Petro-Reef Resources Ltd.: Proposed Recapitalization and Change of Management

December 19 2011 - 7:53AM

Marketwired Canada

Petro-Reef Resources Ltd. ("Petro-Reef") (TSX VENTURE:PER) -

Further to its trading halt on December 5, 2011 and its press release on

December 9, 2011, announcing entering into a letter of intent with a private

company on December 2, 2011, Petro-Reef announces that the letter of intent has

terminated due to the failure of the private company to secure financing.

The Board of Directors of Petro-Reef has decided to continue with its review of

strategic alternatives. Emerging Equities Inc. will continue to act as exclusive

financial advisor to Petro-Reef. Concurrent with this course of action

Petro-Reef shall pursue the opportunities identified in the recent

reinterpretation of 36 sections of 3D seismic.

The new oil well at 9-12-57-26W4 continues to flow at a net 190 boe/d. With the

restart of the 6-7 and 11-7 wells (currently shut in due to allowable

restrictions) the total corporate production in January, 2012 is expected to be

1,050 boe/d. The increased cash flow will allow licencing and drilling of up to

3 wells prior to spring breakup.

An adjoining operator is planning to drill an offset to Petro-Reef's lands in

the Alexander area that if successful could significantly increase the size of

the pool and the proved reserves on Petro-Reef lands.

The term barrel of oil equivalent may be misleading, particularly if used in

isolation. A boe conversion ratio of 6,000 cubic feet per barrel of natural gas

to barrels of oil equivalence is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not represent a value

equivalency at the wellhead. All boe conversions in the report are derived from

converting gas to oil in the ratio mix of 6,000 cubic feet of gas to one barrel

of oil.

Forward-Looking Statements: All statements, other than statements of historical

fact, set forth in this news release, including without Limitation, assumptions

and statements regarding reservoirs, resources and reserves, future production

rates, exploration and development results, financial results, and future plans,

operations and objectives of the Corporation are forward-looking statements that

involve substantial known and unknown risks and uncertainties. Some of these

risks and uncertainties are beyond management's control, including but not

limited to, the impact of general economic conditions, industry conditions,

fluctuation of commodity prices, fluctuation of foreign exchange rates,

environmental risks, industry competition, availability of qualified personnel

and management, availability of materials, equipment and third party services,

stock market volatility, timely and cost effective access to sufficient capital

from internal and external sources. The reader is cautioned that assumptions

used in the preparation of such information, although considered reasonable by

the Corporation at the time of preparation, may prove to be incorrect. There can

be no assurance that such statements will prove to be accurate and actual

results and future events could differ materially from those anticipated in such

statements.

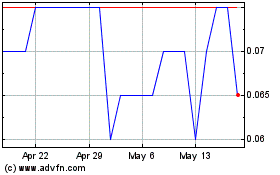

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From Apr 2024 to May 2024

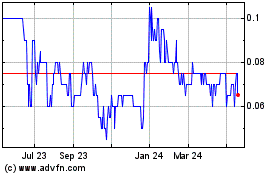

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From May 2023 to May 2024