Lithic Resources Ltd.: Positive Testwork Supports Co-production of Iron Concentrates at West Desert Zinc-Copper Project

May 21 2013 - 8:15AM

Marketwired Canada

Lithic Resources Ltd. (TSX VENTURE:LTH) (the "Company") is pleased to announce

that it has received the results of metallurgical testwork in support of an

ongoing Preliminary Economic Assessment (PEA) for its 100% owned West Desert

zinc-copper-silver-gold-iron project in Utah (the "Project"). The West Desert

project hosts significant zinc-copper resources with associated massive,

high-grade iron (magnetite) mineralization.

"Today's results indicate that magnetite in the West Desert project could be

recovered as a co-product of zinc-copper production through a cost effective and

conventional process into a marketable, high-quality iron concentrate. Simply

stated, a large proportion of the material mined and processed in order to

extract zinc and copper, which was given no value in previous studies and was

directed to tailings, now has the potential to provide a significant additional

source of revenue for the West Desert project," stated Chris Staargaard,

President and CEO. "The option of co-producing iron concentrates offers a

variety of positive implications, including the potential for:

a. a significant increase in Project revenue resulting in lower cost zinc

production,

b. a smaller, lower cost tailings facility due to the diversion of a

significant volume of magnetite,

c. increased flexibility in scaling and mining, and

d. an increase in the resource base through the addition of iron

(magnetite) mineralization.

The possibility of adding high grade iron as yet another saleable commodity from

West Desert in addition to zinc, copper, silver, gold and indium is an exciting

and constructive development for the Project and the Company", he added.

2013 Metallurgical Testwork

Based on the suggestion in previous studies (2010) that iron could contribute to

the project economics, additional metallurgical test work was commissioned in

February 2013 at ALS Metallurgy in Kamloops, B.C. The work focused on the

potential production of an iron (magnetite) concentrate concurrent with the

processing of sulphide mineralization to produce copper and zinc concentrates

and was supervised on the Company's behalf by Mr. Jeffrey Austin, P.Eng.

A new inventory of drill core was selected to incorporate a more wide ranging

representation of the iron mineralization at West Desert. Thirty-one samples of

core were blended to form a single composite (150 kg) of mineralization that was

used in metallurgical testwork. Metallurgical testing followed a very

traditional process simulation including primary grinding, magnetic separation

to produce a rough iron concentrate and subsequent re-grinding and magnetic

separation to produce a high-grade iron concentrate.

The results of the 2013 testwork showed that:

a. A marketable, high-grade iron (magnetite) concentrate grading 63% iron

can potentially be produced with a traditional process flowsheet using

known processing techniques. The recovery of iron was very high in the

process testwork at levels above 95%. Minor amounts of diluents are

present in the concentrate. Levels of potential deleterious elements are

low.

b. The iron up-grading process is effective at removing copper and zinc and

insignificant levels of these metals remained in the iron concentrate.

It is expected that base metal values such as copper and zinc and any

associated silver, gold and indium, will be recovered separately into

flotation concentrates.

Significant levels of magnetite have been shown to be present in all

metallurgical composite samples of sulphide-based zinc-copper mineralization

used in the testwork carried out by the Company to date, as seen in the table

below. The positive testwork results suggest that a large proportion of this

magnetite has the potential to be recovered and sold.

Summary of Estimated Magnetite Content - Copper-Zinc Metallurgical Test

Composites

----------------------------------------------------------------------------

Laboratory Test Sample % Magnetite

----------------------------------------------------------------------------

G&T Metallurgical (2010) Cu-Zn Composite 18

G&T Metallurgical (2010) High Zinc Composite 25

G&T Metallurgical (2010) Low Zinc Composite 39

ALS Metallurgy (May 2013)(i) High Iron Composite 74

----------------------------------------------------------------------------

(i) formerly G&T Metallurgical

In addition to iron (magnetite) production derived from the processing of

sulphide resources, large volumes of massive magnetite with varying grades of

zinc and copper are present within and around the existing resource. Although no

formal resource estimate including iron values has been made to date, this

mineralization will be studied for its potential to add to the Project resource

base.

About the West Desert Project

The road-accessable West Desert project is located approximately 160 kilometres

southwest of Salt Lake City, Utah. It is approximately 75 kilometres from a

railhead and is serviced by grid electricity. The project comprises a large,

undeveloped sulphide resource along with associated near surface oxide

resources, based on approximately 40,000 metres of diamond drilling (November

19, 2009 news release). Mineralization is open in several directions with good

potential to expand existing resources and very good potential for the discovery

of new zones beyond these extensions. The Project is fully permitted and bonded

for future exploration.

West Desert Project Resources (2009)

----------------------------------------------------------------------------

Zinc Zinc Copper

Tonnes Equivalent Zinc Copper Indium (million (million Indium

Category (million) (%) (%) (%) (g/t) lbs) lbs) (kg)

----------------------------------------------------------------------------

Sulphide

----------------------------------------------------------------------------

Indicated 5.8 6.60 4.44 0.31 49 568 39 283,100

Inferred 13.8 6.83 4.84 0.37 37 1,472 113 516,400

----------------------------------------------------------------------------

Oxide

----------------------------------------------------------------------------

Indicated 1.1 5.48 4.54 0.26 10 111 6 11,500

Inferred 4.6 4.45 3.73 0.16 13 382 17 58,300

----------------------------------------------------------------------------

Note: Based on a 3% Zinc-equivalent (ZnEq) cutoff grade for the Sulphide

resource and a 1% ZnEq cutoff grade for the Oxide resource. Zinc-equivalent

grade was calculated using a zinc price of US$0.80/lb, a copper price of

US$2/lb and an indium price of US$500/kg. Zinc equivalent grades do not

include significant recoverable gold and silver demonstrated to be present

in subsequent metallurgical testwork.

An earlier PEA (August 5, 2010 news release) contemplated an underground-only

production model based on the sulphide resource. It evaluated the mining and

processing of 1.2 million tonnes per year and generated annual payable metal

production of 90 million pounds zinc, 7.1 million pounds copper, 1.1 million

ounces of silver and 7,000 ounces gold over an 11 year mine life. The 2010 model

utilized long term metal prices of US$1.10/lb zinc, US$2.00/lb copper, US$12/oz

silver, US$850/oz gold and an indium price of US$500/kg.

Metallurgical studies completed at the time indicated good recoveries from

sulphide mineralization to produce separate zinc and copper concentrates using

conventional flotation processing. The "clean" concentrates (absent of mercury,

arsenic, selenium, iron sulphide) contained important levels of gold, silver and

indium and produced significant byproduct iron in the form of magnetite. The

2010 PEA concluded that there is good potential to expand the existing resources

and improve the economics of the Project and furthermore identified the

processing of oxide resources and separation of a magnetite concentrate as

future opportunities.

In January 2013, the Company commissioned a new PEA from Mine Development

Associates in Reno, Nevada, on the basis of a number of factors and

opportunities, including:

a. Improved base and precious metal prices and lower smelter fees since the

2010 PEA.

b. Potential optimization of underground mining operations and refinement

of capital requirements.

c. Potential open pit mining of near surface oxide resources.

d. Potential revenue capture from significant amounts of by-product iron

generated from the processing of sulphide resources.

The technical information in this news release has been prepared in accordance

with Canadian regulatory requirements as set out in NI43-101 and was reviewed by

C.F. Staargaard, P.Geo., a Qualified Person as defined in NI43-101. Mr. Jeffrey

B. Austin, P.Eng., President of International Metallurgical and Environmental

Inc., is supervising the metallurgical studies for the PEA. Mr. Austin has

extensive experience in the commissioning of new mines and has supported several

hundred project studies over the last 25 years.

Technical reports concerning the West Desert project may be found at

www.lithicresources.com or on www.sedar.com.

LITHIC RESOURCES LTD.

C.F. Staargaard, President and CEO

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking

information (collectively, "forward-looking statements") within the meaning of

applicable Canadian and US securities legislation. All statements, other than

statements of historical fact, included herein including, without limitation,

statements regarding the potential of the Company's mineral projects and the

Company's planned drilling and exploration programs. Although the Company

believes that such statements are reasonable, it can give no assurance that such

expectations will prove to be correct. Forward-looking statements are typically

identified by words such as: believe, expect, anticipate, intend, estimate,

postulate and similar expressions, or are those, which, by their nature, refer

to future events. The Company cautions investors that any forward-looking

statements by the Company are not guarantees of future results, performance, or

actions and that actual results and actions may differ materially from those in

forward-looking statements as a result of various factors, including, but not

limited to, those risks and uncertainties disclosed in the Company's Management

Discussion and Analysis for the year ended December 31, 2012 filed with certain

securities commissions in Canada and other information released by the Company

and filed with the appropriate regulatory agencies. All of the Company's

Canadian public disclosure filings may be accessed via www.sedar.com and readers

are urged to review these materials, including the technical reports filed with

respect to the Company's mineral properties.

FOR FURTHER INFORMATION PLEASE CONTACT:

Lihtic Resources Ltd.

Joyce Musial

Corporate Communications

(604) 687-7211

joyce@lithicresources.com

www.ithicresources.com

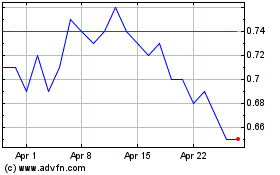

Lithium Ionic (TSXV:LTH)

Historical Stock Chart

From Apr 2024 to May 2024

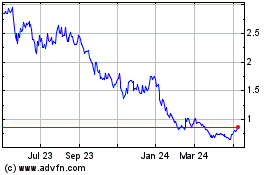

Lithium Ionic (TSXV:LTH)

Historical Stock Chart

From May 2023 to May 2024