Blue Moon Metals Inc. (“

Blue Moon” or the

“

Company”) (

TSXV: MOON) is

pleased to announce the acquisition of all the shares in

Repparfjord Eiendom AS (“

REAS”) from Wergeland

Eigedom AS (“

WG”), a private Norwegian Company,

along with associated ship loading equipment and infrastructure

related to aggregate mining, port area and adjacent properties to

Blue Moon’s Nussir Project in Norway (the “

Nussir

Project”) (together the “

Transaction”).

Through a series of transactions, Blue Moon has paid 180 million

NOK (~US$16 million) as consideration, comprised of 42.1 million

common shares of Blue Moon (the “

Consideration

Shares”) (at C$0.30 per Consideration Share) and

approximately US$7.2M in cash. WG now owns approximately 8% of the

issued and outstanding common shares of Blue Moon (the

“

Blue Moon Shares”). REAS has a ground lease

agreement with the Finnmark Estate, a legal entity established by

law in Norway, for the use of the Oyen Industrial Land. Under the

terms of an agreement between Blue Moon and WG dated March 6, 2025

(the “

Agreement”), WG will continue to be able to

sublease part of the land for aggregate production, in

consideration for annual sublease payment fees. Pursuant to the

Agreement, WG has also agreed to acquire agreed upon waste rock

volumes from the Nussir Project for a minimum price of 15 NOK /

tonne.

This is a transformational transaction providing

the Nussir Project with the majority of the required infrastructure

for the project to be built. Key highlights of the acquired

infrastructure include:

- Quay for aggregate logistics

including a modern ship-loading and conveyer system that is in

active use by WG

- Port facility for large ships

- Fully permitted and operating

aggregate mine

- Barracks for construction and

operations at the Nussir Project

- Administrative and storage

building

- Full process plant building in good

condition and of sufficient size to install a 6,000 tpd flotation

plant

- Large silo and conveyer

systems

- License to utilize fresh water from

a reservoir

- Ancillary land to the project (the

“Ancillary Lands”)

- Zoning in place for an industrial

site including for mining and processing

The below image shows the mill building, silo

and office administration area taken in January 2025. The

deep-water fjord is ice-free year-round. The portal for the mine

will be immediately beside the mill building and two powerlines

cross the property right behind the mill building. Power costs for

industrial use are ~US$0.04/kWh. The Transaction has closed, but

some filings, registrations and legal perfection, in particular

related to the Ancillary Lands, will be concluded as soon as

possible.

The Consideration Shares were deposited into

escrow pursuant to the TSX Venture Exchange (the

“TSXV”)’s escrow policies, and are subject to a

statutory hold period of four months and one day from the date of

issue. Currently the Consideration Shares are subject to the TSXV

Tier 2 escrow release schedule, with 10% being released from escrow

commencing on the date of the TSXV bulletin, and thereafter in 15%

increments on each of the six, twelve, eighteen, twenty-four,

thirty and thirty-six months following the date thereof. However,

Blue Moon is currently uplisting from a TSXV Tier 2 issuer to a

TSXV Tier 1 issuer. Such process, if approved by the TSXV, would

result in the effective escrow period expected to be the shortened

Tier 1 escrow release schedule, with four equal tranches of 25%

being released from escrow commencing on the date of the TSXV

bulletin approving the uplisting, and thereafter on each of the

six, twelve and eighteen months following the date thereof. The

uplisting remains subject to TSXV approval.

Hartree Tranche 2

In connection with its strategic investment

announced in Blue Moon’s December 19, 2024, press release, Hartree

Partners LP (“Hartree”) has purchased 17.5 million

Blue Moon Shares at C$0.30 per Blue Moon Share for total proceeds

of C$5.25 million (the “Investment”). No finders

fees are payable on the Investment, and the Blue Moon Shares issued

pursuant to the Investment are subject to a statutory 4 month and

one day hold period from issuance. The proceeds from the Investment

will be used for general corporate purposes and advancement of Blue

Moon’s three mining projects.

There are now 511,092,306 Blue Moon Shares

outstanding, of which approximately 8% are held by Hartree.

Share Consolidation

Further to Blue Moon’s press release dated March

3, 2025, the Company will consolidate the Blue Moon Shares on the

basis of ten (10) pre-consolidation Blue Moon Shares for every one

(1) post-consolidation Blue Moon Share (the

“Consolidation”). Effective as of the opening of

market on or about March 14, 2025, the Blue Moon Shares will

commence trading on a post-Consolidation basis on the TSXV.

Following the Consolidation, it is expected there will be

approximately 51,109,231 post-Consolidation Blue Moon Shares

outstanding. A new CUSIP number of 09570Q509 replaces the old

CUSIP number of 09570Q202 to distinguish between the pre- and post-

consolidated Blue Moon Shares. The Consolidation remains subject to

TSXV approval.

Letters of transmittal describing the process by

which shareholders may obtain new share certificates representing

their post-Consolidation Blue Moon Shares will be mailed shortly to

registered shareholders who hold their Blue Moon Shares via

certificate. Shareholders who hold their shares via Direct

Registration System, or through a broker or other intermediary and

do not have shares registered in their name, will not be required

to complete a letter of transmittal.

Corporate Update

The Company has awarded a total of 845,069

deferred share units (“DSUs”) under the Company’s

share compensation plan to the independent members of the board of

directors. The DSUs will vest upon the directors’ departure from

the Company.

Qualified Persons

The technical and scientific information of this

news release has been reviewed and approved by Mr. Dustin Small,

P.Eng., a non-Independent Qualified Person, as defined by NI

43-101.

About Blue

Moon

Blue Moon is advancing 3 brownfield polymetallic

projects, including the Nussir copper-gold-silver project in

Norway, the NSG copper-zinc-gold-silver project in Norway and the

Blue Moon zinc-gold-silver-copper project in the United States. All

3 projects are well located with existing local infrastructure

including roads, power and historical infrastructure. Zinc and

copper are currently on the USGS and EU list of metals critical to

the global economy and national security. More information is

available on the Company’s website (www.bluemoonmetals.com).

For further

information

Blue Moon Metals

Inc.Christian Kargl-SimardPresident, CEO and

DirectorPhone: (416) 230 3440Email:

christian@bluemoonmetals.com

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

CAUTIONARY

DISCLAIMER -

FORWARD LOOKING

STATEMENTS

This news release includes “forward-looking

statements” and “forward-looking information” within the meaning of

applicable Canadian and U.S. securities laws. All statements

included herein that address events or developments that we

expect to occur in the future are forward-looking statements.

Forward-looking information may in some cases be identified by

words such as “will”, “anticipates”, “expects”, “intends” and

similar expressions suggesting future events or future

performance. Forward-looking statements in this press release

include, but are not limited to, statements regarding: the

anticipated benefits of the Transaction; that WG will continue to

be able to sublease part of the land; that WG will acquire all

waste rock from the Nussir Project; that the Nussir Project will be

built; that the Transaction provides the majority of the required

infrastructure for the Nussir Project; the location of the portal

for the mine; the uplisting of the Company to Tier 1; the escrow

schedule applicable to the Consideration Shares; the expected use

of proceeds of the Investment; the statements regarding the

advancement of Blue Moon’s three mining projects by the Company;

Blue Moon’s decision regarding construction of its projects and

the timing thereof; the effective date of the Consolidation; the

number of Blue Moon shares outstanding post-consolidation; the

timing of the vesting and conversion of the deferred share units

granted, if at all.

We caution that all forward-looking information

is inherently subject to change and uncertainty and that actual

results may differ materially from those expressed or implied by

the forward-looking information. A number of risks, uncertainties

and other factors could cause actual results and events to differ

materially from those expressed or implied in the forward-looking

information or could cause our current objectives, strategies and

intentions to change, including but not limited to: the

anticipated benefits of the Transaction will not be as anticipated;

that WG will decide to no longer sublease part of the land; that

the waste rock from the Nussir Project will not meet the standard

to be sold to WG; that the Nussir Project may never be built; the

strategic benefits expected to result from the Transaction will not

be fully realized; that the portal may be located somewhere else;

that the proceeds from the Financing may be used differently than

expected. Accordingly, we warn investors to exercise caution when

considering statements containing forward-looking information and

that it would be unreasonable to rely on such statements as

creating legal rights regarding our future results or plans. We

cannot guarantee that any forward-looking information will

materialize and you are cautioned not to place undue reliance on

this forward-looking information. Any forward-looking information

contained in this news release represents management’s current

expectations and are based on information currently available to

management, and are subject to change after the date of this news

release. We are under no obligation (and we expressly disclaim any

such obligation) to update or alter any statements containing

forward-looking information, the factors or assumptions underlying

them, whether as a result of new information, future events or

otherwise, except as required by law. All of the forward-looking

information in this news release is qualified by the cautionary

statements herein.

Forward-looking information is provided herein

for the purpose of giving information about the Transaction and the

Investment referred to herein There can also be no assurance that

the strategic benefits expected to result from the Transaction or

the Investment will be fully realized.

A comprehensive discussion of other risks that

impact Blue Moon can also be found in its public reports and

filings which are available at www.sedarplus.ca.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/880d4534-d531-472b-88ab-8b4706628119

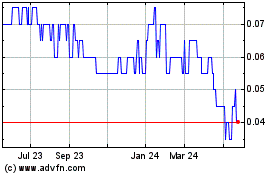

Blue Moon Metals (TSXV:MOON)

Historical Stock Chart

From Feb 2025 to Mar 2025

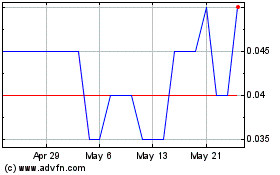

Blue Moon Metals (TSXV:MOON)

Historical Stock Chart

From Mar 2024 to Mar 2025