Prime Restaurants Royalty Income Fund Announces Agreement in Principle to Combine With Prime Restaurants of Canada Inc. and PRC

February 16 2010 - 7:45AM

Marketwired Canada

Prime Restaurants Royalty Income Fund (TSX:EAT.UN) (the "Fund") announced today

that the Fund has reached an agreement in principle with Prime Restaurants of

Canada Inc. ("PRC"), PRC's sole shareholder, Prime Restaurant Holdings Inc.

("PRH") and PRC Trademarks Inc. ("TradeMarkCo") regarding the principal terms of

a proposed transaction (the "Combination Transaction") to combine and form a

new, publicly-traded corporation to be named Prime Restaurants Inc. ("Amalco").

PRC also announced that an operational restructuring plan designed to improve

its business of operating and franchising restaurants is being implemented.

Under the existing structure, TradeMarkCo receives licensing royalties generated

by the Prime Restaurants. The Combination Transaction will consolidate ownership

of the intellectual property for the Prime Restaurants (which is currently owned

by TradeMarkCo) and the franchising business currently operated by PRC. The

conversion to a corporation in conjunction with the Combination Transaction will

also provide certainty to the unitholders of the Fund ("Unitholders") with

respect to the 2011 effective date of tax legislation affecting income trusts

and will simplify the structure of the combined business.

"We believe our unitholders will benefit from the combination of the Prime

Restaurants and the related intellectual property, together with an early

conversion to a corporation" said Steven Sharpe, Chairman of the Fund. "The

combination will enable investors to more easily value our operations, our

brands and our growth potential. The trustees of the Fund and the principals and

management team at PRC believe that the interests of all parties are best served

by a corporate structure that provides greater transparency, oversight of the

operating business and access to financing. The proposed combination will result

in a corporate structure that provides enhanced accountability to investors, and

a more direct correlation between the performance of the operating business and

the results and prospects of the public company. Under the proposed new

structure, the current 'vend-in' formula for new restaurant additions to the

royalty pool will be eliminated and the benefits of growth in the Prime

Restaurant system will accrue to all investors. In conjunction with the

operational restructuring well under way at Prime, we believe the future is

bright for the combined businesses."

Principal Terms of the Proposed Combination Transaction

The new entity, Amalco, will be the result of the combination of PRC and

TradeMarkCo. The Fund will be dissolved as part of the transaction and

Unitholders will receive shares in Amalco. The definitive terms of the

transaction are to be reflected in a combination agreement to be negotiated

among the parties.

PRC has been in default of its royalty payment obligations under the license and

royalty agreement between PRC and TradeMarkCo since October 2009, which resulted

in a reduction of monthly distributions to Unitholders. The Combination

Transaction will include the resolution of this default and all deferred amounts

under current arrangements between the parties.

PRH's current indirect fully-diluted interest in the Fund (after the exercise of

certain exchange rights by PRC) is approximately 36.7%. Amalco will have three

classes of shares: (i) a class that is planned to be listed on the TSX and which

will be held by PRH and the Unitholders (the "Public Shares"), (ii) a class held

by PRH only and convertible into Public Shares if certain financial targets are

met (the "B Shares") and (iii) a class held by PRH only, that is non-voting and

non-participating and which is also convertible into the Public Shares if

certain financial targets are met (the "C Shares"). Immediately after the

completion of the Combination Transaction, PRH's interest in Amalco will be

approximately 25% of the shares outstanding at closing (prior to factoring in

the C Shares) and PRH will own approximately 7% of the Public Shares. The

agreement in principle provides that PRH may convert its B Shares and C Shares

into Public Shares if certain financial targets are met by Amalco (in whole or

in part) over the next three to five years. If the financial targets are met in

full by Amalco, PRH's interest in Amalco could grow to as much as 30% (taking

into consideration the possible conversion of the C Shares). If the financial

targets are not met, PRH's interest in Amalco could drop to as low as 23% of the

shares outstanding. Immediately after the completion of the Combination

Transaction, Unitholders of the Fund other than PRC will receive Public Shares,

representing approximately 75% of shares outstanding on closing (prior to

factoring in the C Shares) and approximately 93% of the Public Shares. All of

the foregoing percentages are calculated prior to the implementation of a

long-term incentive plan for employees and directors of Amalco which will have a

dilutive effect on all shareholders.

Highlights of Operational Restructuring

PRC operates and franchises casual dining restaurants and premium pubs. In

response the challenging economic conditions facing its corporate and franchised

restaurants and pubs, PRC has implemented a restructuring plan designed to

improve operations and financial results. The highlights of the operational

restructuring include:

1. reductions to office overhead and expenses;

2. centralizing brand management and key support services for all brands,

resulting in a unified operating methodology and processes; and

3. introduction of key internal and external operating metrics, focusing on

restaurant audits, mystery shoppers and web-based guest feedback.

Distributions

In anticipation of the Combination Transaction, the Fund also announced today

that monthly distributions to Unitholders are expected to remain at $0.04 per

Unit effective until the distribution payable in April 2010 to Unitholders of

record on March 31, 2010.

If the Arrangement receives all necessary approvals and is implemented, it is

anticipated that Amalco will adopt a dividend policy to pay dividends on a

quarterly basis on the Public Shares. It is currently anticipated that the

amount of such quarterly dividend will initially be $0.12 per Public Share. The

dividend policy will be subject to the discretion of the board of directors of

Amalco and may vary depending on, among other things, Amalco's operating cash

flow, financial requirements, restrictions under future credit facilities, the

satisfaction of solvency tests imposed by the corporate legislation for the

declaration of dividends and other conditions existing at such future time. As a

result, no assurance can be given as to whether Amalco will pay dividends, or

the frequency or amount of any such dividend.

Board of Directors and Management Team

The initial directors of Amalco will be Steven Sharpe, Paul Haggis and Michael

Aronovici, current trustees of Prime, as well as John Rothschild and Sidney

Horn, both of whom are currently directors of PRC and TradeMarkCo. Messrs.

Sharpe, Haggis and Aronovici will all be independent directors of Amalco. Mr.

Rothschild, currently the Chief Executive Officer of PRC, will be Chief

Executive Officer of Amalco. The current management team at PRC will move to

Amalco and continue to guide operations.

Approvals and Closing of the Transaction

Additional details of the Combination Transaction will be announced by way of

news release and filings on SEDAR (www.sedar.com) in the coming weeks. The

Combination Transaction will be implemented through a plan of arrangement. Prime

expects to mail an information circular to Unitholders in respect of the

Combination Transaction and other business in early March 2010. The Unitholder

vote in respect of the Combination Transaction will take place at the Annual and

Special Meeting of the Fund, which is currently scheduled to be held on March

30, 2010. The record date for determining Unitholders entitled to vote on the

Combination Transaction is expected to be February 26, 2010. The Combination

Transaction is subject to, among other customary conditions, execution of

definitive agreements and other required documentation, receipt by the trustees

of the Fund of a satisfactory formal valuation and fairness opinion, approval by

the Ontario Superior Court of Justice of the plan of arrangement by which the

transaction will be implemented and a positive vote in favour of the Combination

Transaction by the holders of at least 66 2/3% of Prime's voting units

represented at the meeting (including a majority of the voting units held by

disinterested Unitholders). If approved, the Combination Transaction is

scheduled to close on or about April 5, 2010.

The trustees of the Fund have engaged Capital Canada Limited to prepare a formal

valuation of PRC and the Fund as well as a fairness opinion on the Combination

Transaction.

The Combination Transaction and listing of the Public Shares of Amalco are

subject to all necessary regulatory approvals, including approval of the TSX.

About Prime Restaurants Royalty Income Fund

The Fund, through TradeMarkCo, is entitled to receive top-line royalties of

3.25% of the gross food and beverage revenue from pooled restaurants under the

terms of a 99-year licence agreement between TradeMarkCo and PRC.

About PRC and the Fund

PRC operates and franchises a diversified portfolio of leading brands of casual

dining restaurants and premium pubs in Canada. As a pioneer in the Canadian

casual dining industry since 1980, it is considered an important innovator in

the development of strong brands, and today has three core brands: East Side

Mario's, Casey's and Fionn MacCool's. PRC and its franchisees employ over 12,000

people across the country.

The Fund is a limited purpose trust authorised to issue an unlimited number of

Trust Units and established to invest in TradeMarkCo. The source of revenue for

the Fund is through its ownership in, and debt instrument issued by,

TradeMarkCo. The Fund receives interest income on the TradeMarkCo Note which it

distributes to its Unitholders. TradeMarkCo owns certain trade-marks and

licenses their use to PRC which operates and franchises the restaurant and bar

business. In return, TradeMarkCo receives royalty income from the royalty pooled

restaurants operated and franchised by PRC. Additional information relating to

the Fund, including the Fund's financial statements, the Annual Information Form

of the Fund and PRC's MD&A and consolidated financial statements can be found at

www.sedar.com and the Fund's website at www.primeincomefund.ca

Forward-Looking Statements

The public communications of the Fund often include written or oral

forward-looking statements. Statements of this type are included in this news

release, and may be included in filings with Canadian securities regulators, or

in other communications. Forward-looking statements may involve, but are not

limited to, comments with respect to our objectives for 2010 and beyond, our,

PRC's and Amalco's strategies or planned future actions, our, PRC's and Amalco's

targets or expectations for our financial performance and condition, PRC's

ability to pay royalty payments and our ability to pay distributions or

dividends. All statements, other than statements of historical fact, contained

in this new release are forward-looking statements, including, without

limitation, statements regarding the future financial position and operations

(including estimated revenue from royalty pooled restaurants and the estimated

administrative and other operating expenses of the Fund), business strategy,

distributions, plans and objectives of or involving the Fund, PRC and Amalco.

Readers can identify many of these statements by looking for words such as

"believe", "expects", "will", "intends", "projects", "anticipates", "estimates",

"continues" and similar words or the negative thereof. Although management of

the Fund and PRC believe that the expectations represented in such

forward-looking statements are reasonable, there can be no assurance that such

expectations will prove to be correct.

By their nature, forward-looking statements require us to make assumptions and

are subject to inherent risks and uncertainties including those discussed in the

Fund's MD&A and the Fund's annual information form dated March 11, 2009, (the

"AIF") under "Narrative Description of the Business - Risk Factors" which are

available at www.sedar.com. There is significant risk that predictions and other

forward-looking statements will not prove to be accurate. We caution readers of

this news release not to place undue reliance on our forward-looking statements

because a number of factors could cause actual future results, conditions,

actions or events to differ materially from the targets, expectations, estimates

or intentions expressed in the forward- looking statements.

Assumptions and analysis about the performance of the Fund, PRC and Amalco and

the markets in which they operate are considered in forecasting the Fund's,

PRC's and Amalco's expected financial results, PRC's ability to pay royalty

payments and the Fund's ability to pay distributions and in making related

forward-looking statements. The key assumption in respect of the Fund's level of

distributions is that the cumulative distributable cash will be able to support

the Fund's current level of distributions. The Fund receives the cash it

distributes from TradeMarkCo. TradeMarkCo receives all of the cash it pays to

the Fund through a royalty from PRC. Accordingly, the ability of the Fund to pay

its distributions depends on PRC's financial performance and ability to pay the

royalty. In respect of the ability to maintain and grow the royalty pooled

revenue and PRC's financial performance, key assumptions include those relating

to the demand for the goods and services under the Prime trademarks and in

respect of the Canadian markets in which the royalty pooled restaurants operate.

Should any of these factors or assumptions vary, actual results may differ

materially from the forward-looking statements.

The information set forth in the MD&A and AIF identifies factors that could

affect the operating results and performance of the Fund and PRC. We caution

that the list of factors discussed in the MD&A and the AIF is not exhaustive,

and that, when relying on forward-looking statements to make decisions with

respect to the Fund, investors and others should carefully consider the factors

discussed, as well as other uncertainties and potential events, and the inherent

risks and uncertainties of forward-looking statements.

The forward-looking statements contained herein are expressly qualified in their

entirety by this cautionary statement. The forward-looking statements included

in this news release are made as of the date of this news release. Except as

required by applicable securities laws, the Fund does not undertake to update

any forward-looking statement, whether written or oral, that it may make or that

may be made, from time to time, on its behalf.

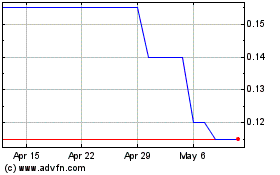

Pearl River (TSXV:PRH)

Historical Stock Chart

From Apr 2024 to May 2024

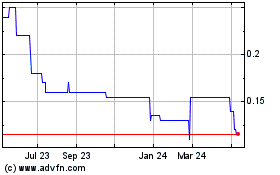

Pearl River (TSXV:PRH)

Historical Stock Chart

From May 2023 to May 2024