Continental Nickel Limited (TSX VENTURE:CNI) ("CNI" or the "Company") is pleased

to announce that it has received a positive Preliminary Economic Assessment

("PEA") for the development of its Ntaka Hill Nickel Project ("Ntaka Hill" or

the "Project"). Ntaka Hill is part of the 75:25 Nachingwea exploration joint

venture property in southern Tanzania with IMX Resources Limited of Australia.

Highlights

-- Total after tax NPV for the Base Case of US$207M.

-- Total life of mine forecast production for the Base Case of 376 million

lbs of nickel contained in high grade concentrate, based on Mineral

Resources announced 15 April 2011.

-- Low capital cost for the project reflecting the low infrastructure

requirements and staged development.

-- Initial scale of the project sized to suit extraction of high grade near

surface Measured and Indicated Resources in the first four years

followed by an expansion, which will of a scale to suit the resources in

the Sleeping Giant zone, which are still the subject of step-out

drilling.

-- Overall mine life in excess of 12 years.

-- Cash costs (C1) and total production costs (C2) per pound of contained

nickel in the second quartile on industry cost curves.

-- Excellent metallurgical performance (previously announced in detail 15

September 2011) delivers the possibility to attract a premium for the

concentrate off take.

Immediate Upside

-- Previous drilling of the Sleeping Giant zone showed the presence of low

grade mineralisation that is not included in the current resource

estimate.

-- Results of the PEA indicate that a lower cut-off grade can be used than

in the preparation of the current Mineral Resource.

-- A Sensitivity Case based on an allowance for potential tonnage and grade

of this low grade mineralisation in the Base Case pit indicated the

possibility of increasing contained nickel production by 20% and greatly

improving project value.

-- The current extension drilling program continues to provide positive

results on the Sleeping Giant zone which also includes wide

intersections of disseminated mineralisation within the Base Case pit

shell. These results, along with full analysis of the low grade

mineralisation, will be used to update Mineral Resources and the

economic assessment at the beginning of the second quarter of 2012.

The study considered two development scenarios and the upside sensitivity case

which are outlined further below. As shown in Table 1 below, the Project

provides a positive economic outcome from the mining and treatment of the

resources at Ntaka Hill.

Table 1 - Highlights of Project and Economic Outcomes

----------------------------------------------------------------------------

Parameter Base Case

----------------------------------------------------------------------------

Mining

Years 1 to 4 processing rate, Mtpa 1.0

Years 5 onwards processing rate, Mtpa 2.5

Total mill feed, Mt 23.8

Total material mined, Mt 432.8

Strip ratio 17.2

----------------------------------------------------------------------------

Production

Average Feed Grade, %Ni 0.82

Average Ni Recovery, % 87.3

Average Concentrate Grade, %Ni 15.2

Concentrate Contained Ni, lbs'000 377,000

----------------------------------------------------------------------------

Capital Costs

Initial Capital Cost, US$M 216.7

Total Capital Cost, US$M 559.0

----------------------------------------------------------------------------

Unit Production Costs, US$/lb. Ni

Operating 4.24

Capital 1.48

Total 5.72

----------------------------------------------------------------------------

Economic Outcomes, US$M

Net after-tax cash flow 539

After-tax internal rate of return, % 21.6

After-tax NPV @ 8% discount rate 207.4

----------------------------------------------------------------------------

Note: All cases in this Preliminary Economic Assessment are preliminary in

nature and include both Indicated and Inferred Mineral Resources. Inferred

Mineral Resources are considered too speculative geologically to have the

economic considerations applied to them that would enable them to be

categorized as Mineral Reserves. There is no certainty that the Preliminary

Economic Assessment will be realized.

Mr. David Massola, President and CEO, commented "The positive results of the

technical study are an important milestone in the advancement of the Ntaka Hill

Project. The Company will move into the next stage of evaluating the project by

updating the resources and project economics to include the analysis of already

identified low grade mineralisation and incorporate the results of this season's

step-out drilling on Sleeping Giant."

"We will progress options studies looking at various project parameters and

other technical studies in 2012 with the goal of preparing a feasibility study

by the end of the year. In parallel with this, we will move forward with

detailed metallurgical test work and the environment studies and permitting as

these represent the critical path in bringing the project into production."

"We are also confident that the Company's current and future exploration

programs will continue to add resources that will enhance the project going

forward."

The preliminary economic assessment was compiled by Roscoe Postle Associates

Inc. ("RPA"), Mineralurgy Pty Ltd ("Mineralurgy") and Lycopodium Minerals Pty

Limited ("Lycopodium"). The key consultants involved in the studies are

described at the end of this press release, in the "Qualified Persons" section.

The preparation of the study was managed by Stewart Watkins, CNI's Study

Manager.

Next Steps

Based on the results of this PEA, CNI's management and board are committed to

continuing the evaluation of the Project. Activities that are currently

underway, which include drilling to secure additional metallurgical samples,

metallurgical test work, environmental baseline studies and the preparation of

the environmental scoping study will position the project for fast track

development.

Following the completion of the step-out drilling, the extents of the Sleeping

Giant mineralisation will be redefined using an updated nickel cut-off grade to

accommodate the economics outlined in this study. This will result in an update

of the Mineral Resource, which will include detailed analysis of the low grade

mineralisation that has been included in the Upside Sensitivity Case. This

updated Mineral Resource will then be used as a basis to update the project

economics. The company is targeting the start of the second quarter 2012 to

release the results of an updated Preliminary Economic Analysis.

A detailed outline of the project evaluation and development timeline with key

milestone dates is outlined below.

Options Considered

The PEA considered two development scenarios, Open Pit Only or "Base Case", Open

Pit Plus Underground. Along with traditional sensitivity analysis, an Upside

Sensitivity Case was also investigated to understand the impact of low grade

mineralisation that is believed to be contained in the Base Case Sleeping Giant

pit.

All of these scenarios commence operation at 1 Mtpa of mill feed for four years

followed by an expansion of the mining and processing rate. This upgrade

development philosophy is aimed at providing a project scenario that delivers

early production from current Measured and Indicated Resources, maintains modest

capital requirements and is fundable for CNI.

The key aspects include:

Open Pit Only (Base Case)

-- Open pit mining of all zones with resources based on current Mineral

Resources announced April 2011.

-- First four years of ore production and processing at a rate of 1 Mtpa

from the higher grade near surface L, H, J, M and NAD013 zones which are

predominately contained in the current Measured and Indicated Resources

categories.

-- Expansion of ore production and processing rate in year five to 2.5 Mtpa

coinciding with the commencement of mining from the Sleeping Giant zone.

-- G zone, possessing lower grade and less favorable metallurgy, mined at

the end of the mine life.

-- Total mine life of approximately 12 years.

Open Pit Plus Underground

-- Resources based on current Mineral Resources announced April 2011.

-- First four years of ore production and processing at a rate of 1 Mtpa

from open pit mining of J, L, M, G and the upper portion of H zones.

-- Expansion of ore production and processing rate in year five to 2.5 Mtpa

coinciding with the commencement of underground mining from the Sleeping

Giant, NAD013 and the lower portion of H zones.

-- Total mine life of just over 12 years.

Upside Sensitivity Case

-- Open pit mining of all zones with resources based on current Mineral

Resources and the addition of an allowance for potential tonnage and

grade of the low grade mineralisation contained in the upper parts of

the Sleeping Giant pit shell. The understanding of the value of any low

grade mineralisation contained in the pit shells has been a recent

occurrence and, as such, there has been insufficient time to complete a

rigorous geological interpretation of this low grade mineralisation.

-- First four years of operations identical to the Base Case.

-- Expansion of ore production and processing rate in year five to 4 Mtpa

coinciding with the commencement of mining from the Sleeping Giant zone.

-- G zone mined at the end of the mine life.

-- Total mine life of just over 12 years.

-- It should be noted that the Upside Sensitivity Case includes an

allowance for material identified as an "exploration target" (as defined

by NI43-101). The allowance for the quantity and grade of this

"exploration target" is conceptual in nature and there has been

insufficient analysis completed to define a Mineral Resource. It is

uncertain if further exploration will result in the definition of a

Mineral Resource in this area.

The economic analysis of the options demonstrated that the Open Pit Only (Base

Case) scenario provided a far superior return than the Open Pit Plus Underground

scenario (which achieved an after-Tax NPV @8% of US$117M) and as such further

discussion of this scenario is not included in this release.

Mineral Resources

Ntaka Hill resources, as disclosed on 15 April, 2011, are outlined below in Table 2.

Table 2 -Summary of Ntaka Hill Mineral Resources

----------------------------------------------------------------------------

Resource Category Tonnes % Ni % Cu Contained Ni

(000's) (tonnes)

----------------------------------------------------------------------------

Measured 1,871 1.74 0.30 32,500

Indicated 3,110 0.91 0.20 28,400

----------------------------------------------------------------------------

Total Measured + Indicated 4,981 1.22 0.24 60,900

----------------------------------------------------------------------------

Inferred 17,260 0.76 0.17 131,000

----------------------------------------------------------------------------

Notes:

1. CIM definitions were followed for Mineral Resources.

2. Mineral Resources were estimated at a NSR cut-off value of $17/t for

open pit mining; this corresponds to an approximate grade of 0.14% Ni.

3. Mineral Resources were estimated using an average long-term nickel,

copper, and cobalt prices of $10.00/lb, $3.50/lb, and $20.00/lb,

respectively.

4. Preliminary metal recoveries were estimated at 87% for nickel, 81% for

copper, and 80% for cobalt.

5. No minimum width was used.

6. Ntaka Hill Mineral Resources collectively include J, G, M, L, NAD013, H

and Sleeping Giant zones.

The current and previous drilling programs have also intersected multiple zones

of disseminated sulphide mineralization located above the Sleeping Giant zone

which have not yet been included in the Mineral Resource estimate. An allowance

of between 12 Mt and 14 Mt, at grades ranging from 0.25% Ni to 0.40% Ni has been

made for this low grade "exploration target" (as defined in Ni 43-101) based on

conceptual interpretation of low grade mineralisation intersections contained

within the bounds of the Sleeping Giant pit shell.

Mining

Open Pit Mining is based on conceptual pit shells. Mining is planned to be

carried out by contract mining for the first four years of production by

conventional means with a conversion to owner mining thereafter. Key mining

parameters used and calculated in the PEA are summarised in Table 3.

Table 3 - Key Mining Parameters

----------------------------------------------------------------------------

Parameter Base Case

----------------------------------------------------------------------------

Pre-Production

Tonnes Moved, Mt 8.0

Years 1 to 4

Mill Feed Production, Mtpa 1.0

Mill Feed Produced, Mt 3.9

Waste Moved, Mt 78.1

Total Moved, Mt 82.0

Total Moved per Day, t 66,000

Strip Ratio 20.0

Years 5 to LOM

Mill Feed Production, Mtpa 2.5

Mill Feed Produced, Mt 19.9

Waste Moved, Mt 322.9

Total Moved, Mt 342.7

Total Moved per Day, t 137,000

Strip Ratio 16.2

Life of Mine

Mill Feed Produced, Mt 23.8

Waste Moved, Mt 409.0

Total Moved, Mt 432.8

Strip Ratio 17.2

----------------------------------------------------------------------------

The Upside Sensitivity Case assumes that some material classified as waste

within the Sleeping Giant pit in the Base Case will be processed as mill feed.

Consequently the mining operation for the first four years would remain

unchanged however the ratio between waste and mill feed would be reduced

thereafter. It is estimated that the change in stripping ratio would be to lower

it from the Base Case of 17.2 to between 10 and 12.

Processing, Metallurgy and Production

Preliminary metallurgical test work results have indicated that the Project can

use a conventional approach to the recovery of nickel from sulphide ore and

produce a high grade nickel plus copper bulk concentrate with very low levels of

MgO and clean of other contaminants. These results have previously been

announced (15 September 2011) in detail. Using these initial flotation test work

results and previous mineralogical studies, an estimate was made of the

concentrate grade and recovery from each mineralised zone and this was applied

to the production schedule.

Based on typical industry practice, the mineralogical information available and

the initial flotation test work, a flowsheet design and basic design criteria

were developed for use in this study. Key aspects of this design and criteria

include:

-- Two stage crushing followed by ball milling to a product size of 80%

passing 75 micron.

-- Rougher flotation, followed by three stages of cleaning to produce a

combined nickel and copper bulk concentrate.

-- Thickening and filtration of the concentrate prior to loading into

containers for transport to smelters.

-- Typical reagent additions.

A summary of key production parameters are given in Table 4.

Table 4 - Key Processing and Production Parameters

----------------------------------------------------------------------------

Parameter Base Case

----------------------------------------------------------------------------

Years 1 to 4

Mill Throughput, Mtpa 1.0

Total Milled, Mt 3.9

Average Feed Grade, %Ni 1.41

Average Ni Recovery, % 84.4

Average Concentrate Grade, %Ni 16.9

Concentrate Contained Ni, lbs'000 102,000

Years 5 to LOM

Mill Throughput, Mtpa 2.5

Total Milled, Mt 19.9

Average Feed Grade, %Ni 0.71

Average Ni Recovery, % 88.1

Average Concentrate Grade, %Ni 14.6

Concentrate Contained Ni, lbs'000 275,000

Life of Mine

Total Milled, Mt 23.8

Average Feed Grade, %Ni 0.82

Average Ni Recovery, % 87.3

Average Concentrate Grade, %Ni 15.2

Concentrate Contained Ni, lbs'000 377,000

----------------------------------------------------------------------------

The inclusion of the allowance for low grade mineralisation in the Upside

Sensitivity Case reduces the average feed grade following the commencement of

expanded mining in the Sleeping Giant zone to between 0.55% and 0.6% Ni however

recovery to concentrate would not be expected to vary greatly due to the

excellent metallurgical performance of the Sleeping Giant style mineralisation.

Operating Costs

Operating costs for the mining, processing and general and administration were

developed for the Project by the various consultants. Key input parameters for

the operating costs included:

-- Contractor mining for the initial four year of operations with a

conversion to owner mining thereafter.

-- Typical consumables, labour and other requirements.

-- Power sourced from the Mtwara distribution grid which is separate from

other parts of Tanzania and fed from a privately operated natural gas

fired power station. Connection to this grid is from existing lines near

Nachingwea (approximately 45km from site).

A summary of the operating costs is given in Table 5.

Table 5 -Operating Costs Summary (+/-30%)

----------------------------------------------------------------------------

Parameter Open Pit Only

US$'000 US$/t

----------------------------------------------------------------------------

Years 1 to 4

Mining 258,426

per tonne moved 3.15

per tonne milled 66.27

Processing 70,285 18.02

G&A 49,418 12.67

----------------------------------------------------------------------------

TOTAL 378,129 96.96

----------------------------------------------------------------------------

Years 5 to LOM

Mining 651,187

per tonne moved 1.90

per tonne milled 32.77

Processing 271,558 13.67

G&A 108,720 5.47

----------------------------------------------------------------------------

TOTAL 1,031,464 51.91

----------------------------------------------------------------------------

Life of Mine

Mining 909,613

per tonne moved 2.10

per tonne milled 38.27

Processing 341,843 14.38

G&A 158,138 6.65

----------------------------------------------------------------------------

TOTAL 1,409,594 59.30

----------------------------------------------------------------------------

Unit Operating Costs (US$/lb Ni) (net

of by-product revenue) 3.43

----------------------------------------------------------------------------

For the Upside Sensitivity Case for year five onwards (since years 1 to 4 are

identical to the Base Case) it would be expected that the total mining costs

would not change since the total material mined would not vary, which would lead

to a significant reduction in the unit mining cost per tonne milled. Processing

costs would vary on the breakdown between fixed and variable costs and G&A costs

would be largely fixed. Based on this conceptual style of analysis the Upside

Sensitivity case would be expected to return overall operating costs of between

US$40 and US$45 per tonne milled.

Capital Costs

A breakdown of the estimated capital costs for the Base Case is presented in

Table 6.

Table 6 - Breakdown of Capital Cost Estimate (+/-30%)

----------------------------------------------------------------------------

Cost Area Initial Upgrade Sustaining

(million US$) (million US$) (million US$)

----------------------------------------------------------------------------

Mining 31.2 148.0 46.9

Process Plant 64.5 50.2 6.0

Infrastructure 38.8 19.8 3.6

Tailings Dam 5.1 0.0 7.5

Environmental 0.0 0.0 21.0

Owners Costs 12.8 14.8 0.0

Working capital 16.1 8.5 0.0

EPCM 18.8 23.1 0.0

Contingency 29.4 32.8 0.0

----------------------------------------------------------------------------

TOTAL 216.7 297.2 85.0

----------------------------------------------------------------------------

Note: Working Capital recovery at the end of the LOM is US$39.9M giving a

total capital cost of US$559.0M

For the Upside Sensitivity Case, the up-front capital cost would remain

unchanged from the above, however, the plant upgrade costs would increase with

the increased throughput. These costs were estimated from scaling to give a

total upgrade capital cost of around US$385M (comparable to US$297.2M for the

Base Case) with only minor increases in sustaining and working capital over the

Base Case.

Concentrate Marketing and Revenue

CNI engaged Mineral Commerce Services Pty Ltd ("MCS") to conduct a concentrate

marketing study to provide metal price assumptions, concentrate terms and

freight costs for use in the this study. MCS developed base case metal price

assumptions based on published forecasts. A range of prices was forecast and

median levels of US$22,500 per tonne of nickel and US$7,500 per tonne of copper

were used.

MCS concluded that there would be significant demand for a sulphide concentrate

from the project with its high predicted nickel grade and low contaminants.

Based on typical off-take contracts for high grade nickel concentrates MCS

estimated that the project should achieve 77% payable for nickel (inclusive of

smelting and refining charges and at forecast prices) with an average of US$90

per dry metric tonne of concentrate for other metal credits.

Concentrate from the project will be containerised at the mine site and trucked

approximately 300km to the port of Mtwara in southern Tanzania. Containerised

concentrate will be stored near the port and then loaded using ships gear on an

approximately monthly basis. Concentrate transport costs were estimated based on

typical trucking and shipping charges with Tanzanian specific port charges

estimated. These costs are summarised in Table 7.

Table 7 - Concentrate Transport Estimates

----------------------------------------------------------------------------

Parameter Cost

US$/dry t

----------------------------------------------------------------------------

Road transport to port 57.00

Port Handling 26.00

Port ad valorem (Tanzanian Port Authority Charge) 0.5% of CIF Value

Weighing, sampling and assaying at destination 4.00

Insurance 3.00

Sea Freight

China 32.00

Europe 98.00

North America 84.00

South America 79.00

----------------------------------------------------------------------------

The concentrate marketing and freight terms were reviewed by RPA for use in the PEA.

Economic Assessment

RPA developed a financial model for the Project using the production parameters,

capital and operating costs and revenue information presented above. Assumptions

on taxation and other financial parameters were provided by CNI. The net present

value (NPV) and Internal Rate of Return (IRR) discounted to the commencement of

project delivery are presented on an after-tax basis (only Tanzanian taxes

included). Table 8 below presents the financial highlights associated with the

Project.

Table 8 - Financial and Investment Analysis Highlights

----------------------------------------------------------------------------

Parameter Base Case

----------------------------------------------------------------------------

Financials, US$M

Revenues (mine gate basis) 2,721

Operating income (EBIT) 1,242

Net earnings 1,028

Cash flow from operations 1,433

Free cash flow to equity 539.0

Investment Analysis, US$M

Initial Capital Cost 216.7

Expansion Capital Cost 297.2

Total Sustaining Capital 85.0

Total Capital (after working capital recovery) 559.0

After-tax internal rate of return, % 21.6

Payback, years 5.3

After-tax NPV @ 8% discount rate 207.4

----------------------------------------------------------------------------

Note: All scenarios in this Preliminary Economic Assessment are preliminary

in nature and include both Indicated and Inferred Mineral Resources.

Inferred Mineral Resources are considered too speculative geologically to

have the economic considerations applied to them that would enable them to

be categorized as Mineral Reserves. There is no certainty that the

Preliminary Economic Assessment will be realized.

The cash costs (C1) and the total production costs (C2) per pound of nickel net

of by-product credits for the Base Case are calculated to be US$4.24 and US$5.72

respectively. Both of these measures place the project in the second quartile of

global nickel producers on published industry cost curves.

As previously stated, the inclusion of an allowance for low grade mineralisation

in the Base Case pit in the Upside Sensitivity Case would be expected to provide

a large benefit to the underlying value of the project. The detailed sensitivity

analysis carried out for this case included incorporating the complex impacts of

mill feed tonnage, feed grade, operating costs and capital cost on the return

from the project. This sensitivity analysis indicated that the project NPV could

be expected to increase by approximately US$100M should this sensitivity case be

realised.

Project Development Timeline

Along with the previously outlined re-estimation of the mineral resources and

update of the project economics, the development timeline for the project

includes a number of key milestones. These milestones are outlined in Table 9.

Table 9 - Project Development Timeline Milestones

----------------------------------------------------------------------------

Project Milestone Timing

----------------------------------------------------------------------------

Submit Environmental Scoping Study and Terms of

Reference for Approval December 2011

Update Mineral Resources and PEA Beginning 2Q12

Definitive metallurgical test work complete End 2Q12

Various options studies completed End 2Q12

Complete environmental baseline studies Mid 2012

Complete in-fill drilling on Sleeping Giant zone 4Q12

Submit EIS and EMP for Approval 4Q12

Conditional Off-Take in Place 4Q12

Complete Feasibility Study End 2012

Update Mineral Resource, Prepare Mining Reserve and

Technical Report 1Q13

Project Commitment by CNI 1Q13

Front End Engineering Design 2Q13

Mining Licence and Mine Development Agreement 3Q13

Financing and Production Commitment 3Q13

Commence Construction on Site (end of Wet Season) 2Q14

Commence Commissioning 2Q15

First Production and Shipment 3Q15

----------------------------------------------------------------------------

It is worth noting that the critical path on the current construction schedule

is the wet season in 2013/14 and as such there exists a certain degree of

latitude in the development program and the timeline for permitting, design and

procurement activities.

Qualified Persons

The PEA summarized here for the Ntaka Hill Nickel project will be incorporated

into an NI 43-101 compliant Technical Report to be available on SEDAR and CNI's

website within 45 days of the date of this news release.

The Company is not aware of any environmental, permitting, legal, title,

taxation, socio-political, marketing or other issue that might materially affect

this estimate of Mineral Resources. The projections, forecasts and estimates

presented in the PEA constitute forward-looking statements, and readers are

urged not to place undue reliance on such statements. Additional cautionary and

forward-looking statement information is provided at the end of this press

release.

The Qualified Persons for the purpose of National Instrument 43-101 "Standards

of Disclosure for Mineral Projects" for the PEA are shown in Table 10.

Table 10 - Qualified Persons

----------------------------------------------------------------------------

Section Company Qualified Person

----------------------------------------------------------------------------

Mineral Resources RPA Chester Moore, P. Geo.

Mining and Mine Capital and

Operating Costs RPA Marc Lavigne, Ing.

Metallurgy, flowsheet design,

performance predictions Mineralurgy Peter Munro, FAusIMM

Process plant and infrastructure Christopher Waller,

operating/capital costs Lycopodium MAusIMM(CP)

Concentrate marketing and freight RPA Jason Cox, P.Eng

Financial modelling and general

aspects RPA Jason Cox, P.Eng

----------------------------------------------------------------------------

All qualified persons have reviewed this press release and consented to the

inclusion of the data in the form and context in which it appears.

About Continental Nickel Limited

Continental is focused on the exploration, discovery and development of nickel

sulphide deposits in geologically prospective, but under-explored regions

globally. The Company's key asset is its 75% interest in its Nachingwea property

in Tanzania, where Mineral Resources (Measured and Indicated) have been

estimated at 60,900 tonnes of contained nickel, and an additional 131,000 tonnes

of contained nickel in Inferred Mineral Resources (CNI press release April 15,

2011). The project is a 75:25 exploration joint venture between the Company and

IMX Resources Limited.

The Company also has an option to joint venture on the St. Stephen project in

New Brunswick, Canada where the 2010 diamond drill program discovered new Ni-Cu

sulphide zones.

As at the date of this release, the Company has 42,713,508 common shares issued

and outstanding (51,031,914 on a fully-diluted basis) and trades on the TSX

Venture Exchange under the symbol CNI. The Company remains well funded with over

C$13.6 million in the treasury as at June 30, 2011.

On behalf of Continental Nickel Limited

Dave Massola, President and Chief Executive Officer

CAUTIONARY STATEMENT: This News Release includes certain "forward-looking

statements". All statements other than statements of historical fact included in

this release including, without limitation, statements regarding potential

mineralization, potential or estimated metal recoveries, resources and reserves,

exploration results, future plans and objectives of Continental Nickel Limited,

is forward-looking information that involves various risks and uncertainties.

There can be no assurance that such information will prove to be accurate and

actual results and future events could differ materially from those anticipated

in such information. Important factors that could cause actual results to differ

materially from Continental Nickel Limited's expectations are the risks detailed

herein and from time to time in the filings made by Continental Nickel Limited

with securities regulators.

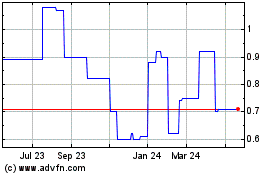

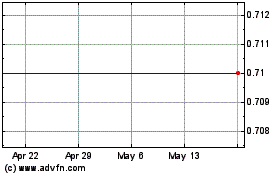

McChip Resources (TSXV:MCS)

Historical Stock Chart

From Apr 2024 to May 2024

McChip Resources (TSXV:MCS)

Historical Stock Chart

From May 2023 to May 2024