Parkit Enterprise Inc. (“Parkit” or the “Corporation”)

(TSXV: PKT), today reported the Corporation’s third

quarter 2022 results. Steve Scott, Chair of Parkit, commented:

“To date, Parkit continues its leasing momentum

with significant renewals and maintains its focus on operations

with improving margins. The Company continues to build the

foundation for growth by executing on operations and staying

disciplined on acquisitions. Looking ahead, we expect to increase

our revenue, net rental income and FFO, through maximizing

occupancy and delivering high quality property and asset

management.”

2022 THIRD QUARTER RESULTS AND RECENT

BUSINESS HIGHLIGHTS

- Revenues

and net rental income. Revenues and net rental income

increased with the investment properties acquired during the year.

Investment properties revenue for the three and nine months ended

September 30, 2022 rose to $2,846,709 and $7,649,000, compared to

$1,741,371 and $3,663,562 for the three and nine months ended

September 30, 2021. Net rental income (“NRI”),

increased to $1,589,859 and $3,832,075 for the three and nine

months ended September 30, 2022, compared to $1,046,586 and

$2,208,432 for the three and nine months ended September 30,

2021.

-

Significant liquidity position. Parkit has

$18,631,008 of cash with $16,000,000 available in undrawn credit

facilities and unencumbered investment properties with a fair value

of approximately $49,712,000.

- Change

in cash flow. Cash flows from operating activities

increased to $3,571,514 for the nine months ended September 30,

2022 compared to an increase of $599,081 for the nine months ended

September 30, 2021. Parkit used net cash of $40,252,477 in

investing activities for the nine months ended September 30, 2022,

compared to cash used of $63,854,944 from investing activities for

the nine months ended September 30, 2021. Parkit received net cash

of $33,512,344 in financing activities for the nine months ended

September 30, 2022, compared to net cash received of $110,424,477

for the nine months ended September 30, 2021.

- Funds

from operations (“FFO”) increased. The FFO, a Non-IFRS

Measure, for the three and nine months ended September 30, 2022

increased to $533,385 and $1,295,171, compared to FFO of $536,587

and $762,093 for the three and nine months ended September 30,

2021. The increase in FFO comes from the acquisition of investment

properties as Parkit continues to shift its strategy to focus on

industrial real estate.

- Loss for

the period. The net loss for the three and nine months

ended, September 30, 2022 was $177,183 and $927,150, compared to a

net loss of $678,310 and $4,188,310 for the three and nine months

ended September 30, 2021. The decrease in the net loss is a result

of an increase in NRI and a decrease in share-based compensation,

transaction costs and land transfer taxes from the prior year.

-

Acquisitions. To date Parkit has purchased five

properties for a cost of $57,280,000.

- Parking

results continue to improve as the effects of the pandemic

diminish. Parkit’s parking joint ventures reported a

profit of $160,236 and $404,328 for the three and nine months ended

September 30, 2022, compared to a loss of $6,547 and $320,002 for

the three and nine months ended September 30, 2021. Subsequent to

September 30, 2022, as its joint venture continued to stabilize,

Parkit received a distribution from its OPH joint venture of

$2,194,620.

-

Increased activity on its Normal Course Issuer Bid

(“NCIB”). Parkit increased its activity on the NCIB with

6,145,700 shares purchased for $5,915,293 for the nine months ended

September 30, 2022.

-

Continued focus on environmental, social and governance

(“ESG”) initiatives. Parkit continued its focus on ESG

initiatives by prioritizing environmental investments in its

development plans and reviewing its corporate policies.

Operational HighlightsParkit

continues to execute on its operational objectives:

- Leasing at elevated rental

spreads. Parkit continues to renew tenants at higher rates

with renewals in the Greater Toronto Area and Ottawa at 123% above

the prior in place rent.

- Advancing its

development. Parkit continues to advance its development

properties to maximize property density and NRI potential.

- Margin

improvement. Parkit’s margin continue to improve with

streamlining operations and a continued increase in rents. Gross

margins for stabilized properties were 65% and gross margins for

all properties was 50% for the nine months ended September 30,

2022.

Parkit is focused on continuing its shift into

industrial real estate by growing its portfolio and maximizing cash

flows from its investment properties, while stabilizing its parking

operations.

Further InformationFor

comprehensive disclosure of Parkit’s performance for the three

months and nine months ended September 30, 2022 and its financial

position as at such date, please see Parkit’s Interim Financial

Statements and Management’s Discussion and Analysis for the three

and nine months ended September 30, 2022 filed on SEDAR at

www.sedar.com.

Non-IFRS MeasuresManagement

uses both IFRS and Non-IFRS Measures to assess the financial and

operating performance of the Corporation’s operations. These

Non-IFRS Measures are not recognized measures under IFRS, do not

have a standardized meaning under IFRS and are unlikely to be

comparable to similar measures presented by other companies. The

Non-IFRS Measures referenced in this news release include the

following:

Funds from Operations (“FFO”) –

is a Non-IFRS Measure of operating performance as it focuses on

cash flow from operating activities. REALPAC is the national

industry association dedicated to advancing the long-term vitality

of Canada’s real property sector. REALPAC defines Funds From

Operations (FFO) as net income (calculated in accordance with

IFRS), adjusted for, among other things, depreciation, transaction

costs, gains and losses from property dispositions, foreign

exchange, as well as other non-cash items. The Corporation believes

that FFO can be a beneficial measure, when combined with primary

IFRS measures, to assist in the evaluation of the Corporation’s

ability to generate cash and evaluate its return on investments as

it excludes the effects of real estate amortization and gains and

losses from the sale of real estate, all of which are based on

historical cost accounting and which may be of limited

significance in evaluating current performance.

FFO should not be viewed as an alternative to,

in isolation from, or superior to, net income or cash flow from

operations, or results from Parkit’s comprehensive operations,

respectively, or other measures calculated in accordance with IFRS.

FFO should not be interpreted as an indicator of cash generated

from operating activities and is not indicative of cash available

to fund operating expenditures, or for the payment of cash

distributions. FFO is simply an additional measure of operating

performance which highlight trends in Parkit’s core business that

may not otherwise be apparent when relying solely on IFRS financial

measures. Parkit’s management also uses this Non-IFRS Measure in

order to facilitate operating performance comparisons from period

to period and to prepare operating budgets. In addition, while

Parkit’s methods of calculating FFO comply with REALPAC

recommendations, FFO may differ from and not be comparable to FFO

used by other companies.

The following table indicates how the Parkit

reconciles FFO to the nearest IFRS measure.

|

|

Three months endedSeptember 30,

2022 |

|

Three months endedSeptember 30, 2021 |

|

Nine months endedSeptember 30, 2022 |

|

Nine months endedSeptember 30, 2021 |

|

|

Net loss and comprehensive loss |

$ |

(177,183 |

) |

$ |

(678,310 |

) |

$ |

(927,150 |

) |

$ |

(4,188,310 |

) |

| Add /

(Deduct): |

|

|

|

|

| Share of

loss (gain) from equity-accounted investees |

|

(160,236 |

) |

|

6,547 |

|

|

(404,328 |

) |

|

320,002 |

|

|

Depreciation |

|

959,906 |

|

|

562,434 |

|

|

2,740,760 |

|

|

1,159,224 |

|

| Foreign

exchange |

|

(89,102 |

) |

|

(43,922 |

) |

|

(114,430 |

) |

|

(2,929 |

) |

|

Transaction cost and land transfer tax on acquisition |

|

- |

|

|

689,838 |

|

|

- |

|

|

1,793,739 |

|

|

Share-based compensation |

|

- |

|

|

- |

|

|

- |

|

|

1,667,520 |

|

|

Income tax expense (recovery) |

|

- |

|

|

- |

|

|

319 |

|

|

12,847 |

|

|

FFO |

$ |

533,385 |

|

$ |

536,587 |

|

$ |

1,295,171 |

|

$ |

762,093 |

|

|

FFO per share |

$ |

0.00 |

|

$ |

0.00 |

|

$ |

0.01 |

|

$ |

0.00 |

|

About Parkit Enterprise Inc.

Parkit is an industrial real estate platform focused on the

acquisition, growth and management of strategically located

industrial properties across key markets in Canada, with a focus on

the Greater Toronto Area+ (“GTA+”), Ottawa and Montreal, to

complement its parking assets across the United States. Parkit's

Common Shares are listed on TSX-V (Symbol: PKT).

For more information, please contact Mr. Carey

Chow, Mr. Iqbal Khan or Mr. Steven Scott:

Investor Relations Contact Number:

1-888-627-9881Email: ir@parkitenterprise.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Forward-Looking Information: This news release

contains “forward-looking information” within the meaning of

applicable Canadian securities legislation. All statements, other

than statements of historical fact, included herein is

forward-looking information. In particular, this news release

contains forward-looking information in relation to: Parkit’s

expectations in respect of increasing its revenue, net rental

income and FFO, through maximizing occupancy and delivering quality

property and asset management; Parkit’s continued shift to focus

on industrial real estate by growing its portfolio and maximizing

cash flows from its investment properties, while stabilizing its

parking operations; Parkit’s continued focus on ESG initiatives by

prioritizing environmental investments; Parkit’s continuing

advancement of its development properties by maximizing property

density; and Parkit’s strategy and focus regarding acquiring

high-quality and strategically located industrial properties with a

focus on the GTA+, Ottawa and Montreal. This forward-looking

information reflects Parkit’s current beliefs and is based on

information currently available to Parkit and on assumptions

Parkit believes are reasonable. These assumptions include, but are

not limited to: the level of activity in the industrial real estate

business and the economy generally; continued consumer interest in

Parkit’s services and products; Parkit’s continued ability to

acquire properties that are in-line with its strategic focus,

including prioritizing environmental investments; Parkit’s

continuing ability to grow its portfolio of investment properties;

Parkit’s past results continuing to be an indicator of future

results; the diminishing effects of the COVID-19 pandemic in

Canada, the United States, and elsewhere; consumer interest in

Parkit’s services and products; and Parkit’s continued response and

ability to navigate the COVID-19 pandemic being consistent with,

or better than, its ability and response to date. Forward-looking

information is subject to known and unknown risks and uncertainties

that may cause the actual results, performance or developments to

differ materially from those contained in or implied by such

forward-looking information. These risks, uncertainties, and

factors may include, but are not limited to: general business,

economic, competitive, political and social uncertainties; general

capital market conditions and market prices for securities; delay

or failure to receive board of directors, third party or regulatory

approvals; the actual results of Parkit’s future operations;

competition; changes in legislation, including environmental

legislation, affecting Parkit; the timing and availability of

external financing on acceptable terms; conclusions of economic

evaluations and appraisals; lack of qualified, skilled labour or

loss of key individuals; risks related to the COVID-19 pandemic

including various recommendations, orders and measures of

governmental authorities to try to limit the pandemic, including

travel restrictions, border closures, non-essential business

closures, service disruptions, quarantines, self-isolations,

shelters-in-place, social distancing and mandatory vaccination

policies, disruptions to markets, economic activity, financing,

supply chains and sales channels, and a deterioration of general

economic conditions including a possible national or global

recession; and the impact that the COVID-19 pandemic may have on

Parkit which may include: a short-term delay in payments from

customers, an increase in accounts receivable and an increase of

losses on accounts receivable; decreased demand for the services

that Parkit offers; and a deterioration of financial markets that

could limit Parkit’s ability to obtain external financing. A

description of additional risk factors that may cause actual

results to differ materially from forward-looking information can

be found in Parkit’s disclosure documents on the SEDAR website at

www.sedar.com. Although Parkit has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. Readers are cautioned that the foregoing list of risks,

uncertainties and factors is not exhaustive. Accordingly, readers

should not place undue reliance on forward-looking information.

Readers are further cautioned not to place undue reliance on

forward-looking information as there can be no assurance that the

plans, intentions or expectations upon which they are placed will

occur. Such information, although considered reasonable by

management at the time of preparation, may prove to be incorrect

and actual results may differ materially from those anticipated.

Forward-looking information contained in this news release is

expressly qualified by this cautionary statement. The

forward-looking information contained in this news release

represents the expectations of Parkit as of the date of this news

release and, accordingly, is subject to change after such date.

However, Parkit expressly disclaims any intention or obligation to

update or revise any forward-looking information, whether as a

result of new information, future events or otherwise, except as

expressly required by applicable securities law.

The expectations to increase revenue, net rental

income, FFO, cash flow and rental growth contained in this news

release may be considered a financial outlook as defined by

applicable securities legislation. Such information and any other

financial outlooks contained in this news release have been

approved by management of the Corporation as of the date hereof.

Such financial outlooks are provided for the purpose of presenting

information about management's current expectations and goals

relating to the future business of the Corporation. Readers are

cautioned that reliance on such information may not be appropriate

for other purposes.

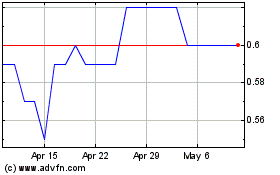

Parkit Enterprise (TSXV:PKT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Parkit Enterprise (TSXV:PKT)

Historical Stock Chart

From Jan 2024 to Jan 2025