Questor Technology Inc. (“Questor” or the “Company”) (TSX-V: QST)

announced today its financial and operating results for the third

quarter ended September 30, 2023.

Questor’s unaudited Condensed Consolidated

Financial Statements and Management’s Discussion and Analysis for

the quarter ended September 30, 2023 are available on the Company’s

website at www.questortech.com/investors and at

www.sedarplus.ca.

Unless otherwise noted, all financial figures

are presented in Canadian dollars, prepared in accordance with

International Financial Reporting Standards and are unaudited for

the three months ended September 30, 2023 and 2022.

THIRD QUARTER 2023 FINANCIAL

RESULTS

|

|

Three months ended September 30, |

Nine months ended September 30, |

|

For the |

2023 |

2022 |

2023 |

2022 |

|

(Stated in CDN $) |

|

|

|

|

|

Revenue |

1,690,390 |

1,673,929 |

5,745,743 |

6,715,865 |

|

Gross profit |

442,655 |

484,374 |

1,992,876 |

1,547,079 |

|

Loss for the period |

(3,237,785) |

(12,311) |

(3,914,430) |

(835,842) |

|

Loss per share - basic and diluted |

(0.12) |

(0.00) |

(0.14) |

(0.03) |

|

|

|

|

|

|

|

As at |

|

September 30, 2023 |

December 31, 2022 |

|

(Stated in CDN $) |

|

|

|

|

Working capital 1 |

|

|

12,467,357 |

15,005,682 |

|

Total assets |

|

|

29,029,172 |

33,872,553 |

|

Total equity |

|

|

25,212,067 |

29,194,788 |

|

1 Working capital is defined as total current assets less total

current liabilities. |

|

|

Revenue for the three months ended September 30,

2023 is flat compared to the same period in 2022. Revenue for the

nine months ended September 30, 2023 has decreased $1.0 million

compared to the same period in 2022. Rental revenue has increased

13 and 29 percent and service revenue has increased 48 and 64

percent for the three and nine months ended September 30, 2023,

compared to the same periods in 2022. These increases are offset by

a decrease of $0.2 million and $1.9 million in equipment sales

revenue for the three and nine months ended September 30, 2023 due

to the Company focusing on larger more complex international sales

which take longer to close. As at the date of this press release,

the Company has $0.5 million of committed equipment sales revenue

to be completed for 2023. The Company has a number of large

proposals currently being worked on.

Gross profit for the three and nine months ended

September 30, 2023 was impacted negatively by a valuation allowance

taken against slow moving inventory of $0.2 million The increase in

gross profit for the nine months ended September 30, 2023 compared

to the same period in 2022 is a result of $0.5 million of costs

related to the waste to heat power project in Mexico with no

associated revenue being recorded in 2022.

During the three months ended September 30,

2023, the Company’s net asset value was greater than its market

capitalization resulting in an impairment test being performed in

accordance with IFRS. An impairment charge of $3.6 million was

taken on non-financial assets in the three months ended September

30, 2023 resulting in an increase in the loss for the three and

nine months ended September 30, 2023 compared to 2022. The loss for

the three and nine months ended September 30, 2023 was also

impacted by $0.1 million of termination payments and $0.2 million

signing bonus.

The Company continues to have a strong financial

position at September 30, 2023 including cash and cash equivalents

of $3.7 million, $9.6 million of highly liquid short-term

investments and working capital of $12.5 million.

THIRD QUARTER 2023 HIGHLIGHTS AND

SUBSEQUENT EVENTS

On August 23, 2023, Ms. Mascarenhas employment

was terminated by the prior Board of Directors. The abrupt

departure of Ms. Mascarenhas caught shareholders, including Ms.

Mascarenhas, by surprise. Certain major shareholders (who held a

significant number of shares of the Company) were concerned with

change of direction and were not aligned with the prior Board’s

strategy. After numerous communications between such shareholders

and the prior Board, all members of the prior Board, with the

exception of Ms. Mascarenhas, agreed to resign. On September 22,

2023, the Company announced the resignation of the following

members from its Board of Directors; James Inkster, Derek

O’Malley-Keyes, Glenn Leroux and Stewart Hanlon. In conjunction

with his resignation from the Questor Board, Mr. O’Malley-Keyes

also stepped down from his position as interim President and Chief

Executive Officer. The positions made available by the resignations

have been filled through the appointment of four new directors: Dr.

Normand Brais, Mr. Paul Huizinga, Mr. Bastien Commet and Mr. David

Stam. The Company also announced that Ms. Mascarenhas had been

re-hired as the President and Chief Executive Officer of the

Company and appointed as the Chair of the Board. The Company

is extremely pleased to welcome the new Board Members. Alongside

Ms. Mascarenhas, it is expected that their diverse experience and

expertise will help drive growth and success for the Company both

domestically and internationally.

The Company is continuing to assemble the prototype for its 1500kw

waste heat to power unit and shop testing will commence in the

first quarter of 2024. Installation at a third-party site and final

field testing is expected to commence in the second half of

2024.

In July, a case management hearing was held with

the judge in respect to the Emissions Rx contempt application. The

judge has scheduled a two-day hearing of Questor's application for

contempt of court against Emissions Rx and each of the individual

defendants, to be heard on December 12 and 13, 2023. The

defendants' responding affidavits were required to be filed by

November 4th, and deadlines have been set by the Court for

cross-examinations and filing of written arguments in advance of

the hearing.

Subsequent to September 30, 2023, the Board

approved a change to the Director compensation structure such that

each independent board member will receive deferred share units

valued at $35,000 which vest in one year, as their annual

compensation. The Board also approved the issuance of

100,000 stock options, 330,000 restricted share units and 150,000

performance share units to the President and CEO as part of the new

employment contract. These restricted share units will vest

two-thirds on the one-year anniversary of the grant date and one

third on the second anniversary of the grant date. The stock

options and performance share units granted will vest in accordance

with the Company’s current vesting schedule disclosed in the 2022

annual consolidated financial statements.

PRESIDENT’S MESSAGE

The global emission regulatory environment is

rapidly evolving and continues to develop favorably for the

Company’s products, as regulators, investors and the public put

pressure on the industry to reduce methane emissions, flaring and

venting from their operations. Many major countries including

Canada and the United States have unveiled significant funding and

regulatory overhauls with an aim to reduce global methane

emissions. Recent US policy addresses methane emissions from the

fossil fuel industry, including a significant new fee imposed on

methane leaks, enacted as part of the Inflation Reduction Act. The

Inflation Reduction Act (“IRA”; H.R. 5376) is the most significant

investment the US government has made in fighting climate change,

putting more than $369 billion toward projects that will reduce

planet-warming emissions. The IRA includes supplemental

appropriations of $850 million to the Environmental Protection

Agency and $700 million for “marginal conventional wells” to

provide grants to facilities subject to the methane charge for a

range of objectives, including “improving and deploying industrial

equipment and processes” that reduce methane emissions. These funds

could support technology adoption at smaller oil and natural gas

facilities or sites where the volumes are insufficient to justify

infrastructure capital but significant enough to require technology

like Questor’s to ensure that methane and other hazardous

pollutants are destroyed at a guaranteed high efficiency. Questor

provides a cost-effective solution that ensures compliance avoiding

fines and fees. This government support is particularly helpful to

smaller oil and gas producers who may not have the capital budget

to address their site emissions. The IRA fee of “$900 per metric

ton of methane starting in 2024, increasing to $1,500 per metric

ton after two years” is pushing the industry to look for practical

solutions that are proven and cost-effective.

On November 15, 2023, the European Commission,

European Parliament and Council of the European Union, finalized

groundbreaking methane import standards to address methane

emissions from imported oil and gas. These new standards will have

a significant global impact on the industry. The production and

operations of any company that exports to the EU will have to adopt

these standards in addition to their own local emission

regulations. In 2022, Europe imported more oil and

related products, than any other region across the globe, at

roughly 14.4 million barrels per day1. China followed closely as

the second-largest importer, with 12.2 million daily barrels1. The

EU's biggest suppliers of crude oil are the United States,

Norway, and Kazakhstan2. As a result, the US will face significant

pressure to reduce flaring and venting in their oil producing

regions to meet the standards, particularly in the Permian and

North Dakota where significant volumes of gas are being flared. The

solution Questor has provided in Colorado is transferable to these

jurisdictions. In Colorado, Questor demonstrated its ability to

cost-effectively eliminate flaring, venting and reduce the

emissions by utilizing its rental fleet, especially when there was

a lack of pipeline infrastructure to cleanly deal with the gas.

As far as liquefied natural gas is concerned,

the United States was the EU's leading supplier in the

second quarter of 2023, with a share of 46% in total EU imports

followed by the Middle East and North Africa at 21% and Nigeria at

5%3. To meet these new standards all the natural gas areas will

have to eliminate their flaring and venting as well. Questor works

with Midstream and pipeline companies in most of these natural gas

plays and have worked extensively with Midstream companies in the

Marcellus and Haynesville/Eagleford gas plays in the US. Assisting

the Exploration and Production (E&P) companies in these areas

to eliminate their flaring and venting while drilling and

completing wells, similar to what Questor already does well in

Colorado and North Dakota, creates a solid opportunity for our

rental fleet. Questor just recently fielded its first calls with

E&P companies in the Marcellus and the Permian, looking for our

rental units, to deal with flaring and venting in their drilling

and completions operations.

These new EU standards also impact other

countries. India is the largest supplier of refined fuels to

Europe4. Questor has had an opportunity to visit and provide a

proposal to address flaring and venting at two refineries in India

with the aim of reducing emissions and improving air quality. In

Nigeria, the oil and gas regulator has granted approval to conduct

a pilot to use Questor’s equipment to demonstrate the opportunity

to eliminate flaring and venting onshore. Internationally, Questor

is addressing the market opportunity through strategic partnerships

with companies already operating in those jurisdictions with a

strong track record and extensive experience on the ground. Questor

has spent the last two years developing relationships with these

partners, educating them on our technology and supporting them in

client meetings and proposals. Questor has recently submitted many

proposals through its partners all of which have the potential to

grow our internal revenue significantly. Questor has partnered with

the following players; In India, Questor has partnered with

Hi-Tech, who have been in business since 1989 with 11 locations and

a track record introducing technology solutions to the Indian

market. Questor is represented by OilSERV, a leading integrated

oilfield services company in the Middle East and North Africa

region. In Nigeria, Questor is represented by Ar-Rahman Technical

Services Nig. Limited. In the Latin America region, Questor has

partnered with Hoerbiger, which has over 120 locations in around 50

countries worldwide and has been in business since 1925.

Questor will continue to build on its 25-year

track record in North America. Questor has demonstrated its

solutions are applicable to energy companies across the full cycle

from drilling wells, to producing to processing, all the way to

transporting the energy to the consumer. Demand for Questor’s

solutions will increase as the regulations and standards get

operationalized and come into effect. Questor sees significant

opportunities in both North America and internationally and is

developing a sales team to take advantage of the opportunities.

Questor focuses across the entire oil and gas value chain in the

jurisdictions where it has a strong track record and there is a

need for change. With regulator endorsements, ISO 14034

certification on our technology performance and a strong track

record, Questor is in a great position to support its clients in

this demanding regulatory environment.

1 www.statista.com, article titled “Leading

crude oil importers worldwide in 2022”; August 29, 20232

ec.europa.eu, article titled “Crude oil imports and prices: changes

in 2022”; March 28, 2023

3 ec.europa.eu, article titled “EU imports of energy products

continued to drop in Q2, 2023”; September 25, 20234

www.thehindu.com, article titled: India is now Europe’s largest

supplier of refined fuels: Kplr; May 1, 2023

FORWARD LOOKING STATEMENTS

Certain information in this news release

constitutes forward-looking statements. When used in this news

release, the words "may", "would", "could", "will", "intend",

"plan", "anticipate", "believe", "seek", "propose", "estimate",

"expect", and similar expressions, as they relate to the Company,

are intended to identify forward-looking statements. In particular,

this news release contains forward-looking statements with respect

to, among other things, business objectives, expected growth,

results of operations, performance, business projects and

opportunities and financial results. These statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements. Such statements

reflect the Company’s current views with respect to future events

based on certain material factors and assumptions and are subject

to certain risks and uncertainties, including without limitation,

changes in market, competition, governmental or regulatory

developments, general economic conditions and other factors set out

in the Company’s public disclosure documents. Many factors could

cause the Company’s actual results, performance or achievements to

vary from those described in this news release, including without

limitation those listed above. These factors should not be

construed as exhaustive. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying

forward-looking statements prove incorrect, actual results may vary

materially from those described in this news release and such

forward-looking statements included in, or incorporated by

reference in this news release, should not be unduly relied upon.

Such statements speak only as of the date of this news release. The

Company does not intend, and does not assume any obligation, to

update these forward-looking statements. The forward-looking

statements contained in this news release are expressly qualified

by this cautionary statement.

ABOUT QUESTOR TECHNOLOGY

INC.

Questor Technology Inc., incorporated in Canada

under the Business Companies Act (Alberta) is an environmental

emissions reduction technology company founded in 1994, with global

operations. The Company is focused on clean air technologies that

safely and cost effectively improve air quality, support energy

efficiency and greenhouse gas emission reductions. The Company

designs, manufactures and services high efficiency clean combustion

systems that destroy harmful pollutants, including Methane,

Hydrogen Sulfide gas, Volatile Organic Hydrocarbons, Hazardous Air

Pollutants and BTEX (Benzene, Toluene, Ethylbenzene and Xylene)

gases within waste gas streams at 99.99 percent efficiency per its

ISO 14034 Certification. This enables its clients to meet emission

regulations, reduce greenhouse gas emissions, address community

concerns and improve safety at industrial sites.

The Company also has proprietary heat to power

generation technology and is currently targeting new markets

including landfill biogas, syngas, waste engine exhaust, geothermal

and solar, cement plant waste heat in addition to a wide variety of

oil and gas projects. The combination of Questor’s clean combustion

and power generation technologies can help clients achieve net zero

emission targets for minimal cost. The Company is also doing

research and development on data solutions to deliver an integrated

system that amalgamates all of the emission detection data

available to demonstrate a clear picture of the site’s emission

profile.

The Company’s common shares are traded on the

TSX Venture Exchange under the symbol “QST”. The address of the

Company’s corporate and registered office is 2240, 140 – 4 Avenue

S.W. Calgary, Alberta, Canada, T2P 3N3.

QUESTOR TRADES ON THE TSX VENTURE

EXCHANGE UNDER THE SYMBOL ‘QST’

|

Audrey Mascarenhas |

Ann-Marie Osinski |

|

President and Chief Executive Officer |

Corporate Secretary and Chief Financial Officer |

|

Email: amascarenhas@questortech.com |

Email: aosinski@questortech.com |

|

|

|

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This document is not intended for dissemination

or distribution in the United States.

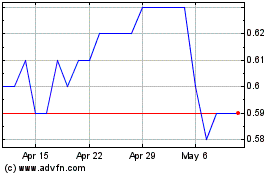

Questor Technology (TSXV:QST)

Historical Stock Chart

From Nov 2024 to Dec 2024

Questor Technology (TSXV:QST)

Historical Stock Chart

From Dec 2023 to Dec 2024