Petro-Reef Resources Ltd. (TSX VENTURE:PER), ("Petro-Reef" or the "Company") is

pleased to release its financial and operating results for the three and six

month periods ended June 30, 2012. This press release should be read in

conjunction with the Company's June 30, 2012 quarterly financial statements and

MD&A filed on Sedar.

Financial Summary

----------------------------------------------------------------------------

Three months ended June 30

----------------------------------------------------------------------------

2012 2011 % Change

----------------------------------------------------------------------------

Oil and gas revenue $ 2,522,702 $ 2,249,472 12

Cash flow from operations (1) 511,217 953,248 (46)

Per share - basic and diluted 0.01 0.02 (52)

Net income 926,424 1,363 -

Per share - basic and diluted 0.01 0.00 -

Net debt (1) 12,695,625 13,793,310 (8)

Capital expenditures $ 756,242 $ 2,368,000 (68)

Shares outstanding - end of period 62,239,477 56,261,477 11

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Six months ended June 30

----------------------------------------------------------------------------

2012 2011 % Change

----------------------------------------------------------------------------

Oil and gas revenue $ 5,378,595 $ 5,371,751 0

Cash flow from operations (1) 1,738,981 2,587,396 (33)

Per share - basic and diluted 0.03 0.05 (44)

Net income (loss) 815,042 (1,052,232) -

Per share - basic and diluted 0.01 (0.02) -

Net debt (1) 12,695,625 13,793,310 (8)

Capital expenditures $ 1,602,074 $ 5,996,000 (73)

Shares outstanding - end of period 62,239,477 56,261,477 11

----------------------------------------------------------------------------

(1) Non GAAP measure

Daily Production and Commodity Prices

----------------------------------------------------------------------------

Three months ended June 30 2012 2011 % Change

----------------------------------------------------------------------------

Daily production

Oil and NGLs (bbl/d) 341 163 109

Natural gas (mcf/d) 1,866 2,555 (27)

----------------------------------------------------------------------------

Oil equivalent (boe/d @ 6:1) 652 589 11

----------------------------------------------------------------------------

Realized commodity prices ($CDN)

Oil and NGLs (bbl) 68.88 91.68 (25)

Natural gas (mcf) 2.28 3.81 (40)

----------------------------------------------------------------------------

Oil equivalent (boe @ 6:1) 41.53 42.15 (1)

----------------------------------------------------------------------------

Average prices for oil and gas dropped sharply in Q2 2012 as the average oil

price dropped 25% and the average gas price fell by 40%.However, the average

price per boe remained level as oil production increased to 52% of total

production from 28% in Q2 2011.

Daily production volumes increased by 11% to 652 boe/d in the three months ended

June 30, 2012 as compared to 589 boe/d for the same period in 2011. Oil volumes

increased by 109% quarter over quarter while gas production decreased by 27%. In

Q2 2012 oil and NGL production comprised 52% of total production as compared to

28% in Q2 2011.

----------------------------------------------------------------------------

Six months ended June 30 2012 2011 % Change

----------------------------------------------------------------------------

Daily production

Oil and NGLs (bbl/d) 325 229 42

Natural gas (mcf/d) 2,303 2,808 (18)

----------------------------------------------------------------------------

Oil equivalent (boe/d @ 6:1) 709 697 2

----------------------------------------------------------------------------

Realized commodity prices ($CDN)

Oil and NGLs (bbl) 75.19 81.06 (7)

Natural gas (mcf) 2.28 3.94 (42)

----------------------------------------------------------------------------

Oil equivalent (boe @ 6:1) 41.42 42.72 (3)

----------------------------------------------------------------------------

Average prices for oil and gas decreased in the six months ended June 30, 2012

as the average oil price dropped 7% and the average gas price fell by

42%.However, the average price per boe only decreased by 3% as oil production

increased by 42% as compared to the same period in 2011.

Daily production volumes increased by 2% to 709 boe/d in the six months ended

June 30, 2012 as compared to 697 boe/d for the same period in 2011. Oil volumes

increased by 42% while gas production decreased by 18%. In the six months ended

June 30, 2012 oil and NGL production comprised 46% of total production as

compared to 33% in 2011.

Revenue by product

Three months ended June 30 2012 2011 % Change

----------------------------------------------------------------------------

CDN $

Oil revenue 2,134,766 1,365,342 56

Natural gas revenue 387,936 884,130 (56)

----------------------------------------------------------------------------

Total revenue 2,522,702 2,249,472 12

----------------------------------------------------------------------------

In Q2 2012 oil revenues comprised 85% of total revenue as compared to 61% in Q2

2011. Oil revenue increased by 56% while natural gas revenue decreased by 56%.

Six months ended June 30 2012 2011 % Change

----------------------------------------------------------------------------

CDN $

Oil revenue 4,429,626 3,427,498 29

Natural gas revenue 948,969 1,944,254 (51)

----------------------------------------------------------------------------

Total revenue 5,378,595 5,371,752 0

----------------------------------------------------------------------------

For the six months ended June 30, 2012 oil revenues comprised 82% of total

revenue as compared to 64% in the same period in 2011. Oil revenue increased by

29% while natural gas revenue decreased by 51%.

Earnings and Cash Flow Summary

Three months ended % %

June 30 2012 2011 Change 2012 2011 Change

CDN $ ($/boe) ($/boe)

----------------------------------------------------------------------------

Gross Revenue 2,522,702 2,249,472 12 41.53 42.15 (1)

Royalties (347,700) (369,899) (6) (5.72) (6.93) (17)

----------------------------------------------------------------------------

Revenue after

royalties 2,175,002 1,879,573 16 35.81 35.22 2

Operating expenses 827,282 831,653 (1) 13.62 15.58 (13)

----------------------------------------------------------------------------

Operating netback

(1) 1,347,720 1,047,920 29 22.19 19.64 13

Realized gain (loss)

on financial

derivative

instruments (19,354) 304,819 - (0.32) 5.71 -

General &

administrative

expenses 660,246 303,152 118 10.87 5.68 91

Interest expense 156,903 96,339 63 2.58 1.81 43

----------------------------------------------------------------------------

Cash flow from

operations (1) 511,217 953,248 (46) 8.42 17.86 (53)

Unrealized gain

(loss) on financial

derivative

instruments 1,594,928 394,883 304 26.26 7.40 -

Other income - - - 0.00 0.00

Stock based

compensation 33,208 192,717 (83) 0.55 3.61 (85)

Accretion 10,996 17,386 (37) 0.18 0.33 (44)

Depletion and

depreciation 1,135,517 1,229,832 (8) 18.70 23.04 (19)

----------------------------------------------------------------------------

Income before income

taxes 926,424 (91,804) - 15.25 (1.72) -

Deferred income tax

(recovery) - (93,167) - 0.00 (1.75) -

----------------------------------------------------------------------------

Net Income 926,424 1,363 - 15.25 0.03 -

----------------------------------------------------------------------------

Per Share - Basic 0.01 0.00

Per Share - Diluted 0.01 0.00

----------------------------------------------------------------------------

Six months ended June % %

30 2012 2011 Change 2012 2011 Change

CDN $ ($/boe) ($/boe)

----------------------------------------------------------------------------

Gross Revenue 5,378,595 5,371,751 0 41.42 42.72 (3)

Royalties (623,225) (882,957) (29) (4.80) (7.02) (32)

----------------------------------------------------------------------------

Revenue after royalties4,755,370 4,488,794 6 36.62 35.70 3

Operating expenses 1,646,413 1,677,727 (2) 12.68 13.34 (5)

----------------------------------------------------------------------------

Operating netback (1) 3,108,957 2,811,067 11 23.94 22.36 7

Realized gain (loss) on

financial derivative

instruments (117,292) 479,954 - (0.90) 3.82 -

General &

administrative

expenses 961,284 507,876 89 7.40 4.04 83

Interest expense 291,400 195,749 49 2.24 1.56 44

----------------------------------------------------------------------------

Cash flow from

operations (1) 1,738,981 2,587,396 (33) 13.39 20.58 (35)

Unrealized gain (loss)

on financial

derivative instruments1,523,909 (508,790) - 11.74 (4.05) -

Other income 230,252 250,919 (8) 1.77 2.00 (11)

Stock based

compensation 120,579 333,253 (64) 0.93 2.65 (65)

Accretion 21,960 34,329 (36) 0.17 0.27 (38)

Depletion and

depreciation 2,535,561 2,867,450 (12) 19.53 22.80 (14)

----------------------------------------------------------------------------

Income (loss) before

income taxes 815,042 (905,507) - 6.28 (7.20) -

Deferred income tax

expense - 146,725 - 0.00 1.17 -

----------------------------------------------------------------------------

Net Income (loss) 815,042 (1,052,232) - 6.28 (8.37) -

----------------------------------------------------------------------------

Per Share - Basic 0.01 (0.02)

Per Share - Diluted 0.01 (0.02)

----------------------------------------------------------------------------

(1) Non-GAAP measure

Forward-Looking Statements: All statements, other than statements of historical

fact, set forth in this news release, including without limitation, assumptions

and statements regarding reservoirs, resources and reserves, future production

rates, exploration and development results, financial results, and future plans,

operations and objectives of the Corporation are forward-looking statements that

involve substantial known and unknown risks and uncertainties. Some of these

risks and uncertainties are beyond management's control, including but not

limited to, the impact of general economic conditions, industry conditions,

fluctuation of commodity prices, fluctuation of foreign exchange rates,

environmental risks, industry competition, availability of qualified personnel

and management, availability of materials, equipment and third party services,

stock market volatility, timely and cost effective access to sufficient capital

from internal and external sources. The reader is cautioned that assumptions

used in the preparation of such information, although considered reasonable by

the Corporation at the time of preparation, may prove to be incorrect. There can

be no assurance that such statements will prove to be accurate and actual

results and future events could differ materially from those anticipated in such

statements.

Reference is made to barrels of oil equivalent (BOE). Barrels of oil equivalent

may be misleading, particularly if used in isolation. In accordance with

National Instrument 51-101, a BOE conversion ratio for natural gas of 6 Mcf: 1

bbl has been used, which is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a value

equivalency at the wellhead.

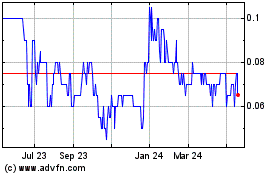

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From Dec 2024 to Jan 2025

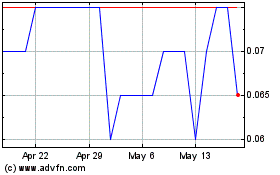

Peruvian Metals (TSXV:PER)

Historical Stock Chart

From Jan 2024 to Jan 2025