Midland Exploration Inc. ("Midland") (TSX VENTURE:MD) is pleased to provide an

update on its various ongoing exploration activities across Quebec, including

projects in partnership with Agnico Eagle Mines Limited ("Agnico Eagle"), Teck

Resources Limited ("Teck"), Osisko Mining Corporation ("Osisko"), Maudore

Minerals Ltd ("Maudore") and Japan Oil, Gas and Metals National Corporation

("JOGMEC").

To date in 2013, more than 7,500 metres were drilled, several new geophysical

surveys were completed as well as prospecting, trenching and channel sampling.

The results of this work have led to the discovery of new gold and platinum

group elements ("PGE") showings, outlining of several new prospective areas and

identification of high-priority drill targets for 2014.

Gold projects in the Abitibi region

Patris Project - Midland/Teck (Option)

The wholly owned Patris project comprises 218 claims covering a surface area of

about 90 square kilometres located less than 10 kilometres northwest of the

prolific Doyon/Westwood-Bousquet-La Ronde gold mining camp. The Patris property

offers excellent gold potential as it covers the Manneville Fault over more than

8 kilometres, and the La Pause Fault over more than 10 kilometres, both

recognized as subsidiary faults to the famous Destor-Porcupine Fault Zone.

Under a new option agreement recently signed with Teck where Midland is the

Project Manager of the initial program (see release dated September 17, 2013),

prospecting, soil geochemistry and trenching were carried out on the newly

identified Rosie showing, which intersected 15.5 grams per ton gold ("g/t Au")

in a grab sample, to characterize the geological setting of the showing and to

prioritize induced polarization ("IP") anomalies in preparation for an upcoming

drill program. Assay results from the work recently completed in October are

pending.

Maritime-Cadillac Project - Midland/Agnico Eagle JV

The Maritime-Cadillac property is located along the Larder Lake - Cadillac break

and is contiguous to the Agnico Eagle's Lapa gold mine property (2.1 million

tonnes in proven and probable reserves categories at a gold grade of 6.0 g/t,

for 395,000 ounces of gold), in commercial production since May 2009. The

Maritime-Cadillac project is a joint-venture currently owned 51% by Agnico Eagle

and 49% by Midland.

The 2013 drill campaign, totalling 2,373 metres on the Maritime-Cadillac

property, included five (5) underground holes drilled from the Lapa Mine's

exploration drift 1,000 metres deep, and one (1) drill hole completed from the

surface. The surface drill hole 141-13-35, aiming the Dyke West zone at a

vertical depth of 600 metres, returned 1.5 g/t Au over 18.9 metres between 673.3

and 692.2 metres, including 1.85 g/t Au over 12.9 metres between 679.3 and 692.2

metres. This drill hole was completed about 300 metres below drill hole

141-10-26 which returned 8.6 g/t Au over 5.5 metres between 383.1 and 388.6

metres, including an interval of 13.8 g/t Au over 3.0 metres.

The Dyke West zone remains completely open above drill hole 141-10-26, below

hole 141-13-35, and laterally below the vertical depth of 500 metres.

Underground drill holes intersected anomalous gold zones with values up to 1.92

g/t Au over 1.5 metre and 1.36 g/t Au over 1.5 metre in drill hole 101-S-02.

Midland Exploration is currently planning a drill program to test the extensions

of the Dyke West zone in 2014.

Laflamme Project - Midland/Maudore JV

The Laflamme project comprises 715 claims covering a surface area of about 365

square kilometres. This project is currently a joint venture with Aurbec Mines

Inc., a wholly-owned subsidiary of Maudore. This project is located about 25

kilometres northwest of the town of Lebel-sur-Quevillon and about 30 kilometres

east of the Sleeping Giant mine and mill in Quebec.

During the 2013 summer, Midland completed several IP surveys totalling more than

40 kilometres, which led to the identification of several new drill targets

along a gold trend interpreted and traced over more than 20 kilometres. This

trend was identified by Midland during the winter 2013 drill campaign designed

to establish the northeastward continuity of a gold discovery made in 2011

(Piccadilly showing: 9.7 g/t Au over 1.0 metre) and along the strike extensions

of the Comtois North West discovery announced in June 2012, which graded 71.2

g/t Au over 1.2 metre and 0.8 g/t Au over 40.8 metres (Source: Press release by

Maudore dated June 6, 2012). These holes drilled by Midland in the winter of

2013 along the prospective trend led to the discovery of new gold showings at

Trafalgar (0.40 g/t Au over 5.7 metres including an interval grading 1.72 g/t Au

over 1.0 metre) and Notting Hill (0.34 g/t Au over 25.56 metres including an

interval grading 3.12 g/t Au over 1.5 metre). Upcoming works on Laflamme will

mainly comprise diamond drilling in order to test the best geophysical targets

identified along the gold trend.

Jouvex Project - 100% Midland

The Jouvex property comprises 272 claims covering a surface area of

approximately 143 square kilometres along the Casa Berardi-Douay-Cameron

gold-bearing deformation zone. The Jouvex property is wholly owned by Midland

and is located about 50 kilometres west of Matagami in the Abitibi region of

Quebec.

This property, with strong gold potential, covers over more than 10 kilometres,

a prominent regional flexure along the Casa Berardi-Douay-Cameron deformation

zone. This major structure hosts the Casa Berardi mine, located about 65

kilometres further west, and the Douay and Douay West deposits about 7

kilometres to the southeast of the Jouvex property. The Douay gold deposits

contain 2.8 million ounces of gold as inferred resources and 238,433 ounces of

gold as measured and indicated resources (Source: Aurvista Gold Corporation

website).

Recently, a new helicopter-borne VTEM-type electromagnetic survey totalling

about 400 kilometres, led to the identification of several new electromagnetic

anomalies ("EM") that were previously undetected by historical airborne surveys.

These new EM anomalies combined with IP anomalies delineated during recent

ground-based surveys in the vicinity of a historical gold showing grading 6.2

g/t Au over 1.52 metre in drill hole, represent new high-priority drill targets

on the Jouvex property.

Casault Project - 100% Midland

The Casault gold property comprises 286 claims exclusively owned by Midland

covering an approximate area of 157 square kilometres. The Casault property

covers a portion of the Sunday Lake Fault over more than 20 kilometres strike

length and is located about 40 kilometres east of the Detour Lake gold deposit,

which currently hosts, near surface, 15.6 million ounces of proven and probable

mineral gold reserves (National Instrument 43-101 ("NI 43-101") compliant).

In 2012, a new high-grade gold-bearing zone was discovered near surface in drill

hole CAS-12-07 with 10.4 g/t Au over 1.45 metres along the northern contact

between a quartz monzodiorite intrusion and sedimentary rocks. This high-grade

gold zone is within a wider strongly sericitized alteration zone anomalous in

gold over more than 13.75 metres that remains open in all directions. The winter

2013 drill campaign on Casault included fourteen (14) short diamond drill holes

totalling 2,992.0 metres of drilling. This program identified two new and

underexplored favorable areas for gold. The first gold-prospective area is

located about 5 kilometres southwest of the Martiniere West gold zone held by

Balmoral Resources Ltd. Drill hole CAS-13-28A was terminated at a depth of 201.0

metres in a sheared gabbro exhibiting quartz-carbonate veins with pyrite

mineralization that graded 0.29 g/t Au over 9.0 metres at the end of the hole.

The second gold-prospective area was intersected by drill hole CAS-13-36

collared near the Sunday Lake Fault in the western portion of the property. This

second prospective zone returned an anomalous 0.17 g/t Au over 7.5 metres from

66.5 to 74.0 metres within a shear zone with sericite alteration. These areas

remain underexplored and open in all directions. Upcoming exploration work will

include additional IP surveys as well as further drilling to test the extensions

of these prospective zones.

Recently, due to decreasing gold price and a focus on exploring its wholly-owned

properties, Osisko informed Midland of its intention to terminate the option

agreement which could have allowed them to earn 50% interest in the Casault

project.

During the first two years of this agreement, Osisko funded more than $3 million

in exploration work on Casault, mainly in drilling. Midland has greatly

benefited from working with Osisko and wishes to acknowledge its important

contribution in improving the geological understanding of this property.

Gold projects in the James Bay region

Baie James Eleonore Project - 100% Midland

The Eleonore project encompasses Eleonore Centre and West properties for a

combined total of 247 claims covering 128 square kilometres. These two blocks

are located approximately 30 kilometres southwest from and in a geological

environment similar to Goldcorp Inc.'s Eleonore deposit. This world-class gold

deposit contains 3.15 million ounces of measured and indicated gold resources at

an average grade of 11.92 g/t Au, and 6.25 million ounces of inferred gold

resources at an average grade of 12.93 g/t Au per tonne (Source: Goldcorp press

release February 17, 2010).

The 2013 prospecting program on Eleonore Centre property led to the discovery of

several new gold showings. The Golden Gun East (18.8 g/t Au) and Golden Gun West

(11.95 g/t Au, 2.36 g/t Au and 1.69 g/t Au) showings were respectively found 75

metres east and 200 metres west of the Golden Gun showing (13.6 g/t Au). The

Aston Martin showing (1.63 g/t Au) was discovered about 1.4 kilometre south of

the Golden Gun area and is associated to an EM conductor and a strong IP

anomaly. A new gold showing was also discovered in the northwestern part of the

IP grid at about 200 metres east from the Casino showing (0.64 g/t Au) and

returned 1.58 g/t Au. Moreover, five (5) trenches were completed on the Golden

Gun and Aston Martin areas. The Golden Gun West trench returned 0.44 g/t Au over

4.0 metres, including 0.91 g/t Au over 1.0 metre. Interestingly, a grab sample

returning up to 11.95 g/t Au was found in a sheared conglomeratic metasediment

injected of pyrite and quartz-tourmaline veinlets. Results from the Golden Gun

trench returned 0.28 g/t Au over 4.0 metres, including 0.35 over 1.0 metre. On

the Golden Gun South trench, heavily concentrate quartz-tourmaline veinlets were

uncovered returning up to 4.78 g/t Au from a grab sample.

Marked by abundant quartz-tourmaline veinlets over several hundred square

meters, these results confirm that a sizeable auriferous hydrothermal system is

present on the Eleonore Centre property. Moreover, several strong IP anomalies,

locally coincident with arsenic-copper-antimony soil geochem anomalies, remain

unexplained.

Platinum Group Elements project (Labrador Trough - Quebec)

Pallas Project - 100% Midland

In 2013, foreseeing significant price increases for the Platinum Group Elements

("PGE"), Midland acquired 477 new claims covering more than 217 square

kilometres in the Labrador Trough. This new strategic acquisition covers a

large, folded, pluri-kilometric ultramafic-mafic complex known for its strong

PGE exploration potential.

In only a week of field work, Midland has discovered several significant

platinum, palladium and gold ("2PGE + Au") mineralization with one returning 3.5

g/t 2PGE + Au. While prospecting farther along strike north, 5 grab samples

returned 2.46, 1.54, 1.11, 0.99 and 0.77 g/t 2PGE + Au respectively. This

mineralized trend has been traced over more than 250m. Farther in the Thevenet

Lake area, two grab samples along a same mineralized trend and separated by 330

metres has returned 0,85 et 3,9 g/t 2PGE + Au respectively. Elsewhere, in only

one stop, 3 grab samples collected within 50 metres of each other contained 2.9,

1.09 and 0.59 g/t 2PGE + Au respectively. All mineralization are concentrated in

differentiated mafic gabbro containing reef-like pegmatitic gabbro horizons

(characterized to be long, wide and narrow deposits). Midland is very

enthusiastic by these early results and plans a follow-up exploration program

for next year.

Rare Earth project (Quebec and Labrador)

Ytterby Project - Midland /JOGMEC JV

During 2013, in partnership with JOGMEC, exploration field works on the rare

earth elements ("REE") Ytterby project were limited to the Strange Lake glacial

dispersal train. The property comprises more than 400 claims, covering almost

entirely, some 100 square kilometers of the Strange Lake glacial dispersal

train. Field works included collecting 40 new mineralized blocks and 21 surface

tills samples. This work confirmed the presence and good REE grades in the

boulders and tills samples over more than 30 kilometers derived from the REE

likely source, the B-Zone and the Strange Lake Deposits. The B-Zone deposit

currently has an indicated resource of 278,128,000 tonnes at 0.93% total rare

earth oxides plus yttrium oxide ("TREO + Y2O3"), 1.92% zirconium oxide ("ZrO2"),

and 0.18% niobium pentoxide ("Nb2O5"), and an inferred resource of 214,351,000

tonnes at 0.85% TREO + Y2O3, 1.71% ZrO2 and 0.14% Nb2O5; whereas the Strange

Lake Deposit has an estimated resource of (not NI 43-101 compliant) 52 million

tonnes at 3.25% ZrO2, 0.56% Nb2O5 and 0.66% Y2O3 and 1.3% REE. Average grade

from the mineralized boulders on the Midland's property returned 0.71% TREO+

Y2O3.

Discussions with JOGMEC to plan the next exploration campaign are underway with

the objective to further evaluate the economic potential to extract the

mineralized boulders from the Strange Lake glacial dispersal train.

Cu-Zn project (Appalachians-Quebec)

Weedon Project - 100% Midland

From Soquem, Midland has recently acquired 100% interest in base metal rights on

the Lingwick deposit located on its Weedon property. The Weedon property is

located in the Ascot-Weedon felsic belt, about 120 kilometres south of Quebec

City. With this new acquisition, Midland now holds all mineral rights on this

deposit. Historical resources (not NI 43-101 compliant) were estimated at

350,000 tonnes grading 5.84% zinc ("Zn"), 0.61% cuivre ("Cu"), 0.14% plomb

("Pb"), and 0.35 g/t Au. The Lingwick deposit remains open down-plunge

southeastward and is untested below 300 metres vertical depth. As compensation,

Midland granted, subject to buyback, a 1.5% net smelter return ("NSR") royalty

to Soquem Inc.

The Weedon property comprises 242 claims covering about 125 square kilometers.

It covers more than 30 kilometres of favourable stratigraphy in the Ascot-Weedon

volcano-sedimentary belt which hosts several deposits, among which three former

mines at Cupra-d'Estrie (Historical production: 2.43 million of tons ("Mt") at

2.74% Cu, 3.28% Zn, 38.0 g/t silver ("Ag"), and 0.5 g/t Au), Solbec (Historical

production: 2.06 Mt at 1.57% Cu, 4.57% Zn, 0.68% Pb, 48.6 g/t Ag, and 0.61 g/t

Au) and Weedon (Historical production: 1.6 Mt at 2.33% Cu, 0.86% Zn, and 0.56

g/t Au).

Recent gravity and IP geophysical surveys carried out on the Weedon property

have delineated a series of new drill targets strategically located along strike

the respective extensions of the Lingwick, Weedon, Cupra-d'Estrie and Solbec

deposits. Midland is currently seeking a new partner on this project and intends

to secure a new option agreement in order to rapidly drill test these new

targets.

Quality Control ("QA/QC")

The drilling program on the Maritime-Cadillac project was operated by Agnico

Eagle whereas the Casault's drill program was operated by Osisko. The drill

program on Laflamme was operated and supervised by Midland. For these three

projects, selected samples were taken from NQ-size drill core sawn in two

halves; one half was shipped to a commercial laboratory for analysis and the

second half was kept for future reference. Quality control samples including

standards and blanks were inserted in the sample stream for mineralized zones.

Analyses, including those from the Patris and Eleonore Centre projects, were

conducted by ALS Minerals in Val-d'Or. Drill intersections are reported as core

lengths and their true thickness remains to be determined. The data were

reviewed by Mario Masson, VP Midland Exploration and Qualified Person as defined

by NI43-101.

The Pallas and Ytterby exploration programs were supervised by Mr. Robert

Banville, senior geologist for Midland and Qualified Person as defined under

NI43-101. Analyses from the Pallas project were conducted by ALS Minerals in Val

d'Or and previously reported analyses for Ytterby were performed by Actlabs of

Ancaster, Ontario. Both laboratories used strict internal QA/QC programs which

include mineralized standards, blanks and duplicate samples.

About Midland

Midland targets the excellent mineral potential of Quebec to make the discovery

of new world-class deposits of gold, PGE, base metals and rare earth elements.

Midland is proud to count on reputable partners such as Teck Resources Limited,

Agnico Eagle Mines Limited, Maudore Minerals Limited, Japan Oil, Gas and Metals

National Corporation and SOQUEM Inc. Midland prefers to work in partnership and

intends to quickly conclude additional agreements in regard to newly acquired

properties. Management is currently reviewing other opportunities and projects

to build up the Company portfolio and generate shareholder value.

This press release was prepared by Mario Masson, VP Midland Exploration and

Qualified Person as defined by NI 43-101.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

This press release may contain forward-looking statements that are subject to

known and unknown risks and uncertainties that could cause actual results to

vary materially from targeted results. Such risks and uncertainties include

those described in Midland's periodic reports including the annual report or in

the filings made by Midland from time to time with securities regulatory

authorities

FOR FURTHER INFORMATION PLEASE CONTACT:

Midland Exploration Inc.

Gino Roger, President and Chief Executive Officer

450 420-5977

450 420-5978 (FAX)

info@midlandexploration.com

www.midlandexploration.com

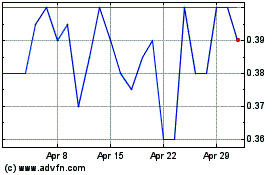

Midland Exploration (TSXV:MD)

Historical Stock Chart

From Apr 2024 to May 2024

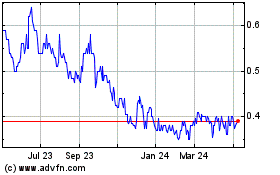

Midland Exploration (TSXV:MD)

Historical Stock Chart

From May 2023 to May 2024