- Strong operational performance and increased

profitability in a favourable oil price environment

- M&P’s working interest production in 2022 was stable at

25,584 boepd

- Sales totalled $676 million, an increase of 35%, in line with

the increase in the average sale price of oil ($97.8/bbl compared

with $72.5/bbl in 2021)

- EBITDA of $443 million and recurring net income of $211

million, up 58% and 55% respectively

- Strong cash flow generation through continued cost

discipline

- Operating and administrative expenses at their lowest since the

adaptation plan was introduced in 2020; over $100 million in

cumulative savings over three years

- Free cash flow of $198 million for the year ($275 million

excluding M&A)

- Continued deleveraging and very strong financial

position

- Net debt of $200 million as at 31 December 2022, down $143

million over the year despite external growth transactions ($78

million) and the dividend ($29 million)

- Debt refinanced in 2022, offering visibility and favourable

terms until 2028

- Closing of the acquisition of Wentworth Resources expected

between Q2 and Q3 2023

- Approval of Wentworth Resources shareholders obtained on 23

January 2023

- Completion of the acquisition subject to the approval of the

Tanzanian authorities

- Immediate redistribution of the value created to

shareholders

- Dividend of €0.14 per share ($29 million) paid in July 2022 for

2021

- Dividend of €0.23 per share ($50 million) submitted to

shareholders’ vote for 2022

Regulatory News:

Maurel & Prom (Paris:MAU):

Audio conference for

analysts and investors M&P will hold an

analyst/investor conference via an audio webcast in French and

English, today at 10:00 a.m., followed by a Q&A session.

To attend this webcast live or listen to the recording,

click the following link:

https://channel.royalcast.com/landingpage/maureletpromfr/20230314_1/

Key financial indicators

in $ million

2022

2021

Change

Income statement

Sales

676

500

+35%

Opex & G&A

-161

-168

Royalties and production taxes

-85

-77

Change in overlift/underlift position

13

25

Other

–

–

EBITDA

443

280

+58%

Depreciation, amortisation and provisions

and impairment of production assets

-85

-107

Expenses on exploration assets

-1

-0

Other

-4

-16

Operating income

352

158

+124%

Net financial expenses

-23

-16

Income tax

-145

-44

Share of income/loss of associates

22

23

Net income

206

121

+71%

O/w net income before non-recurring

items

211

136

+55%

Cash flows

Cash flow before income tax

444

280

Income tax paid

-112

-82

Operating cash flow before change in

working capital

331

198

+67%

Change in working capital requirement

34

82

Operating cash flow

366

280

+31%

Development capex

-92

-164

Exploration capex

-11

–

M&A

-78

-8

Dividends received

12

15

Free cash flow

198

123

+61%

Net debt service

-224

-96

Dividends paid

-29

–

Other

-2

1

Change in cash position

-58

27

N/A

Cash and debt

Closing cash

138

196

Closing gross debt

337

539

Closing net debt

200

343

-42%

At its meeting of 13 March 2023, chaired by John Anis, the Board

of Directors of the Maurel & Prom Group (“M&P” or “the

Group”) approved the audited financial statements1 for the year

ended 31 December 2022.

Olivier de Langavant, Chief Executive Officer of M&P,

stated: “For the second year in a row, the Group’s financial

results have seen significant improvement. This is obviously linked

to macroeconomic circumstances and the high crude oil price

environment, especially in the first half of 2022. However, our

cost discipline has also played a key role in a context of high

inflation. The resulting strong cash flow generation has allowed us

to pursue our capital allocation strategy: deleveraging, growth,

and distribution. Firstly, deleveraging, with net debt now below

$200 million. Growth, including the purchase of the new C18 Maghèna

drilling rig for Caroil in Gabon as well as the ongoing acquisition

of Wentworth Resources to increase our presence in Tanzania.

Finally, distribution to shareholders, with a new dividend of €0.23

per share proposed for fiscal year 2022, after the dividend of

€0.14 per share paid for fiscal year 2021. This sharp increase is a

testament to our commitment to return value creation to

shareholders, whilst continuing to steadfastly develop the

Group.”

Financial position

Consolidated sales in 2022 amounted to $676 million, an increase

of 35% compared to fiscal year 2021 ($500 million). This increase

is in line with the increase in the average sale price of oil from

$72.5/bbl in 2021 to $97.8/bbl in 2022.

Operating and administrative expenses amounted to $161 million,

the lowest level in recent years ($180 million in 2019, $164

million in 2020, and $168 million in 2021). This demonstrates the

sustainability of the measures taken to significantly and

sustainably reduce the Group’s costs and expenses. Royalties and

production taxes increased significantly ($85 million compared to

$77 million in 2021) due to their proportionality to sale prices.

The positive change in the overlift/underlift position has resulted

in a gain of $13 million.

EBITDA came in at $443 million, an increase of 58% compared to

the previous fiscal year ($280 million). Depreciation and

amortisation charges amounted to $85 million in 2022, versus $107

million in 2021. Current operating income amounted to $352

million.

The net financial expenses shown in the income statement

amounted to $23 million for 2022, up from $16 million in 2021, due

in particular to the rise in interest rates.

In addition to the increase in gross price, the surge in income

tax ($145 million in 2022 compared to $44 million in 2021) results

from the progressive depreciation of the VAT receivable of $56

million as they are being recovered as cost oil, as permitted under

the agreement signed with the Gabonese Republic in November

2021.

M&P’s share in net income from equity associates was $22

million, and corresponds almost exclusively to the 20.46% stake in

Seplat Energy.

Net income for fiscal year 2022 amounted to $206 million, an

increase of 71% compared to 2021 ($121 million). Recurring net

income (excluding extraordinary items) was $211 million, an

increase of 55%.

Before changes in working capital, cash flow from operating

activities was $331 million (compared with $198 million in 2021).

After taking into account changes in working capital (positive

impact of $34 million), the operating cash flow reached $366

million.

Development capex amounted to $92 million, compared to $164

million in the previous year (including $97 million for M&P’s

share of the comprehensive agreement signed with the Gabonese

Republic in November 2021). These investments included $67 million

for development activities on the Ezanga asset in Gabon, $9 million

for activities in Angola, and $15 million for the Caroil drilling

subsidiary, covering in particular the purchase of a new C18

Maghèna drilling rig.

Exploration capex amounted to $11 million, of which $10 million

corresponded to the drilling campaign on the COR-15 licence in

Colombia.

Asset acquisition expenditure was $78 million in 2022, of which

$76 million corresponded to the placement in an escrow account of

the amount required to complete the acquisition of Wentworth

Resources announced in December 2022.

In 2022, M&P received $12 million in dividends, net of

taxes, from its 20.46% stake in Seplat Energy.

Free cash flow (now calculated after dividends received) for

fiscal year 2022 therefore amounted to $198 million, an increase of

61% compared to 2021 ($123 million).

In terms of financing flows, the debt service amounted to $224

million, including $201 million in repayments ($195 million in bank

loans and $6 million in shareholder loans) and $22 million in debt

costs.

Finally, M&P distributed $29 million in dividends in 2022,

€0.14 per share, paid in July 2022.

The cash position at the close of 31 December 2022 was $138

million (31 December 2021: $196 million). This amount excludes $76

million placed on escrow as part of the offer announced on 5

December 2022 for Wentworth Resources, which is therefore already

fully provisioned.

During fiscal year 2022, M&P repaid a total of $201 million

in gross debt, reducing its gross debt to $337 million at 31

December 2022, of which $255 million under the bank loan (RCF of

$67 million fully drawn at 31 December 2022) and $82 million under

the shareholder loan. It is worth noting that gross debt has been

reduced by more than half over the past three years, from $700

million at the end of 2019.

Over fiscal year 2022, net debt decreased by $143 million to

$200 million, compared to $343 million at 31 December 2021.

With the refinancing concluded in May 2022 and effective from

July 2022, M&P continues to have financing at favourable rates

(SOFR + spread (0.11%) + 2.00% for the $188 million amortised

tranche of the bank loan, and SOFR + spread (0.11%) + 2.25% for the

$67 million RCF tranche), for a term now extended to 2027. The

first quarterly repayment of the bank loan is due in April

2023.

Aside from its robust cash position, M&P has access to

additional liquidity thanks to the undrawn $100-million tranche of

the shareholder loan.

Debt repayment profile at 31 December

2022:

Object omitted.

Key terms of the refinanced debt

facilities at 31 December 2022:

Bank loan Amortising

portion

Bank loan RCF

tranche

Shareholder loan

Amount drawn

$188 million

$67 million

$82 million

(+ $100 million available)

Interest rate

SOFR + spread (0.11%) + 2.00%

SOFR + spread (0.11%) + 2.25%

(0.675% on the undrawn

portion)

SOFR + spread (0.11%) + 2.10%

Repayments

18 quarterly instalments

At maturity

22 quarterly instalments

First deadline

Q2 2023

–

Q2 2023

Last instalment

Q3 2027

Q3 2027

Q3 2028

- Operating and financial forecasts for 2023

The Group expects M&P’s working interest production to reach

26,200 boepd in 2023, including:

- 15,600 bopd in Gabon (equivalent to gross production of 19,500

bopd at Ezanga)

- 43.2 mmcfd (equivalent to gross production of 90.0 mmcfd at

Mnazi Bay)

- 3,400 bopd in Angola (equivalent to gross production of 17,000

bopd on Block 3/05)

With these production assumptions, the forecasts for cash flow

from operating activities in 2023 under various Brent price

assumptions are as follows:

- At $70/bbl: $260 million

- At $80/bbl: $310 million

- At $90/bbl: $360 million

Other significant cash outflows budgeted for the year, for a

total of $273 million:

- Development investments: $100

million, allocated as follows:

- $85 million in Gabon

- $5 million in Tanzania

- $10 million in Angola (non-operated)

- Exploration investments: Budget of

$45 million, including $35 million contingent, including:

- The end of the drilling campaign on the COR-15 permit in

Colombia (completed in February 2023)

- The potential acquisition of 3D seismic data for the Ezanga

permit in Gabon

- Financing: $128 million, allocated

as follows:

- $58 million in debt repayments

- $20 million in net cost of debt

- $50 million in dividends

This guidance is given on a constant scope basis, excluding the

potential impact of the ongoing acquisition of Wentworth

Resources.

After reviewing the Group’s financial situation and its

performance for the year 2022, the Board of Directors proposes to

pay a dividend of €0.23 per share, for a total amount of $50

million.

This amount of €0.23 per share represents an increase of 64%

compared to the €0.14 dividend paid in 2022 for financial year

2021. This reflects the significant improvement in the Group’s

financial performance and demonstrates its desire to immediately

return to creating value for shareholders.

2022 activity

- Environment, Health, Safety and Security (EHS-S)

performance

For the second year in a row, the lost time injury rate (“LTIR”)

rate was nil. The total recordable injury Rate (“TRIR”) per million

hours worked was 1.61, compared to 2.52 in 2021.

Object omitted.

Note: Lost Time Injury Rate (LTIR) and Total Recordable Injury

Rate (TRIR) are calculated per million hours worked

As part of its decarbonisation policy, the Group implemented a

number of measures in 2022 to reduce its greenhouse gas emissions.

This includes, for example, the connection of the well platforms to

the Onal power plant grid on the Ezanga permit in Gabon. Thanks to

these initiatives, greenhouse gas emissions (scope 1 and 2) on

operated assets in production stood at 220kt of CO2 equivalent,

down 14% compared to 2021 (256kt). Compared to 2020, the impact of

flaring is down by 47%, and that of venting by 54%, both ahead of

the long-term objectives respectively defined by the Group in 2021

and 2022.

The carbon intensity (scope 1 and 2) of the Group's operated

production stands at 18.1kg of CO2 equivalent per barrel, down 15%

compared to 2021 (21.3kg) and 40% compared to 2020 (30.3kg).

Greenhouse gas emissions and intensity

per barrel of operated assets in production:

Object omitted.

Note: Greenhouse gas emissions for previous years have been

adjusted to take into account the new calculation methodology

including venting

Q1 2022

Q2 2022

Q3 2022

Q4 2022

2022

2021

Change 2022 vs. 2021

M&P working interest

production

Gabon (oil)

bopd

14,222

13,439

15,253

15,650

14,646

15,540

-6%

Angola (oil)

bopd

3,856

3,916

3,695

3,465

3,732

3,416

+9%

Tanzania (gas)

mmcfd

47.3

41.5

41.3

43.0

43.2

39.2

+10%

Total

boepd

25,966

24,257

25,824

26,283

25,584

25,490

+0%

In fiscal 2022, M&P’s working interest production stood at

25,584 boepd, stable compared to 2021 (25,490 boepd).

In Gabon, M&P’s working interest oil production (80%) on the

Ezanga permit was 14,646 bopd (gross production: 18,308 bopd) for

2022. Average production for the year is therefore 6% lower than in

2021, mainly due to the disruption caused by the incident at the

end of April at the Cap Lopez export terminal, the situation having

returned to normal in the third quarter. The well stimulation

campaign that began in the fourth quarter of 2022 finished in early

2023. Tangible results are visible, with a significant increase in

the field's production potential, which is now above 21,000

bopd.

In Tanzania, M&P’s working interest gas production (48.06%)

on the Mnazi Bay permit stood at 43.2 mmcfd (total production: 90.0

mmcfd) for 2022, up 10% from 2021, which was already a record

year.

In Angola, M&P’s working interest production (20%) from

Block 3/05 in 2022 is 3,732 bopd (gross production: 18,660 bopd),

up 9% from 2021. Discussions on extending the licence beyond its

current term in June 2025 are now well underway. It is expected

that the licence extension will be accompanied by new tax terms

that will enhance the economics of the permit.

- Exploration and appraisal activities

Colombia

In Colombia, drilling operations on the Zorro-1 exploration

wells on the COR-15 permit were launched in November 2022 and

completed in early January 2023. The well encountered oil

indications in the Guadalupe formations, the main objective of the

drilling, and Lower Socha, from which a 20° API oil sample was

taken. However, the production test conducted on Lower Socha only

produced formation water. Consequently, it was decided to abandon

the well, which was done in January 2023.

The second Oveja-1 well, drilled in sequence with the Zorro-1

well, reached its final depth of 884 metres in nine days. Oveja-1

found the Lower Socha reservoir at a depth of 670 metres, with oil

shows comparable to those of Zorro-1. The various measurements

carried out did not indicate the presence of producible

hydrocarbons, and the abandonment of the well was completed in

early February 2023.

The final total cost of this two-well exploration programme was

$15 million, of which M&P financed $8 million. These two wells

mark the end of M&P’s commitment activity within the COR-15

permit. Further studies and a full analysis of the results will be

carried out before deciding on the future of the licence. Also in

Colombia, M&P retains the VSM-4 exploration licence in the

upper Magdalena Valley; a major anticline structure has been

identified on this 970 sq km licence in the vicinity of eight oil

and gas fields, including the San Francisco field. Drilling is

expected to begin in 2024.

Gabon

In Gabon, a 3D seismic data acquisition campaign was initially

planned for 2022 in the southern part of the Ezanga permit. This is

still under study, with a final schedule yet to be confirmed.

Wholly-owned drilling subsidiary Caroil is currently active in

Gabon with the C3 and C16 rigs.

The C3 rig continues to operate as part of the development

drilling campaign on the Ezanga licence, where 15 wells were

drilled in 2022. The C16 rig restarted operations in August 2022

and drilled 2 wells during the year under contract to Assala

Energy.

To cope with the complexity of upcoming operations on the Ezanga

field and to replace the C3 rig, Caroil acquired a new high-tech

drilling rig (C18 Maghèna) which is expected to enter service in

March 2023 in Gabon.

- Other highlights of the fiscal year

Offer for Wentworth Resources

On 5 December 2022, M&P and Wentworth Resources

(“Wentworth”) jointly announced that they had reached agreement on

the terms of a recommended acquisition of Wentworth by M&P for

a cash consideration of 32,5 pence per share, or approximately $76

million. Wentworth’s only asset (excluding its $30 million cash

balance as at 1 November 2022) is its 31.94% direct and indirect

interest in the Mnazi Bay gas asset in Tanzania, operated by

M&P. If the acquisition is completed, M&P’s stake in Mnazi

Bay will increase from 48.06% to 80%.

Wentworth Resources published the Scheme Document for the

acquisition on 25 January 2023. On 23 February 2023, the requisite

majority of shareholders voted to approve the Scheme at the Court

Meeting and to pass the resolution to amend Wentworth’s articles of

association and to implement the Scheme at the General Meeting.

The completion of the acquisition of Wentworth remains subject

to the approval of the Tanzanian authorities, which is currently

expected between Q2 and Q3 2023. M&P will communicate on this

subject in due course.

Presence in Venezuela

In Venezuela, due to international sanctions against PDVSA,

operations conducted by the Group in relation to its stake in

Petroregional del Lago (“PRDL”) are strictly limited to maintenance

related to the safety of staff and assets, and to environmental

protection. Consequently, no contribution to M&P’s net income

has been recognised, despite the fact that the asset is still in

production (gross production of 16,281 bopd in 2022, or 6,512 bopd

theoretically for the 40% consolidated stake held by M&P) and

still has development potential.

In addition, M&P has entered into negotiations with the

Venezuelan government to obtain a new operating framework similar

to that of Chevron. In early December 2022 and with the approval of

the US government, Chevron signed an agreement with the Venezuelan

authorities allowing for the payment of debts owed by PDVSA as well

as enhanced control over the operations of their joint venture with

PDVSA, particularly in the areas of procurement, cash management

and crude sales.

Group reserves as at 31 December

2022

The Group’s reserves correspond to the volumes of technically

recoverable hydrocarbons on permits where production is currently

underway—proportionate to the Group’s share of interest in those

permits—plus those revealed by discovery and delineation wells that

can be operated commercially. These reserves were certified as at

31 December 2022 by DeGolyer and MacNaughton in Gabon and Angola,

and by RPS Energy in Tanzania.

The Group’s 2P reserves stood at 173.2 mmboe at 31 December

2022, of which 108.5 mmboe are proven reserves (1P).

2P reserves for M&P’s working

interest:

Oil (mmbbls)

Oil (mmbbls)

Gas (bcf)

MMboe

Gabon

Angola

Tanzania

Group total

31/12/2021

123.5

13.7

204.3

171.2

Production

-5.3

-1.4

-15.8

-9.3

Revision

+2.6

+5.7

+17.7

+11.2

31/12/2022

120.8

18.0

206.2

173.2

O/w 1P reserves

77.1

15.5

96.2

108.5

As a % of 2P

64%

86%

47%

63%

Note that these figures do not take into account M&P’s

20.46% interest in Seplat Energy, one of Nigeria’s main operators

listed on the London and Lagos stock exchanges. As a reminder,

Seplat’s 2P reserves were 430 mmboe (206 million barrels of oil and

1,343 billion cubic feet of gas) at 31 December 2022, i.e. 88 mmboe

for M&P’s 20.46% interest.

In addition, due to international sanctions against Venezuela’s

state oil company PDVSA, the activity associated with M&P’s

interest in PRDL is, for the time being, limited to operations

related solely to the safety of staff and assets, and to

environmental protection. Accordingly, no reserves have been

recognised for this interest.

____________________________

Français

English

pieds cubes

pc

cf

cubic feet

millions de pieds cubes par

jour

Mpc/j

mmcfd

million cubic feet per day

milliards de pieds cubes

Gpc

bcf

billion cubic feet

baril

B

bbl

barrel

barils d’huile par jour

b/j

bopd

barrels of oil per day

millions de barils

Mb

mmbbls

million barrels

barils équivalent pétrole

bep

boe

barrels of oil equivalent

barils équivalent pétrole par

jour

bep/j

boepd

barrels of oil equivalent per day

millions de barils équivalent

pétrole

Mbep

mmboe

million barrels of oil equivalent

____________________________

For more information, please visit www.maureletprom.fr/en/.

This document may contain forecasts regarding

the financial position, results, business and industrial strategy

of Maurel & Prom. By nature, forecasts contain risks and

uncertainties to the extent that they are based on events or

circumstances that may or may not happen in the future. These

forecasts are based on assumptions we believe to be reasonable, but

which may prove to be incorrect and which depend on a number of

risk factors, such as fluctuations in crude oil prices, changes in

exchange rates, uncertainties related to the valuation of our oil

reserves, actual rates of oil production and the related costs,

operational problems, political stability, legislative or

regulatory reforms, or even wars, terrorism and sabotage.

Maurel & Prom is listed for trading on

Euronext Paris CAC All-Tradable – CAC Small – CAC Mid & Small –

Eligible PEA-PME and SRD Isin FR0000051070/Bloomberg MAU.FP/Reuters

MAUP.PA

____________________________

1 The financial statements have been audited and certified

without qualification

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230313005845/en/

Maurel & Prom Press, shareholder and investor

relations +33 (0)1 53 83 16 45 ir@maureletprom.fr

NewCap Financial communications and investor

relations/Media relations Louis-Victor Delouvrier/Nicolas Merigeau

+33 (0)1 44 71 98 53/+33 (0)1 44 71 94 98

maureletprom@newcap.eu

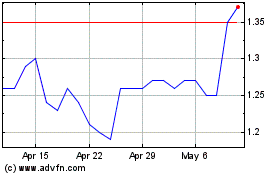

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Jan 2024 to Jan 2025