Fort Chicago Formally Launches Offer to Acquire Swift Power

July 02 2010 - 1:07PM

Marketwired

Swift Power Corp. (TSX VENTURE: SPC) ("Swift Power" or the

"Company") is pleased to announce that Fort Chicago Pipelines

(Canada) Ltd., an indirect wholly-owned subsidiary of Fort Chicago

Energy Partners L.P. ("Fort Chicago") announced today that it has

mailed to shareholders of Swift Power ("Swift Shareholders") and

filed with the Canadian securities regulatory authorities, an offer

and take-over bid circular (collectively the "Offer Documents"),

formally commencing Fort Chicago's offer to acquire (the "Offer")

all of the issued and outstanding shares of Swift Power ("Shares"),

as well as shares issuable upon exercise of outstanding options,

for $0.35 in cash for each Share. The board of directors of Swift

Power unanimously recommends that Swift Shareholders accept the

Offer and tender their Swift Shares to the Offer.

The Offer is being made pursuant to the terms of a

pre-acquisition agreement dated June 22, 2010 between Swift Power

and Fort Chicago. The consideration under the Offer represents a

premium of 40% to Swift Power's closing price on the TSX Venture

Exchange (the "TSX-V") on June 21, 2010 and a premium of

approximately 62% to Swift Power's 20-day volume weighted average

price on the TSX-V for the 20 trading day period ending June 21,

2010.

In addition, Swift Power has prepared and filed a directors'

circular (the "Directors' Circular") in accordance with Canadian

securities law requirements. As outlined in the Directors'

Circular, the board of directors of Swift Power has unanimously

determined that the Offer is fair, from a financial point of view,

to the Swift Shareholders and is in the best interests of Swift

Power and the Swift Shareholders. The Directors Circular was mailed

concurrently with the Offer Documents.

Full details of the Offer are contained in the Offer Documents

and the Directors' Circular. Shareholders are encouraged to read

the documents and to consider the important information contained

therein. Copies of the Offer Documents and Directors' Circular

along with other relevant documents are available electronically

under Swift's profile at www.sedar.com. The Offer is open for

acceptance until 4:30 p.m. (Calgary time) on August 9, 2010.

Fort Chicago has retained Computershare Investor Services Inc.

to act as its depositary in connection with the Offer.

Swift Shareholders who are in doubt as to how to respond to the

Offer should consult their investment dealer, stockbroker, bank

manager, lawyer or other professional advisors.

About Fort Chicago

Fort Chicago is a publicly traded limited partnership based in

Calgary, Alberta, that owns and operates energy infrastructure

assets across North America. Its Class A Units are listed on the

Toronto Stock Exchange under the symbol FCE.UN.

About Swift Power

Swift Power is based in Vancouver, BC and is engaged in the

development of run-of-river hydroelectric power projects. In April

of this year, Swift Power was awarded a long-term Electricity

Purchase Agreement by BC Hydro for the Dasque Cluster hydroelectric

project. This 20 megawatt project is located near Terrace, BC, and

is planned to be in operation by late 2012, pending receipt of

necessary regulatory approvals. Swift Power holds rights to nine

water licence applications filed with the government of British

Columbia regarding several sites in BC. Additional information

about Swift Power is available on the Company's website at

www.swiftpower.ca.

FOR FURTHER INFORMATION

Swift Shares should be deposited under the Offer with the

depositary, being Computershare Investor Services Inc. Shareholders

should contact the depositary, at 1-800-564-6253 or

corporateactions@computershare.com, for assistance in accepting the

Offer and in depositing their Shares. Shareholders whose common

shares are registered in the name of an investment advisor, stock

broker, bank, trust company or other nominee should immediately

contact that nominee for assistance if they wish to accept the

Offer in order to take the necessary steps to be able to deposit

such common shares under the Offer.

Reader Advisory

This announcement is for informational purposes only and does

not constitute or form part of any offer or invitation to purchase,

acquire, subscribe for, sell, dispose of or issue, or any

solicitation of an offer to sell, dispose, issue purchase, acquire

or subscribe for any security. The Offer (including any variation

or extension in accordance with applicable securities laws) is

being made exclusively by means of, and subject to the terms and

conditions set out in the Offer Documents. Swift Shareholders

should read these materials carefully as they contain important

information, including the terms and conditions of the Offer. The

Offer Documents as well as the Directors' Circular will be

available electronically without charge at www.sedar.com.

Reader Advisory Regarding Forward-Looking Information

Certain statements contained in this news release, including

statements that contain words such as "may", "will", "would",

"could", "should", "anticipate", "believe", "intend", "expect",

"plan", "estimate", "budget", "outlook", "propose", "project", and

statements relating to matters that are not historical fact

constitute forward-looking information within the meaning of

applicable Canadian securities legislation. In this news release,

forward-looking information and statements include the anticipated

completion of the Offer.

The forward-looking information in this news release is subject

to known and unknown risks and uncertainties and other factors and

assumptions, which include, but are not limited to: the risk that

the Offer will not be completed as anticipated or at all; the risk

that one or more of the conditions to which the Offer is subject

will not be met; and risk the of delay in completion of the Offer.

In addition, Swift Power is subject to risks and uncertainties

which are discussed in greater detail in filings made by Swift

Power with the Canadian securities regulatory authorities. Actual

results could differ materially from those anticipated in these

forward-looking statements if the assumptions underlying them prove

incorrect, or if one or more of the uncertainties or risks

described above materializes.

Readers are strongly cautioned that the above list of factors

affecting forward-looking information is not exhaustive. Further,

forward- looking statements are made as at the date they are given

and, except as required by applicable law, Swift Power does not

intend, and does not assume any obligation, to update any

forward-looking statements, whether as a result of new information

or otherwise. The forward-looking statements contained in this news

release are expressly qualified by this advisory.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Contacts: Swift Power Corp. Alexi Zawadzki President and CEO

(604) 637-6393 (604) 688-4457 (FAX) www.swiftpower.ca Fort Chicago

Energy Partners L.P. Stephen H. White President and CEO (403)

296-0140

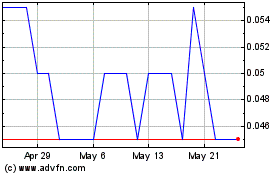

SPC Nickel (TSXV:SPC)

Historical Stock Chart

From Dec 2024 to Jan 2025

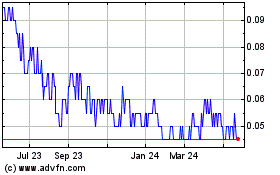

SPC Nickel (TSXV:SPC)

Historical Stock Chart

From Jan 2024 to Jan 2025