Montero Reports Positive Preliminary Economic Assessment at the Duyker Eiland Phosphate Project, South Africa

February 28 2012 - 7:00AM

Marketwired Canada

Montero Mining and Exploration Ltd. (TSX VENTURE:MON) ("Montero") announces the

results of an initial NI 43-101 compliant Preliminary Economic Assessment

("PEA") of its sedimentary phosphate Duyker Eiland Project located 30 kilometers

north of the Port of Saldanha, in the Western Cape Province of South Africa.

The PEA is based on an initial Inferred Mineral Resource of 32.8 million tonnes,

grading at 7.15% P2O5, as previously reported following an independent resource

estimate prepared by AMEC Earth & Environmental (UK) Limited. Preliminary

metallurgical test work indicated that an acid-grade phosphate concentrate of

33% P2O5to 35% P2O5 (72.1% BPL to 76.5% BPL) can be produced by flotation. (See

News Release dated 14/12/2011). The independent PEA was conducted by Turgis

Consulting (Pty) Ltd. (Turgis) who will also submit the NI 43-101 compliant

report on SEDAR within 45 days. The PEA is preliminary in nature as it includes

Inferred Mineral Resources which are considered too speculative geologically to

have the economic considerations applied to them that would enable them to be

categorized as "Mineral Reserves". There is no certainty that the PEA will be

realized as Mineral Resources that are not Mineral Reserves do not have

demonstrated economic viability.

Dr. Tony Harwood, President and Chief Executive Officer of Montero commented,

"We are pleased the results of the PEA on the initial Inferred NI 43-101 Mineral

Resource at Duyker Eiland has returned such robust economics with a NPV of CAD$

150 million with a 10% discount rate. Montero is in discussions with a number of

parties interested in commercializing our phosphate assets. Montero remains

committed to establishing early production on our flagship Wigu Hill Rare-Earth

Project in Tanzania while seeking partners to develop our phosphate assets."

Highlights of the PEA

-- A NPV of CAD$ 150 million (at a discount rate of 10%) and an IRR of 41%

-- Average 4.5 million tonnes per annum rock mined at low stripping ratios

of 0.57:1

-- Average production of 490,000 tonnes per annum of 33% P2O5concentrate

-- 11 year Life of Mine (based on initial resource estimate)

-- Operating cash costs CAD$ 99 per tonne concentrate Free alongside Ship

("FAS") Port of Saldanha, South Africa

-- Capital costs of CAD$ 129 million

-- Opportunities to increase value of project through production of

fertilizers

Summary of the Project Economics

The PEA indicates that the project is expected to generate robust financial

returns. All figures are presented pre-tax and before South African royalty

deductions. All costs were estimated locally in South African Rand (ZAR) and

converted to Canadian Dollars (CAD$) for reporting purposes. The average

exchange rate for CAD/ZAR is based on a 12 month average from 01/02/11 to

31/01/12 (source: historical interbank rate at www.oanda.com). All revenues were

estimated in USD and converted to ZAR. The average exchange rate for USD/ZAR is

based on a 12 month average from 01/02/11 to 31/01/12 (source: historical

interbank rate at www.oanda.com). The results and assumptions for the economic

analysis are as follows:

----------------------------------------------------------------------------

Economic Analysis using ZAR/CAD exchange rate: 7.38 and ZAR/USD exchange

rate: 7.33

----------------------------------------------------------------------------

NPV CAD $150 Million

----------------------------------------------------------------------------

IRR 41%

----------------------------------------------------------------------------

Discount Rate 10%

----------------------------------------------------------------------------

Total Capex CAD$ 129 Million

----------------------------------------------------------------------------

Total Opex per tonne of 33% P2O5 concentrate Free USD$ 100 or

Alongside Ship ("FAS") Port of Saldanha: CAD$ 99

----------------------------------------------------------------------------

Estimated 33% P2O5 Concentrate Price FAS Port of Saldanha: USD$ 188

----------------------------------------------------------------------------

Price

The concentrate price was based on rock phosphate prices published by the World

Bank. USD$ 188 per tonne is the 12 month average price of contract 70% BPL

concentrate FAS Casablanca, Morocco between February 2011 and January 2012. The

product concentration expected from Duyker Eiland is between 72% BPL to 76.5%

BPL.

Sensitivity to price was investigated at reduced product prices. At a reduction

in product revenue per tonne of 15% (USD$ 160) the project still demonstrates

robust returns with an IRR of 27%. Currently, 70% BPL rock phosphate FAS

Casablanca is published by the World Bank at USD$ 202 per tonne (January 2012).

Operating Costs

Infrastructure operating costs and mining costs were estimated from the Turgis

cost database and the latter confirmed by comparison with costs supplied by a

local mining contractor. Power and water consumption were estimated from

experience and work carried out in the experimental flotation tests with costs

estimated from South African utility rates and escalated based on expected

increases in these rates. Reagent consumption was calculated from the flotation

tests, a reagent suite based on a fatty acid combination was selected and costs

obtained from a local supplier. Owners costs comprised largely of labour was

estimated from the generation of a labour compliment with standard industry

labour rates applied. Maintenance spares and other auxiliary costs were factored

from industrial experience. Transport and logistics costs which include

transport to port, warehousing at port and transport to wharf alongside ship

(FAS) were calculated based on a budget quote received from local transport

company.

A 20% contingency was included in these estimates resulting in concentrate cost

FAS Port of Saldanha of CAD$ 99 per tonne. It was estimated that port and

loading costs (Free on Board or "FOB") would cost less than CAD$ 10 per tonne of

concentrate.

Capital Costs

Capital costs were estimated by undertaking conceptual level engineering to

define the plant and infrastructure requirements. Capital was then estimated for

these requirements based on: sizing equipment according to a developed flow

sheet and related mass balance; obtaining equipment cost from budget prices from

equipment suppliers and the Turgis cost data base; factoring the additional

direct costs and the indirect costs based on the total direct cost and according

to industrial experience.

The capital generated was then increased by various degrees for the following

categories: Engineering, Procurement and Construction Management at 15%,

Contingencies at 20%, and Ongoing Capital at 5%. Total capital costs for the

Project are estimated to be CAD$ 129 million.

NPV

Based on these assumptions a preliminary financial model indicates robust

project economics with a NPV of CAD$ 150 million. This figure does not include

expenditure required for exploration and engineering development during 2012 and

2013. Montero will continue to explore the possibility of production of other

higher-content phosphate fertilizers and other products to generate additional

returns for the Project.

Future Work

The next steps for the Duyker Eiland Phosphate Project will be to increase the

resource confidence and estimates and complete sampling to allow for detailed

characterization of the rock phosphate concentrates that may be produced. An

Environmental and Social scoping study may commence in preparation for

Pre-feasibility Studies and additional economic assessment may be commissioned

to examine the viability of a fertilizer plant investment in the area.

Qualified Person's Statement

Turgis is a Johannesburg based engineering consultancy, focused on the mining

industry, and has over 20 years of experience in engineering projects for mining

companies in Africa. The Turgis PEA team is headed by Sten Johansson (MSAIMM), a

Process Engineer and a qualified person for the purpose of National Instrument

43-101. Mr. Johansson has firsthand experience operating a phosphate

beneficiation plant at a phosphate mine that once operated 25 km from Duyker

Eiland. Andrew Pooley (FSAIMM) is a Mining Engineer and a qualified person for

the purpose of National Instrument 43-101 and will cover the mining aspects of

the PEA. Technical information contained in this press release has been reviewed

by Mr. Mike Evans, M.Sc. Pr.Sci.Nat., who is a qualified person for the purpose

of National Instrument 43-101 and a Consulting Geologist to Montero.

About Montero Mining & Exploration

Montero Mining and Exploration Ltd. is a mineral exploration and development

company engaged in the identification, acquisition, evaluation and exploration

of mineral properties primarily focused on rare earth elements (REE), but with

phosphates and uranium assets in Tanzania, South Africa and Quebec, Canada,

respectively. Montero is focused on adding value for all shareholders through

the acquisition and exploration on properties, which have the highest potential

for future discoveries or development of existing mineral resources into

mineable reserves. We remain engaged in the development of our flagship Wigu

Hill Rare Earth Element Project in Tanzania, which is a high-grade, undeveloped

Light Rare Earth Element deposit. The Company's current focus is on updating the

initial NI 43-101 Mineral Resource Estimate and advancing the

hydro-metallurgical testwork with Mintek. With the rising prices of REEs and

China's control over export quotas, it is becoming imperative that the rest of

the world develops new rare earth resources to meet the increasing demand from

"green" technology and high-tech applications.

Montero's growth strategy is to develop the Wigu Hill Rare Earth Element project

and to bring this to account through eventual rare earth production and cash

flow, while operating in an environmentally and socially responsible manner. We

will continue to add value through the development of our portfolio of

properties. Montero trades on the TSX Venture Exchange under the symbol MON.

Dr. Tony Harwood - President and CEO

CAUTIONARY STATEMENT: This News Release includes certain "forward-looking

statements". These statements are based on information currently available to

the Company and the Company provides no assurance that actual results will meet

management's expectations. Forward-looking statements include estimates and

statements that describe the Company's future plans, objectives or goals,

including words to the effect that the Company or management expects a stated

condition or result to occur. Forward-looking statements may be identified by

such terms as "believes", "anticipates", "expects", "estimates", "may", "could",

"would", "will", or "plan". Since forward-looking statements are based on

assumptions and address future events and conditions, by their very nature they

involve inherent risks and uncertainties. Actual results relating to, among

other things, results of exploration, project development, reclamation and

capital costs of the Company's mineral properties, and the Company's financial

condition and prospects, could differ materially from those currently

anticipated in such statements for many reasons such as: changes in general

economic conditions and conditions in the financial markets; changes in demand

and prices for minerals; litigation, legislative, environmental and other

judicial, regulatory, political and competitive developments; technological and

operational difficulties encountered in connection with the activities of the

Company; and other matters discussed in this news release. This list is not

exhaustive of the factors that may affect any of the Company's forward-looking

statements. These and other factors should be considered carefully and readers

should not place undue reliance on the Company's forward-looking statements. The

Company does not undertake to update any forward-looking statement that may be

made from time to time by the Company or on its behalf, except in accordance

with applicable securities laws.

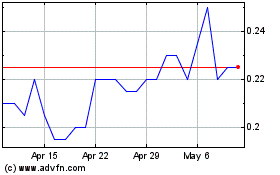

Montero Mining and Explo... (TSXV:MON)

Historical Stock Chart

From Jun 2024 to Jul 2024

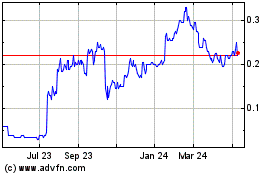

Montero Mining and Explo... (TSXV:MON)

Historical Stock Chart

From Jul 2023 to Jul 2024