Regulatory News:

Maurel & Prom (Paris:MAU):

- M&P’s working interest production in first-half 2023:

27,406 boepd, up 5% compared to the second half of 2022

- M&P working interest production of 15,779 bopd in Gabon, an

increase of 2% compared to the second half of 2022

- M&P working interest production of 3,763 bopd in Angola, an

increase of 5% compared to the second half of 2022

- M&P working interest gas production of 47.2 mmcfd in

Tanzania, an increase of 12% compared to the second half of

2022

- Valued production of $289 million and sales of $299 million

in the first half of 2023

- Average sale price of oil was $74.8/bbl over the period, a

decrease of 17% from the second half of 2022 ($90.5/bbl).

- Contribution of drilling activities $11 million over the six

months

- Review of asset portfolio to optimise capital allocation

- In Angola, extension to 2040 obtained for the licence of Block

3/05; validation of improved tax terms in progress

- In Namibia, decision taken not to apply for the renewal of PEL

44 and PEL 45 exploration licences which expired on 15 June

2023

- Ongoing discussions with Tanzanian authorities regarding the

approval of the acquisition of Wentworth Resources; closing of the

transaction now expected in the second half of 2023

- Strong balance sheet and of value returns to

shareholders

- Net debt of $178 million as at 30 June 2023, down $21 million

over the half year ($200 million as at 31 December 2022)

- Dividend of €0.23 per share ($49 million) paid at the start of

July

Key indicators for the first half of

2023

Q1

2023

Q2

2023

H1

2023

H1

2022

H2

2022

Change H1 2023 vs.

H1 2022

H2 2022

M&P working interest

production

Gabon (oil)

bopd

15,839

15,719

15,779

13,828

15,451

+14%

+2%

Angola (oil)

bopd

3,424

4,097

3,763

3,902

3,580

-4%

+5%

Tanzania (gas)

mmcfd

46.7

47.6

47.2

44.4

42.1

+6%

+12%

Total

boepd

27,054

27,755

27,406

25,126

26,053

+9%

+5%

Average sale price

Oil

$/bbl

75.2

74.0

74.8

105.0

90.5

-29%

-17%

Gas

$/mmBtu

3.76

3.77

3.77

3.50

3.51

+8%

+7%

Sales

Gabon

$mm

105

106

211

262

265

-20%

-20%

Angola

$mm

19

22

41

57

47

-28%

-13%

Tanzania

$mm

18

18

36

32

36

+13%

+0%

Valued production

$mm

142

147

289

352

349

-18%

-17%

Drilling activities

$mm

5

6

11

1

10

Restatement for lifting imbalances and

inventory revaluation

$mm

42

-43

-1

1

-37

Consolidated sales

$mm

190

109

299

355

322

-16%

-7%

M&P’s working interest production in the first half of 2023

was 27,406 boepd. The average sale price of oil for the period was

$74.8/bbl.

The Group’s valued production (income from production

activities, excluding lifting imbalances and inventory revaluation)

was $289 million in the first six months of 2023.

The restatement of lifting imbalances net of inventory

revaluation had a limited impact over the period (negative $1

million). After incorporating the $11 million relating to drilling

activities, consolidated sales for the first six months of 2023 are

therefore $299 million.

Production activities

M&P’s working interest oil production (80%) on the Ezanga

permit stood at 15,779 bopd for the first half of 2023, an increase

of 2% compared to the second half of 2022.

M&P’s working interest gas production (48.06%) on the Mnazi

Bay permit was 47.2 mmcfd for the first half of 2023, up 12% from

the second half of 2022.

M&P working interest production from Blocks 3/05 (20%) and

3/05A (26.7%) in the first half of 2023 was 3,763 bopd in Q1 2023,

an increase of 5% on the second half of 2022.

Following publication of the decree of approval on 10 May, the

licence of Block 3/05 has now been extended from 2025 to 2040.

Discussions between the operator of the block and the regulator

with a view to finalising the improved tax terms associated with

the extension of the licence have successfully concluded and

implementation of the terms is now pending validation by the

authorities.

Exploration activities

M&P launched a farm-out process in November 2022 with a view

to finding a partner for exploration licences PEL 44 and PEL 45,

operated by M&P with an 85% working interest. The process ended

during the first half of 2023 without resulting in any offers from

companies invited to examine technical data on the two assets.

M&P therefore decided not to apply to enter the next

exploration phase, which includes drilling obligations, and the

licences for both PEL 44 and PEL 45 expired on 15 June 2023. This

marks the end of the Group’s operations in Namibia.

After exploratory drilling operations on the COR-15 permit ended

in February 2023, M&P analysed the data collected to determine

the prospectivity remaining on the permit. This exercise did not

enable identification of any new targets, in an asset for which the

Group is now free of any obligation for works.

Drilling activities

The C18 Maghèna drilling rig newly acquired by the Group and

operated by Caroil was commissioned in March and is currently

carrying out the drilling campaign on the Ezanga permit.

As part of its drilling services for third parties, in June 2023

Caroil signed an agreement with Perenco for a five-month drilling

campaign starting in Q4 2023, for which the C3 drilling rig is

currently being upgraded. The C16 drilling rig continues to be

deployed on the drilling campaign for Assala Energy in the south of

the country.

Information on the current offer for

Wentworth Resources

On 23 February 2023, Wentworth Resources shareholders approved

M&P's offer by voting in favour of the Scheme at the Court

Meeting and in favour of its implementation at the General

Shareholders’ Meeting.

As part of the approvals process for this transaction as

detailed in Part III of the Scheme Document, M&P requires

approvals of Tanzania’s Fair Competition Commission (the “FCC”).

The FCC issued a decision notice that M&P’s application shall

not be determined at this time and will be marked closed by the

FCC. M&P is consulting with the relevant Tanzanian government

stakeholders in order to find a solution and bring the acquisition

to a successful conclusion. M&P is also consulting with

relevant Tanzanian government stakeholders about national oil and

gas company TPDC’s demand to exercise a right of first refusal to

the acquisition.

The completion of the acquisition of Wentworth Resources remains

subject to these approvals by the Tanzanian authorities, which is

expected in the second half of 2023. M&P will communicate on

this subject in due course.

Financial position

Available liquidity as at 30 June 2023 was $137 million

(compared to $138 million as at 31 December 2022) and covered only

the cash position, as the $67 million RCF tranche was fully drawn.

This excludes the sum placed in escrow as part of the offer

announced on 5 December 2022 for Wentworth Resources, which

amounted to $81 million as at 30 June 2023.

Gross debt amounted to $315 million at 31 March 2023, including

$236 million in a bank loan and $79 million in a shareholder loan.

The first quarterly maturities on both instruments since the 2022

refinancing were paid in April 2023, for a total amount of $23

million ($19 million for the bank loan and $4 million for the

shareholder loan).

Net debt therefore amounted to $178 million at 30 June 2023, a

decrease of $21 million compared to 31 December 2022 ($200

million).

Français

English

pieds cubes

pc

cf

cubic feet

millions de pieds cubes par

jour

Mpc/j

mmcfd

million cubic feet per day

milliards de pieds cubes

Gpc

bcf

billion cubic feet

baril

B

bbl

barrel

barils d’huile par jour

b/j

bopd

barrels of oil per day

millions de barils

Mb

mmbbls

million barrels

barils équivalent pétrole

bep

boe

barrels of oil equivalent

barils équivalent pétrole par

jour

bep/j

boepd

barrels of oil equivalent per day

millions de barils équivalent

pétrole

Mbep

mmboe

million barrels of oil equivalent

For more information, please visit www.maureletprom.fr/en/

This document may contain forecasts regarding

the financial position, results, business and industrial strategy

of Maurel & Prom. By nature, forecasts contain risks and

uncertainties to the extent that they are based on events or

circumstances that may or may not happen in the future. These

forecasts are based on assumptions we believe to be reasonable, but

which may prove to be incorrect and which depend on a number of

risk factors, such as fluctuations in crude oil prices, changes in

exchange rates, uncertainties related to the valuation of our oil

reserves, actual rates of oil production and the related costs,

operational problems, political stability, legislative or

regulatory reforms, or even wars, terrorism and sabotage.

Maurel & Prom is listed for trading on

Euronext Paris CAC All-Tradable – CAC Small – CAC Mid & Small –

Eligible PEA-PME and SRD Isin FR0000051070 / Bloomberg MAU.FP /

Reuters MAUP.PA

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230719241079/en/

Maurel & Prom Press, shareholder and investor

relations Tel: +33 (0)1 53 83 16 45 ir@maureletprom.fr

NewCap Financial communications and investor

relations/Media relations Louis-Victor Delouvrier/Nicolas Merigeau

Tel: +33 (0)1 44 71 98 53/+33 (0)1 44 71 94 98

maureletprom@newcap.eu

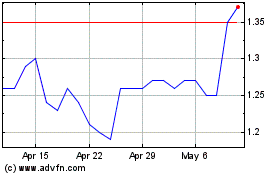

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Jan 2024 to Jan 2025