FuelPositive Corporation (TSX.V: NHHH) (OTCQB: NHHHF) (the

“

Company”) is pleased to announce that it has

closed a non-brokered private placement (the

“

Offering”) of 6,741,000 units (each, a

“

Unit”) at a price of $0.06 per Unit, for

aggregate gross proceeds of $404,460. Each Unit consists of one

common share of the Company and one common share purchase warrant

(each, a “

Warrant”), allowing holders to purchase

an additional common share at an exercise price of $0.09 until

September 11, 2026. In the event the volume-weighted average

closing price of the Company’s common shares on the TSX Venture

Exchange (the “

TSXV”) exceeds $0.40 for ten

consecutive trading days, the Company retains the option to

accelerate the expiry date of the Warrants to thirty days after a

public announcement of the election.

All securities issued in the Offering are

subject to a statutory hold period until January 12, 2024, in

accordance with applicable securities laws. In connection with the

Offering, the Company paid $12,352 and issued 205,870 Warrants to

an arms-length third party (the “Finder”) who

assisted in introducing a subscriber to the Offering.

The net proceeds from this Offering will be

utilized for further development of demonstration systems for the

commercial production of green ammonia, and for general working

capital purposes.

Debt Settlement

The Company also announces that, at the request

of the TSXV, it has revised the terms of its previously announced

proposal to settle outstanding indebtedness totaling $133,000, as

previously announced by the Company in its news release of August

1, 2023. The Company will now settle the indebtedness through the

issuance of 2,046,154 common shares of the Company at a deemed

price of $0.065 per common shares and will not issue an equivalent

number of share purchase warrants.

The Company has also reached an agreement with

an additional arm’s-length creditor to settle further outstanding

indebtedness totaling US$25,000 through the issuance of 681,600

units (each, a “Settlement Unit”) at a deemed

price of $0.05 per Settlement Unit. Each Settlement Unit consists

of one common share of the Company and one common share purchase

warrant, allowing the holder to purchase an additional common share

at an exercise price of $0.065 for a period of thirty-six months

subject to accelerated expiry in the event the volume-weighted

average closing price of the Company’s common shares on the TSXV

exceeds $0.40 for ten consecutive trading days.

Completion of the debt settlements remains

subject to the approval of the TSX Venture Exchange. All securities

issued in connection with the debt settlements will be subject to

restrictions on resale for a period of four-months-and-one-day in

accordance with applicable securities laws.

Warrant Repricing

The Company also announced that it was unable to

secure the approval of the TSXV to the repricing of certain

outstanding share purchase warrants, as announced by the Company in

its news release of August 21, 2023. As a result, the warrants have

expired without exercise, and in lieu of the expiration of the

warrants the Company has provided the holders of the warrants with

an opportunity to participate in the Offering.

Option Grant

Finally, the Company announces that it has

granted an aggregate of 2,046,154 incentive stock options (the

“Options”) to certain advisors. The Options vest

immediately and are exercisable at a price of $0.09 until September

11, 2028.

For further information, please contact:

Ian CliffordChief Executive Officer and Board

ChairIan@fuelpositive.com www.fuelpositive.com

Investor Relations United States &

International:RB Milestone Group (RBMG)

fuelpositive@rbmilestone.com

Investor Relations Canada:Transcend

Capitalet@transcendcapitalinc.com

About FuelPositive

FuelPositive is a Canadian technology company

committed to providing commercially viable and sustainable, “cradle

to cradle” clean technology solutions, including an on-farm/onsite,

containerized Green Ammonia (NH3) production system that eliminates

carbon emissions from the production of Green Ammonia.

By focusing on technologies that are clean,

sustainable, economically advantageous and realizable, the Company

aims to help mitigate climate change, addressing unsustainable

agricultural practices through innovative technology and practical

solutions that can be implemented now. The FuelPositive

on-farm/onsite, containerized Green Ammonia production system is

designed to produce pure, anhydrous ammonia for multiple

applications, including fertilizer for farming, fuel for grain

drying and internal combustion engines, a practical alternative for

fuel cells and a solution for grid storage. Green Ammonia is also

considered a key enabler of the hydrogen economy.

FuelPositive systems are designed to provide for

Green Ammonia production on-farm/onsite, where and when needed.

This eliminates wildly fluctuating supply chains and offers

end-users clean fertilizer, energy and Green Ammonia supply

security while eliminating carbon emissions from the production

process. The first customers will be farmers. Farmers use 80% of

the traditional grey ammonia produced today as fertilizer.

See pre-sale details here:

https://fuelpositive.com/pre-sales/.

Cautionary Statement

Trading in the securities of the Company should

be considered highly speculative. No stock exchange, securities

commission or other regulatory authority has approved or

disapproved the information contained herein. Neither the TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accept

responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains certain

“forward-looking information” and “forward-looking statements”

(collectively, “forward-looking statements”) that are based on

expectations, estimates and projections as of the date of this news

release. The information in this release about future plans and

objectives of the Company, including the expected expenditures of

the proceeds of the private placement, are forward-looking

statements.

These forward-looking statements are based on

assumptions and estimates of management of the Company at the time

they were made and involve known and unknown risks, uncertainties

and other factors which may cause the actual results, performance

or achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements. Forward-looking statements are

necessarily based upon a number of estimates and assumptions that,

while considered reasonable by the Company as of the time of such

statements, are inherently subject to significant business,

economic and competitive uncertainties and contingencies. These

estimates and assumptions may prove to be incorrect.

Many of these uncertainties and contingencies

can directly or indirectly affect and could cause, actual results

to differ materially from those expressed or implied in any

forward-looking statements. There can be no assurance that

forward-looking information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements.

Forward-looking information is provided for the

purpose of providing information about management’s expectations

and plans relating to the future. The Company disclaims any

intention or obligation to update or revise any forward-looking

information or to explain any material difference between

subsequent actual events and such forward-looking information,

except to the extent required by applicable law.

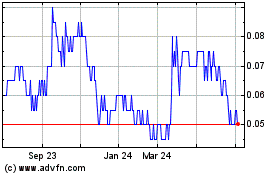

FuelPositive (TSXV:NHHH)

Historical Stock Chart

From Dec 2024 to Jan 2025

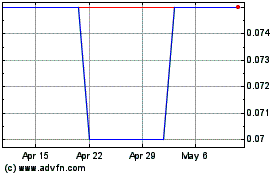

FuelPositive (TSXV:NHHH)

Historical Stock Chart

From Jan 2024 to Jan 2025