Rockridge Resources Ltd. (TSX-V: ROCK)

(OTCQB: RRRLF) (Frankfurt: RR0)

(“Rockridge”) (the “Company”) is pleased to announce the voting

results from its Annual General and Special Meeting of Shareholders

(“the “Meeting”), held on January 6th, 2025.

Shareholders voted in favour of all matters of

business before the Meeting. Each of those matters is set out in

detail in the Management Information Circular published in

connection with the Meeting, which is available on the Company’s

website https://www.rockridgeresourcesltd.com/

A total of 51,050,981 common shares,

representing approximately 41% of the Company’s outstanding common

shares, were voted in person and by proxy at the Meeting.

Shareholders voted in favour of the previously announced three-way

merger transaction (the “Transaction”), pursuant to which,

Eros will acquire (i) all of the issued and outstanding shares of

Rockridge by way of plan of arrangement under the Business

Corporations Act (British Columbia) (the “Rockridge

Arrangement”) and (ii) all of the issued and outstanding shares

of MAS Gold that it does not already own by way of plan of

arrangement under the Business Corporations Act (British Columbia)

(the “MAS Arrangement”).

At the Meeting, each of Jonathan Wiesblatt,

Jordan Trimble, Joseph Gallucci, Tim Termuende and Ross McElroy

were elected to the board of directors of the resulting company

(the “Board”) for the ensuing year. Rockridge’s shareholders

also approved the appointment of Davidson and Company LLP as the

auditors of the Company for the ensuing year and authorized the

Board to determine the auditor's remuneration.

Rockridge’s CEO Jon Wiesblatt commented: “This

is a monumental day for Rockridge and for its shareholders. The

pending transaction between Eros, MAS Gold and Rockridge will

create a pure-play, well financed gold and copper company with

operations focused in the La Ronge gold belt in Saskatchewan. Post

the completion of the transaction the company will have six

exciting exploration projects with several gold and copper

deposits. This collection of highly prospective projects will help

to drive value for shareholders going forward. The newly created

board of directors has many decades of expertise operating and

exploring for gold and copper in Saskatchewan and is well suited to

creating value for shareholders. We are looking forward to working

with the new board and all stakeholders to build the next great

exploration company in Western Canada.”

Rockridge’s President Jordan Trimble commented:

“We are thrilled to have shareholder approval for this

transformational transaction for Rockridge. Upon final completion

of the merger, the company will be well positioned to take

advantage of strengthening gold and copper markets with highly

prospective assets in Saskatchewan host to resources and robust

exploration upside potential. We look forward to a busy year ahead

with exploration being planned at several of the gold

projects.”

Pursuant to the Transaction, shareholders of

Rockridge will receive 0.375 common shares of Eros (each full

share, an “Eros Share”) for each Rockridge common share (a

“Rockridge Share”) held and shareholders of MAS Gold will

receive 0.25 Eros Shares for each MAS Gold common share (a “MAS

Gold Share”) held. Upon closing of the Transaction, existing

Eros shareholders will own approximately 42.37% of the combined

company, existing MAS Gold shareholders will own approximately

37.33% of the combined company, and existing Rockridge shareholders

will own approximately 20.30% (based on the current issued and

outstanding shares of each of the companies).

Rockridge has also been informed by Eros and MAS

Gold that all requisite shareholder approvals required by each of

them for the completion of the Transaction, as described in detail

in the Information Circular, were obtained today at meetings of the

shareholders of Eros and MAS Gold, respectively. The companies will

apply for final orders approving the Transaction from the Supreme

Court of British Columbia on January 9, 2025. Closing of the

transaction remains subject to certain customary closing conditions

including court approval. Assuming the satisfaction of these

closing conditions, the transaction is expected to close by

mid-January 2025.

Additional Information

Full details of the Transaction are set out in

the Business Combination Agreement, which is filed on the Company’s

profile on SEDAR+ at www.sedarplus.ca.

On behalf of the Board,

Jonathan Weisblatt CEO

About Rockridge Resources Ltd.

Rockridge Resources Ltd. is a public mineral

exploration company focused on the acquisition, exploration and

development of mineral resource properties in Canada, specifically

copper and gold. Rockridge’s 100% owned Knife Lake Project is

located in Saskatchewan which is ranked as a top mining

jurisdiction in the world by the Fraser Institute. The project

hosts the Knife Lake Deposit, which is a VMS, near-surface

Cu-Co-Au-Ag-Zn deposit open along strike and at depth. There is

strong discovery potential in and around the deposit area as well

as at regional targets on the large property package. Rockridge’s

gold asset is its 100% owned Raney Gold Project, which is a

high-grade gold exploration project located in the same greenstone

belt that hosts the world class Timmins and Kirkland Lake lode gold

mining camps. Additional information about Rockridge and its

project portfolio can be found on the Company’s website at

www.rockridgeresourcesltd.com.

Rockridge Resources Ltd.

Jonathan Wiesblatt, CEONicholas Coltura, Corporate

Communications Email:

info@rockridgeresourcesltd.com jwiesblatt@rockridgeresourcesltd.com

NEITHER THE TSXV NOR ITS REGULATION SERVICES

PROVIDER ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THE

CONTENT OF THIS NEWS RELEASE.

None of the securities to be issued pursuant to

the Transaction have been, nor will be, registered under the United

States Securities Act of 1933, as amended (the “U.S. Securities

Act”) or any U.S. state securities laws, and may not be offered or

sold in the United States or to, or for the account or benefit of,

United States persons absent registration or an applicable

exemption from the registration requirements of the U.S. Securities

Act and applicable U.S. state securities laws. This press release

does not constitute an offer to sell or the solicitation of an

offer to buy securities in the United States, nor in any other

jurisdiction.

Forward-Looking Information and

Statements

This press release contains certain

“forward-looking information” and “forward-looking statements”

within the meaning of applicable securities legislation. Such

forward-looking information and forward-looking statements are not

representative of historical facts or information or current

condition, but instead represent only the beliefs of the Company

regarding future events, plans or objectives, many of which, by

their nature, are inherently uncertain and outside of the Company’s

control. Generally, such forward-looking information or

forward-looking statements can be identified by the use of

forward-looking terminology such “could”, “intend”, “expect”,

“believe”, “will”, “projected”, “planned”, “estimated”, “soon”,

“potential”, “anticipate” or variations of such words. By

identifying such information and statements in this manner, the

Company is alerting the reader that such information and statements

are subject to known and unknown risks, uncertainties and other

factors that may cause the actual results, level of activity,

performance or achievements of the Company and/or the combined

company to be materially different from those expressed or implied

by such information and statements. In addition, in connection with

the forward-looking information and forward-looking statements

contained in this press release, the Company has made certain

assumptions. Among the key factors that could cause actual results

to differ materially from those projected in the forward-looking

information and statements are the following: the inability of the

Company, Eros and MAS Gold to integrate successfully such that the

anticipated benefits of the Transaction are realized; the inability

to realize synergies and cost savings at the times, and to the

extent, anticipated; the inability of the Company, Eros or MAS Gold

to obtain the necessary regulatory, stock exchange, shareholder and

other approvals which may be required for the Transaction; the

inability of the Company to close the Transaction on the terms and

timing described herein, or at all; the inability of the Company to

work effectively with strategic partners and any changes to key

personnel; inability of the combined company to successfully

complete a private placement or other financing upon completion of

the Transaction; and material adverse changes in general economic,

business and political conditions, including changes in the

financial markets. These risks are not intended to represent a

complete list of the factors that could affect the Company and/or

the combined company; however, these factors should be considered

carefully. Should one or more of these risks, uncertainties or

other factors materialize, or should assumptions underlying the

forward-looking information or forward-looking statements prove

incorrect, actual results may vary materially from those described

herein. The impact of any one assumption, risk, uncertainty, or

other factor on a particular forward-looking statement cannot be

determined with certainty because they are interdependent and the

combined company’s future decisions and actions will depend on

management’s assessment of all information at the relevant

time.

Although the Company believes that the

assumptions and factors used in preparing, and the expectations

contained in, the forward-looking information and forward-looking

statements are reasonable, undue reliance should not be placed on

such information and forward-looking statements, and no assurance

or guarantee can be given that such forward-looking information and

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such information and statements. The forward-looking

information and forward-looking statements contained in this press

release are made as of the date of this press release, and the

Company does not undertake to update any forward-looking

information and/or forward-looking statements that are contained or

referenced herein, except in accordance with applicable securities

laws.

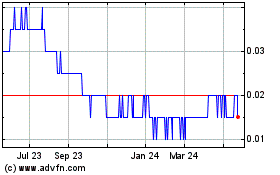

Eros Resources (TSXV:ROCK)

Historical Stock Chart

From Jan 2025 to Feb 2025

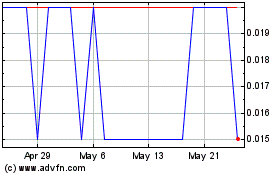

Eros Resources (TSXV:ROCK)

Historical Stock Chart

From Feb 2024 to Feb 2025