Reunion Gold Corporation (TSXV: RGD; OTCQX: RGDFF) (the

“

Company” or “

Reunion Gold”)

announced today that it has filed and will commence mailing of the

joint management information circular (the

“

Circular”) and related materials for its annual

general and special meeting (the “

Meeting”) of the

holders of Reunion Gold common shares (the “

Reunion Gold

Shareholders”) and the holders of options

(“

Reunion Gold Options”) to purchase Reunion Gold

common shares (the “

Reunion Gold Optionholders”

and together with the Reunion Gold Shareholders, the

“

Reunion Gold Voting Securityholders”), to be held

at the offices of Stikeman Elliott LLP, located at 5300 Commerce

Court West, 199 Bay St. Toronto, Ontario, M5L 1B9, on July 9, 2024,

at 10:00 a.m. (EDT).

Annual General and Special Meeting on

July 9, 2024

At the Meeting, Reunion Gold Voting

Securityholders will be asked to consider and vote on, among other

things, a special resolution (the “Arrangement

Resolution”) approving a statutory plan of arrangement

(the “Arrangement”), subject to the terms and

conditions of an arrangement agreement dated April 22, 2024, and

amended as of June 7, 2024 (the “Arrangement

Agreement”), entered into between Reunion Gold, G Mining

Ventures Corp. (“GMIN”), and Greenheart Gold Inc.

(formerly 15963982 Canada Inc.) (“Spinco” or

“Greenheart”).

Pursuant to the Arrangement, a new entity to be

incorporated to hold and manage the combined business of Reunion

Gold and GMIN (“New GMIN”) will acquire (i) all of

the issued and outstanding common shares in the capital of Reunion

Gold (each whole share, a “Reunion Gold Share”)

and (ii) all of the issued and outstanding common shares in the

capital of GMIN (each whole share, a “GMIN Share”)

by way of a proposed plan of arrangement under Section 192 of the

Canada Business Corporations Act, in an all-equity business

combination transaction.

Immediately following the completion of the

Arrangement:

- Reunion Gold

Shareholders will receive 0.07125 of a common share of New GMIN

(each whole share, a “New GMIN Share”) and 0.05 of

a common share of Spinco (each whole share, a “Spinco

Share”) for each Reunion Gold Share held;

- holders of GMIN

Shares (the “GMIN Shareholders”) will receive 0.25

of a New GMIN for each GMIN Share held;

- Reunion Gold

will assign and transfer to Spinco all of its assets other than the

Oko West project located in Northwest Guyana (the “Oko West

Project”), and $15 million in cash;

- existing Reunion

Gold Shareholders and GMIN Shareholders will own approximately 43%

and 57%, respectively, of New GMIN on a fully-diluted in-the-money

basis prior to a concurrent US$50 million equity financing (which

may be increased to US$60 million); and

- Reunion Gold

Shareholders and New GMIN will own 80.1% and 19.9% respectively, of

the outstanding Spinco Shares.

The Arrangement will require approval by: (a) at

least 66 2/3% of the votes cast by the Reunion Gold Shareholders,

present in person or represented by proxy at the Meeting; (b) at

least 66 2/3% of the votes cast by the Reunion Gold Voting

Securityholders, present in person or represented by proxy at the

Meeting, voting together as a single class; and (c) a majority of

the votes cast by the Reunion Gold Shareholders present in person

or represented by proxy at the Meeting, excluding the votes

attached to the Reunion Gold Shares in accordance with Section

8.1(2) of Multilateral Instrument 61-101 - Protection of Minority

Security Holders in Special Arrangements.

Directors and members of senior management of

Reunion Gold and La Mancha, as well as two subsidiaries of, and a

trust controlled by, Dundee Corporation, who in the aggregate own

approximately 29% of the outstanding Reunion Gold Shares, have

entered into voting support agreements pursuant to which they have

agreed to vote their shares in favor of the Arrangement, subject to

the terms thereof.

Reunion Gold Special Committee and Board

Recommendation

The special committee (the “Reunion Gold

Special Committee”) of the Reunion Gold board of directors

(the “Reunion Gold Board”) formed for the purpose

of considering the Arrangement, unanimously determined, after

careful consideration, including a thorough review of the

Arrangement Agreement, the fairness opinions provided by BMO

Capital Markets and SCP Resource Finance LP, and other matters

considered relevant, that the Arrangement is in the best interests

of Reunion Gold. Accordingly, the Reunion Gold Special Committee

unanimously recommended that the Reunion Gold Board approve the

Arrangement Agreement and recommend that Reunion Gold Voting

Securityholders vote in favour of the Reunion Gold Arrangement

Resolution.

The Reunion Gold Board unanimously

recommends that Reunion Gold Voting Securityholders vote

FOR the Arrangement

Resolution.

Receipt of Interim Order

Reunion Gold is also pleased to announce that

the Ontario Superior Court of Justice (Commercial List) (the

“Court”) has granted an interim order providing

for the calling and holding of the Meeting and other procedural

matters relating to the Arrangement.

The Arrangement is subject to certain

conditions, including the approval by Reunion Gold Voting

Securityholders of the Reunion Gold Arrangement Resolution and the

GMIN Shareholders of a special resolution approving the Arrangement

at a duly called meeting of the GMIN Shareholders, the approval of

the Ontario Superior Court of Justice (Commercial List) and the

approval of the TSX. Assuming all the conditions to completion of

the Arrangement are satisfied, the Company anticipates the

Arrangement to close on or about July 15, 2024.

Spinco TSXV Listing

Application

In connection with the Arrangement, Greenheart

has applied to list its shares on the TSXV as a Tier 2 exploration

company. As part of the Arrangement, the Majorodam Project will be

transferred to Greenheart. Concurrently with the filing of the

Circular, Reunion Gold has filed a technical report in respect of

the Majorodam project titled “NI 43-101 Technical Report on the

Majorodam Gold Project – Sipaliwini and Brokopondo districts of

Suriname, South America”, dated effective May 20, 2024, prepared by

Ross Sherlock of Ph.D., P.Geo. of Tantalus Geoscience Services

Ltd., a copy of which is available under Reunion Gold’s SEDAR+

profile.

Other Matters to be Considered at the

Meeting

In addition to the Reunion Gold Arrangement

Resolution, the Meeting will be held for the following

purposes:

- to receive and

consider the annual consolidated financial statements of Reunion

Gold for the financial year ended December 31, 2023 and the

external auditors’ report thereon;

- to elect the

directors of Reunion Gold for the ensuing year;

- to appoint

Raymond Chabot Grant Thornton LLP as the independent auditors of

Reunion Gold and to authorize the directors to fix the auditors’

compensation;

- to consider

and, if deemed advisable, to approve, with or without variation, an

ordinary resolution ratifying and approving Reunion Gold’s amended

and restated share option plan for continuation until the next

annual shareholder meeting of Reunion Gold; and

- to consider

and, if deemed advisable, to approve, with or without variation, an

ordinary resolution approving the adoption of the Spinco share

option plan.

Voting

If you do not expect to be present and vote your

securities at the Meeting, please vote your securities online over

the Internet, by telephone or by mail. Please refer to the

instructions on the form of proxy or voting instruction form

included with this notice on how to vote your Reunion Gold Voting

Securities. Information on voting can also be easily found on

Reunion Gold’s voting microsite at www.ReunionVotes.com.

If you have any questions or need more

information about voting your Reunion Gold Shares, please contact

Reunion Gold’s strategic shareholder advisor and proxy solicitation

agent, Kingsdale Advisors, by telephone at 1-888-564-7333

(toll-free in North America) or at 1-416-623-2516 (collect call and

text enabled outside North America), or by email at

contactus@kingsdaleadvisors.com.

Copies of the Circular and related meeting

materials and the Arrangement Agreement can be downloaded from

Reunion Gold’s voting microsite at www.ReunionVotes.com, Reunion

Gold's website at www.reuniongold.com and under Reunion Gold's

issuer profile on SEDAR+ at www.sedarplus.ca.

About Reunion

Gold Corporation

Reunion Gold Corporation (TSXV:RGD)

(OTCQX:RGDFF) is a leading gold explorer in the Guiana Shield,

South America. In 2020, Reunion Gold announced an exciting new

greenfield gold discovery at its Oko West project in Guyana and

announced its maiden mineral resource estimate in June 2023 after

just 22 months of resource definition drilling. In February 2024,

Reunion Gold announced an updated Mineral Resource Estimate (the

“2024 MRE”) containing a total of 4.3 Moz of gold in Indicated

Resources grading 2.05 g/t and 1.6 Moz of gold in Inferred

Resources grading 2.59 g/t. The 2024 MRE includes an underground

Resource containing 1.1 Moz of gold at a grade of 3.12 g/t Au in

the Inferred category. Please refer to the Technical Report

entitled “NI 43-101 Technical Report, Oko West Gold Project,

Cuyuni-Mazaruni Mining Districts, Guyana” dated April 11, 2024,

available under Reunion Gold’s profile on SEDAR+.

The Company's common shares are listed on the

TSX Venture Exchange under the symbol 'RGD' and trade on the OTCQX

under the symbol 'RGDFF'. Additional information about the Company

is available on SEDAR+ (www.sedarplus.ca) and the Company's website

(www.reuniongold.com).

For further information, please contact:

REUNION GOLD

CORPORATION

Rick Howes, President and CEO, or Doug Flegg, Business

Development Advisor E: doug_flegg@reuniongold.com E:

info@reuniongold.com Telephone: +1 450.677.2585

Cautionary Statement

Regarding Forward-Looking

Statements

All statements, other than statements of

historical fact, contained in this press release constitute

“forward-looking information” and “forward-looking statements”

within the meaning of certain securities laws and are based on

expectations and projections as of the date of this press release.

Forward-looking statements contained in this press release include,

without limitation, those related to (i) the Meeting to be held on

July 9, 2024; (ii) the approval of the Arrangement by at least

two-thirds of the votes cast by Reunion Gold Shareholders and

Reunion Gold Voting Security Holders; (iii) the Arrangement to

close in July 2024; (iv) the state of things immediately following

the completion of the Arrangement, notably the ownership of New

GMIN by Reunion Gold Shareholders and GMIN Shareholders,

respectively; (v) the listing of the Spinco Shares on the TSXV; and

(vi) more generally, the section entitled “About Reunion Gold

Corporation”.

Forward-looking statements are based on

expectations, estimates and projections as of the time of this

press release. Forward-looking statements are necessarily based

upon a number of estimates and assumptions that, while considered

reasonable by the Company as of the time of such statements, are

inherently subject to significant business, economic and

competitive uncertainties and contingencies. These estimates and

assumptions may prove to be incorrect. Such assumptions include,

without limitation, those underlying the statements in the “About

Reunion Gold Corporation” section.

Many of these uncertainties and contingencies

can directly or indirectly affect, and could cause, actual results

to differ materially from those expressed or implied in any

forward-looking statements. There can be no assurance that, notably

but without limitation, the Company will (i) bring the Oko West

Project into commercial production within budget; or (ii) grow into

the next intermediate producer, as future events could differ

materially from what is currently anticipated by the Company. There

can neither be any assurance that (i) the Reunion Gold Voting

Securityholders will vote in favor of the Arrangement; (ii) the

Arrangement will close; and (iii) the outcome of the Arrangement

will be as set out in this press release, as future events could

differ materially from what is currently anticipated by the

Company.

By their very nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and risks exist that estimates, forecasts, projections

and other forward-looking statements will not be achieved or that

assumptions do not reflect future experience. Forward-looking

statements are provided for the purpose of providing information

about management’s expectations and plans relating to the future.

Readers are cautioned not to place undue reliance on these

forward-looking statements as a number of important risk factors

and future events could cause the actual outcomes to differ

materially from the beliefs, plans, objectives, expectations,

anticipations, estimates, assumptions and intentions expressed in

such forward-looking statements. All of the forward-looking

statements made in this press release are qualified by these

cautionary statements and those made in the Company’s other filings

with the securities regulators of Canada including, but not limited

to, the cautionary statements made in the relevant sections of the

Company’s (i) Annual Information Form dated April 25, 2024, for the

financial year ended December 31, 2023, and (ii) Management’s

Discussion & Analysis for the financial year ended December 31,

2023. The Company cautions that the foregoing list of factors that

may affect future results is not exhaustive, and new, unforeseeable

risks may arise from time to time. The Company disclaims any

intention or obligation to update or revise any forward-looking

statements or to explain any material difference between subsequent

actual events and such forward-looking statements, except to the

extent required by applicable law.

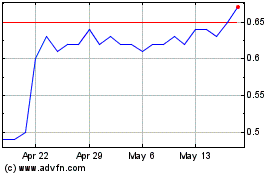

Reunion Gold (TSXV:RGD)

Historical Stock Chart

From May 2024 to Jun 2024

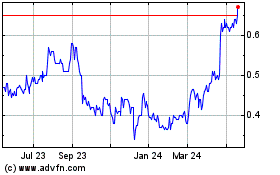

Reunion Gold (TSXV:RGD)

Historical Stock Chart

From Jun 2023 to Jun 2024