THEMAC Initiates Exploration On Potential Gold Deposit Near Copper Flat Project

December 06 2012 - 7:57AM

Marketwired Canada

THEMAC Resources Group Limited ("THEMAC" or "the Company") (TSX VENTURE:MAC)

today announced assay results from gold mineralization discovered within the old

Andrews mining district, approximately one mile northeast of the Company's 150

million tonne Copper Flat deposit in New Mexico, USA.

Exploration Highlights:

-- Gold/silver mineralization at Andrews with at least four persistent

structures within the zone

-- Samples contain strongly anomalous gold values with values as great as

90.6 g/t and 76.3 g/t

-- 18 of 21 samples contain significant gold mineralization with only one

sample below the limit of detection

-- Located one mile northeast of the Copper Flat deposit and within the

Company's claim block

-- Geophysical work has been initiated

"We are very excited by this new development at Copper Flat," said Andre

Douchane, CEO. "Historically, the district has produced over 500,000 ounces of

gold from vein deposits and alluvial workings, but the focus of our work has

been on the copper porphyry. The new Andrews prospect, one of several gold

targets, offers the possibility of a significant new source of gold

mineralization."

Encouraging assay results from 21 select rock and grab samples collected during

reconnaissance in the Andrews area have been received and summarized in the

following table.

---------------------------------------------------------------------------

Sample # Au ppb Au g/t Ag g/t Cu ppm Pb ppm Zn ppm As ppm Bi ppm Te ppm

---------------------------------------------------------------------------

CFRI-01 greater

than

289 0.289 9.9 824 1390 1620 1000.0 10.9 0.9

---------------------------------------------------------------------------

CFRI-02 136 0.136 2.2 121 867 170 151.0 6.7 0.5

---------------------------------------------------------------------------

CFRI-03 greater greater greater

than than than

3000 90.6 150.0 9140 1060 1280 445.0 1000.0 5.9

---------------------------------------------------------------------------

CFRI-04 greater greater

than than

3000 20.8 8.2 986 3610 1650 1000.0 209.0 5.6

---------------------------------------------------------------------------

CFRI-05 greater greater

than than

3000 9.7 6.0 470 760 284 1000.0 452.0 6.8

---------------------------------------------------------------------------

CFRI-06 341 0.341 1.5 17 263 319 61.3 16.1 0.7

---------------------------------------------------------------------------

CFRI-07 greater

than

3000 4.7 6.4 936 378 348 54.1 15.6 1.1

---------------------------------------------------------------------------

CFRI-08 greater greater

than than

3000 11 15.9 1660 2680 492 1000.0 772.0 0.9

---------------------------------------------------------------------------

CFRI-09 714 0.714 0.7 156 46.4 264 56.4 19.4 0.8

---------------------------------------------------------------------------

CFRI-10 2950 2.9 7.9 831 199 190 81.2 44.3 0.4

---------------------------------------------------------------------------

CFRI-11 greater greater greater greater

than than than than

3000 76.3 150 1.24% 4210 845 1000.0 1000.0 21.1

---------------------------------------------------------------------------

CFRI-12 greater greater

than than

3000 16.8 23.0 1520 1090 633 1000.0 509.0 12.8

---------------------------------------------------------------------------

CFRI-13 greater

than

3000 3.12 3.9 367 302 146 494.0 105.0 19.4

---------------------------------------------------------------------------

CFRI-14 greater greater

than than

3000 5.18 23.3 844 756 421 958.0 1000.0 16.9

---------------------------------------------------------------------------

CFRI-15 954 0.954 2.7 148 45 200 679.0 29.8 3.7

---------------------------------------------------------------------------

CFRI-16 greater

than

3000 16.8 12.1 842 179 121 99.3 998.0 1.8

---------------------------------------------------------------------------

CFRI-17 less

than

57 0.057 0.1 146 30.7 63 52.2 18.6 0.2

---------------------------------------------------------------------------

CFRI-18 less

than

67 0.067 0.1 107 38.1 119 379.0 10.5 0.6

---------------------------------------------------------------------------

CFRI-19 greater

than

3000 6.27 2.4 312 135 283 181.0 215.0 40.3

---------------------------------------------------------------------------

CFRI-20 2625 2.625 1.7 159 92 53 346.0 71.8 3.7

---------------------------------------------------------------------------

CFRI-21 less less less

than than than

5 .005 0.1 41 28 49 108.0 4.0 0.1

---------------------------------------------------------------------------

Table 1: Andrews Area Assay Results

The above geochemical samples were analyzed by Skyline Laboratory located in

Tucson, Arizona.

All of the samples were initially analyzed by a multi-element ICP, while the

initial gold and silver values were determined by fire assay with an atomic

absorption (AA) finish on a 30 g charge.

Gold values exceeding 3000 ppb were checked and confirmed using a fire assay

with gravimetric finish on a 30 g charge.

The area of interest, which is very different mineralization from the Copper

Flat deposit, is underlain by a sequence of andesitic volcanics resting on lower

Paleozoic limestones and is cut by a broad (100 m-150 m wide) zone comprised of

several narrow N50E- N60E trending steeply dipping mineralized structures. Due

to surface exposures, the actual number of structures is not known, but based on

reconnaissance mapping there appears to be at least four persistent structures

within this zone. Individual structures tend to be 2.0'- 4.0' (0.61 m- 1.22 m)

wide and for the most part dip 75-80 degrees to the northwest. There are,

however, a few segments of individual structures in which the dip is 75- 80

degrees to the southeast. The structures typically consist of bleached gouge and

andesitic breccia fragments and fine quartz stockworks or sheeted quartz

veining. At the surface, the vein material is typically limonite stained and

locally quite gossanous and the vein material contains numerous pyrite molds.

As shown above, the assay results indicate that the select samples of vein

material locally contain strongly anomalous gold values with values as great as

90.6 g/t in sample CFRI-03 and 76.3 g/t in sample CFRI- 11.

Additionally, it should be noted that the elevated gold values are associated

with anomalous pathfinder elements (i.e. As greater than 1,000 ppm; Bi greater

than 1,000 ppm, Te 40.3 ppm and Sb 50.9 ppm) that are commonly associated with

gold mineralization.

Preparations are being made to undertake an initial core drilling program on the

Andrews gold target during the summer of 2013. The company sees potential for a

number of different gold targets within the area and is carrying out a

geophysical program to better understand the prospect geology.

Technical information in this news release has been approved by Mr. Ray Irwin,

P. Geo., and a Qualified Person under National Instrument 43-101.

About the Copper Flat Project

Copper Flat is a former producing mine located in Sierra County, State of New

Mexico approximately 150 miles south of Albuquerque and 20 miles southwest of

the town of Truth or Consequences.

Copper Flat is a porphyry copper-molybdenum deposit containing economically

recoverable gold and silver mineralization hosted by a quartz monzonite stock

which intrudes an andesitic volcanic complex. The Cretaceous (75 million years

ago (Ma)) Copper Flat quartz monzonite hosts mineralization dominated by pyrite

and chalcopyrite with subsidiary molybdenite. The mineralization is focused

along intersecting northeast and northwest-trending faults, the intersection of

which is associated with the host intrusive.

The project has an estimated $54 million benefit and financial savings from the

civil infrastructure that is currently in place at Copper Flat including a

tailings dam, largely pre-stripped open pit, power lines, water well field and

pipeline, access roads, diversion channels and usable process building

foundations. The Copper Flat land package comprises in excess of 1,200 hectares,

and the deposit is located entirely on patented mining claims wholly-owned by

THEMAC Resources Group.

Permitting for the return of the project to production is at an advanced stage,

and a feasibility study is targeted for completion in March of 2013.

Preparations are being made to undertake an initial core drilling program on the

Andrews gold target during the summer of 2013.

About THEMAC Resources Group Limited

THEMAC is a mining development company with a strong management team and as of

May 18, 2011, acquired a 100% ownership interest in the Copper Flat

copper-molybdenum-gold-silver project in New Mexico, USA. We are committed to

bringing the closed copper mine, Copper Flat, in Sierra County, New Mexico back

into production with innovation and a sustainable approach to mining development

and production, local economic opportunities and the best reclamation practices

for our unique environment.

The Company is listed on the TSX Venture Exchange (ticker: MAC) and has issued

share capital of 74,117,622 common shares (fully diluted share capital

135,648,241).

For more information please visit www.themacresourcesgroup.com or review the

Company's filings on SEDAR (www.sedar.com).

Forward Looking Statements

Certain information contained or incorporated by reference in this MD&A,

including any information as to THEMAC's future financial or operating

performance, constitutes "forward-looking statements". All statements, other

than statements of historical fact, are forward-looking statements. The words

"believe", "expect", "anticipate", "contemplate", "target", "plan", "intends",

"continue", "budget", "estimate", "may", "will", "schedule" and similar

expressions identify forward-looking statements. Forward-looking statements are

necessarily based upon a number of estimates and assumptions that, while

considered reasonable by the Company, are inherently subject to significant

business, economic and competitive uncertainties and contingencies. Known and

unknown factors could cause actual results to differ materially from those

projected in the forward-looking statements. Such factors include, but are not

limited to: fluctuations in the currency markets; fluctuations in the spot and

forward price of copper, molybdenum, gold, and silver; volatility in the price

of fuel and electricity; changes in national and local government legislation,

taxation, controls, regulations and political or economic developments in Canada

and the USA; business opportunities that may be pursued by the Company; the

anticipated impact of converting to International Financial Reporting Standards,

operating or technical difficulties in connection with mining or development

activities; employee relations; litigation; the speculative nature of

exploration and development, including the risks of obtaining necessary licenses

and permits; and contests over title to properties, particularly title to

undeveloped properties. In addition, there are risks and hazards associated with

the business of exploration, development and mining, including environmental

hazards, industrial accidents, unusual or unexpected formations, pressures,

cave-ins, flooding and the risk of inadequate insurance, or inability to obtain

insurance, to cover these risks. Many of these uncertainties and contingencies

can affect the Company`s actual results and could cause actual results to differ

materially from those expressed or implied in any forward-looking statements

made by, or on behalf of, THEMAC. These factors are discussed in greater detail

in the Company's most recent Form 20-F/Annual Information Form on file with the

U.S. Securities and Exchange Commission and Canadian provincial securities

regulatory authorities. Readers are cautioned that forward-looking statements

are not guarantees of future performance. All of the forward-looking statements

made in this MD&A are qualified by these cautionary statements.

The Company disclaims any intention or obligation to update or revise any

forward-looking statements whether as a result of new information, future events

or otherwise, except to the extent required by applicable laws.

To view Figure 1, please click on the following link:

http://media3.marketwire.com/docs/MACmap1206.pdf

FOR FURTHER INFORMATION PLEASE CONTACT:

THEMAC Resources Group Limited

Andre J. Douchane

CEO

(+1) 416 671 8089 or (+1) 520 850 7529

www.themacresourcesgroup.com

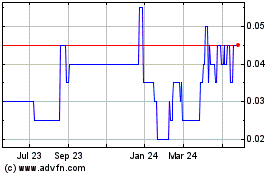

Themac Resources (TSXV:MAC)

Historical Stock Chart

From Nov 2024 to Dec 2024

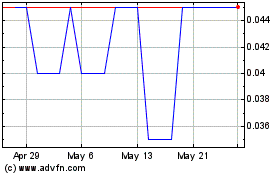

Themac Resources (TSXV:MAC)

Historical Stock Chart

From Dec 2023 to Dec 2024