Quorum Releases Q1 Fiscal Year 2011 Results

June 29 2011 - 11:22AM

Marketwired Canada

Quorum Information Technologies Inc. (TSX VENTURE:QIS) ("Quorum" or the

"Company") today released its First Quarter (Q1) Fiscal Year (FY) 2011 results.

Quorum delivers its dealership management system (DMS), XSELLERATOR(TM), and

related services to automotive dealerships throughout North America. The Company

is both an Integrated Dealership Management System (IDMS) strategic partner with

General Motors Corporation (GM) and an industry partner with Microsoft. Quorum's

XSELLERATOR product is broadly promoted to its target dealerships throughout

North America by these prominent companies.

Maury Marks, Quorum's President and CEO made the following remarks about the

Company's Q1 FY2011 results:

Both 2009 and 2010 were difficult years in the automotive industry. For Quorum,

the turmoil in these years included:

-- The bankruptcy and recovery of GM, our most significant partner.

-- 42% of GM's North American franchised dealerships losing their

franchises.

-- The loss of 26 of our customers that were forced to close their

dealerships.

-- The transformation of 28 of our customers as they moved away from GM to

new OEM's or aftermarket organizations.

The result was further diversification of Quorum's business and now 25% of our

customers operate non-GM franchised dealerships (up from 10% at the beginning of

2009). The Corporation has changed strategically; we are now an "all makes"

organization, but with a continued key emphasis on GM dealerships. Quorum

supplies our product to GM, Isuzu, Chrysler, Hyundai, Kia, Nissan, Subaru, Saab,

NAPA and Bumper to Bumper franchised dealership customers.

During 2009 and 2010, Quorum management focused on reducing our cost structure.

The result was that Quorum posted six consecutive quarters of cash flow positive

results from Q3 FY2009 to Q4 FY2010. I am delighted to report that we have added

to that streak by posting our seventh consecutive cash flow positive quarter in

Q1 FY2011. These continued positive cash flow results allowed us to pay off our

12% secured convertible debenture on December 15, 2010, four months prior to the

debenture's maturity date of April 15, 2011. The Corporation now has a history

of fiscal responsibility that we will build on into the future.

In Q1 FY2011 we had six dealership rooftop installs and our customer base grew

to 245 active dealership rooftops. The new challenge for the Corporation is to

work towards increasing our implementation rate each quarter.

Key financial results summary:

-- Sales decreased slightly by 2% to $1,912K in Q1 FY2011 from $1,946K in

Q1 FY2010 and gross profit decreased to $1,065K in Q1 FY2011 compared to

$1,076K in Q1 FY2010, a 1% decrease. The change in sales is due to:

-- A decrease of $119K in net new revenue which was a result of

completing six installations in Q1 FY2011 down from ten

installations in Q1 FY2010.

-- An increase of $166K in recurring support revenue as a result from

having 245 active dealership rooftops at the end of Q1 FY2011 versus

221 at the end of Q1 FY2010.

-- A decrease in integration revenue of $80K due to a reduced number of

GM integration projects.

-- Earnings before interest, taxes, depreciation and amortization (EBITDA)

increased to $323K in Q1 FY2011 from $297K in Q1 FY2010.

-- Net income before taxes increased to $102K in Q1 FY2011 compared to a

loss of $35K in Q1 FY2010. The increase was due to a continued effort to

reduce the Corporation's cost structure and reduced interest expense.

Management continues to optimize all business processes in the

organization with the goal of continually reducing our cost structure.

Interest was reduced due to the early repayment of the Corporation's 12%

secured convertible debenture on December 15, 2010.

-- Quorum had a net loss of $100K in Q1 FY2011 compared to a net loss of

$28K in Q1 FY2010. The loss in Q1 FY2011 is due to a $202K non-cash

future income tax expense.

With a stronger balance sheet; an incredible product; excellent implementations

and support services; exceptional staff and customers; and seven consecutive

quarters of cash flow positive operations; the Corporation is well positioned to

take advantage of the challenging automotive market. Our primary focus for 2011

is to grow our quarterly sales and implementation rates.

Quorum has filed its Q1 2011 consolidated financial statements and notes thereto

as at and for the period ended March 31, 2011 and accompanying management's

discussion and analysis in accordance with National Instrument 51-102 -

Continuous Disclosure Obligations adopted by the Canadian securities regulatory

authorities. Additional information about Quorum will be available on Quorum's

SEDAR profile at www.sedar.com and Quorum's website at www.QuorumDMS.com.

Financial Highlights

Three Three

Months Months

Ended Ended

March 31, March 31,

2011 2010

--------------------------------------------------------------------------

Gross revenue $ 1,912,268 $ 1,945,599

Cost of products and services sold 847,575 869,169

Gross profit 1,064,693 1,076,430

Earnings before interest, taxes and amortization 322,757 296,777

(EBITDA)

Net income (loss) before deferred income tax 101,757 (34,898)

Net loss (100,177) (28,032)

Basic loss per share (0.0025) (0.0007)

Fully diluted loss per share $ (0.0025)$ (0.0007)

Weighted average number of common shares

Basic 39,298,438 39,298,438

Diluted 39,685,819 42,398,938

XSELLERATOR installations in the period 6 10

XSELLERATOR active dealership rooftops 245 221

--------------------------------------------------------------------------

About Quorum

Quorum is a North American company focused on developing, marketing,

implementing and supporting its XSELLERATOR(TM) product for GM, Isuzu, Chrysler,

Hyundai, KIA, Nissan, Subaru, NAPA and Bumper to Bumper dealerships. XSELLERATOR

is a dealership and customer management software product that automates,

integrates and streamlines every process across departments in a dealership. One

of the select North American suppliers under General Motors' IDMS program,

Quorum is the second largest DMS provider for GM's Canadian dealerships with 25%

of the market. Quorum is a Microsoft Gold Certified Partner and Field-Level

Managed ISV in both Canada and the United States. Quorum Information

Technologies Inc. is traded on the Toronto Venture Exchange (TSX VENTURE) under

the symbol QIS. For additional information please go to www.QuorumDMS.com.

Forward-Looking Information

This press release contains certain forward-looking statements and

forward-looking information ("forward-looking information") within the meaning

of applicable Canadian securities laws. Forward-looking information is often,

but not always, identified by the use of words such as "anticipate", "believe",

"plan", "intend", "objective", "continuous", "ongoing", "estimate", "expect",

"may", "will", "project", "should" or similar words suggesting future outcomes.

In particular, this press release includes forward-looking information relating

to results of operations, plans and objectives, projected costs and business

strategy. Quorum believes the expectations reflected in such forward-looking

information are reasonable but no assurance can be given that these expectations

will prove to be correct and such forward-looking information should not be

unduly relied upon.

Forward-looking information is not a guarantee of future performance and

involves a number of risks and uncertainties some of which are described herein.

Such forward-looking information necessarily involves known and unknown risks

and uncertainties, which may cause Quorum's actual performance and financial

results in future periods to differ materially from any projections of future

performance or results expressed or implied by such forward-looking information.

These risks and uncertainties include but are not limited to the risks

identified in Quorum's Management's Discussion and Analysis for the year ended

March 31, 2011. Any forward- looking information is made as of the date hereof

and, except as required by law, Quorum assumes no obligation to publicly update

or revise such information to reflect new information, subsequent or otherwise.

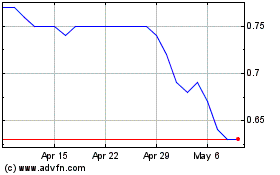

Quorum Information Techn... (TSXV:QIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

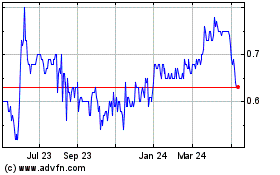

Quorum Information Techn... (TSXV:QIS)

Historical Stock Chart

From Jul 2023 to Jul 2024