Prospective Segment of the 'Main Lode' Structure on Silver Ridge

May 28 2009 - 10:20AM

Marketwired

Klondike Silver Corp. (TSX VENTURE: KS) (the 'Company') is pleased

to announce that diamond drilling has started from their new

underground west extension of the main access '4625 Level' of the

Silvana mine. This is the first stage of exploration on a 7,000

foot (1.5 km) long presumed highly prospective segment of the

productive and historic 'Main Lode' structure which is the

principal source of the Slocan mining camp's silver/lead/zinc

production.

The Main Lode is over 5 miles (8 km) long, extending from

Silverton on Slocan Lake in the west to Sandon in the east through

the 'Silver Ridge' of the Selkirk mountains some 30 miles (50 km)

north of Nelson, BC.

The Silvana production (see below) arose from a length of just

less than one mile (1.5 km) of the Main Lode under Silver Ridge,

westerly from the Silversmith mine, a former major producer near

Sandon. The Company holds approximately 1.5 km of the ground to the

west of this productive zone, to within a quarter of a mile (0.5

km.) of the Mammoth mine. By way of drifting and current drilling

the Company is testing the first 0.2 km of the 1.5 km gap in

exploration of the Main Lode at an elevation of 4,600 to 5,000 feet

(1,400 to 1,500 meters). This programme represents the first

attempt since the early 1990's to step out westerly towards the

Mammoth and the other major Main Lode producers towards

Silverton.

Mineralized surface outcroppings discovered in the 1890's led to

the start of production from this structure in its distal segments.

The westerly segment hosted (from W to E) the Standard mine which

is the largest producer of Ag and Pb in the camp, and the Hecla,

Monarch and Mammoth deposits, over a distance of some 2 miles (3.2

km). The easternmost segment of over a mile (2 km) hosted (from W

to E) the Hope, Silversmith, Slocan Star and Richmond-Eureka

deposits.

About 1.5 million tons of ore were locally processed or

direct-shipped from these operations. Aggregate recovered

production to 1964 from the west segment was 9.5 million ounces of

silver, 45,000 tons of lead and 60,000 tons of zinc. The easterly

segment yielded approximately 9 million ounces of silver, 43,000

tons of lead and 13,000 tons of zinc. (The disparity between zinc

tons recovered from east and west Main Lode mine groups is from the

earlier-developed eastern group having recovered a much smaller

percentage of zinc in processing or by avoiding 'zincy' material

when the metal was less sought after or difficult to recover using

the technology available at the time.)

Almost all of this production arose from a zone within the Main

Lode lying between roughly 4,000 feet (1,200 meters) and 5,500 feet

(1,700 meters) elevation. The central unexplored portion of this

prospective deep zone passes for 2.5 miles (4 km) beneath the 5,000

(1,500 meters) to nearly 8,000 feet (2,400 meters) approximate

elevations of steep-sided Silver Ridge. It received initial

underground exploration westerly from the Silversmith mine area by

the Kelowna Exploration Company in the late 1940's using a

programme of lateral drift mining and diamond-drilling.

A similar but extensive programme was started in late 1962

westwards from the Kelowna work by the "Silmonac Syndicate". Their

persistence was rewarded in 1967 with the discovery from

underground via diamond drilling of a Ag/Pb/Zn mineralized section

of the Main Lode (not recognized definitively as such at the time).

That section was explored, developed and mined from by Silmonac's

successors including Kam-Kotia Mines Limited, Silvana Mines Inc.,

Dickenson Mines Limited and Treminco Resources Ltd. almost

continuously from 1970 to 1993, and now by Klondike Silver.

Production to date is about 8 million ounces of Ag and over

30,000 tons each of Pb and Zn from some 550,000 tons of mill feed,

representing 30% of the area silver and 25% of its lead production.

This makes the Silmonac/Silvana operation easily the second largest

single producer of silver and lead in the Slocan camp after the

Standard Mine. Noteworthy is that the silver-ounces-to-lead-percent

ratio from the Silvana production has been higher than that from

the Standard mine production, an enhancement that improves the

economics of Silvana's typical mill feed.

For a map of the 2009 target drilling are click on the following

link:

http://www.klondikesilver.com/i/pdf/2009-05-28_NRM.pdf

The technical information in this news release has been prepared

in accordance with Canadian regulatory requirements set out in

National Instrument 43-101. Mr. Edward Craft (P.Eng.) is designated

as the qualified person who reviewed and approved the contents of

the press release.

About Klondike Silver

Klondike Silver Corp. has assembled a quality portfolio of

silver and silver-rich poly-metallic properties in historic mineral

districts in North America, and is applying advanced exploration

technologies to add value to these core assets. Klondike Silver is

reviving the Gowganda and Elk Lake silver camps in Ontario, and the

world-famous Klondike district of Yukon Territory. The Company owns

a 100 TPD fully operational flotation mill in Sandon, BC, which is

currently processing material from one of its Yukon properties and

local mines in the historic Slocan Silver Camp.

The statements made in this Press Release may contain

forward-looking statements that may involve a number of risks and

uncertainties. Actual events or results could differ materially

from the Company's expectations and projections.

The TSX Venture Exchange does not accept responsibility for the

adequacy or accuracy of this news release.

Contacts: Corporate Inquiries: Kevin Hull (604) 685-2222 Email:

info@klondikesilver.com Or visit Klondike Silver's web-site:

www.klondikesilver.com to see Smartstox interviews with Company

President, Richard Hughes. AGORACOM Investor Relations Email:

KS@agoracom.com Website: www.agoracom.com/ir/KlondikeSilver

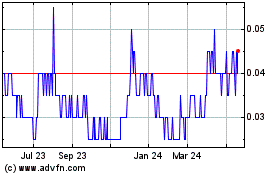

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Dec 2024 to Jan 2025

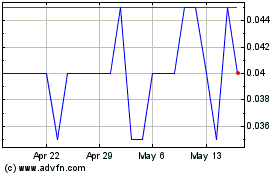

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Jan 2024 to Jan 2025