Petro-Reef Announces Successful Oil Well at Alexander

September 12 2011 - 3:08PM

Marketwired Canada

Petro-Reef Resources Ltd. ("Petro-Reef" or the "Company") (TSX VENTURE:PER)

Petro-Reef has perforated and tested its recently drilled Alexander

09-12-56-27W4 step-out well in the Detrital oil zone. In 48 hours on test the

well flowed at an average oil rate of 296 bbls/day (47 m3/day) with an average

gas rate of 495 mcf/day (14 e3m3/day). The 9-12 well is the Company's fourth oil

well producing from the Detrital zone all of which have been brought on-stream

in the past 18 months. Petro-Reef has a 94-per-cent working interest in the 9-12

well. The well will be tied in during the next six weeks.

This step out well in section 12 confirms that the Detrital oil trend extends

west from section 7 and based on geological mapping and interpretation of 3D

seismic that there are several additional locations to be drilled. The Company

is presently reprocessing all of its 3D seismic data on its Alexander lands to

further evaluate its potential. Due to the reserve additions added through the

2011 drilling program the Company is currently updating its independent reserve

evaluation and expects to release the results once completed.

Also, the Company would like to provide an update to its August 29, 2011 press

release on restricted production volumes for the Alexander 6-7-56-26W4 and

11-7-56-26W4 wells. On August 30, 2011 the Energy Resources Conservation Board

(ERCB) notified Petro-Reef in writing that a condition of granting a special MRL

(maximum rate limitation) of 20 m3/day/well for an 18 month period without GOR

(gas oil ratio) penalty, is the retirement of overproduction. Effective

September 1, 2011 both wells have been shut-in pending retirement of the

overproduction volumes. The overproduction volumes as calculated by the ERCB

will take approximately 125 days (starting September 1, 2011) to fully retire

the overproduction. It is anticipated that both wells should be placed back

on-stream at a MRL of 20 m3/day each (125 bbls/day) in early January 2012.

Petro-Reef anticipates its net daily production rates should increase to in

excess of 1,100 boe/day (42% Oil & NGL) taking into consideration normal

production declines with the new well at 9-12 being tied-in and brought

on-stream in October, 2011, and GPP (Good Production Practices) production

restrictions on 6-7-56-26W4 and 11-7-56-26W4 being lifted in early January,

2012.

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Oil & NGL (bbl/day) Natural gas (mcf/day) Total (boe/day)

----------------------------------------------------------------------------

Current net

production 150 3,200 683

Tie-in 9-12-57-

26W4 110 250 152

GPP restriction

lifted 220 500 303

---------------------------------------------------------

Total net

production 480 3,950 1,138

---------------------------------------------------------

42% 58% 100%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

The term barrel of oil equivalent may be misleading, particularly if used in

isolation. A boe conversion ratio of 6,000 cubic feet per barrel of natural gas

to barrels of oil equivalence is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not represent a value

equivalency at the wellhead. All boe conversions in the report are derived from

converting gas to oil in the ratio mix of 6,000 cubic feet of gas to one barrel

of oil.

Forward-Looking Statements: All statements, other than statements of historical

fact, set forth in this news release, including without Limitation, assumptions

and statements regarding reservoirs, resources and reserves, future production

rates, exploration and development results, financial results, and future plans,

operations and objectives of the Corporation are forward-looking statements that

involve substantial known and unknown risks and uncertainties. Some of these

risks and uncertainties are beyond management's control, including but not

limited to, the impact of general economic conditions, industry conditions,

fluctuation of commodity prices, fluctuation of foreign exchange rates,

environmental risks, industry competition, availability of qualified personnel

and management, availability of materials, equipment and third party services,

stock market volatility, timely and cost effective access to sufficient capital

from internal and external sources. The reader is cautioned that assumptions

used in the preparation of such information, although considered reasonable by

the Corporation at the time of preparation, may prove to be incorrect. There can

be no assurance that such statements will prove to be accurate and actual

results and future events could differ materially from those anticipated in such

statements.

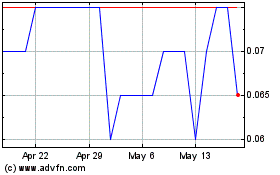

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From Apr 2024 to May 2024

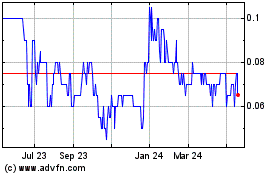

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From May 2023 to May 2024